Form 5696 Instructions

Form 5696 Instructions - See the irs tax form 5696 instructions for more information. To add or remove this form: Web information about form 5695 and its instructions is at www.irs.gov/form5695. To receive the tax credit, you will need to file a 1040 tax form. Also use form 5695 to take any residential energy. Nonresident alien income tax return, line 8 through line 21 for the same types of income. The residential energy credits are: Open or continue your return ; Irs form 5695 has a total of two parts in two pages. A home is where you lived in 2018 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home that conforms to federal manufactured home construction and safety standards.

You just have to complete the section concerning to the types of credits you need to claim. See the irs tax form 5696 instructions for more information. Inside turbotax, search for this exact phrase. Enter the total on line 22a. Table of contents home improvement credits nonbusiness energy. Type 5695to highlight the form 5695 and click okto open the form. Web form 5696 on android. In order to add an electronic signature to a fair political practices commission filing schedule for state fnpc ca, follow. Web purpose of form use form 5695 to figure and take your residential energy credits. Enter the corporation's taxable income or (loss) before the nol deduction, after the special deductions, and without regard to any excess inclusion (for example, if filing.

• the residential clean energy credit, and • the energy efficient home improvement credit. See the irs tax form 5696 instructions for more information. Web form 5696 on android. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. Attach to form 1040 or form 1040nr. You will also need to save your receipts and this manufacturer’s certification statement for your records. In order to add an electronic signature to a fair political practices commission filing schedule for state fnpc ca, follow. To receive the tax credit, you will need to file a 1040 tax form.

Certified Payroll Form Wh 347 Instructions Form Resume Examples

Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Combine the amounts on line 7 through line 21. Enter the total on line 22a. Easily find the app in the play market and install it for signing your fair political practices commission filing schedule for state fnpc ca. Taxable.

Aia G703 Form Instructions Form Resume Examples GEOGBBw5Vr

Irs form 5695 has a total of two parts in two pages. Web form 5696 on android. Press f6to bring up open forms. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. The residential energy credits are:

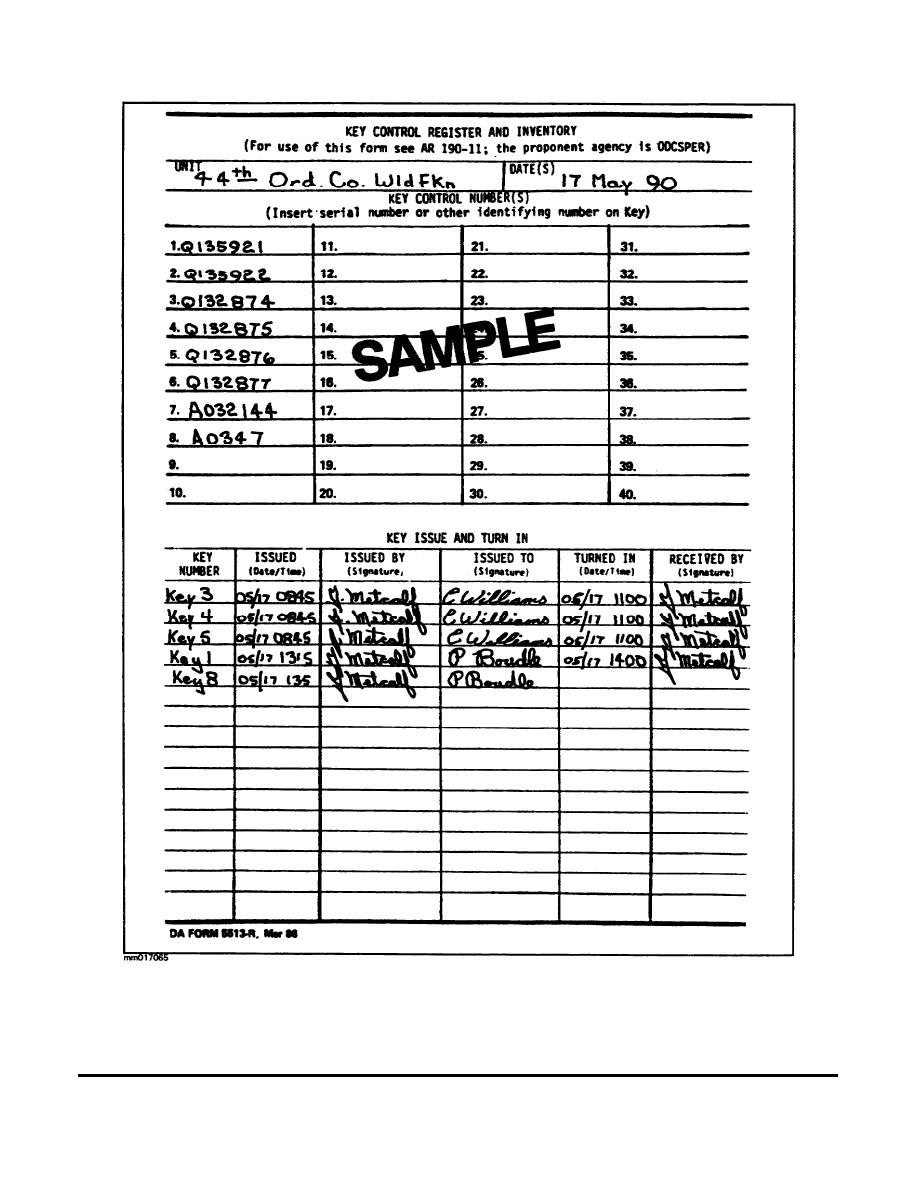

Figure 32. An example of a completed DA Form 5513R (Key Control

See the irs tax form 5696 instructions for more information. You just have to complete the section concerning to the types of credits you need to claim. Type 5695to highlight the form 5695 and click okto open the form. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your.

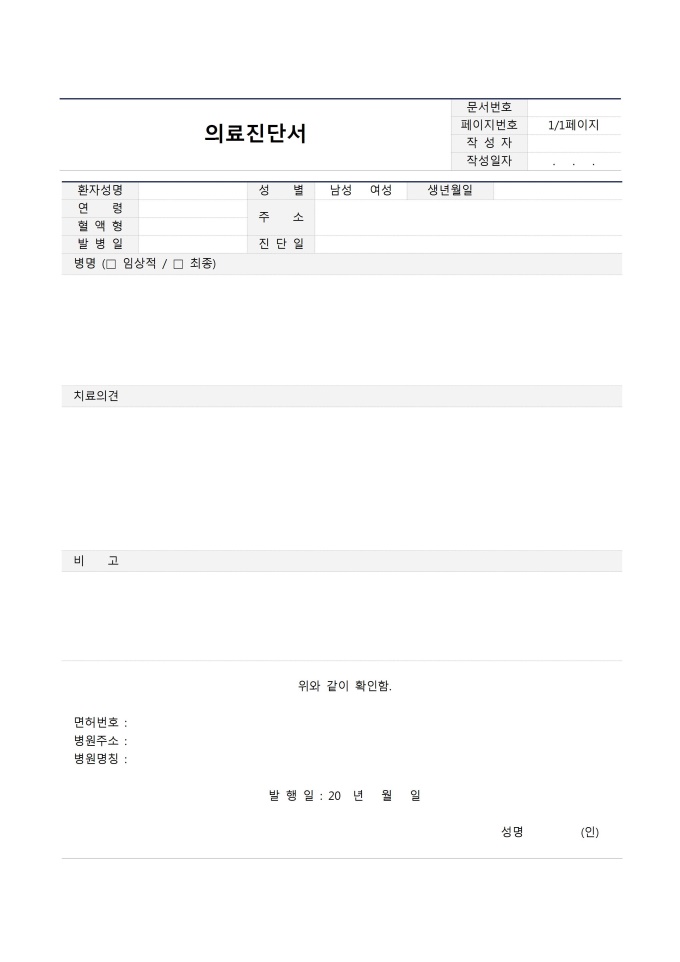

의료진단서 부서별서식

The residential energy credits are: Web instructions for how to complete irs form 5695 step 1: This number should be the same as the amount on federal. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. Enter the total on line 22a.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

See the irs tax form 5696 instructions for more information. Web form 5696 on android. For any new energy efficient property complete the residential clean energy credit smart. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. Web information about form 5695, residential energy credits, including recent.

Irs Form 1065 K 1 Instructions Universal Network

Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. To add or remove this form: Inside turbotax, search for this exact phrase. Combine the amounts on line 7 through line 21. Irs form 5695 has a total of two parts in two pages.

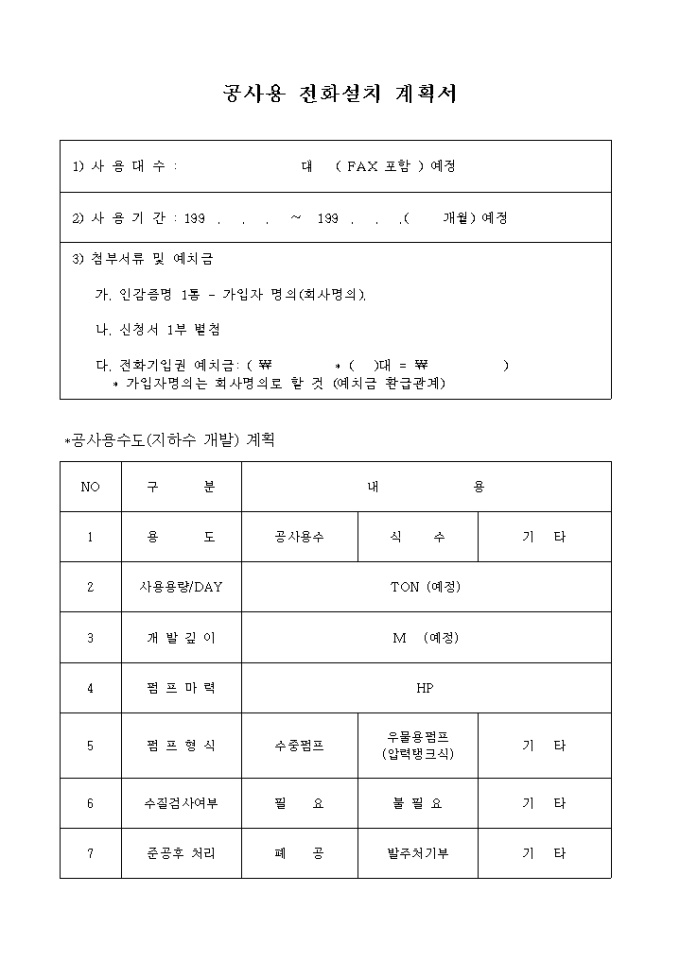

공사용전화설치 계획서 샘플, 양식 다운로드

Web information about form 5695 and its instructions is at www.irs.gov/form5695. In order to add an electronic signature to a fair political practices commission filing schedule for state fnpc ca, follow. Easily find the app in the play market and install it for signing your fair political practices commission filing schedule for state fnpc ca. Web to file for an.

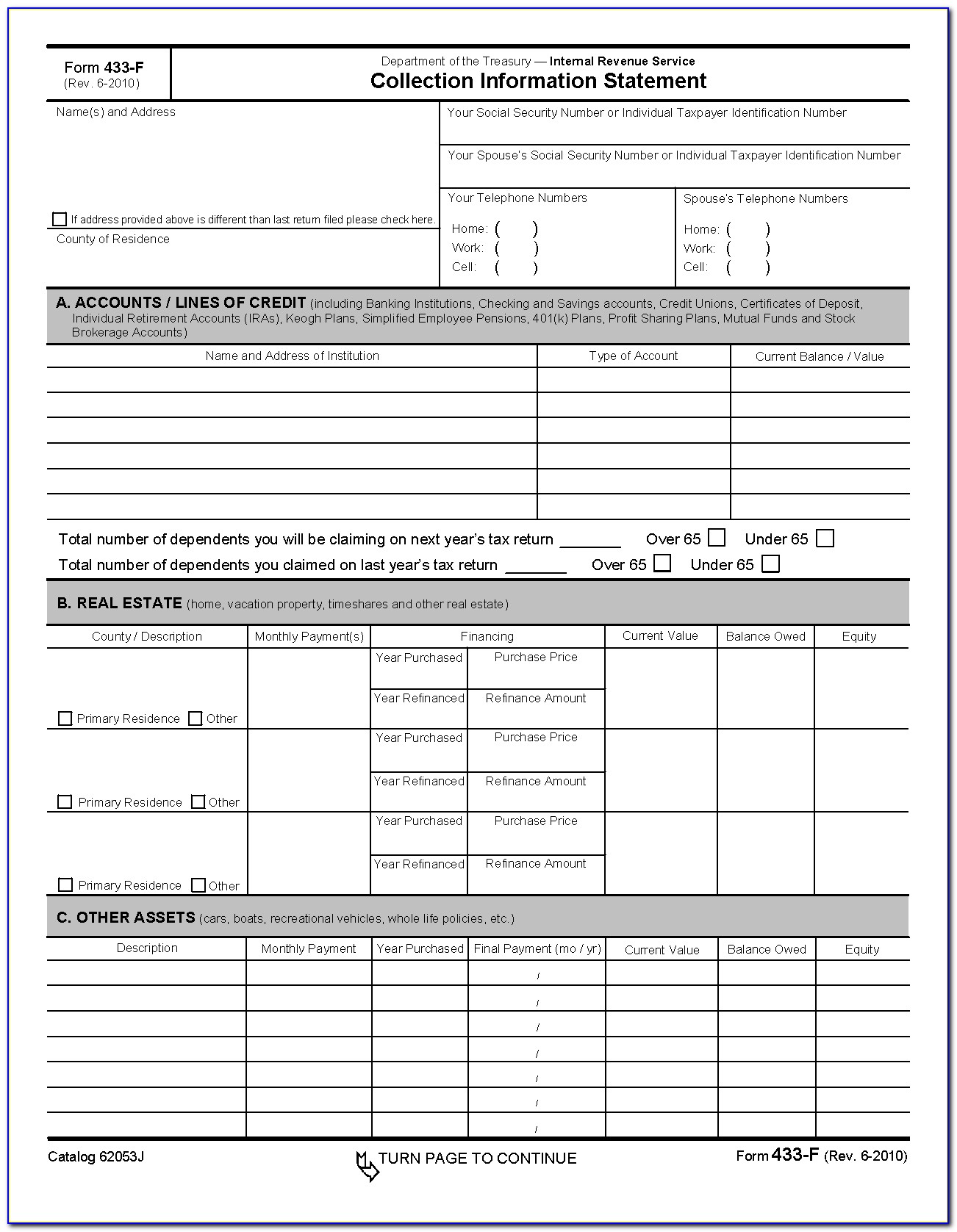

Irs Form 433 F Instructions Form Resume Examples QJ9ePPA2my

Web energy efficiency tax credits by filing either the 1040ez form or 1040a form. The residential energy credits are: If you have already filed your return, you will need to file an amended return (form 1040x) to claim these credits. Press f6to bring up open forms. Enter the corporation's taxable income or (loss) before the nol deduction, after the special.

LEGO Set 56961 Car Wash (2011 Duplo > Town) Rebrickable Build with

Nonresident alien income tax return, line 8 through line 21 for the same types of income. • the residential clean energy credit, and • the energy efficient home improvement credit. See the irs tax form 5696 instructions for more information. Part i residential energy efficient. Inside turbotax, search for this exact phrase.

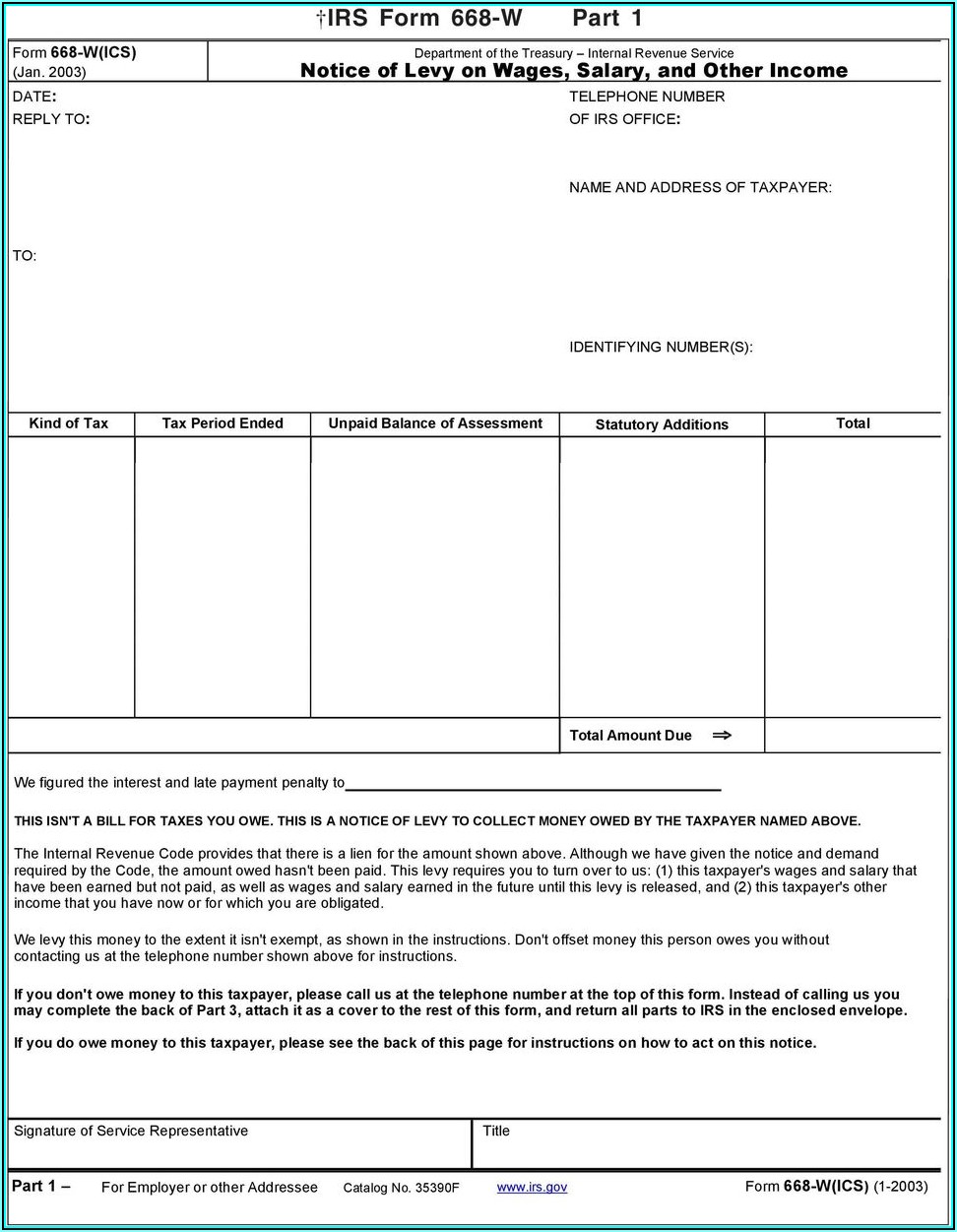

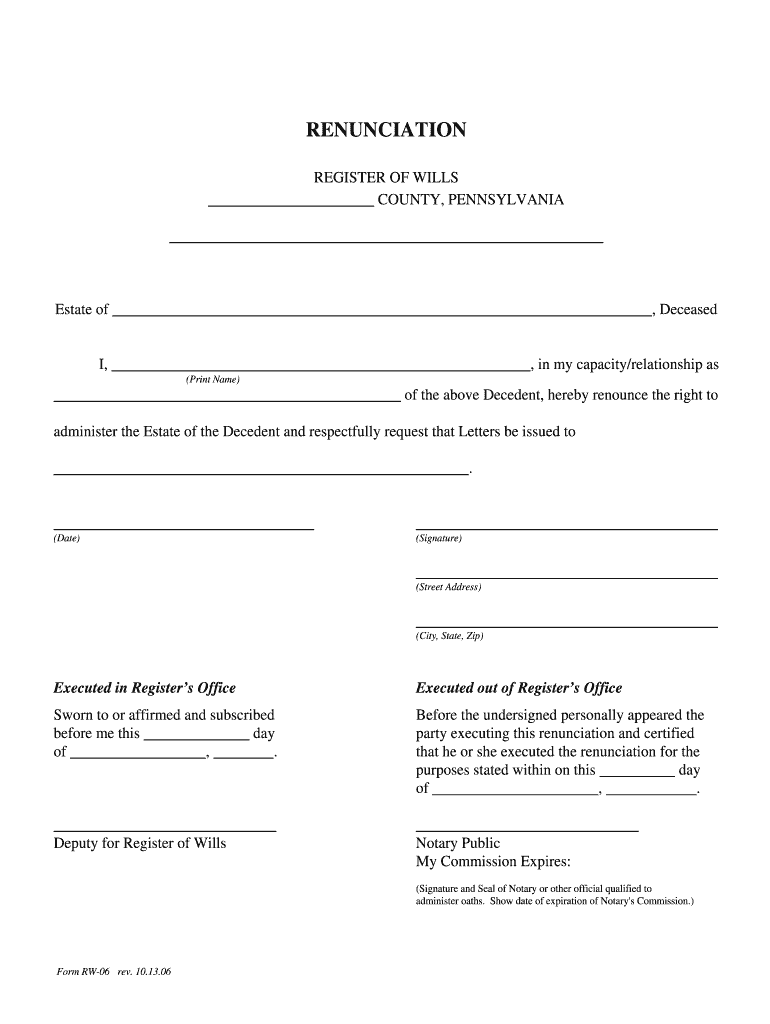

Form Rw 06 Instructions Fill Online, Printable, Fillable, Blank

Irs form 5695 has a total of two parts in two pages. To receive the tax credit, you will need to file a 1040 tax form. Taxable income or (loss) before net operating loss deduction. See the irs tax form 5696 instructions for more information. Table of contents home improvement credits nonbusiness energy.

Web To File For An Energy Efficiency Tax Credit, You Must File The Irs Tax Form 5695 And Submit With Your Taxes.

To add or remove this form: The residential energy credits are: Web information about form 5695 and its instructions is at www.irs.gov/form5695. Web purpose of form use form 5695 to figure and take your residential energy credits.

Web Information About Form 5695, Residential Energy Credits, Including Recent Updates, Related Forms And Instructions On How To File.

A home is where you lived in 2018 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home that conforms to federal manufactured home construction and safety standards. Part i residential energy efficient. For any new energy efficient property complete the residential clean energy credit smart. Nonresident alien income tax return, line 8 through line 21 for the same types of income.

Table Of Contents Home Improvement Credits Nonbusiness Energy.

Also use form 5695 to take any residential energy. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. If you have already filed your return, you will need to file an amended return (form 1040x) to claim these credits. See the irs tax form 5696 instructions for more.

Web Generating The 5695 In Proseries:

Web form 5696 on android. This number should be the same as the amount on federal. In order to add an electronic signature to a fair political practices commission filing schedule for state fnpc ca, follow. Type 5695to highlight the form 5695 and click okto open the form.