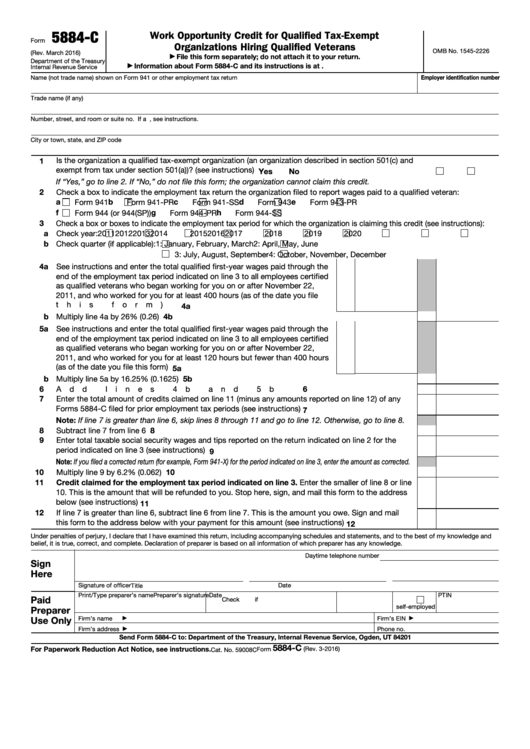

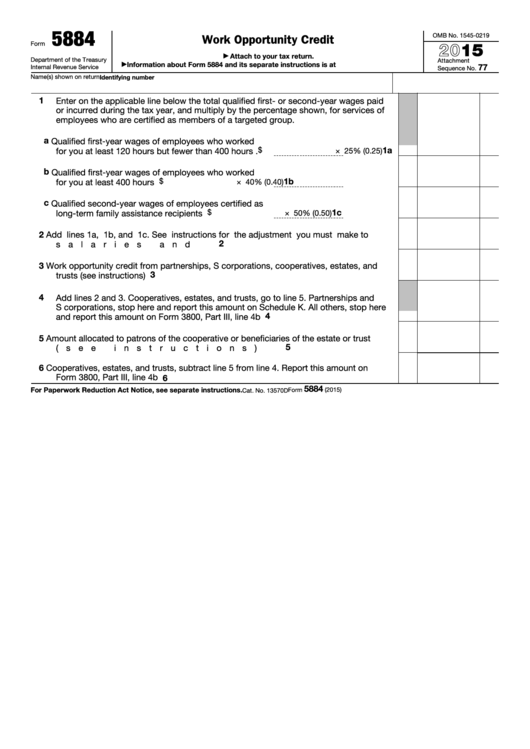

Form 5884 Work Opportunity Credit

Form 5884 Work Opportunity Credit - December 2016) department of the treasury internal revenue service. Web to claim the work opportunity tax credit, you will complete form 5884 and include it with form 3800 when you file your business taxes. Attach to your tax return. Web the work opportunity tax credit (wotc) is a federal tax credit that's available to employers who hire individuals from certain targeted groups. Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. March 2021) department of the treasury internal revenue service. Web can report this credit directly on form 3800, general business credit. Web generating form 5884, work opportunity credit in lacerte select your module below to learn how to generate form 5884 in the program: The wotc is available to employers who hire people from groups that have faced barriers to. Information about form 5884 and.

Web work opportunity credit unless the designation is extended. Web report error it appears you don't have a pdf plugin for this browser. Web follow these steps to generate form 5884 for a sole proprietorship (schedule c): Attach to your tax return. Web employers can use form 5884 to claim the work opportunity tax credit (wotc). Web can report this credit directly on form 3800, general business credit. Attach to your tax return. The wotc is available to employers who hire people from groups that have faced barriers to. March 2021) department of the treasury internal revenue service. December 2016) department of the treasury internal revenue service.

Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. Web employers can use form 5884 to claim the work opportunity tax credit (wotc). Web follow these steps to generate form 5884 for a sole proprietorship (schedule c): Web can report this credit directly on form 3800, general business credit. Web report error it appears you don't have a pdf plugin for this browser. Attach to your tax return. Go to input return ⮕ credits ⮕ general business and vehicle cr. Use form 5884 to claim the work opportunity credit for. March 2021) department of the treasury internal revenue service. The wotc is available to employers who hire people from groups that have faced barriers to.

Top 13 Form 5884 Templates free to download in PDF format

Information about form 5884 and. Web work opportunity credit unless the designation is extended. March 2021) department of the treasury internal revenue service. Web employers can use form 5884 to claim the work opportunity tax credit (wotc). Web follow these steps to generate form 5884 for a sole proprietorship (schedule c):

Form 5884 Work Opportunity Credit (2014) Free Download

Use form 5884 to claim the work opportunity credit for. Attach to your tax return. December 2016) department of the treasury internal revenue service. Web the work opportunity tax credit (wotc) is a federal tax credit that's available to employers who hire individuals from certain targeted groups. Information about form 5884 and.

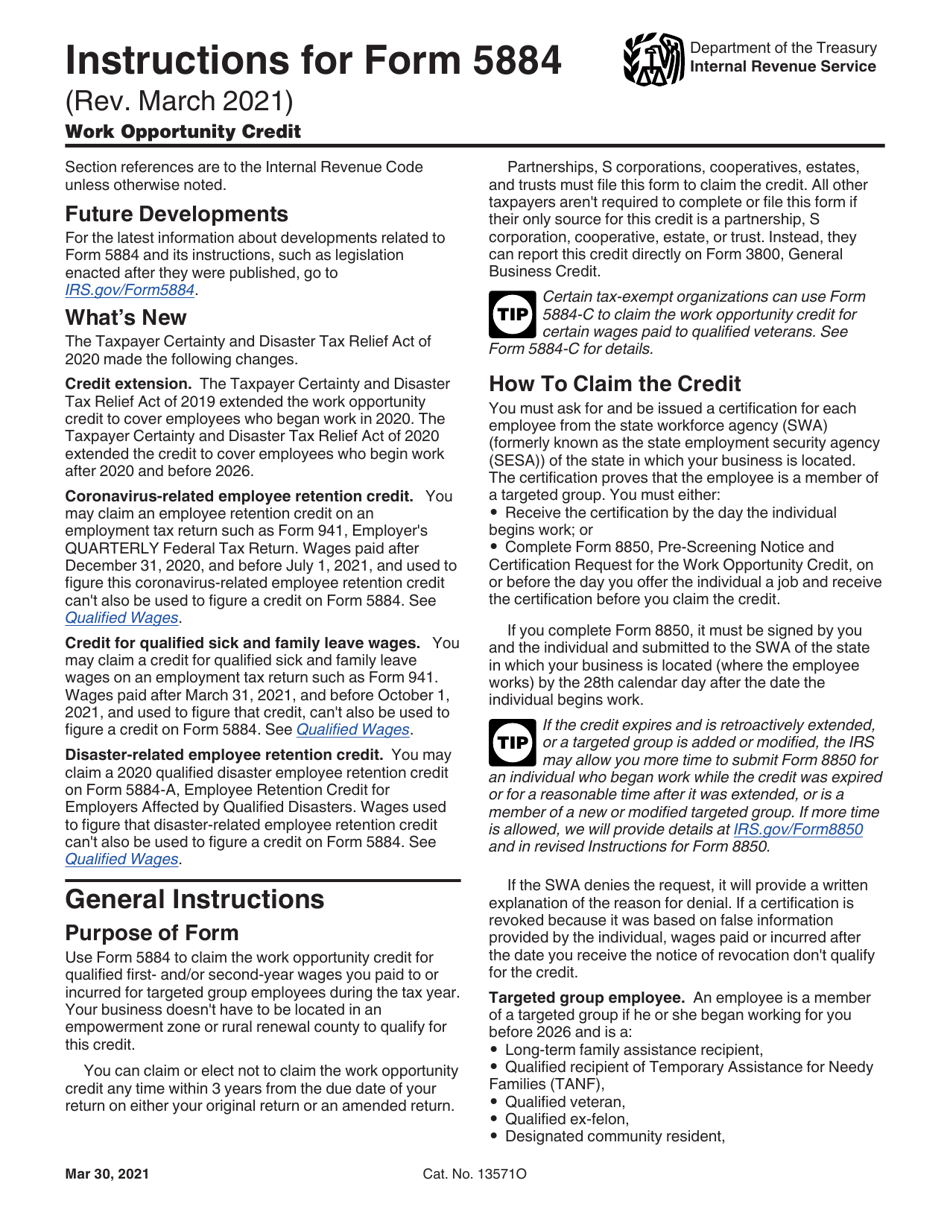

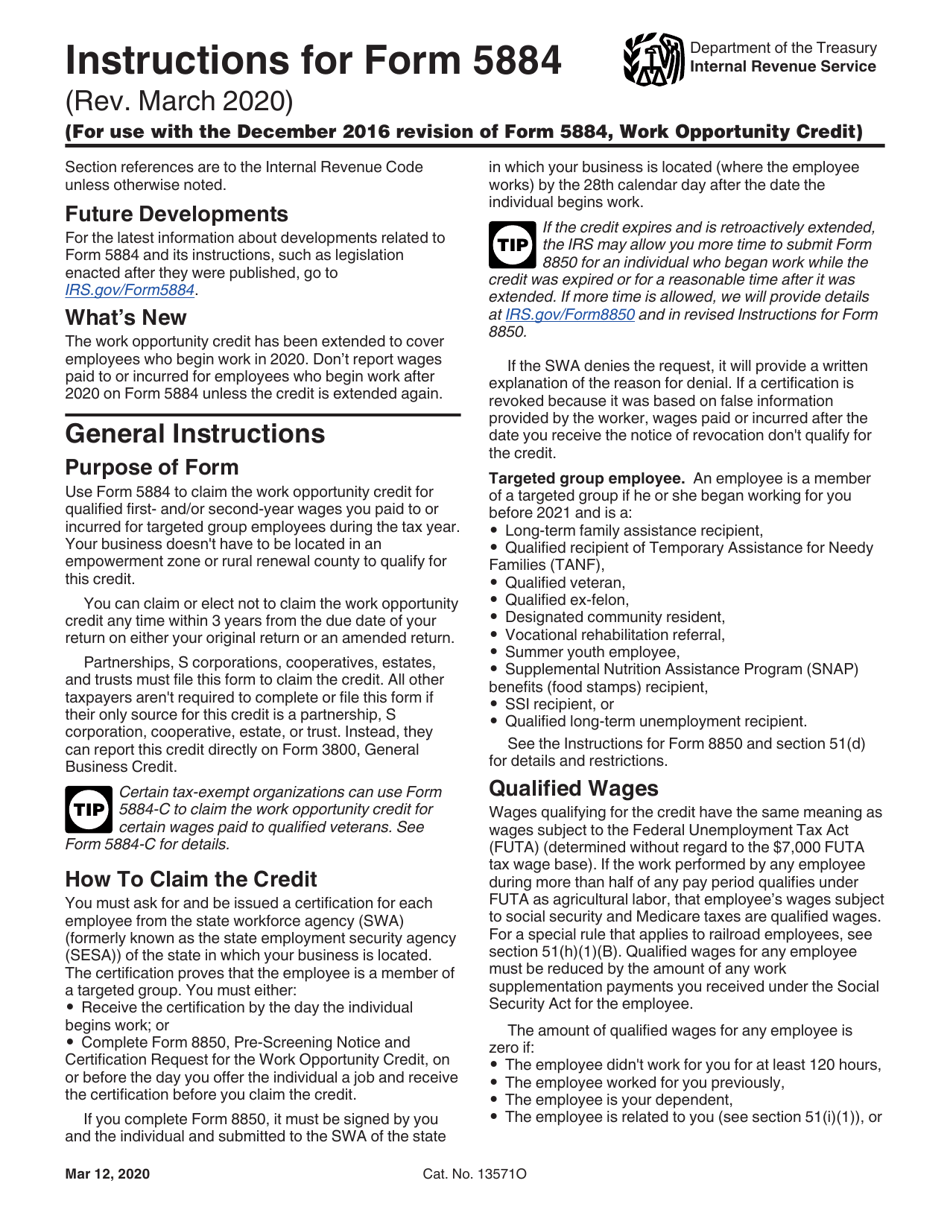

Download Instructions for IRS Form 5884 Work Opportunity Credit PDF

March 2021) department of the treasury internal revenue service. Information about form 5884 and. December 2016) department of the treasury internal revenue service. Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. Use form 5884 to claim the work opportunity credit.

Instructions For Form 5884 Work Opportunity Credit printable pdf download

March 2021) department of the treasury internal revenue service. Web the work opportunity tax credit (wotc) is a federal tax credit that's available to employers who hire individuals from certain targeted groups. Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the..

Form 5884Work Opportunity Credit

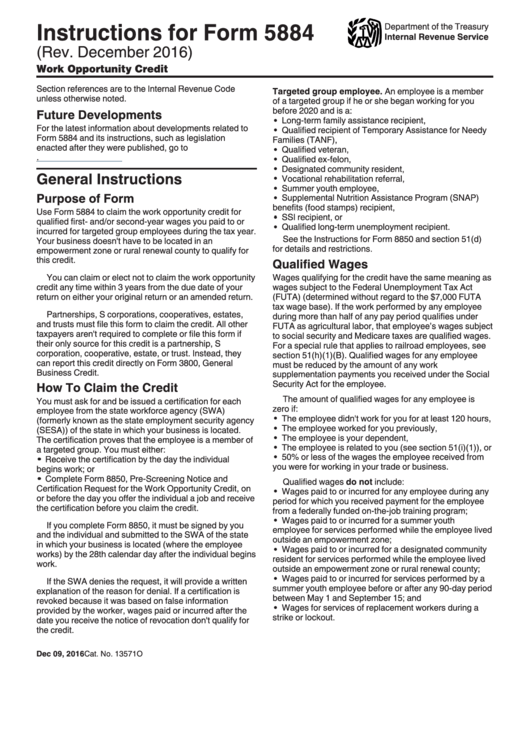

December 2016) department of the treasury internal revenue service. Web work opportunity credit unless the designation is extended. Web follow these steps to generate form 5884 for a sole proprietorship (schedule c): Web report error it appears you don't have a pdf plugin for this browser. Web employers can use form 5884 to claim the work opportunity tax credit (wotc).

Fill Free fillable Form 5884 Work Opportunity Credit for Qualified

Web work opportunity credit unless the designation is extended. Attach to your tax return. Web employers can use form 5884 to claim the work opportunity tax credit (wotc). Web follow these steps to generate form 5884 for a sole proprietorship (schedule c): March 2021) department of the treasury internal revenue service.

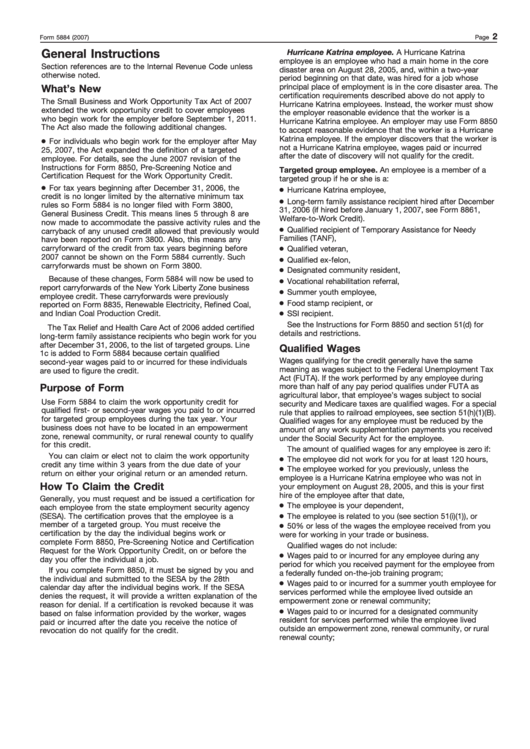

General Instructions For Form 5884 2007 printable pdf download

Web work opportunity credit unless the designation is extended. March 2021) department of the treasury internal revenue service. Web the work opportunity tax credit (wotc) is a federal tax credit that's available to employers who hire individuals from certain targeted groups. Go to input return ⮕ credits ⮕ general business and vehicle cr. Web employers can use form 5884 to.

Fillable Form 5884 Work Opportunity Credit 2015 printable pdf download

Go to input return ⮕ credits ⮕ general business and vehicle cr. The wotc is available to employers who hire people from groups that have faced barriers to. Web the work opportunity tax credit (wotc) is a federal tax credit that's available to employers who hire individuals from certain targeted groups. March 2021) department of the treasury internal revenue service..

Fill Free fillable Form 5884 2016 Work Opportunity Credit PDF form

Web to claim the work opportunity tax credit, you will complete form 5884 and include it with form 3800 when you file your business taxes. Web work opportunity credit unless the designation is extended. Web employers can use form 5884 to claim the work opportunity tax credit (wotc). The wotc is available to employers who hire people from groups that.

Download Instructions for IRS Form 5884 Work Opportunity Credit PDF

Web follow these steps to generate form 5884 for a sole proprietorship (schedule c): Web employers can use form 5884 to claim the work opportunity tax credit (wotc). Attach to your tax return. December 2016) department of the treasury internal revenue service. Web the work opportunity tax credit (wotc) is a federal tax credit that's available to employers who hire.

Web Can Report This Credit Directly On Form 3800, General Business Credit.

Web to claim the work opportunity tax credit, you will complete form 5884 and include it with form 3800 when you file your business taxes. Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. Web employers can use form 5884 to claim the work opportunity tax credit (wotc). Attach to your tax return.

Web Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

December 2016) department of the treasury internal revenue service. March 2021) department of the treasury internal revenue service. The wotc is available to employers who hire people from groups that have faced barriers to. Use form 5884 to claim the work opportunity credit for.

Web The Work Opportunity Tax Credit (Wotc) Is A Federal Tax Credit That's Available To Employers Who Hire Individuals From Certain Targeted Groups.

Go to input return ⮕ credits ⮕ general business and vehicle cr. Information about form 5884 and. Web follow these steps to generate form 5884 for a sole proprietorship (schedule c): Web work opportunity credit unless the designation is extended.

Attach To Your Tax Return.

Web generating form 5884, work opportunity credit in lacerte select your module below to learn how to generate form 5884 in the program: