Form 7004 Instructions

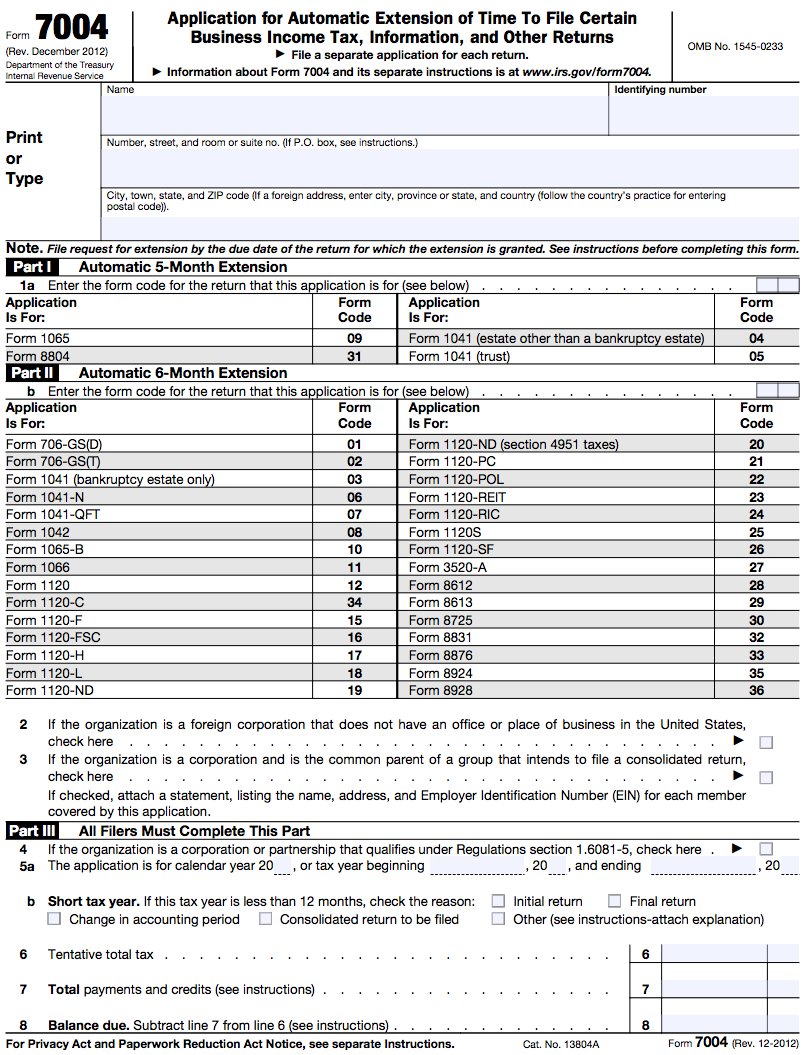

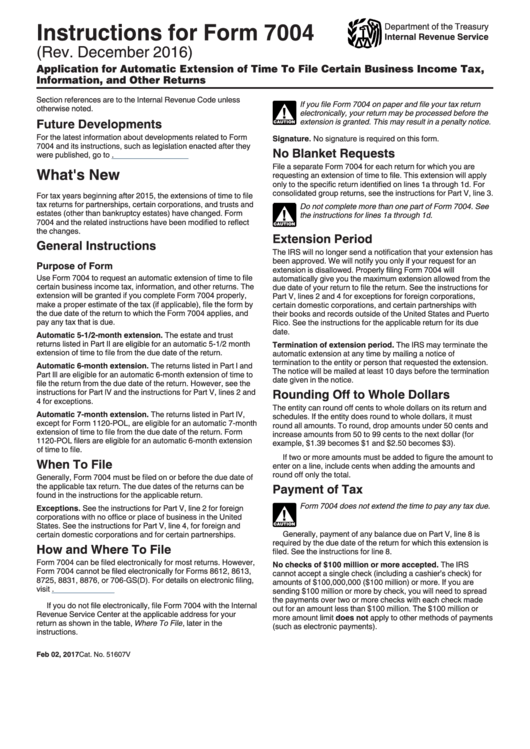

Form 7004 Instructions - Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns.” as the name implies, irs form 7004 is used by various types of businesses to extend the filing deadline on their taxes. File form 7004 based on. Follow the instructions to prepare and print your 7004 form. See the form 7004 instructions for a list of the exceptions. Certain business income tax, information, and other returns. According to the irs, however, you’re only granted this extension if you: Refer to the form 7004 instructions for additional information on payment of tax and balance due. Web you can file an irs form 7004 electronically for most returns. Web the form 7004 does not extend the time for payment of tax. The rounding off to whole dollars extension will be granted if.

Web purpose of form. File form 7004 before or on the deadline of the form you need an extension on Web the form 7004 does not extend the time for payment of tax. Refer to the form 7004 instructions for additional information on payment of tax and balance due. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. We'll provide the mailing address and any payment. Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that tax form. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Select extension of time to file (form 7004) and continue; File form 7004 based on.

Web the form 7004 does not extend the time for payment of tax. File form 7004 before or on the deadline of the form you need an extension on Follow the instructions to prepare and print your 7004 form. Select extension of time to file (form 7004) and continue; Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Web purpose of form. The rounding off to whole dollars extension will be granted if. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date. See the form 7004 instructions for a list of the exceptions.

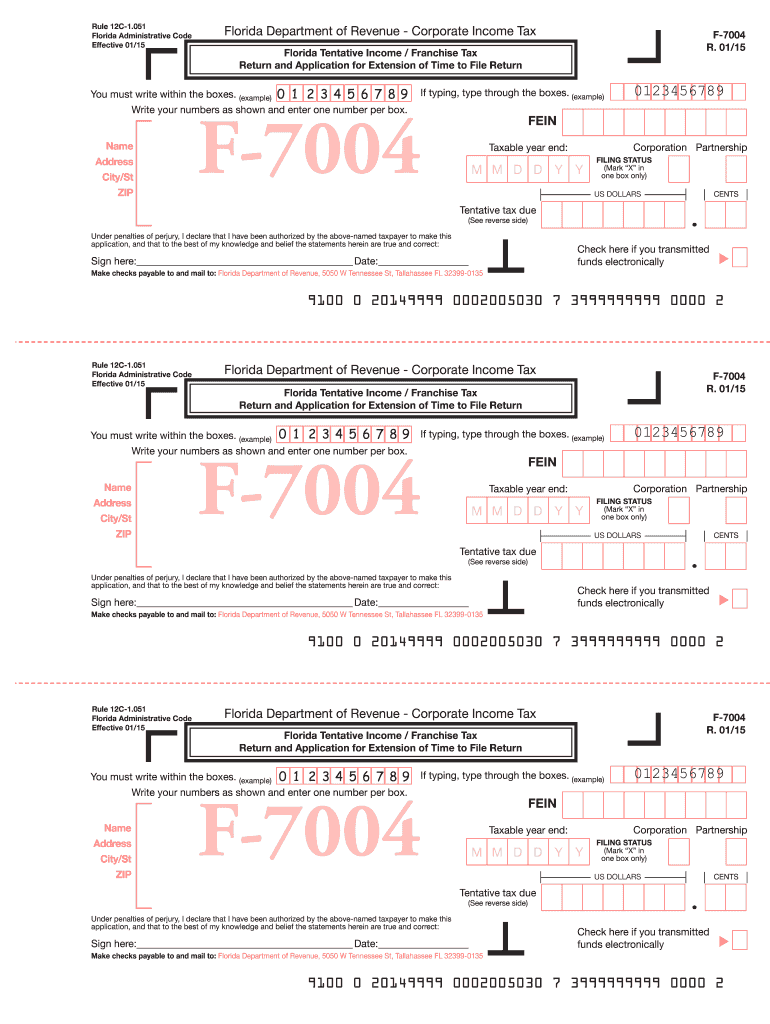

Form 7004 Printable PDF Sample

File form 7004 based on. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Make a proper estimate of any.

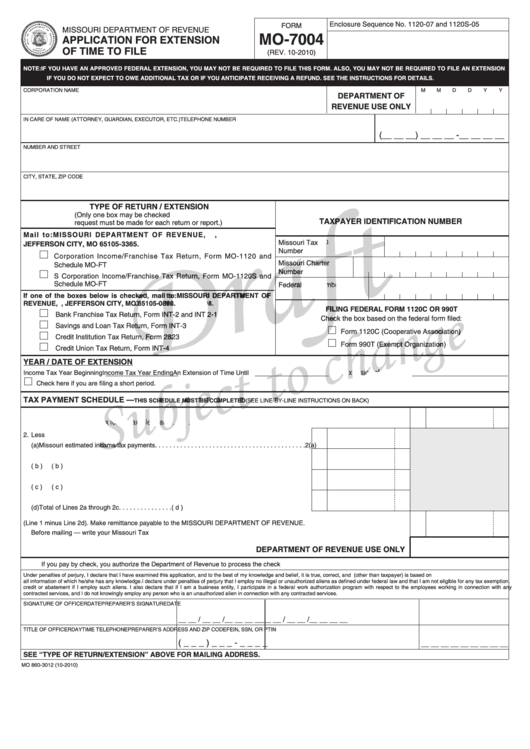

Form Mo7004 Draft Application For Extension Of Time To File 2010

Web follow these steps to print a 7004 in turbotax business: The rounding off to whole dollars extension will be granted if. Certain business income tax, information, and other returns. According to the irs, however, you’re only granted this extension if you: Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that.

Irs Form 7004 amulette

Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web you can file an irs form 7004 electronically for most returns. Web information about form 7004, application for automatic extension of time to file certain business.

のん様ご専用 ありがとうございます♡ トートバッグ バッグ レディース 新着商品

We'll provide the mailing address and any payment. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns.” as the name implies, irs form 7004 is used by various types of businesses to extend the filing deadline on their taxes. See the form 7004.

Instructions For Form 7004 Application For Automatic Extension Of

File form 7004 based on. Select extension of time to file (form 7004) and continue; Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent.

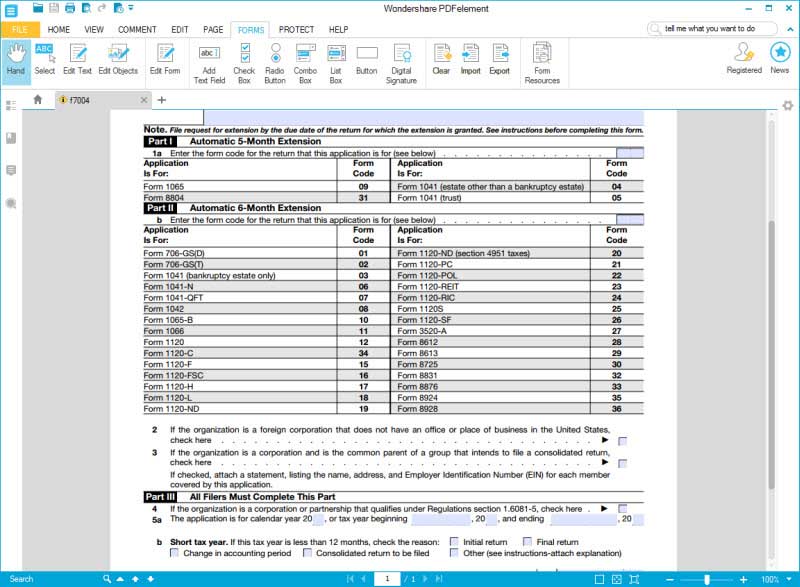

Instructions for How to Fill in IRS Form 7004

See the form 7004 instructions for a list of the exceptions. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. File form 7004 before or on the deadline of the form you need an extension on File form 7004 based.

Form 7004 E File Instructions Universal Network

We'll provide the mailing address and any payment. See the form 7004 instructions for a list of the exceptions. Follow the instructions to prepare and print your 7004 form. According to the irs, however, you’re only granted this extension if you: Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for.

Form F 7004 Fill Out and Sign Printable PDF Template signNow

File form 7004 based on. The rounding off to whole dollars extension will be granted if. According to the irs, however, you’re only granted this extension if you: Form 7004 is used to request an automatic extension to file the certain returns. Web use form 7004 to request an automatic extension of time to file instructions for the applicable return.

Instructions For Form 7004 Application For Automatic Extension Of

Form 7004 is used to request an automatic extension to file the certain returns. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. With your return open, select search and enter extend; The extension will be granted if you complete.

File Form 7004 Online 2021 Business Tax Extension Form

Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that tax form. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business.

According To The Irs, However, You’re Only Granted This Extension If You:

The rounding off to whole dollars extension will be granted if. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web the form 7004 does not extend the time for payment of tax.

Web Successfully And Properly Filing Form 7004 Grants You A Six Month Corporate Tax Extension To File That Tax Form.

Make a proper estimate of any taxes you owe. Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date. Web purpose of form. File form 7004 before or on the deadline of the form you need an extension on

Web We Last Updated The Irs Automatic Business Extension Instructions In February 2023, So This Is The Latest Version Of Form 7004 Instructions, Fully Updated For Tax Year 2022.

Certain business income tax, information, and other returns. Select extension of time to file (form 7004) and continue; See the form 7004 instructions for a list of the exceptions. Web follow these steps to print a 7004 in turbotax business:

File Form 7004 Based On.

The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Web you can file an irs form 7004 electronically for most returns. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns.” as the name implies, irs form 7004 is used by various types of businesses to extend the filing deadline on their taxes. Refer to the form 7004 instructions for additional information on payment of tax and balance due.