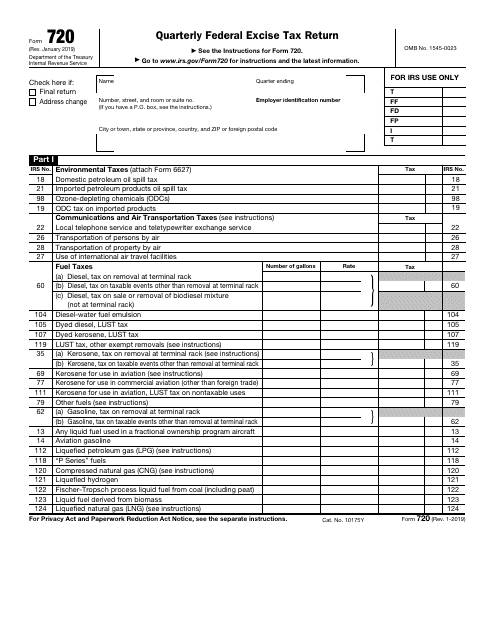

Form 720 2021

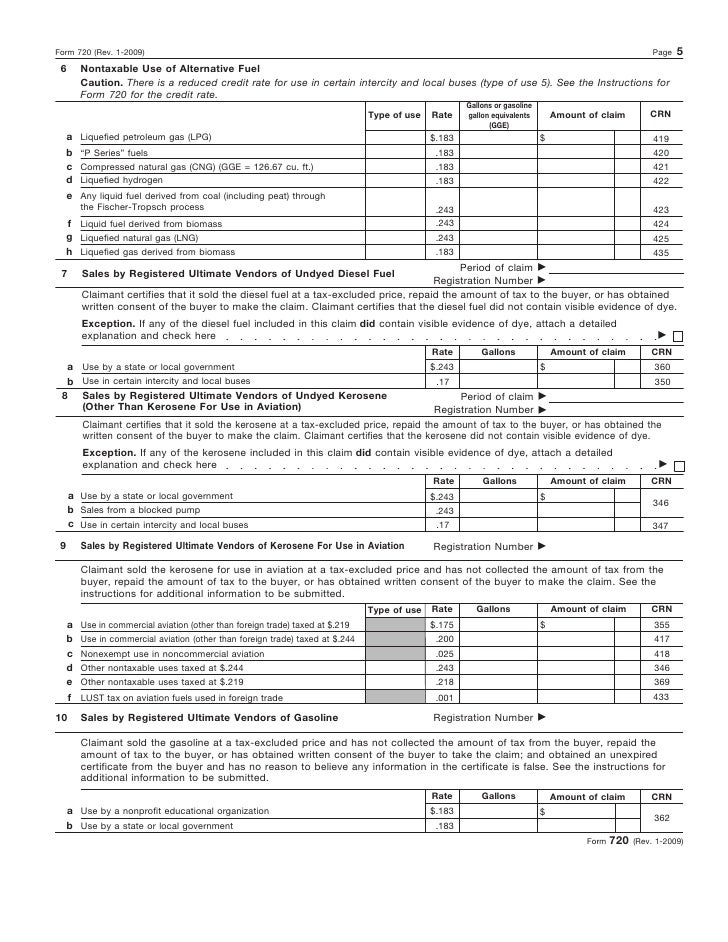

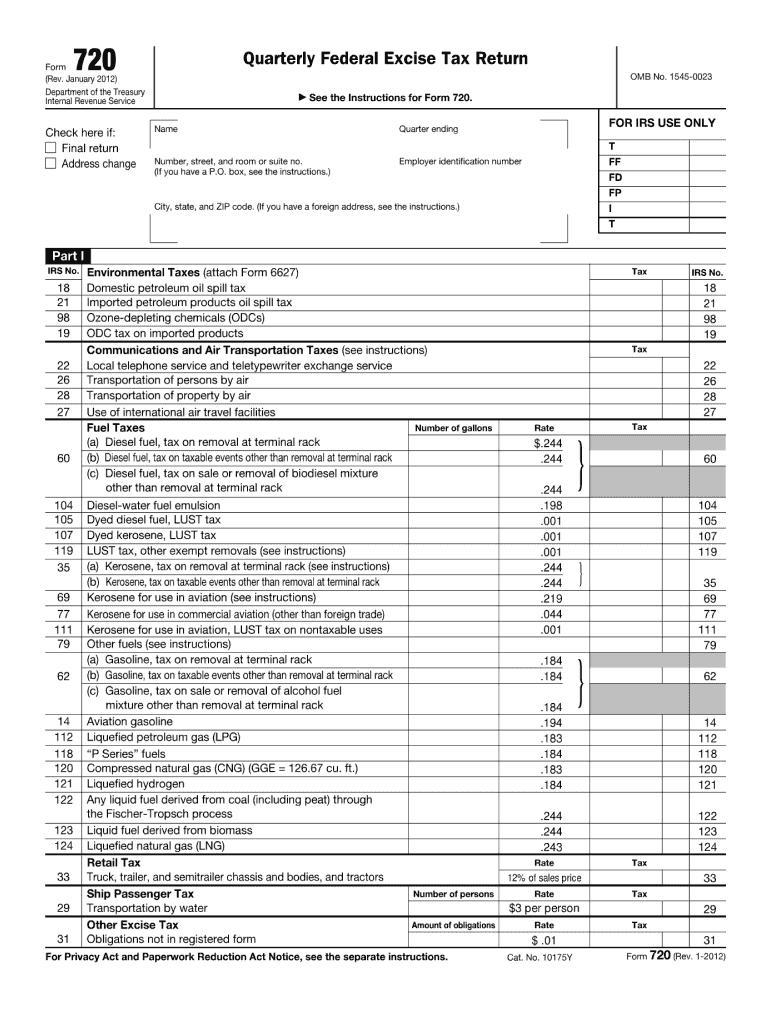

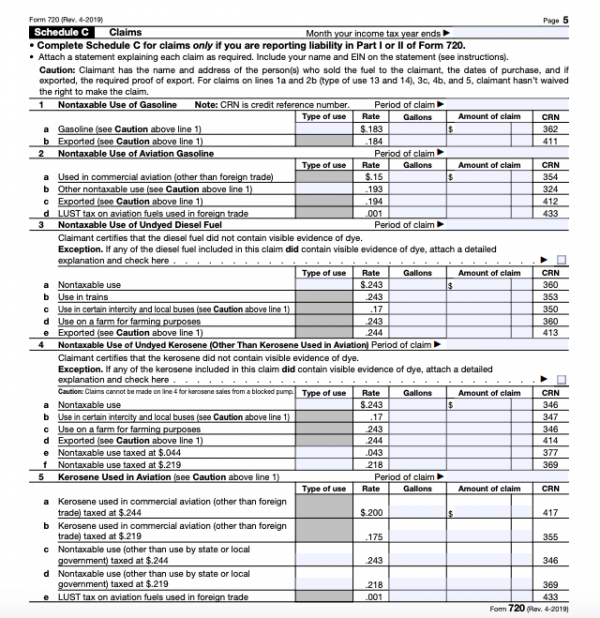

Form 720 2021 - A majority of the excise taxes are charged based on unit sales or weight. If you aren't reporting a tax that you normally report, enter a zero on the appropriate line on form 720, part i or ii. Most excise tax in some ways resembles a state sales tax. You can print other federal tax forms here. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. See the instructions for form 720. Web tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of income/assets. For example, various types of diesel fuel require the payment of approximately 24 cents for each gallon. Excise taxes are taxes paid when purchases are made on a specific good.

Web we last updated the quarterly federal excise tax return in december 2022, so this is the latest version of form 720, fully updated for tax year 2022. For instructions and the latest information. Form 720 includes a line for each type of excise tax that you may be responsible for paying. Web tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of income/assets. You can print other federal tax forms here. If you aren't reporting a tax that you normally report, enter a zero on the appropriate line on form 720, part i or ii. For example, various types of diesel fuel require the payment of approximately 24 cents for each gallon. Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or plan year to which the fee applies. Web filling out form 720. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form.

Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or plan year to which the fee applies. Form 720 includes a line for each type of excise tax that you may be responsible for paying. Also, if you have no tax to report, write “none” on form 720, part iii, line 3; See the instructions for form 720. Web this form 720 is used to report and pay federal excise taxes. Web we last updated the quarterly federal excise tax return in december 2022, so this is the latest version of form 720, fully updated for tax year 2022. Web for information on the fee, see the questions and answers and chart summary. You can print other federal tax forms here. This is a tax form that all businesses must complete quarterly, specifically if your business sells goods or services that are subject to excise tax, you will report and pay those taxes via this form, quarterly federal excise tax return. A majority of the excise taxes are charged based on unit sales or weight.

Form 720 Quarterly Federal Excise Tax Return

Web send form 720 to: Form 720 includes a line for each type of excise tax that you may be responsible for paying. Web tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of income/assets. Web we last updated the quarterly federal excise tax return in december 2022, so.

Form 720TO Terminal Operator Report (2010) Free Download

Web for information on the fee, see the questions and answers and chart summary. For example, various types of diesel fuel require the payment of approximately 24 cents for each gallon. Web tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of income/assets. June 2021) department of the treasury.

2021 Form IRS Instructions 720 Fill Online, Printable, Fillable, Blank

June 2021) department of the treasury internal revenue service. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. For instructions and the latest information. Also, if you have no tax to report, write “none” on form 720, part.

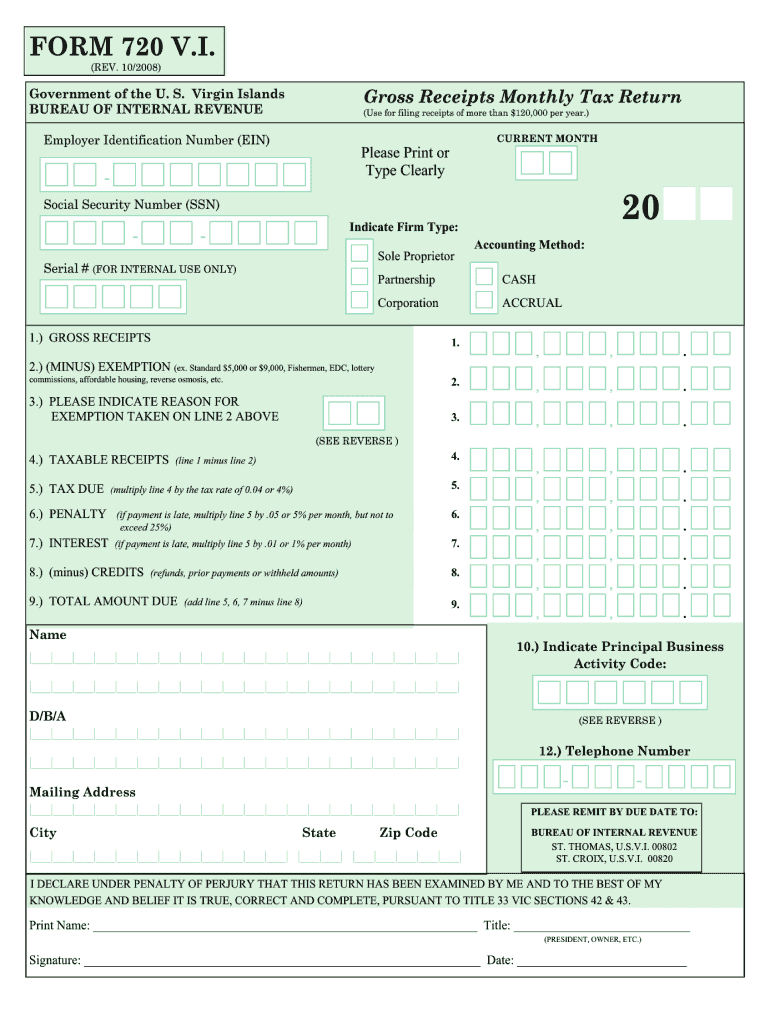

20 FORM 720 VI Virgin Islands Internal Revenue Fill Out and Sign

Quarterly federal excise tax return. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. Web send form 720 to: Form 720 includes a line for each type of excise tax that you may be responsible for paying. You.

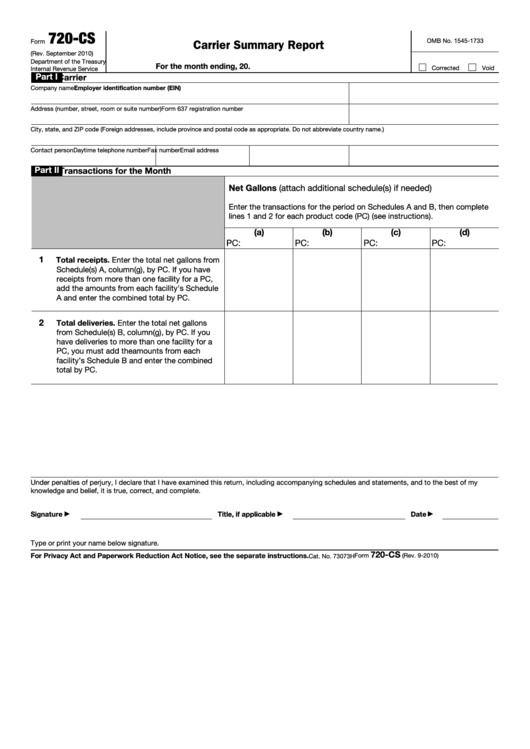

Fillable Form 720Cs Carrier Summary Report printable pdf download

Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or plan year to which the fee applies. If you aren't reporting a tax that you normally report, enter a zero on the appropriate line.

Form 720 Fill Out and Sign Printable PDF Template signNow

Quarterly federal excise tax return. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web we last updated the quarterly federal excise tax return in december 2022, so this is the latest version of form 720, fully updated for tax year 2022. Web this form 720 is used.

Electronic Filing for IRS Tax Form 720 at

Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or plan year to which the fee applies. See the instructions for form 720. For instructions and the latest information. Web for information on the.

IRS Form 720 Download Fillable PDF or Fill Online Quarterly Federal

Quarterly federal excise tax return. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Also, if you have no tax to report, write “none” on form 720, part iii, line 3; Web we last updated the quarterly federal excise tax return in december 2022, so this is the.

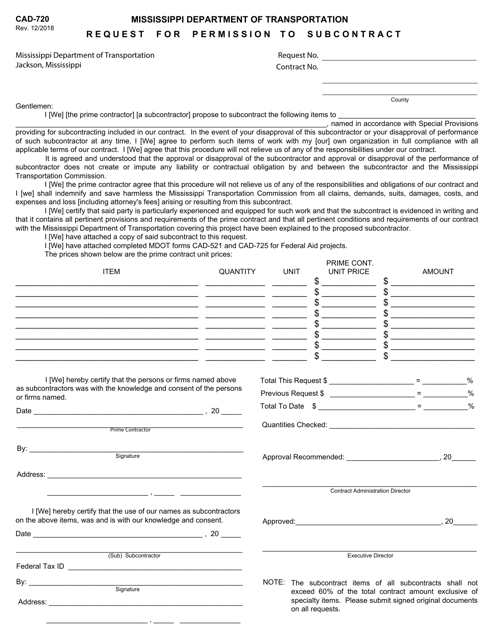

Form CAD720 Download Fillable PDF or Fill Online Request for

For instructions and the latest information. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. Sign and date the return. Quarterly federal excise tax return. Web we last updated the quarterly federal excise tax return in december 2022,.

Form 720 Instructions Where to Get IRS Form 720 and How to Fill It Out

Web we last updated the quarterly federal excise tax return in december 2022, so this is the latest version of form 720, fully updated for tax year 2022. Excise taxes are taxes paid when purchases are made on a specific good. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how.

Form 720 Is Used By Taxpayers To Report Liability By Irs Number And To Pay The Excise Taxes Listed On The Form.

Web filling out form 720. Excise taxes are taxes paid when purchases are made on a specific good. This is a tax form that all businesses must complete quarterly, specifically if your business sells goods or services that are subject to excise tax, you will report and pay those taxes via this form, quarterly federal excise tax return. You can print other federal tax forms here.

Web Tax Form 720, Quarterly Federal Excise Tax Return, Is Used To Calculate And Make Excise Tax Payments On Certain Categories Of Income/Assets.

June 2021) department of the treasury internal revenue service. Web we last updated the quarterly federal excise tax return in december 2022, so this is the latest version of form 720, fully updated for tax year 2022. See the instructions for form 720. Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or plan year to which the fee applies.

Web Information About Form 720, Quarterly Federal Excise Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

For example, various types of diesel fuel require the payment of approximately 24 cents for each gallon. Also, if you have no tax to report, write “none” on form 720, part iii, line 3; A majority of the excise taxes are charged based on unit sales or weight. Sign and date the return.

Web For Information On The Fee, See The Questions And Answers And Chart Summary.

Quarterly federal excise tax return. Web this form 720 is used to report and pay federal excise taxes. Web send form 720 to: For instructions and the latest information.