Form 7202 2021

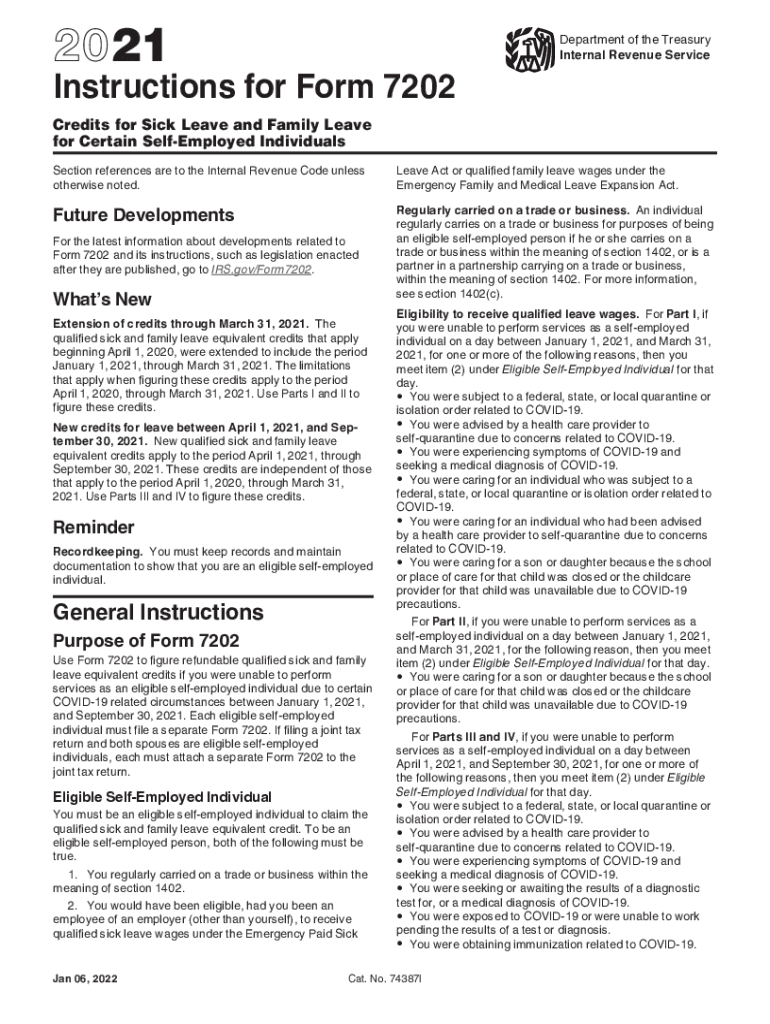

Form 7202 2021 - To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: The form is obsolete after those years.** note:. Solved • by intuit • 170 • updated december 21, 2022. Web form 7202 is produced in view mode to calculate the eligible credit on either line 24 or 35 (part i or part ii) to flow to form 1040, schedule 3, line 12b. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Web general instructions purpose of form 7202 these instructions give you some background information about form 7202. They tell you who may file form 7202. Web this article will assist you with generating form 7202 in intuit proconnect. Web how to generate form 7202 in lacerte. Ad register and subscribe now to work on your irs form 7202 & more fillable forms.

For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Solved • by intuit • 170 • updated december 21, 2022. Web how to generate form 7202 in lacerte. Web up to $40 cash back get, create, make and sign 2021 7202 form. To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web general instructions purpose of form 7202 these instructions give you some background information about form 7202. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. They tell you who may file form 7202. The form is obsolete after those years.** note:. Get form esign fax email add annotation share this is how it works.

Get form esign fax email add annotation share this is how it works. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Web general instructions purpose of form 7202 these instructions give you some background information about form 7202. They tell you who may file form 7202. Solved • by intuit • 170 • updated december 21, 2022. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Essentially, if you worked for an employer this year, you. The credits for sick leave and family leave for certain self. Web form 7202 is produced in view mode to calculate the eligible credit on either line 24 or 35 (part i or part ii) to flow to form 1040, schedule 3, line 12b. To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select:

Irs Instructions 7202 Fill Out and Sign Printable PDF Template signNow

They tell you who may file form 7202. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Irs instructions can be found. Web this article will assist you with generating form 7202 in intuit proconnect. Get form esign fax email add annotation share this is how it works.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

Essentially, if you worked for an employer this year, you. Solved • by intuit • 170 • updated december 21, 2022. They tell you who may file form 7202. Web how to generate form 7202 in lacerte. Web general instructions purpose of form 7202 these instructions give you some background information about form 7202.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Web how to generate form 7202 in lacerte. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. They tell you who may.

Getting Ready for the 2021 Tax Season Basics & Beyond

They tell you who may file form 7202. To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Ad register and subscribe now to.

COVID19 tax relief What is IRS Form 7202, and how it could help if

Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Irs instructions can be found. The form is obsolete after those years.** note:. Web up to $40 cash back get, create, make and sign 2021 7202 form. Solved • by intuit •.

New IRS form available for selfemployed individuals to claim COVID19

For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. They tell you who may file form 7202. The credits for sick leave.

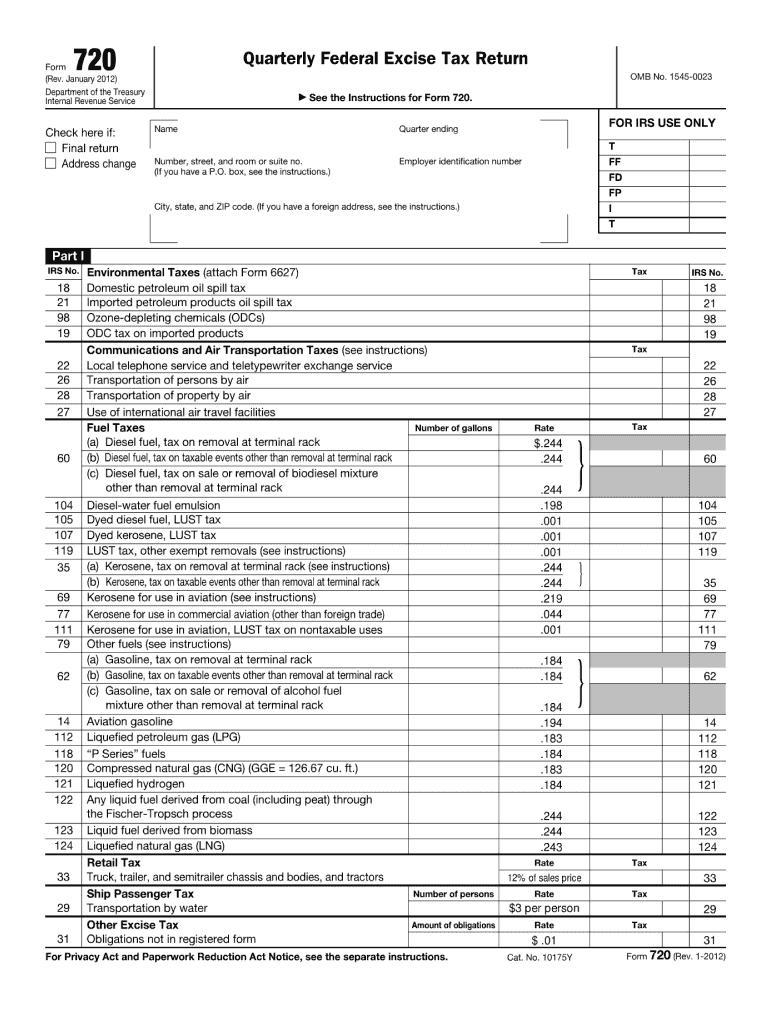

Form 720 Fill Out and Sign Printable PDF Template signNow

Get form esign fax email add annotation share this is how it works. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Essentially, if you worked for an employer this year, you. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

They tell you who may file form 7202. Essentially, if you worked for an employer this year, you. Web this article will assist you with generating form 7202 in intuit proconnect. To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: The form is obsolete after those years.** note:.

Memo SelfEmployed People, Don't Miss Your 2020 Coronavirus Tax

Solved • by intuit • 170 • updated december 21, 2022. Web general instructions purpose of form 7202 these instructions give you some background information about form 7202. Web this article will assist you with generating form 7202 in intuit proconnect. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of..

Form 7202 SelfEmployed Audit Risk Form 7202 Tax Return Evidence the

Web up to $40 cash back get, create, make and sign 2021 7202 form. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. The credits for sick leave and family leave for certain self. Essentially, if you worked for an employer this year, you. Web this article will assist you.

To Access Form 7202 In Taxslayer Pro, From The Main Menu Of The Tax Return (Form 1040) Select:

Essentially, if you worked for an employer this year, you. For 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. The credits for sick leave and family leave for certain self. They tell you who may file form 7202.

The Form Is Obsolete After Those Years.** Note:.

Web up to $40 cash back get, create, make and sign 2021 7202 form. Web form 7202 is produced in view mode to calculate the eligible credit on either line 24 or 35 (part i or part ii) to flow to form 1040, schedule 3, line 12b. Irs instructions can be found. Ad register and subscribe now to work on your irs form 7202 & more fillable forms.

Web How To Generate Form 7202 In Lacerte.

Web this article will assist you with generating form 7202 in intuit proconnect. Web general instructions purpose of form 7202 these instructions give you some background information about form 7202. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Solved • by intuit • 170 • updated december 21, 2022.

/cloudfront-us-east-1.images.arcpublishing.com/gray/C4JFNVOUCNGXVPYLGGMD4GZ5OQ.png)