Form 7004 Fillable

Form 7004 Fillable - It is also known as an. This form is for income earned in tax year 2022, with tax returns due in april. December 2018) 7004 form (rev. There are several sections which you have to complete: The due dates of the returns can be found in the instructions for the. Web you can fill it out online, or you can print it out and complete it by hand. Here what you need to start: Find the federal tax form either. Ad download or email irs 7004 & more fillable forms, try for free now! Web application for automatic extension of time to file certain business income tax, information, and other returns form 7004 (rev.

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Use form 7004 to request an automatic 6. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Efile your extension online free It is also known as an. December 2018) 7004 form (rev. Web it can also be submitted electronically via the irs website. 01/17 tc you must write within the boxes. Provide the irs with data on. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions.

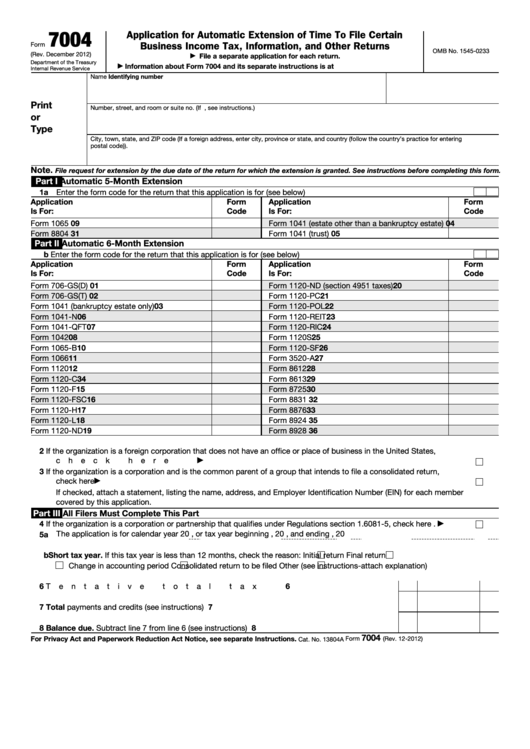

How to fill out form 7004 form 7004 is a relatively short form by irs standards. Here what you need to start: There are several sections which you have to complete: Use form 7004 to request an automatic 6. Web application for automatic extension of time to file certain business income tax, information, and other returns form 7004 (rev. December 2018) 7004 form (rev. Web to complete form 7004: Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our. (example) write your numbers as shown and enter one number.

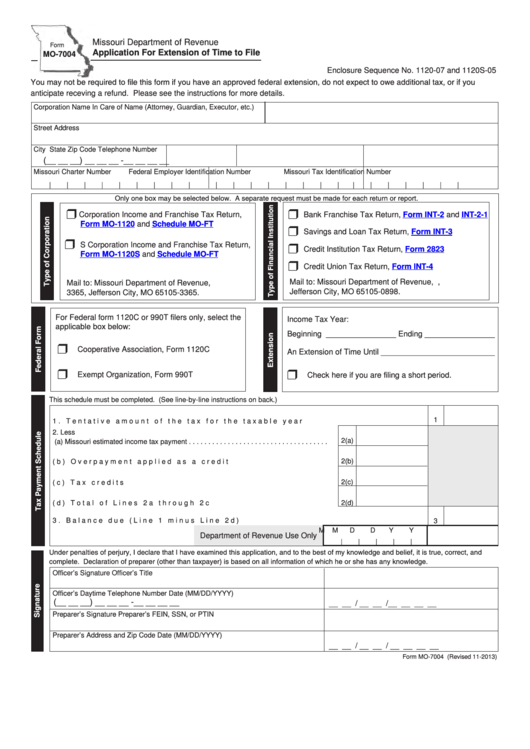

Fillable Form Mo7004 Application For Extension Of Time To File

Web we last updated federal form 7004 in february 2023 from the federal internal revenue service. Provide the irs with data on. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Web to complete form 7004: Ad need more time to prepare your federal tax return?

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. This form is for income earned in tax year 2022, with tax returns due in april. (example) write your numbers as shown and enter one number. Web application for automatic extension of time to file certain business income tax,.

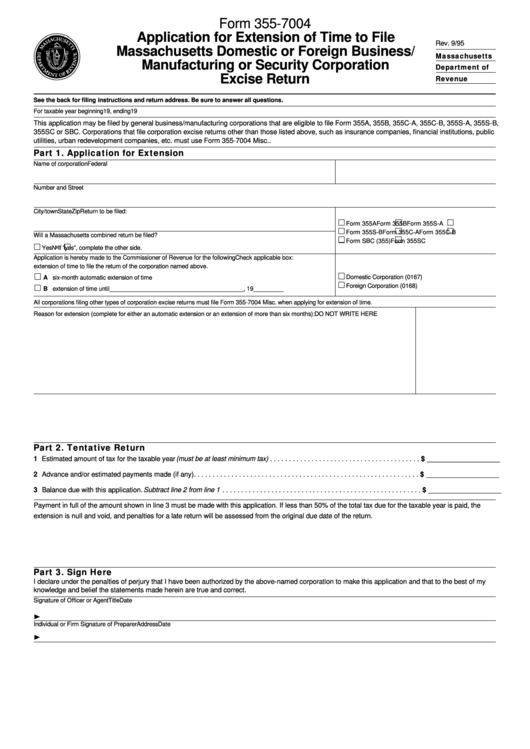

Fillable Form 3557004 Massachusetts Domestic Or Foreign Business

(example) write your numbers as shown and enter one number. Ad download or email irs 7004 & more fillable forms, try for free now! Form 7004 is a tax document used by businesses who want to receive an automatic extension of time to file their taxes for the year. Find the federal tax form either. Web use form 7004 to.

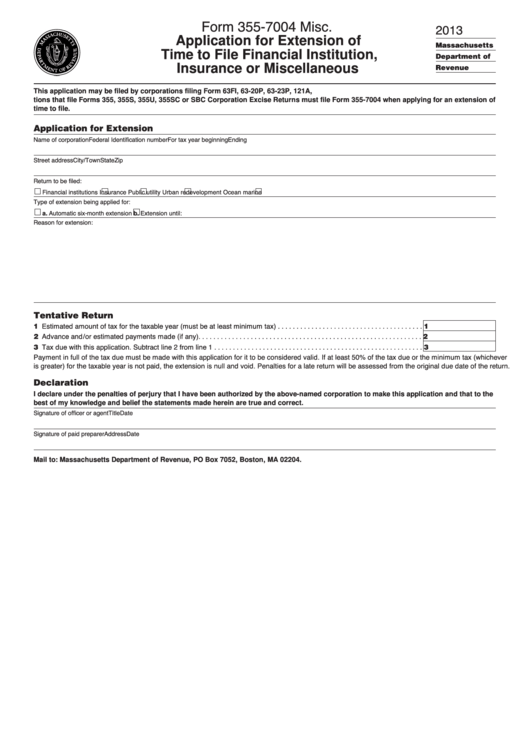

Fillable Form 3557004 Misc Application For Extension Of Time To File

Web irs tax form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. There are several sections which you have to complete: Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out.

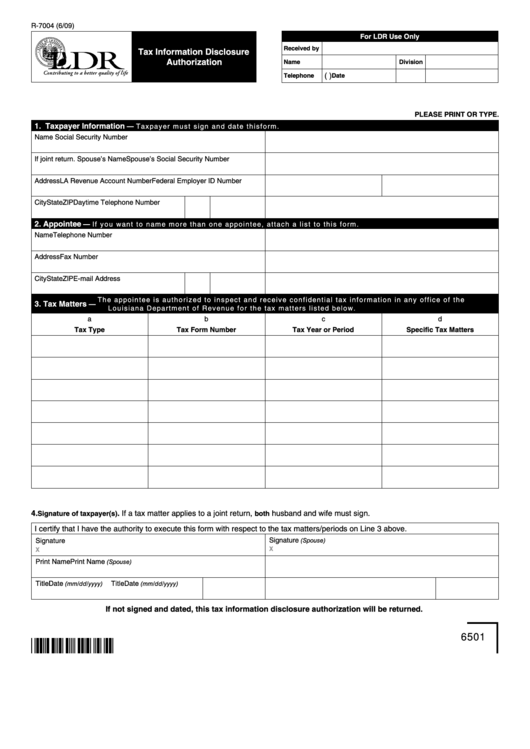

Fillable Form R7004 Tax Information Disclosure Authorization

(example) 0 1 2 3 4 5 6 7 8 9 if typing, type through the boxes. December 2018) 7004 form (rev. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Web you can.

Irs Form 7004 amulette

Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. Ad need more time to prepare your federal tax return? Web you can fill it out online, or you can print it out and complete it by hand. Use form 7004 to request an automatic 6. The form is easy.

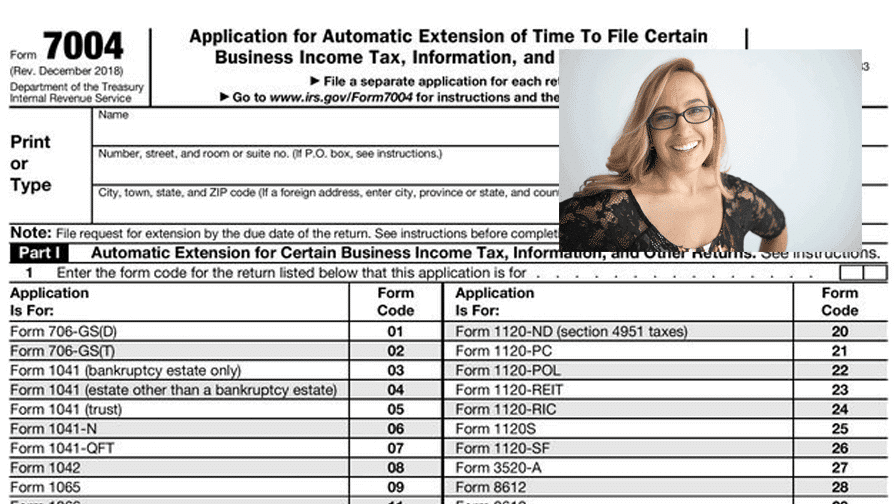

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

Web to complete form 7004: Form 7004 is a tax document used by businesses who want to receive an automatic extension of time to file their taxes for the year. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank.

Irs Fillable Form 7004 Fill online, Printable, Fillable Blank

Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. There are several sections which you have to complete: This form is for income earned in tax year 2022, with tax returns due in april. (example) write your numbers as shown and enter one number. How to fill out form.

Fillable Form 7004 Application For Automatic Extension Of Time To

(example) 0 1 2 3 4 5 6 7 8 9 if typing, type through the boxes. How to fill out form 7004 form 7004 is a relatively short form by irs standards. The form is easy to fill out. Ad need more time to prepare your federal tax return? Web filling out the blank pdf correctly can be a.

How to file an LLC extension Form 7004 YouTube

Web it can also be submitted electronically via the irs website. Fill in your business name, tax identification number, and address at the top of the form. Ad download or email irs 7004 & more fillable forms, try for free now! Here what you need to start: Provide the irs with data on.

Web Use Form 7004 To Request An Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns.

Irs form 7004 is a tax extension. How to fill out form 7004 form 7004 is a relatively short form by irs standards. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. Ad download or email irs 7004 & more fillable forms, try for free now!

Ad Download Or Email Irs 7004 & More Fillable Forms, Register And Subscribe Now!

Efile your extension online free This form is for income earned in tax year 2022, with tax returns due in april. Web you can fill it out online, or you can print it out and complete it by hand. 01/17 tc you must write within the boxes.

The Due Dates Of The Returns Can Be Found In The Instructions For The.

(example) 0 1 2 3 4 5 6 7 8 9 if typing, type through the boxes. December 2018) 7004 form (rev. It is also known as an. (example) write your numbers as shown and enter one number.

Web Irs Tax Form 7004 Is The Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns.

Provide the irs with data on. Here what you need to start: Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our. Form 7004 is a tax document used by businesses who want to receive an automatic extension of time to file their taxes for the year.