Form 8829 2022

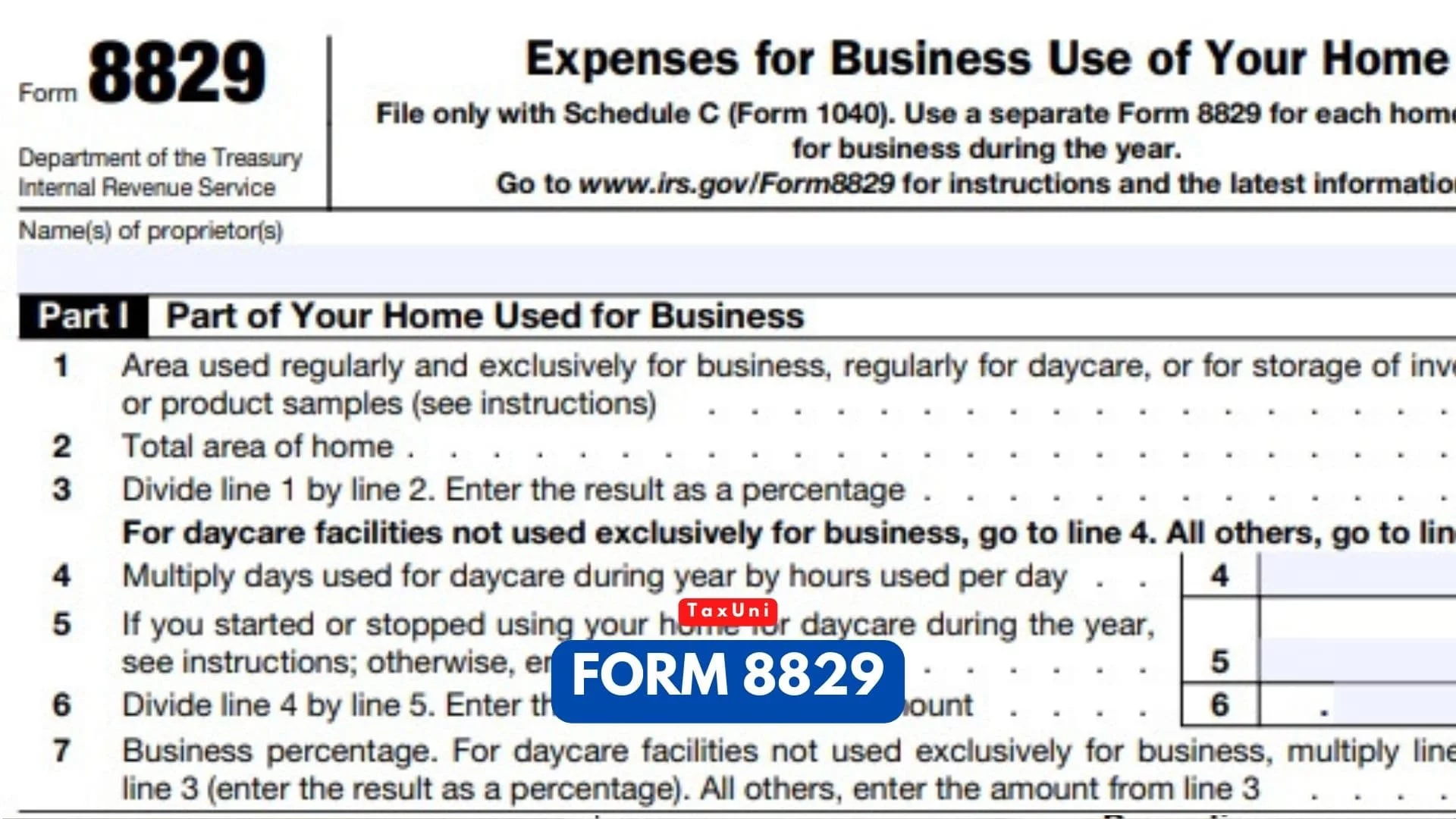

Form 8829 2022 - Use a separate form 8829 for each home you used You must meet specific requirements to deduct expenses for the business use of your. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Web but this year (2021) is different, a different % is used in the software, although the 2021 irs form 8829 still indicates 2.564% should be used. Use a separate form 8829 for each home you used for the business during the year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee.

Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. Web 2023 payroll tax rates, taxable wage limits, and maximum benefit amounts. March 25, 2022 5:58 am. So i am not quite sure why the software got changed this year. • the ui maximum weekly benefit amount is $450. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web irs form 8829 helps you determine what you can and cannot claim. Use a separate form 8829 for each home you used Web but this year (2021) is different, a different % is used in the software, although the 2021 irs form 8829 still indicates 2.564% should be used.

More about the federal form 8829 Web but this year (2021) is different, a different % is used in the software, although the 2021 irs form 8829 still indicates 2.564% should be used. Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. You must meet specific requirements to deduct expenses for the business use of your. March 25, 2022 5:58 am. Use a separate form 8829 for each home you used for the business during the year. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. I think this percentage is related to the 39.5 years depreciation period. Web irs form 8829 helps you determine what you can and cannot claim.

Revisiting Form 8829 Business Use of Home Expenses for 2020 Lear

I think this percentage is related to the 39.5 years depreciation period. Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. More about the federal form 8829 So i am not quite sure why the software got changed this year..

Instructions Form 8829 Fill Out and Sign Printable PDF Template signNow

Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. Web but this year (2021) is different, a different % is used in the software, although the 2021.

Form 8821 Fill Out and Sign Printable PDF Template signNow

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web irs form 8829 helps you determine what you can and cannot claim. • the ui tax rate for new employers is 3.4 percent (.034) for a period of two to three years. Web information about form 8829, expenses for business.

IRS Form 8829 for Remote Workers Here’s How to Complete Flyfin

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. The form calculates the portion of expenses related to your home that you can claim as a tax deduction on schedule c. Web irs form 8829 is one of two ways to claim.

Simplified Method Worksheet 2021 Home Office Simplified Method

Web irs form 8829 helps you determine what you can and cannot claim. March 25, 2022 5:58 am. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use a separate form 8829 for each home you used Web form.

IRS Form 8829 LinebyLine Instructions 2022 Expenses for Business Use

The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. March 25, 2022 5:58 am. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Use a separate form 8829 for each home.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

• the ui maximum weekly benefit amount is $450. Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. So i am not quite sure why the software got changed this year. I think this percentage is related to the 39.5.

Form_8829_explainer_PDF3 Camden County, NJ

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Use a separate form 8829 for each home you used Use a separate form 8829 for each home you used for the business during the year. Web irs form 8829 is one of.

Business Use Of Home (Form 8829) Organizer 2014 printable pdf download

Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Use a separate form 8829 for each home you used for the business during the year. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. Use.

Form 8829 2022 2023

Web irs form 8829 helps you determine what you can and cannot claim. I think this percentage is related to the 39.5 years depreciation period. • the ui maximum weekly benefit amount is $450. Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin.

I Think This Percentage Is Related To The 39.5 Years Depreciation Period.

Use a separate form 8829 for each home you used for the business during the year. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. You must meet specific requirements to deduct expenses for the business use of your. • the ui tax rate for new employers is 3.4 percent (.034) for a period of two to three years.

Web 2023 Payroll Tax Rates, Taxable Wage Limits, And Maximum Benefit Amounts.

• the ui maximum weekly benefit amount is $450. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040).

Web We Last Updated The Expenses For Business Use Of Your Home In December 2022, So This Is The Latest Version Of Form 8829, Fully Updated For Tax Year 2022.

Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. Web irs form 8829 helps you determine what you can and cannot claim. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts.

The Form Calculates The Portion Of Expenses Related To Your Home That You Can Claim As A Tax Deduction On Schedule C.

March 25, 2022 5:58 am. Use a separate form 8829 for each home you used So i am not quite sure why the software got changed this year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022.