Form 8582 Instructions 2022

Form 8582 Instructions 2022 - You can download or print current. Enter name(s) as shown on tax return. Press f6 to bring up open forms. You must complete the address section of the city of detroit return. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. This article will help you: Web form 1040 instructions; Enter losses reported on schedule e (form 1040), supplemental income and loss, part. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Section references are to the internal revenue code.

Web the instructions for federal form 8582 for specific line instructions and examples. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Enter losses reported on schedule e (form 1040), supplemental income and loss, part. Section references are to the internal revenue code. Press f6 to bring up open forms. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Open the client's tax return. Type 8582 and press enter to open the 8582 page 1. Report this amount on form 3800, part iii, line 1k. You can download or print current.

Report this amount on form 3800, part iii, line 1k. Web for instructions and the latest information. 858 name(s) shown on return identifying number part i 2021 passive activity loss. You can download or print current. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Web form 1040 instructions; You must complete the address section of the city of detroit return. Use only those items of income, gain, loss, or deduction derived from or connected with new. Activity description i keep getting the entry check error: Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed.

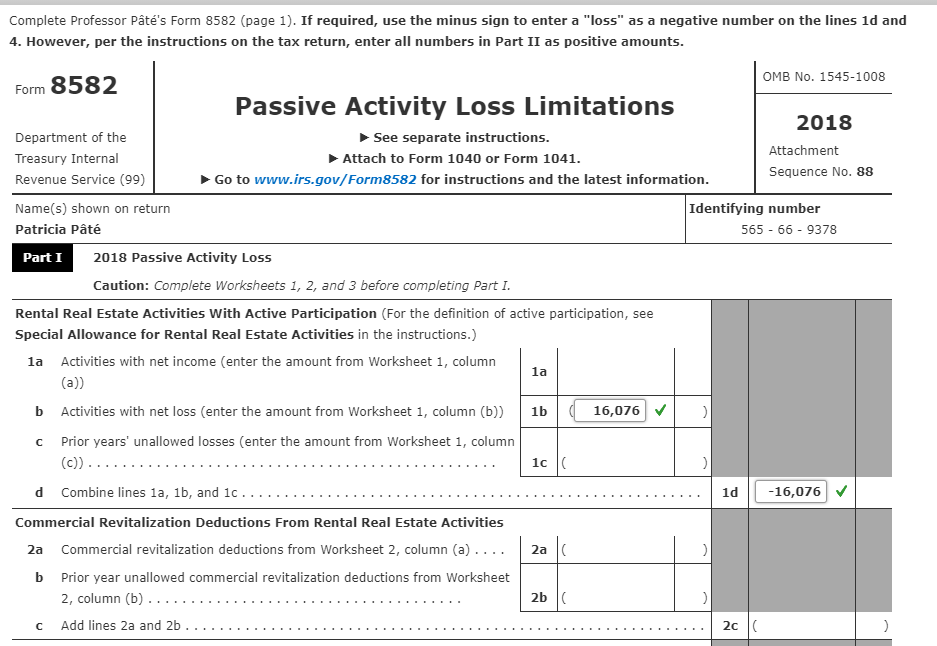

I am stuck on the form 8582 I have the form 1040,

If you lived in maryland only part of the year, you. Only married filers may file joint returns. This article will help you: Press f6 to bring up open forms. Web form 1040 instructions;

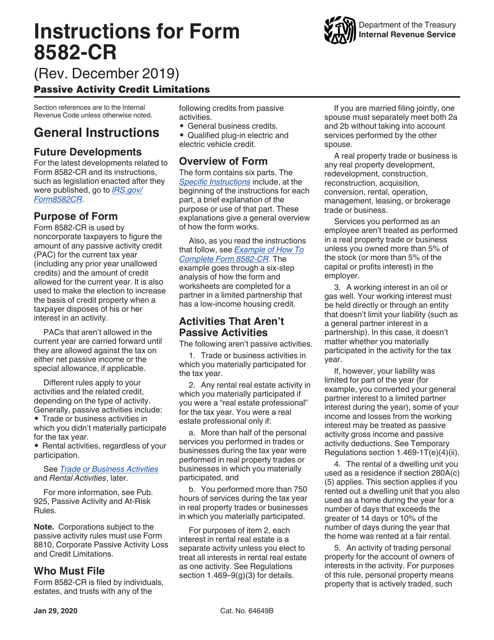

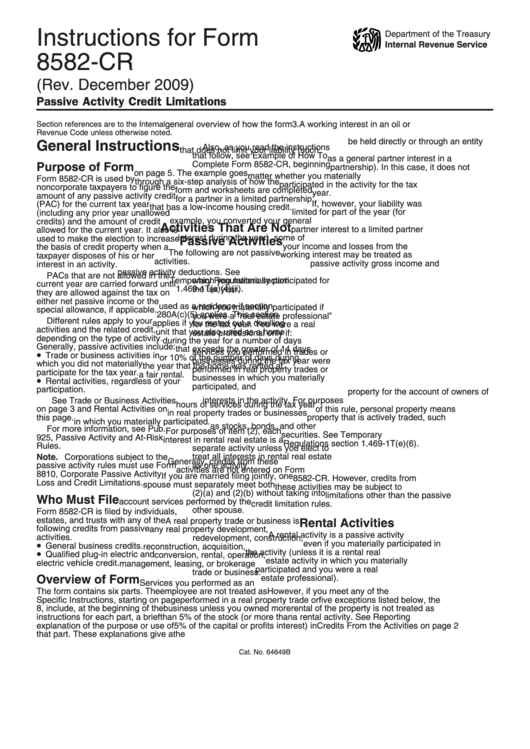

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Use only those items of income, gain, loss, or deduction derived from or connected with new. Activity description i keep getting the entry check error: You must complete the address section of the city of detroit return. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year.

Download Instructions for IRS Form 8582CR Passive Activity Credit

You can download or print current. If you lived in maryland only part of the year, you. 858 name(s) shown on return identifying number part i 2021 passive activity loss. Type 8582 and press enter to open the 8582 page 1. Subtract line 8 from line 7.

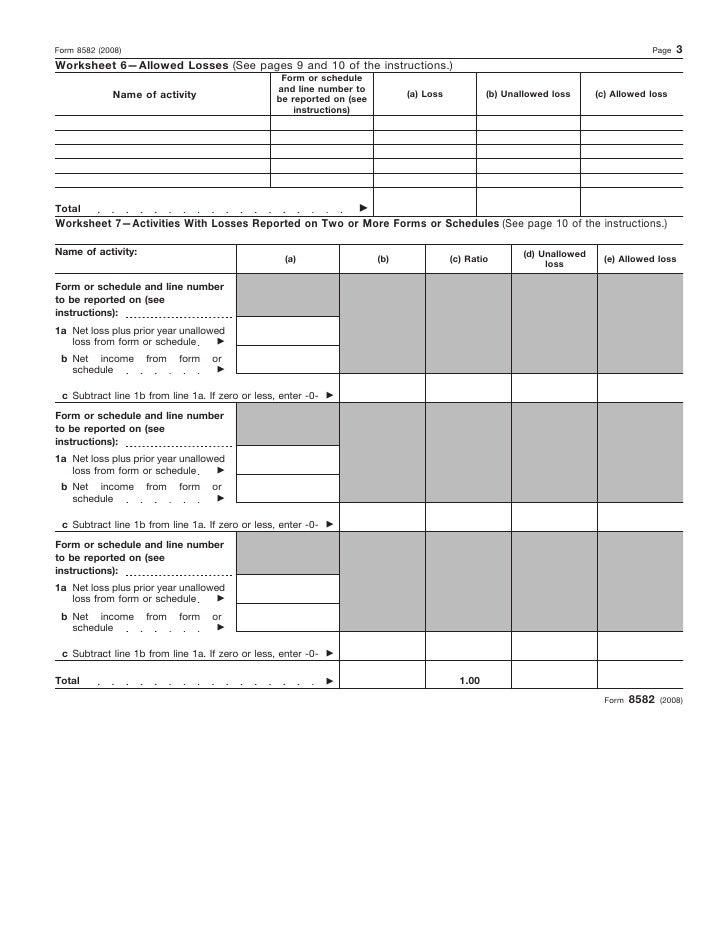

Form 8582Passive Activity Loss Limitations

Press f6 to bring up open forms. Open the client's tax return. Enter name(s) as shown on tax return. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. 858 name(s) shown on return identifying number part i 2021 passive activity loss.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Only married filers may file joint returns. If you lived in maryland only part of the year, you. This article will help you: Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. You can download or print current.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. If you lived in maryland only part of the year, you. This article will help you: Only married filers may file joint returns. Enter losses reported on schedule.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Web viewing the 8582 calculations: Activity description i keep getting the entry check error: Press f6 to bring up open forms. 858 name(s) shown on return identifying number part i 2021 passive activity loss. Type 8582 and press enter to open the 8582 page 1.

Form 8582Passive Activity Loss Limitations

Web viewing the 8582 calculations: Web for instructions and the latest information. Only married filers may file joint returns. Subtract line 8 from line 7. Report this amount on form 3800, part iii, line 1k.

Instructions For Form 8582Cr (Rev. December 2009) printable pdf download

If one or both of the taxpayers is deceased,. Type 8582 and press enter to open the 8582 page 1. Open the client's tax return. Report this amount on form 3800, part iii, line 1k. Activity description i keep getting the entry check error:

Use Only Those Items Of Income, Gain, Loss, Or Deduction Derived From Or Connected With New.

Web for instructions and the latest information. Subtract line 8 from line 7. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. You can download or print current.

When It Comes To The Actual Tax Form 8582 Creation, There Are Three Parts That You Need To Complete:

Web form 1040 instructions; 858 name(s) shown on return identifying number part i 2021 passive activity loss. Section references are to the internal revenue code. You must complete the address section of the city of detroit return.

Press F6 To Bring Up Open Forms.

This article will help you: Open the client's tax return. Web viewing the 8582 calculations: If you lived in maryland only part of the year, you.

Web The Instructions For Federal Form 8582 For Specific Line Instructions And Examples.

Report this amount on form 3800, part iii, line 1k. Enter losses reported on schedule e (form 1040), supplemental income and loss, part. Type 8582 and press enter to open the 8582 page 1. Only married filers may file joint returns.