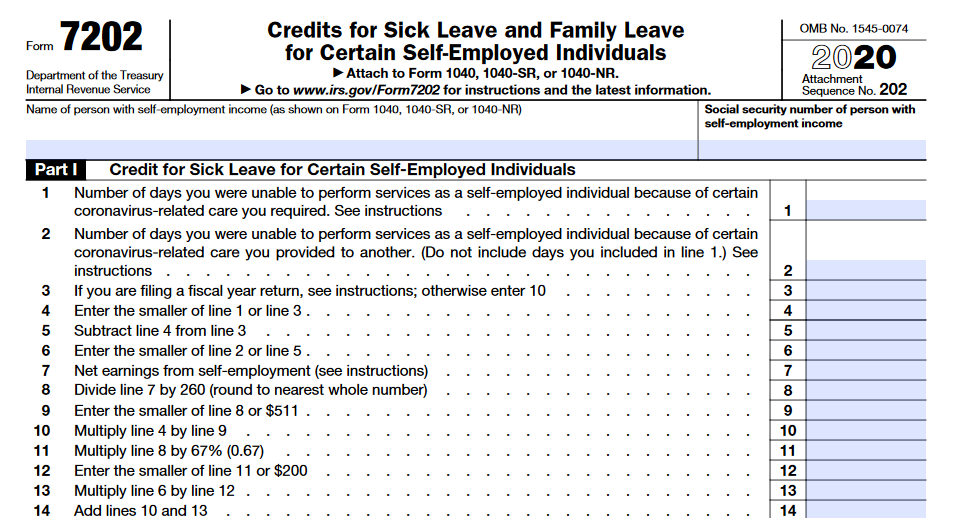

Form 7202 Credit

Form 7202 Credit - Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Essentially, if you worked for an employer this year, you. Part ii of form 7202 focuses on calculating credit for family leave. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s. Family leave credit = 2/3 of the paid sick leave credit. Form 7202 is then attached to the. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. If you are filing a joint return,.

Web february 16, 2021. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Web recalculate the credit on the form 7202. Family leave credit = 2/3 of the paid sick leave credit. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Maximum $200 family leave credit. Form 7202 is then attached to the. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s.

If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s. Maximum $200 family leave credit. Essentially, if you worked for an employer this year, you. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web recalculate the credit on the form 7202. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Form 7202 is then attached to the.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. If you are filing a joint return,. Web form 7202 will allow tax.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

Maximum $200 family leave credit. If you are filing a joint return,. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Family leave credit = 2/3 of the paid sick leave credit. Web maximum $511 paid sick leave credit per day,.

Tax update usa Tax forms, Tax, Independent contractor

Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Family leave credit = 2/3 of the paid sick leave credit. Part ii of form 7202 focuses on calculating credit for family leave. Essentially, if you worked for an employer this year,.

Form 7202 Sick and Family Leave Credit for Self Employed YouTube

Part ii of form 7202 focuses on calculating credit for family leave. If you are filing a joint return,. Maximum $200 family leave credit. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and.

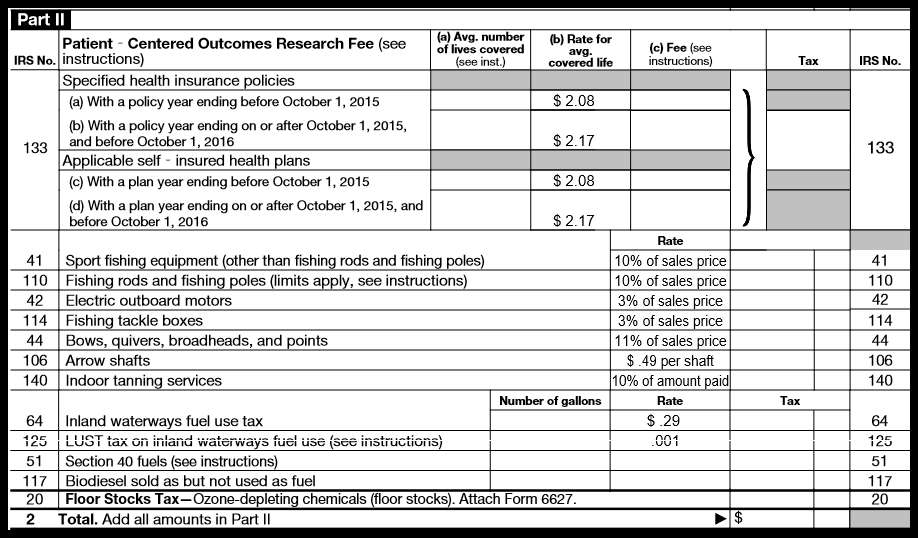

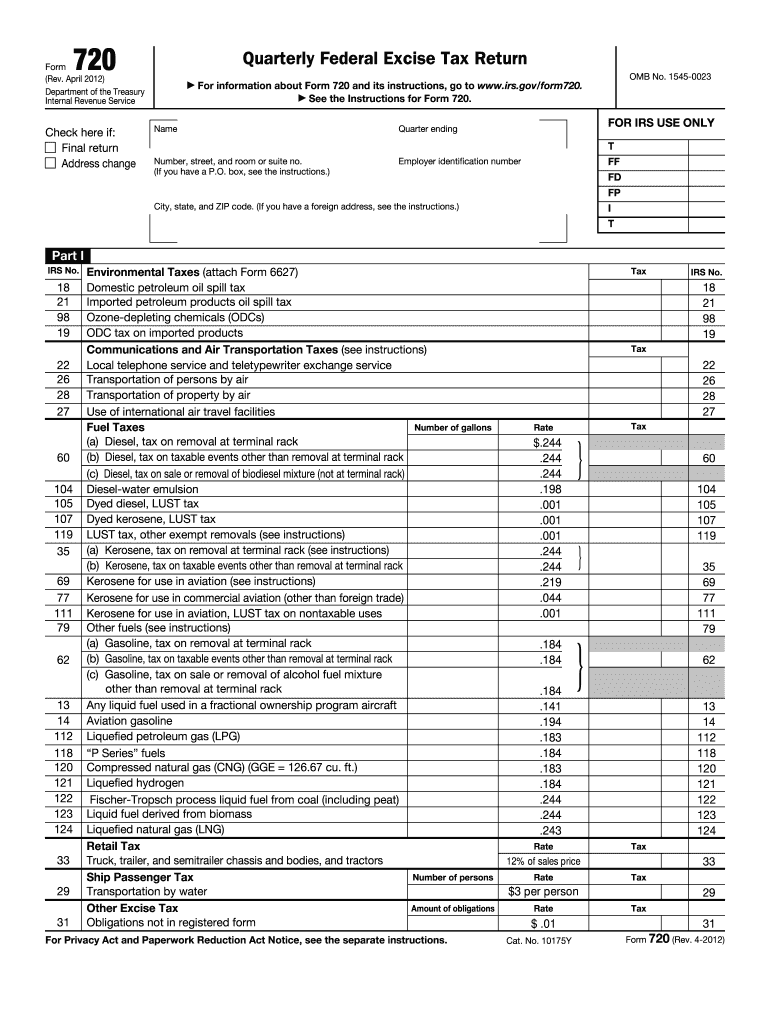

How to Complete Form 720 Quarterly Federal Excise Tax Return

Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Form 7202 is then attached to the. Web february 16, 2021. Maximum $200 family leave credit. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec.

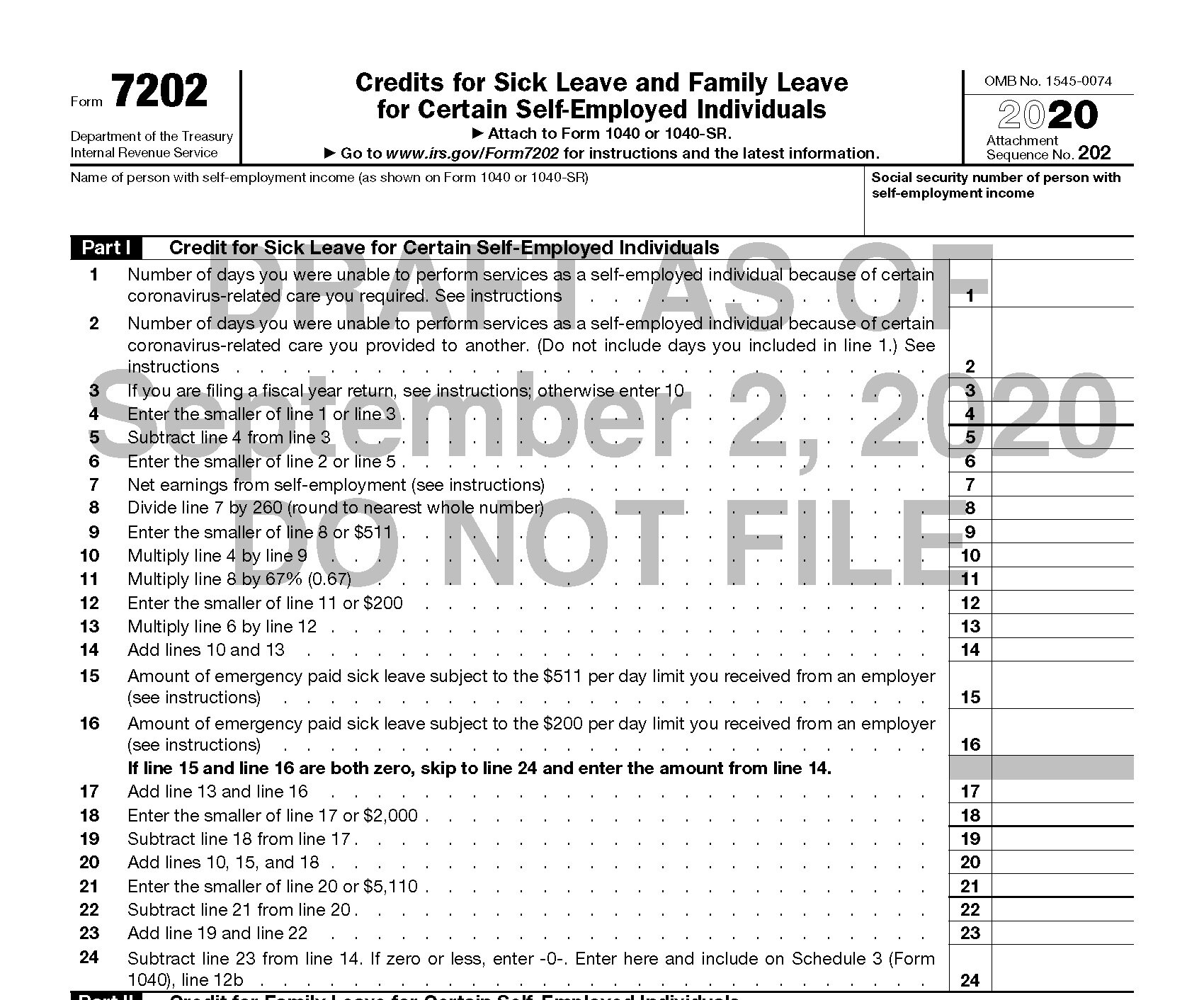

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s. Essentially, if you worked for an employer this year, you. Web recalculate the credit on the form 7202. Maximum $200 family leave credit. Form 7202 is then attached to the.

IRS comes with a New Form 7202 to Claim Tax Credits for Sick and Family

For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Maximum $200 family leave credit. Part ii of form 7202 focuses on calculating credit for family leave. Form 7202 is then attached to the. Web february 16, 2021.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. If you are filing a joint return,. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Form 7202 is then attached to.

Memo SelfEmployed People, Don't Miss Your 2020 Coronavirus Tax

For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Part ii of form 7202 focuses on calculating credit for family leave. Essentially, if you worked for an employer.

Irs Form 720 Fill Out and Sign Printable PDF Template signNow

Web february 16, 2021. Web recalculate the credit on the form 7202. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your.

Form 7202 Is Then Attached To The.

Web recalculate the credit on the form 7202. If you are filing a joint return,. Essentially, if you worked for an employer this year, you. Web february 16, 2021.

Web Maximum $511 Paid Sick Leave Credit Per Day, And $5,110 In The Aggregate.

Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Maximum $200 family leave credit. If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b.

Part Ii Of Form 7202 Focuses On Calculating Credit For Family Leave.

For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Family leave credit = 2/3 of the paid sick leave credit.