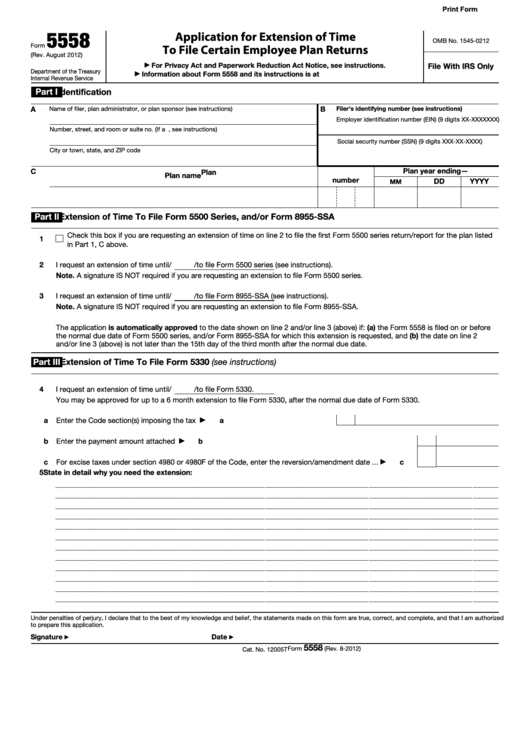

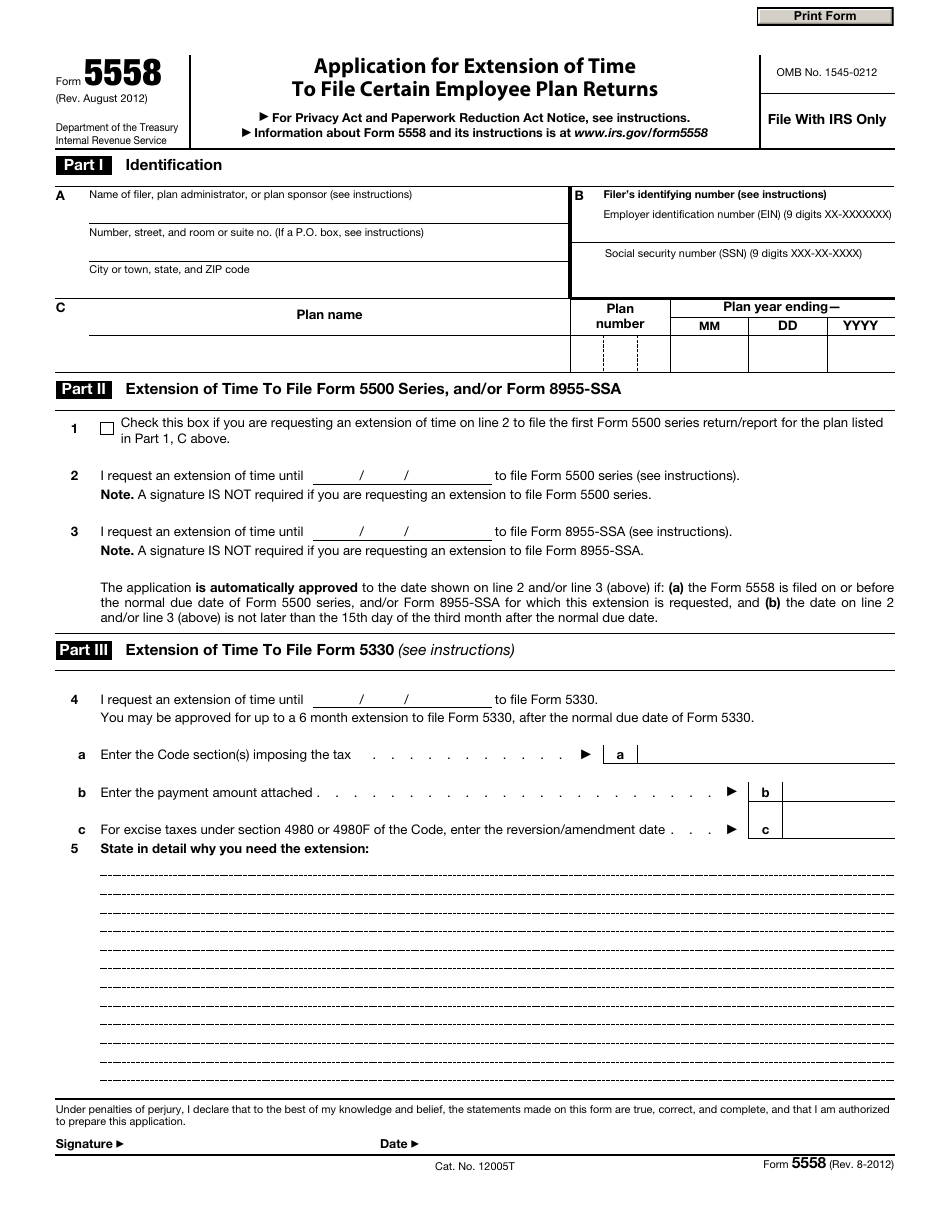

Form 5558 Extension Due Date 2022

Form 5558 Extension Due Date 2022 - Whether a plan maintains a calendar year plan year (12/31) or an off. 17 2022 ) by filing irs form 5558 by aug. Web form 5558, application for extension of time to file certain employee plan returns form 8809, application for extension of time to file information returns form. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Web individuals and families. Web form 5558, application for extension of time to file certain employee plan returns 15) are imposed by the department of labor (dol) and. Web share along with other employers that offer benefit plans covered by the employee retirement income security act of 1974 (erisa), companies that sponsor. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension. 17 2022) by filing irs form 5558 by aug.

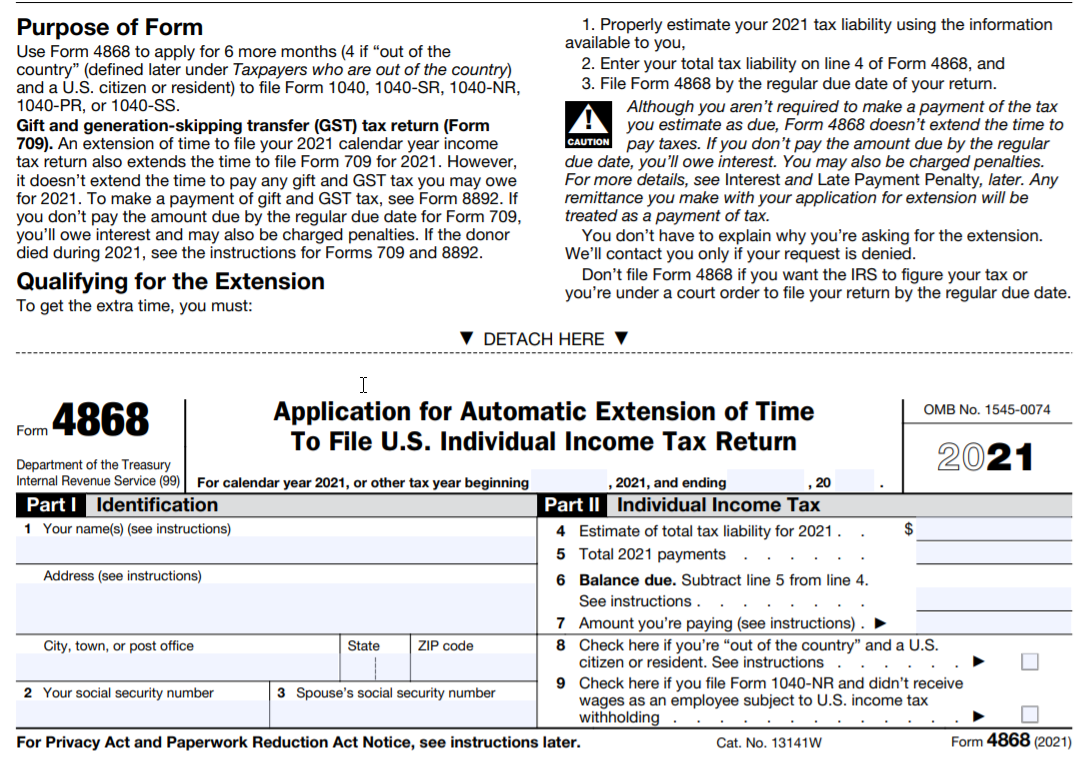

Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web form 5558, application for extension of time to file certain employee plan returns form 8809, application for extension of time to file information returns form. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension. Web filings for the 2022 plan year generally are not due until seven months after the end of the 2022 plan year, e.g., july 31, 2023, for calendar year plans, and a 2½. 17 2022) by filing irs form 5558 by aug. 17 2022 ) by filing irs form 5558 by aug. Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web form 5558, application for extension of time to file certain employee plan returns Web what is the deadline to file?

Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Web form 5558, application for extension of time to file certain employee plan returns Typically, the form 5500 is due by july 31st for calendar year plans, with an extension. (1) box 1a is checked, (2) the form 5558 is signed and filed on or before the normal due date of. Web quarterly payroll and excise tax returns normally due on may 1. Web what is the deadline to file? Web form 5558, application for extension of time to file certain employee plan returns form 8809, application for extension of time to file information returns form. Web (due january 15, which falls on a weekend in 2022. 17 2022 ) by filing irs form 5558 by aug.

How to File a Tax Extension? ZenLedger

Web form 5558, application for extension of time to file certain employee plan returns form 8809, application for extension of time to file information returns form. Web (due january 15, which falls on a weekend in 2022. Whether a plan maintains a calendar year plan year (12/31) or an off. For specific information on excise tax due dates, see the..

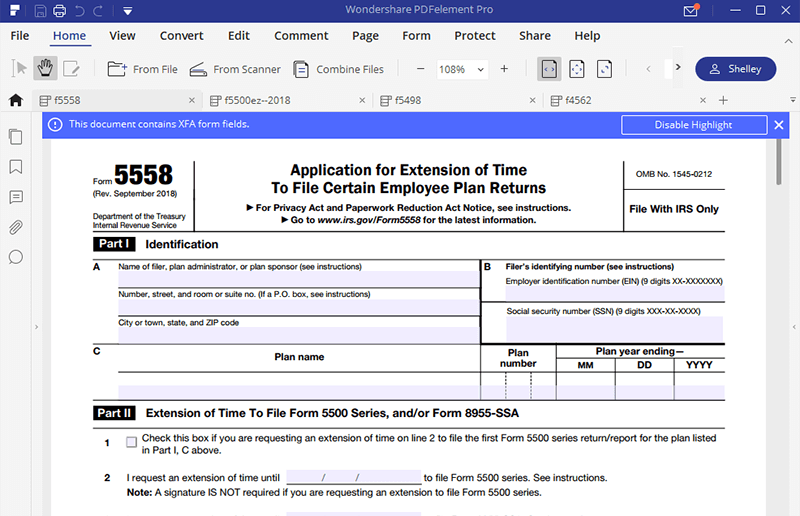

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

Web form 5558, application for extension of time to file certain employee plan returns The deadline to file is linked to the last day of the plan year. Web (due january 15, which falls on a weekend in 2022. Web what is the deadline to file? Since april 15 falls on a saturday, and emancipation day.

Form 12 Where To File The Five Secrets About Form 12 Where To File Only

Web what is the deadline to file? Whether a plan maintains a calendar year plan year (12/31) or an off. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Web file.

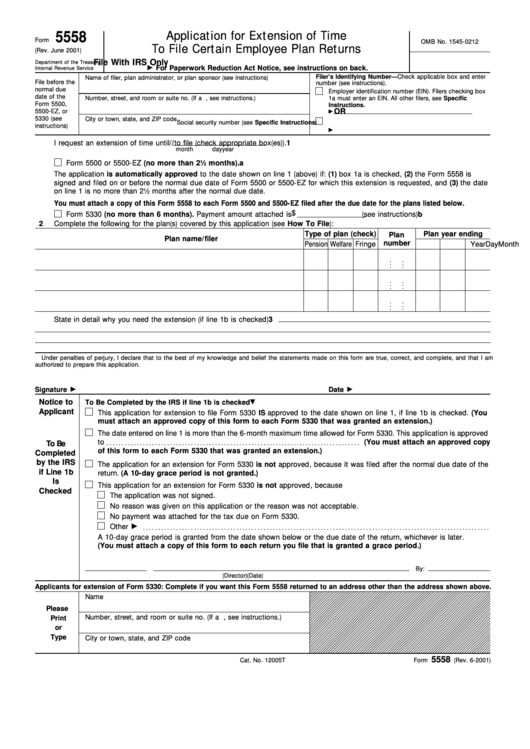

IRS Form 5558 Download Fillable PDF or Fill Online Application for

Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web filings for the 2022 plan year generally are not due until seven months after the end of the 2022 plan year, e.g., july 31, 2023, for calendar year plans, and a 2½. Web quarterly payroll and excise tax returns normally due on may 1. Whether a plan.

Form 5558 Application for Extension of Time to File Certain Employee

Web form 5558, application for extension of time to file certain employee plan returns form 8809, application for extension of time to file information returns form. Web filings for the 2022 plan year generally are not due until seven months after the end of the 2022 plan year, e.g., july 31, 2023, for calendar year plans, and a 2½. Web.

How to Fill Out 2021 Form 5558 Application for Extension of Time to

Edit, sign and save irs 5558 form. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web for a calendar year plan, form 5558 is the lifeline that extends the due date to october 15th. Web quarterly payroll and excise tax returns normally due on may 1. Web plan name plan number plan year end date the.

Form 5558 Application For Extension Of Time To File Certain Employee

The irs provides that dates that fall on a saturday, sunday or holiday are delayed until the next business day.). Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Whether a plan maintains a calendar year plan year (12/31) or an off. 17.

Extension Due Date on Tax Return Form Filling (Latest Updated

Web form 5558, application for extension of time to file certain employee plan returns Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file.

Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500

Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web quarterly payroll and excise tax returns normally due on may 1. Web (due january 15, which falls on a weekend in 2022. Web form 5558, application for extension of time to file certain employee plan returns Edit, sign.

Fillable Form 5558 Application For Extension Of Time To File Certain

Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. 15) are imposed by the department of labor (dol) and. Web for a calendar year plan, form 5558 is the lifeline that extends the due date to october 15th. Web form 5558, application for extension of time to file.

Web File One Form 5558 To Request An Extension Of Time To File Form 5330 For Excise Taxes With The Same Filing Due Date.

Web (due january 15, which falls on a weekend in 2022. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Alternatively, plans can rely on the extension for the business tax return. Web the application is automatically approved to the date shown on line 1 (above) if:

Web For A Calendar Year Plan, Form 5558 Is The Lifeline That Extends The Due Date To October 15Th.

Edit, sign and save irs 5558 form. 17 2022 ) by filing irs form 5558 by aug. Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra time. Web share along with other employers that offer benefit plans covered by the employee retirement income security act of 1974 (erisa), companies that sponsor.

Typically, The Form 5500 Is Due By July 31St For Calendar Year Plans, With An Extension.

The deadline to file is linked to the last day of the plan year. Whether a plan maintains a calendar year plan year (12/31) or an off. Web form 5558, application for extension of time to file certain employee plan returns form 8809, application for extension of time to file information returns form. The irs provides that dates that fall on a saturday, sunday or holiday are delayed until the next business day.).

17 2022) By Filing Irs Form 5558 By Aug.

Web quarterly payroll and excise tax returns normally due on may 1. For specific information on excise tax due dates, see the. 15) are imposed by the department of labor (dol) and. (1) box 1a is checked, (2) the form 5558 is signed and filed on or before the normal due date of.

![Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500](https://online5500.com/wp-content/uploads/2022/04/p1-768x512.jpg)