Form 592-Pte

Form 592-Pte - General information, check if total withholding at end of year. Web how to last modified: Go to partners > partner information. Items of income that are subject to withholding are payments to independent contractors, recipients of. Either state form 565 or 568 should be generated. Web the faqs clarify: To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Web form 592 is also used to report withholding payments for a resident payee. Web file form 592 to report withholding on domestic nonresident individuals. A pte is generally an entity that passes its income or.

A pte is generally an entity that passes its income or. Items of income that are subject to withholding are payments to independent contractors, recipients of. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Corporation name, street address, city, state code, corporation telephone number. Do not use form 592 if any of the following apply: Web two new forms: Go to partners > partner information. No payment, distribution or withholding occurred. General information, check if total withholding at end of year. Web file form 592 to report withholding on domestic nonresident individuals.

Web how to last modified: Web the faqs clarify: Web form 592 is also used to report withholding payments for a resident payee. Web file form 592 to report withholding on domestic nonresident individuals. Corporation name, street address, city, state code, corporation telephone number. Web two new forms: General information, check if total withholding at end of year. Go to partners > partner information. No payment, distribution or withholding occurred. A pte is generally an entity that passes its income or.

Form 592 B ≡ Fill Out Printable PDF Forms Online

Web form 592 is also used to report withholding payments for a resident payee. Web how to last modified: Web two new forms: To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Web file form 592 to report withholding on domestic nonresident individuals.

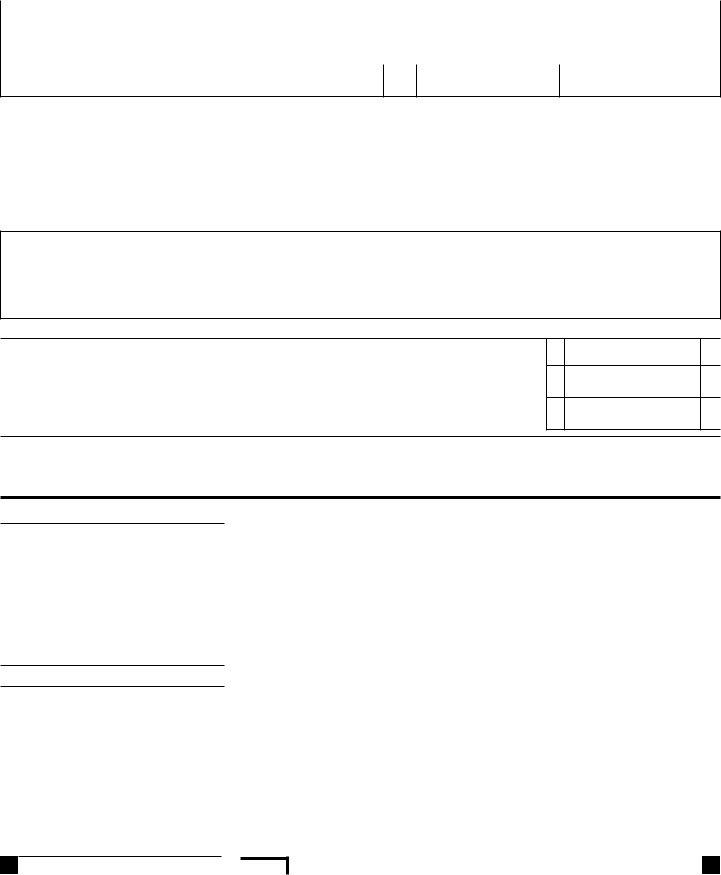

Fillable California Form 592B Nonresident Withholding Tax Statement

Web two new forms: Web how to last modified: Corporation name, street address, city, state code, corporation telephone number. Items of income that are subject to withholding are payments to independent contractors, recipients of. Either state form 565 or 568 should be generated.

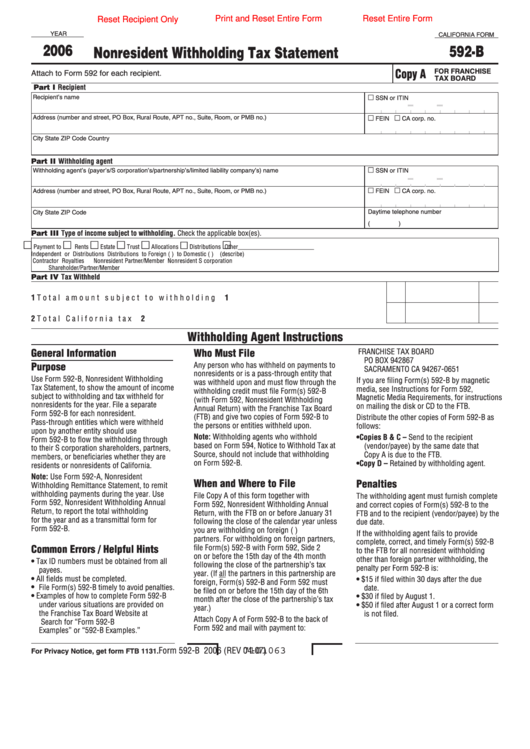

Fillable California Form 592A Foreign Partner Or Member Quarterly

Web form 592 is also used to report withholding payments for a resident payee. Corporation name, street address, city, state code, corporation telephone number. Web two new forms: Items of income that are subject to withholding are payments to independent contractors, recipients of. To learn about your privacy rights, how we may use your information, and the consequences for not.

Standard Form 592 T Fill Online, Printable, Fillable, Blank pdfFiller

Corporation name, street address, city, state code, corporation telephone number. Go to partners > partner information. General information, check if total withholding at end of year. Web the faqs clarify: Web file form 592 to report withholding on domestic nonresident individuals.

New California PassThrough Entity Withholding Forms for 2020 Deloitte US

General information, check if total withholding at end of year. Web the faqs clarify: Web form 592 is also used to report withholding payments for a resident payee. Either state form 565 or 568 should be generated. No payment, distribution or withholding occurred.

Top 11 California Ftb Form 592b Templates free to download in PDF format

Web how to last modified: Either state form 565 or 568 should be generated. A pte is generally an entity that passes its income or. Go to partners > partner information. No payment, distribution or withholding occurred.

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

Go to partners > partner information. Web how to last modified: A pte is generally an entity that passes its income or. Web file form 592 to report withholding on domestic nonresident individuals. Do not use form 592 if any of the following apply:

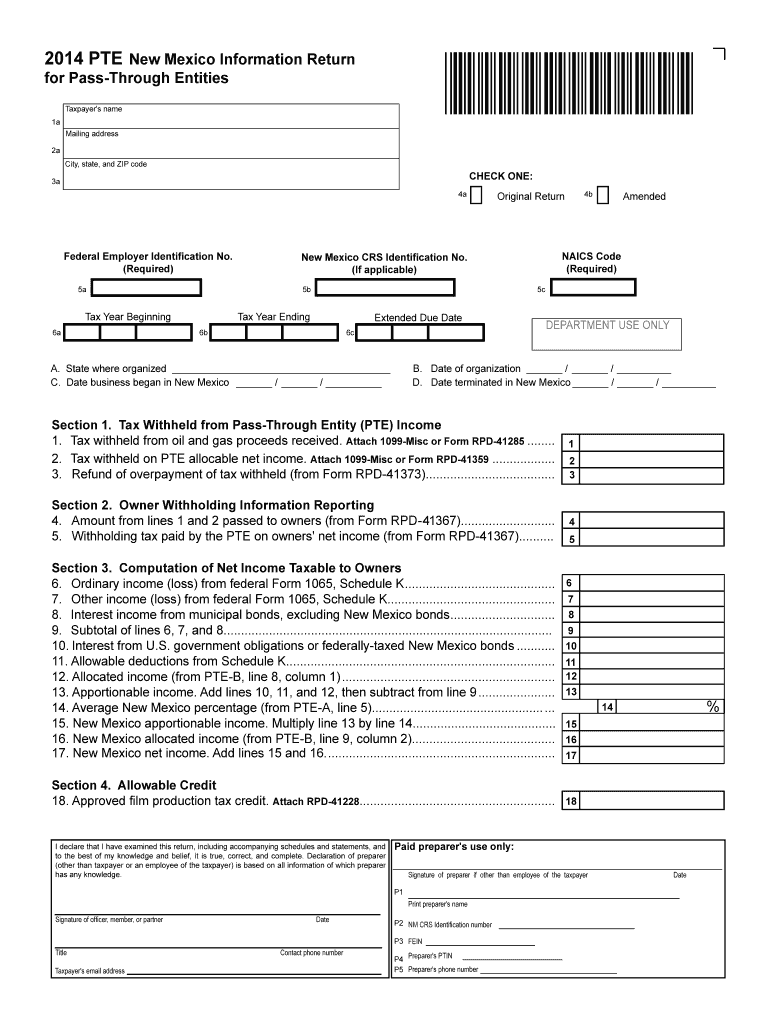

New Mexico Pte Instructions Fill Out and Sign Printable PDF Template

Go to partners > partner information. Web how to last modified: General information, check if total withholding at end of year. Either state form 565 or 568 should be generated. Do not use form 592 if any of the following apply:

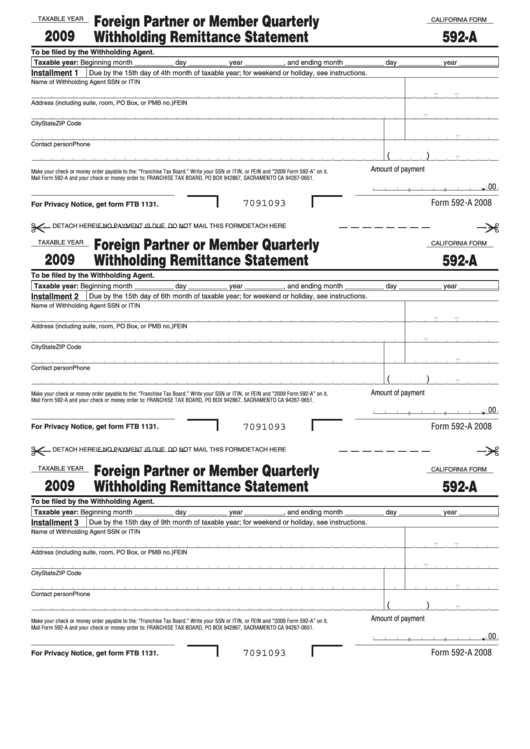

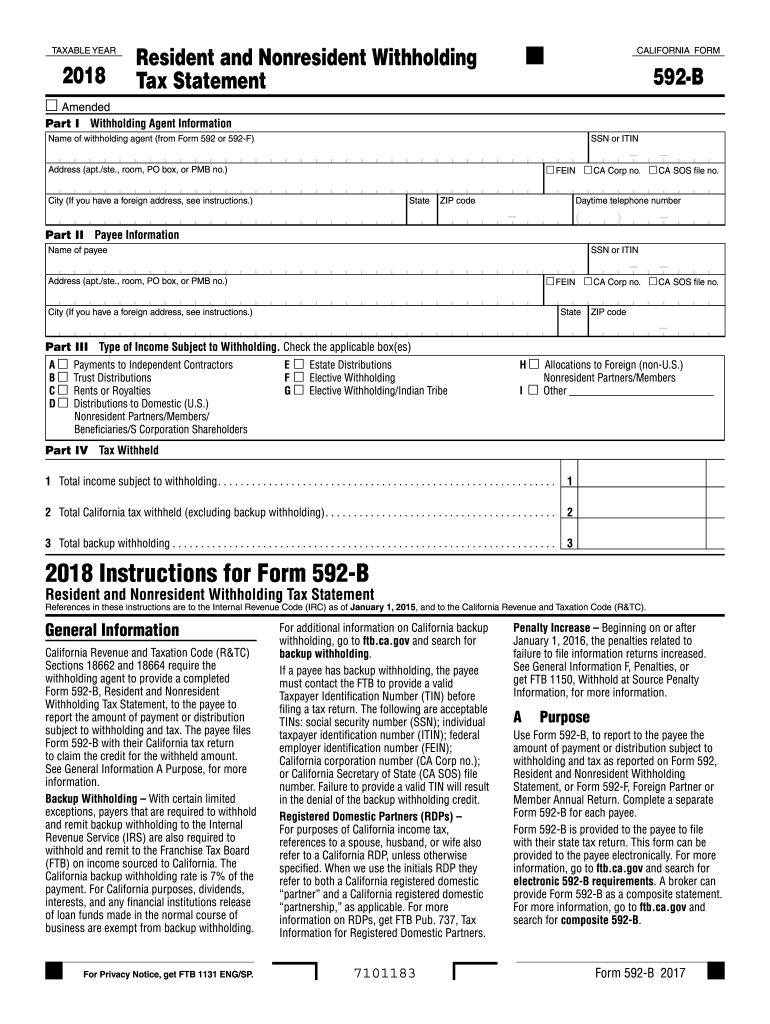

2018 form 592B Resident and Nonresident Withholding. 2018, form 592B

Corporation name, street address, city, state code, corporation telephone number. Web file form 592 to report withholding on domestic nonresident individuals. Either state form 565 or 568 should be generated. No payment, distribution or withholding occurred. General information, check if total withholding at end of year.

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

Either state form 565 or 568 should be generated. A pte is generally an entity that passes its income or. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Do not use form 592 if any of the following apply: Web the faqs clarify:

Web File Form 592 To Report Withholding On Domestic Nonresident Individuals.

General information, check if total withholding at end of year. Go to partners > partner information. Items of income that are subject to withholding are payments to independent contractors, recipients of. Do not use form 592 if any of the following apply:

To Learn About Your Privacy Rights, How We May Use Your Information, And The Consequences For Not Providing The Requested.

No payment, distribution or withholding occurred. A pte is generally an entity that passes its income or. Web two new forms: Either state form 565 or 568 should be generated.

Corporation Name, Street Address, City, State Code, Corporation Telephone Number.

Web how to last modified: Web form 592 is also used to report withholding payments for a resident payee. Web the faqs clarify: