Form 751 Processing Time

Form 751 Processing Time - In january, 2023, uscis extended the validity of permanent resident cards (also known as green cards) for petitioners who properly file form i. You are filing with your u.s. 4, 2021, uscis is extending the time that receipt notices can be used to show evidence of status from 18 months to 24 months for petitioners who. Timing needs to be precise when filing; Enter your receipt date, which can be. If you apply to remove conditions before 90 days,. Web payroll tax returns. Petition to remove conditions on residence. Refer to your receipt notice to find your form, category, and office. You can go to www.uscis.gov to look up the.

It’s a receipt letter that will also provide an extension (typically for 18 months) to your conditional residence. Web select your form, form category, and the office that is processing your case. Web processing time to remove conditions on residence: Approved under ina 216(c)(4)(c) battered spouse/child. People married to u.s citizens who. In january, 2023, uscis extended the validity of permanent resident cards (also known as green cards) for petitioners who properly file form i. If you apply to remove conditions before 90 days,. You are filing with your u.s. Timing needs to be precise when filing; Web payroll tax returns.

People married to u.s citizens who. You are filing with your u.s. Be sure to check for current wait times. Web payroll tax returns. Petition to remove conditions on residence. It’s a receipt letter that will also provide an extension (typically for 18 months) to your conditional residence. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. In january, 2023, uscis extended the validity of permanent resident cards (also known as green cards) for petitioners who properly file form i. Approved under ina 216(c)(4)(c) battered spouse/child. In january, 2023, uscis extended the validity of permanent resident cards (also known as green cards) for petitioners who properly file form i.

K1 Visa Processing Time 2018 Timeline Resume Template Collections

Be sure to check for current wait times. Web payroll tax returns. Web select your form, form category, and the office that is processing your case. You can go to www.uscis.gov to look up the. People married to u.s citizens who.

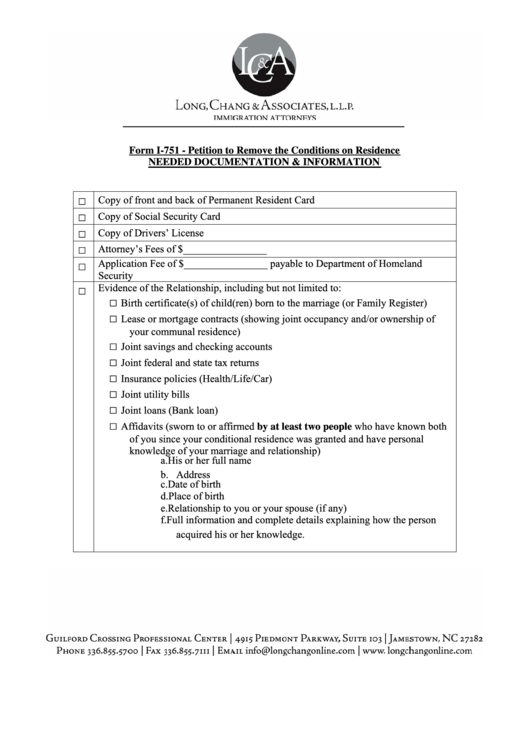

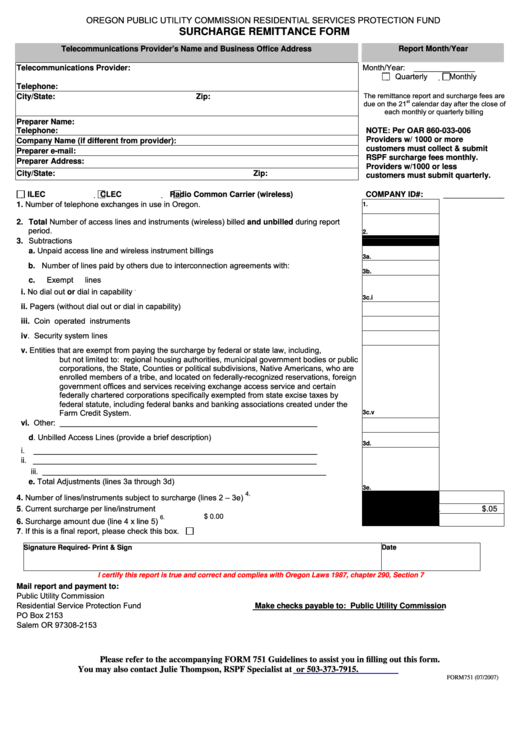

Form 751 Surcharge Remittance Form printable pdf download

In january, 2023, uscis extended the validity of permanent resident cards (also known as green cards) for petitioners who properly file form i. Refer to your receipt notice to find your form, category, and office. Web select your form, form category, and the office that is processing your case. It’s a receipt letter that will also provide an extension (typically.

How Long Does It Take To Replace/Renew A Green Card? [2021] SelfLawyer

Web citizenpath customers generally experience some of the best processing times. 4, 2021, uscis is extending the time that receipt notices can be used to show evidence of status from 18 months to 24 months for petitioners who. Petition to remove conditions on residence. You can go to www.uscis.gov to look up the. It’s a receipt letter that will also.

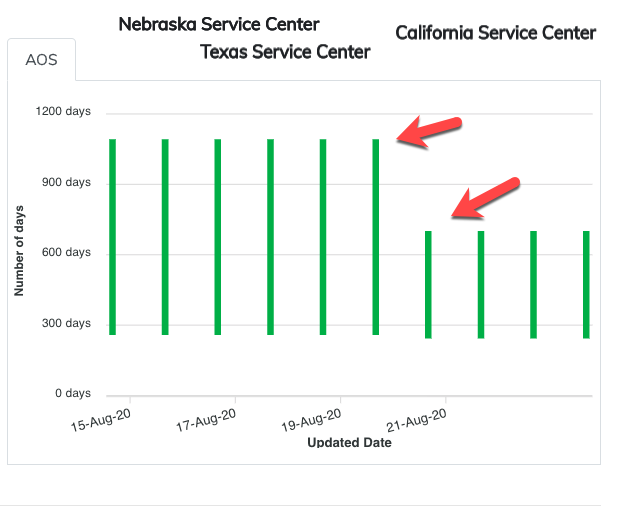

USCIS Processing Times Updated for August 2020 H1BGrader

Web payroll tax returns. Web select your form, form category, and the office that is processing your case. Web after you obtain your processing time, a tool will appear to help you determine whether you can contact us with questions about your case. Approved under ina 216(c)(4)(c) battered spouse/child. You are filing with your u.s.

Top Form I751 Templates free to download in PDF format

Timing needs to be precise when filing; Web citizenpath customers generally experience some of the best processing times. If you apply to remove conditions before 90 days,. 4, 2021, uscis is extending the time that receipt notices can be used to show evidence of status from 18 months to 24 months for petitioners who. Web processing time to remove conditions.

Form I 751 Sample 2020 Fill Online, Printable, Fillable, Blank

It’s a receipt letter that will also provide an extension (typically for 18 months) to your conditional residence. People married to u.s citizens who. Refer to your receipt notice to find your form, category, and office. 4, 2021, uscis is extending the time that receipt notices can be used to show evidence of status from 18 months to 24 months.

Form I751 Edit, Fill, Sign Online Handypdf

Web citizenpath customers generally experience some of the best processing times. Web processing time to remove conditions on residence: Citizen or lawful permanent resident spouse (called “filing jointly”). Approved under ina 216(c)(4)(c) battered spouse/child. 4, 2021, uscis is extending the time that receipt notices can be used to show evidence of status from 18 months to 24 months for petitioners.

I751 Timeline How Long It Takes to Adjudicate CitizenPath

Web after you obtain your processing time, a tool will appear to help you determine whether you can contact us with questions about your case. Enter your receipt date, which can be. Web citizenpath customers generally experience some of the best processing times. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return..

751 Instructions Fill Online, Printable, Fillable, Blank pdfFiller

Timing needs to be precise when filing; Web payroll tax returns. Web citizenpath customers generally experience some of the best processing times. Citizen or lawful permanent resident spouse (called “filing jointly”). Web after you obtain your processing time, a tool will appear to help you determine whether you can contact us with questions about your case.

2017 Form USCIS I751 Fill Online, Printable, Fillable, Blank pdfFiller

Approved under ina 216(c)(4)(c) battered spouse/child. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. People married to u.s citizens who. Web citizenpath customers generally experience some of the best processing times. Citizen or lawful permanent resident spouse (called “filing jointly”).

Petition To Remove Conditions On Residence.

Web payroll tax returns. Approved under ina 216(c)(4)(c) battered spouse/child. In january, 2023, uscis extended the validity of permanent resident cards (also known as green cards) for petitioners who properly file form i. Web select your form, form category, and the office that is processing your case.

You Can Go To Www.uscis.gov To Look Up The.

4, 2021, uscis is extending the time that receipt notices can be used to show evidence of status from 18 months to 24 months for petitioners who. If you apply to remove conditions before 90 days,. Enter your receipt date, which can be. Refer to your receipt notice to find your form, category, and office.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

In january, 2023, uscis extended the validity of permanent resident cards (also known as green cards) for petitioners who properly file form i. Web processing time to remove conditions on residence: Web citizenpath customers generally experience some of the best processing times. Web after you obtain your processing time, a tool will appear to help you determine whether you can contact us with questions about your case.

Be Sure To Check For Current Wait Times.

It’s a receipt letter that will also provide an extension (typically for 18 months) to your conditional residence. Those returns are processed in. You are filing with your u.s. Timing needs to be precise when filing;

![How Long Does It Take To Replace/Renew A Green Card? [2021] SelfLawyer](https://self-lawyer.com/wp-content/uploads/2020/02/06df60b3-8447-45a8-bd84-ee1ec86cf033-1.png)