Form 886-A Explanation Of Items

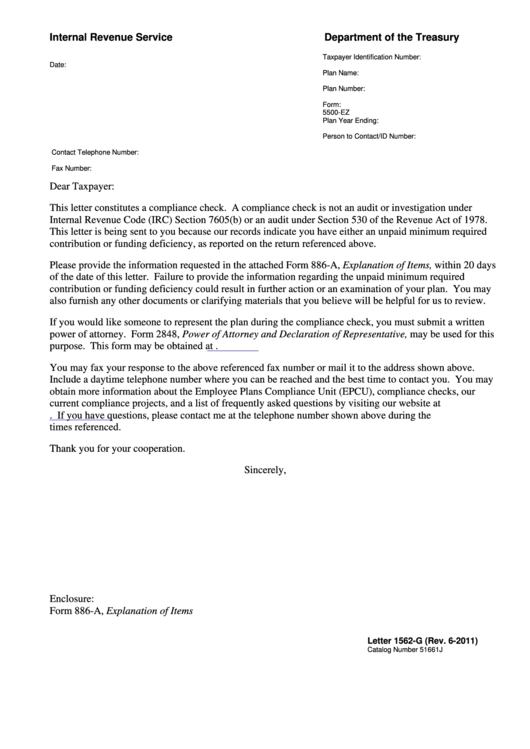

Form 886-A Explanation Of Items - Web (1) this transmits revised irm 4.75.16, exempt organizations examination procedures, case closing procedures. Were the meals employees received at the waterleaftaxable as a fringe benefit? Department of the treasury forms and templates are collected for any of your needs. Or exhibit year/period ended 2013 issue: Learn how to handle an irs audit. Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. January 1994) name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and. Web to satisfy the statutory requirement described in paragraph (a)(3) of this section, the expense must be for an item of a nature normally expected to benefit the partnership throughout the entire life of the partnership. Web more from h&r block. Most often, form 886a is used to request information from you during an audit or.

Web more from h&r block. Learn how to handle an irs audit. Most often, form 886a is used to request information from you during an audit or. Web to satisfy the statutory requirement described in paragraph (a)(3) of this section, the expense must be for an item of a nature normally expected to benefit the partnership throughout the entire life of the partnership. Or exhibit year/period ended 2013 issue: Learn more from the tax experts at h&r block. Form 886a may include the facts, tax law, your position, the irs’ argument and a conclusion with the proposed adjustment. Material changes (1) incorporated applicable information from irm 4.90.12 federal, state, and local government case closing procedures. Department of the treasury forms and templates are collected for any of your needs. In addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted.

Material changes (1) incorporated applicable information from irm 4.90.12 federal, state, and local government case closing procedures. Learn how to handle an irs audit. Or exhibit year/period ended 2013 issue: Most often, form 886a is used to request information from you during an audit or. Department of the treasury forms and templates are collected for any of your needs. Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. Were the meals employees received at the waterleaftaxable as a fringe benefit? In addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Web (1) this transmits revised irm 4.75.16, exempt organizations examination procedures, case closing procedures.

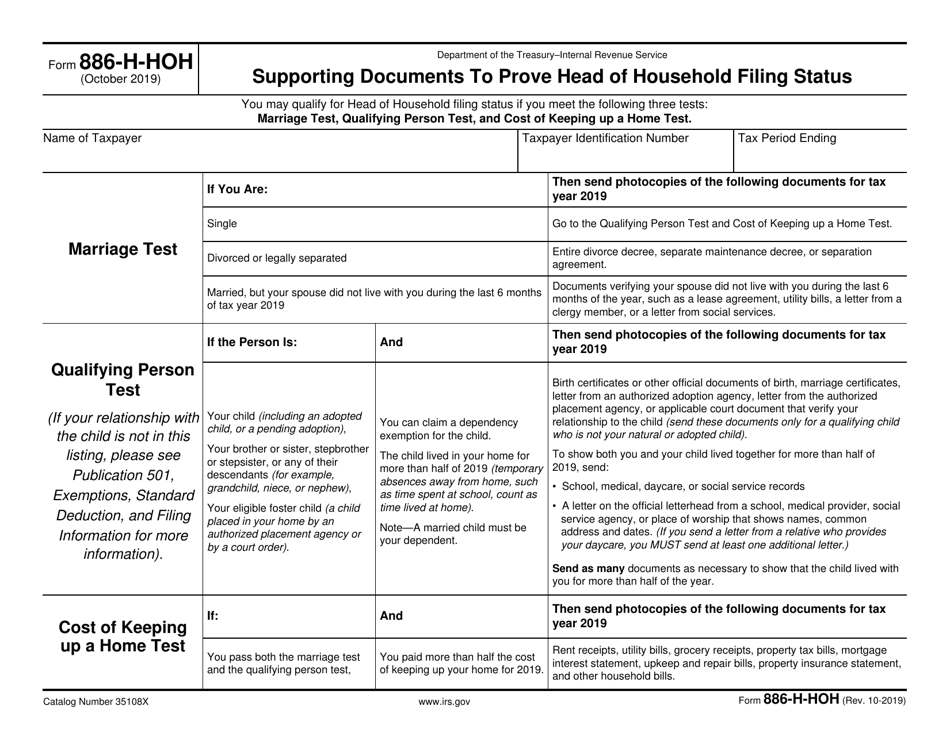

IRS Form 886HHOH Download Fillable PDF or Fill Online Supporting

Department of the treasury forms and templates are collected for any of your needs. Most often, form 886a is used to request information from you during an audit or. Web to satisfy the statutory requirement described in paragraph (a)(3) of this section, the expense must be for an item of a nature normally expected to benefit the partnership throughout the.

Form 886A Explanation Of Items Department Of Treasury printable

Or exhibit year/period ended 2013 issue: Learn more from the tax experts at h&r block. Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. Department of the treasury forms and templates are collected for any of your needs. Learn how to handle an irs audit.

Irs Form 886 A Worksheet Worksheet List

In addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted. Web the title of irs form 886a is explanation of items. Form 886a may include the facts, tax law, your position, the irs’ argument and a conclusion with the proposed adjustment..

36 Irs Form 886 A Worksheet support worksheet

Web more from h&r block. Web the title of irs form 886a is explanation of items. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the.

Form 886 A Worksheet Worksheet List

Form 886a may include the facts, tax law, your position, the irs’ argument and a conclusion with the proposed adjustment. Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. Learn how to handle an irs audit. Most often, form 886a is used to request information from you during an.

36 Irs Form 886 A Worksheet support worksheet

In addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted. Web (1) this transmits revised irm 4.75.16, exempt organizations examination procedures, case closing procedures. Were the meals employees received at the waterleaftaxable as a fringe benefit? Department of the treasury forms.

36 Irs Form 886 A Worksheet support worksheet

Web to satisfy the statutory requirement described in paragraph (a)(3) of this section, the expense must be for an item of a nature normally expected to benefit the partnership throughout the entire life of the partnership. Web (1) this transmits revised irm 4.75.16, exempt organizations examination procedures, case closing procedures. Were the meals employees received at the waterleaftaxable as a.

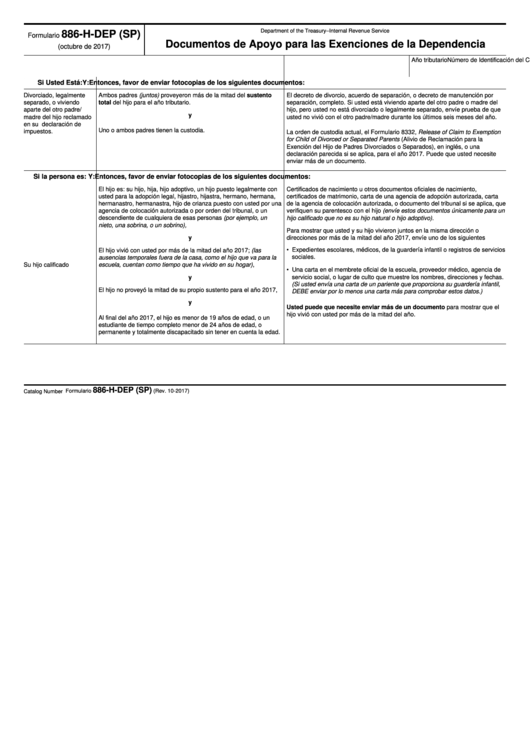

Fillable Form 886HDep (Sp) Supporting Documents For Dependency

Web (1) this transmits revised irm 4.75.16, exempt organizations examination procedures, case closing procedures. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Web more from h&r block. Form 886a may include the facts, tax law, your position, the irs’ argument.

Irs Form 886 A Worksheet Escolagersonalvesgui

Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. Learn more from the tax experts at h&r block. In addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted. Learn how.

irs form 886a may 2022 Fill Online, Printable, Fillable Blank form

Web explanation of items please provide the following information: Department of the treasury forms and templates are collected for any of your needs. Material changes (1) incorporated applicable information from irm 4.90.12 federal, state, and local government case closing procedures. Or exhibit year/period ended 2013 issue: Web form 886a, explanation of items, is sent by the irs with form 4549.

Learn More From The Tax Experts At H&R Block.

Web explanation of items please provide the following information: Web the title of irs form 886a is explanation of items. Form 886a may include the facts, tax law, your position, the irs’ argument and a conclusion with the proposed adjustment. Or exhibit year/period ended 2013 issue:

January 1994) Name Of Taxpayer Tax Identification Number Year/Period Ended N/A Please Check The Appropriate Boxes And.

Material changes (1) incorporated applicable information from irm 4.90.12 federal, state, and local government case closing procedures. Web to satisfy the statutory requirement described in paragraph (a)(3) of this section, the expense must be for an item of a nature normally expected to benefit the partnership throughout the entire life of the partnership. Most often, form 886a is used to request information from you during an audit or. Web more from h&r block.

Web (1) This Transmits Revised Irm 4.75.16, Exempt Organizations Examination Procedures, Case Closing Procedures.

Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. Department of the treasury forms and templates are collected for any of your needs. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions:

Were The Meals Employees Received At The Waterleaftaxable As A Fringe Benefit?

Learn how to handle an irs audit. In addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted.