Form 8832 Late Election Relief

Form 8832 Late Election Relief - Web upon receipt of a completed form 8832 requesting relief, the i.r.s. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web i need guidance on the wording late election. Election information (part i) and late election relief (part ii). I need some guidance on the wording for the late election relief explanation for reasonable cause in my form 8832. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. When you first filed form 8832, you were denied your request because you filed late. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center within three. You must meet four conditions to qualify: You’ll complete this part of the form only if you are filing your tax classification after the deadline.

Web you’ll probably know if you need to check this because you’ve thoroughly researched late classification relief, or you’ve spoken to a lawyer. An eligible entity may be eligible for late. Where to file file form 8832 with the. Web up to $32 cash back this part of form 8832 is only required if you are seeking late election relief (otherwise, you may skip it). Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. Web i need guidance on the wording late election. According to your objectives, you can elect to have your llc taxed as a. Web an eligible entity may elect to change (or confirm) its classification for tax purposes by filing irs form 8832 within 75 days of the desired effective date of the classification. Web an eligible entity may be eligible for late election relief in certain circumstances. Web if you don’t file within the time frames mentioned above, you can seek late election relief.

Web if you don’t file within the time frames mentioned above, you can seek late election relief. Web by filing form 8832 with the irs, you can choose a tax status for your entity besides the default status. Where to file file form 8832 with the. Web upon receipt of a completed form 8832 requesting relief, the i.r.s. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Form 8832 is used by eligible. Web specified on form 8832 cannot be more than 75 days prior to the date on which the election is filed and cannot be more than 12 months after the date on which the election. The entity did not timely file form 8832, the entity has a. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. You’ll complete this part of the form only if you are filing your tax classification after the deadline.

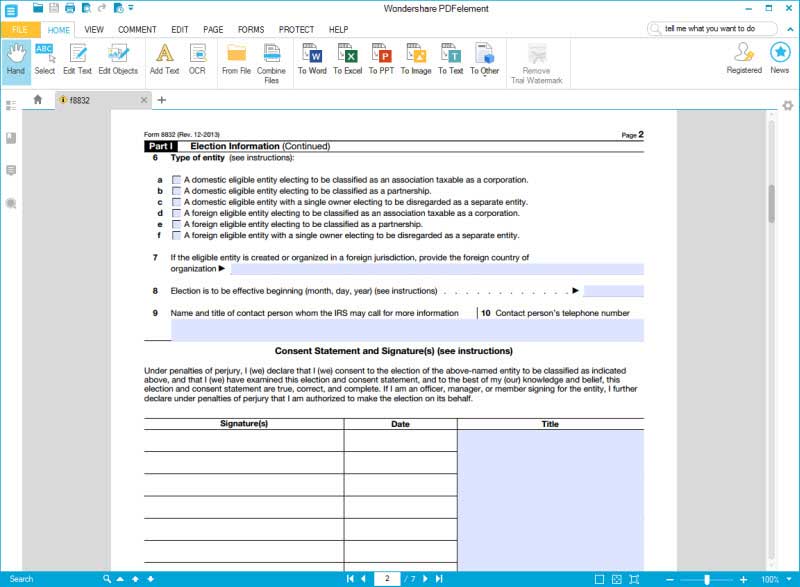

Form 8832 Entity Classification Election

Form 8832 is used by eligible. You may be eligible for late relief if. According to your objectives, you can elect to have your llc taxed as a. Web i need guidance on the wording late election. You’ll complete this part of the form only if you are filing your tax classification after the deadline.

Form 8832 Entity Classification Election (2013) Free Download

Will determine whether the requirements for granting the late entity classification election have been satisfied. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. Web part ii, late election relief. Web information about form 8832, entity classification election, including recent updates,.

IRS Form 8832 How to Fill it Right

Web you’ll probably know if you need to check this because you’ve thoroughly researched late classification relief, or you’ve spoken to a lawyer. I need some guidance on the wording for the late election relief explanation for reasonable cause in my form 8832. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how.

IRS Form 8832 Instructions and FAQs for Business Owners

Web part ii, late election relief. Part i asks a series of questions pertaining to your tax status election. Web specified on form 8832 cannot be more than 75 days prior to the date on which the election is filed and cannot be more than 12 months after the date on which the election. You’ll complete this part of the.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web i need guidance on the wording late election. Web by filing form 8832 with the irs, you can choose a tax status for your entity besides the default status. Web specified on form 8832 cannot be more than 75 days prior to the date on which the election is filed and cannot be more than 12 months after the.

Fill Free fillable Form 8832 Entity Classification Election 2013 PDF form

Web if you don’t file within the time frames mentioned above, you can seek late election relief. Web late election relief complete part ii only if the entity is requesting late election relief under rev. Web part ii, late election relief. Web you’ll probably know if you need to check this because you’ve thoroughly researched late classification relief, or you’ve.

Form 8832 Fillable Online and PDF eSign Genie

Part i asks a series of questions pertaining to your tax status election. You may be eligible for late relief if. Election information (part i) and late election relief (part ii). An eligible entity may be eligible for late. Web an eligible entity may elect to change (or confirm) its classification for tax purposes by filing irs form 8832 within.

form 8832 late election relief reasonable cause examples Fill Online

Web upon receipt of a completed form 8832 requesting relief, the i.r.s. Web an eligible entity may be eligible for late election relief in certain circumstances. Where to file file form 8832 with the. You’ll complete this part of the form only if you are filing your tax classification after the deadline. Web to make a late election under the.

IRS Form 8832A Guide to Entity Classification Election

Web part ii, late election relief. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center within three. Election information (part i) and late election relief (part ii). For more information, see late election relief, later. You’ll complete this part of the.

Using Form 8832 to Change Your LLC’s Tax Classification

Web if you don’t file within the time frames mentioned above, you can seek late election relief. Web you’ll probably know if you need to check this because you’ve thoroughly researched late classification relief, or you’ve spoken to a lawyer. According to your objectives, you can elect to have your llc taxed as a. Web information about form 8832, entity.

Part I Asks A Series Of Questions Pertaining To Your Tax Status Election.

An eligible entity may be eligible for late. Web upon receipt of a completed form 8832 requesting relief, the i.r.s. Web part ii, late election relief. I need some guidance on the wording for the late election relief explanation for reasonable cause in my form 8832.

Web To Make A Late Election Under The Provisions Of The Revenue Procedure, An Eligible Entity Must File A Completed Form 8832 With The Applicable Irs Service Center.

Web if you don’t file within the time frames mentioned above, you can seek late election relief. You’ll complete this part of the form only if you are filing your tax classification after the deadline. When you first filed form 8832, you were denied your request because you filed late. You must meet four conditions to qualify:

Web Information About Form 8832, Entity Classification Election, Including Recent Updates, Related Forms, And Instructions On How To File.

Web i need guidance on the wording late election. Web up to $32 cash back this part of form 8832 is only required if you are seeking late election relief (otherwise, you may skip it). Web the form has two parts: Web you’ll probably know if you need to check this because you’ve thoroughly researched late classification relief, or you’ve spoken to a lawyer.

Web To Make A Late Election Under The Provisions Of The Revenue Procedure, An Eligible Entity Must File A Completed Form 8832 With The Applicable Irs Service Center Within Three.

Where to file file form 8832 with the. Web specified on form 8832 cannot be more than 75 days prior to the date on which the election is filed and cannot be more than 12 months after the date on which the election. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Form 8832 is used by eligible.