Form 5500 Schedule H Instructions

Form 5500 Schedule H Instructions - The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Web form 5500, line 2d. Schedule h (form 1040) for figuring your household employment taxes. To insurance carriers for the provision of benefits other real estate page Schedule h (form 5500) 2020 page. Phase iii, similar to the september 2021 proposal, adds breakout categories to the administrative expenses category of the income and expenses section of the schedule h (financial information) balance sheet to improve fee and expense transparency. If schedule h is filed, part iii of the schedule, regarding the independent qualified public accountant's (iqpa) report and opinion, must be completed. Filings for plan years prior to 2009 are not displayed through this website. Web schedule h (form 5500) 2001 directly to participants or beneficiaries, including direct rollovers through if an accountant's opinion is attached, enter the name and ein of the accountant (or accounting firm) other total unrealized appreciation (depreciation) of assets: Web schedule h breakout of administrative expenses.

Schedule h (form 5500) 2020 page. Web for paperwork reduction act notice, see the instructions for form 5500. (a) beginning of year (b) end of year (1) This website provides the forms, schedules, and. Schedule h (form 5500) 2020 v.200204. Web form 5500, annual return/report of employee benefit plan (form and instructions) who files the employer maintaining the plan or the plan administrator of a pension or welfare benefit plan covered by erisa. Web schedule h (form 5500) 2001 directly to participants or beneficiaries, including direct rollovers through if an accountant's opinion is attached, enter the name and ein of the accountant (or accounting firm) other total unrealized appreciation (depreciation) of assets: Schedule h (form 1040) for figuring your household employment taxes. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Web schedule h breakout of administrative expenses.

The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Schedule h (form 5500) 2020 v.200204. Web form 5500, line 2d. Filings for plan years prior to 2009 are not displayed through this website. Schedule h (form 1040) for figuring your household employment taxes. Web for paperwork reduction act notice, see the instructions for form 5500. To insurance carriers for the provision of benefits other real estate page (a) beginning of year (b) end of year (1) Web form 5500 annual return/report of employee benefit plan | instructions; Web form 5500, annual return/report of employee benefit plan (form and instructions) who files the employer maintaining the plan or the plan administrator of a pension or welfare benefit plan covered by erisa.

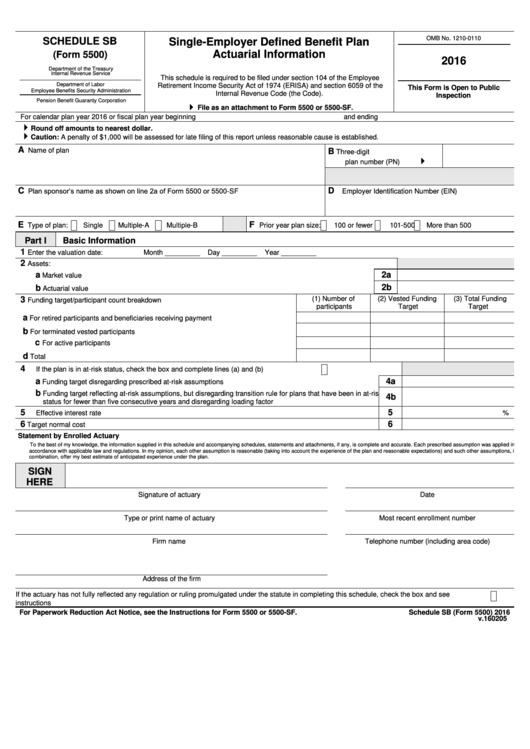

Fillable Schedule Sb (Form 5500) SingleEmployer Defined Benefit Plan

Schedule h (form 1040) for figuring your household employment taxes. Web form 5500, line 2d. If schedule h is filed, part iii of the schedule, regarding the independent qualified public accountant's (iqpa) report and opinion, must be completed. (a) beginning of year (b) end of year (1) To insurance carriers for the provision of benefits other real estate page

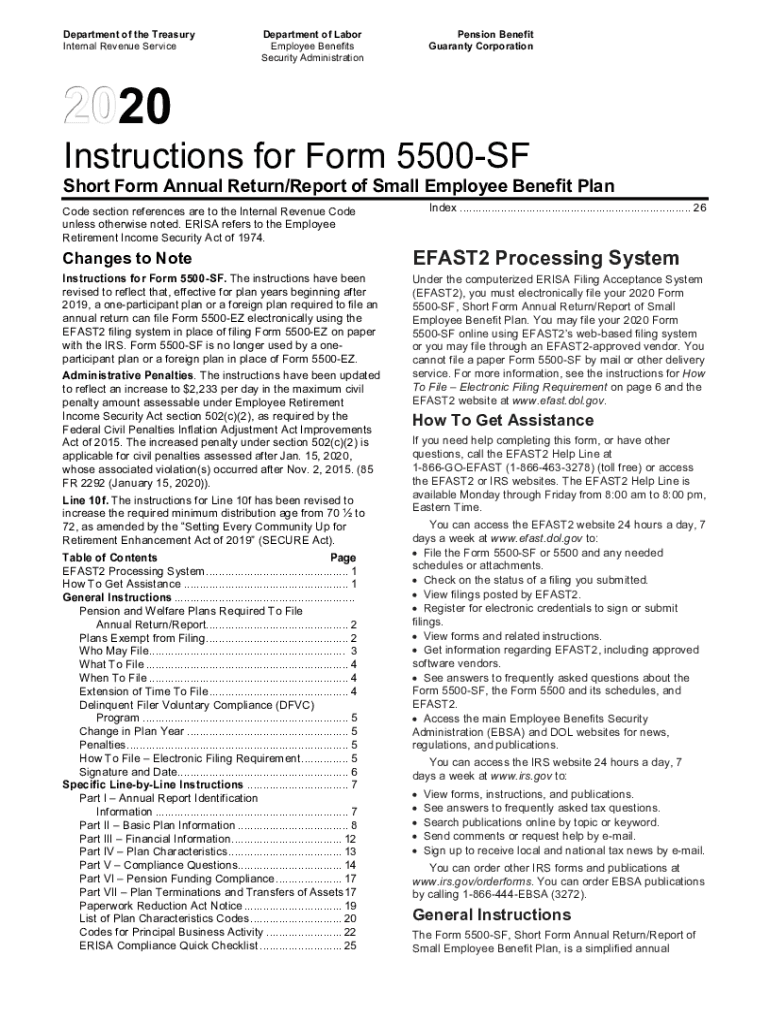

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web for paperwork reduction act notice, see the instructions for form 5500. Web form 5500, annual return/report of employee benefit plan (form and instructions) who files the employer maintaining the plan or the plan administrator of a pension or welfare benefit plan covered by erisa. Schedule h (form 1040) for figuring your household employment taxes. This website provides the forms,.

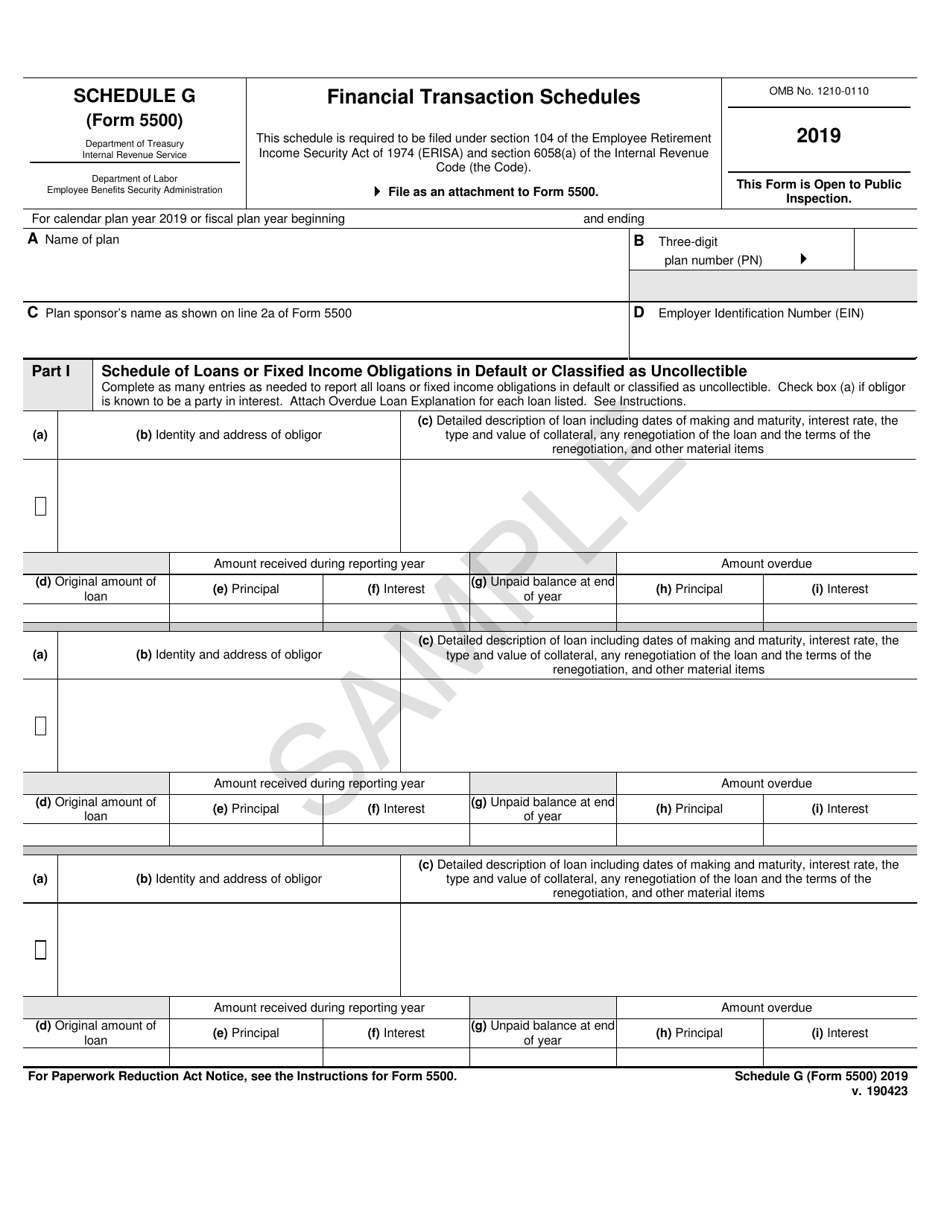

IRS Form 5500 Schedule G Download Fillable PDF or Fill Online Financial

Schedule h (form 1040) for figuring your household employment taxes. This website provides the forms, schedules, and. Schedule h (form 5500) 2020 page. Web form 5500, line 2d. Web form 5500, annual return/report of employee benefit plan (form and instructions) who files the employer maintaining the plan or the plan administrator of a pension or welfare benefit plan covered by.

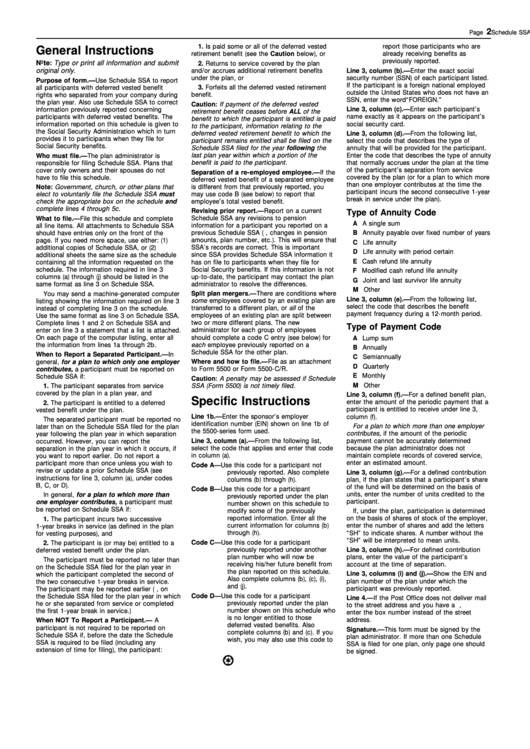

Instructions For Form 5500 (Schedule Ssa) Annual Registration

Web here is a list of forms that household employers need to complete. This website provides the forms, schedules, and. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Web form 5500, line 2d. Phase iii, similar to the september 2021 proposal, adds breakout categories to the.

Form 5500 Instructions 5 Steps to Filing Correctly

The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Web for paperwork reduction act notice, see the instructions for form 5500. Web form 5500, annual return/report of employee benefit plan (form and instructions) who files the employer maintaining the plan or the plan administrator of a pension.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

(a) beginning of year (b) end of year (1) Web form 5500 annual return/report of employee benefit plan | instructions; If schedule h is filed, part iii of the schedule, regarding the independent qualified public accountant's (iqpa) report and opinion, must be completed. The instructions to line 2d of the form 5500 have been clarified on how to report the.

Schedule H Fill Online, Printable, Fillable, Blank pdfFiller

Schedule h (form 5500) 2020 page. Filings for plan years prior to 2009 are not displayed through this website. Web form 5500, annual return/report of employee benefit plan (form and instructions) who files the employer maintaining the plan or the plan administrator of a pension or welfare benefit plan covered by erisa. If schedule h is filed, part iii of.

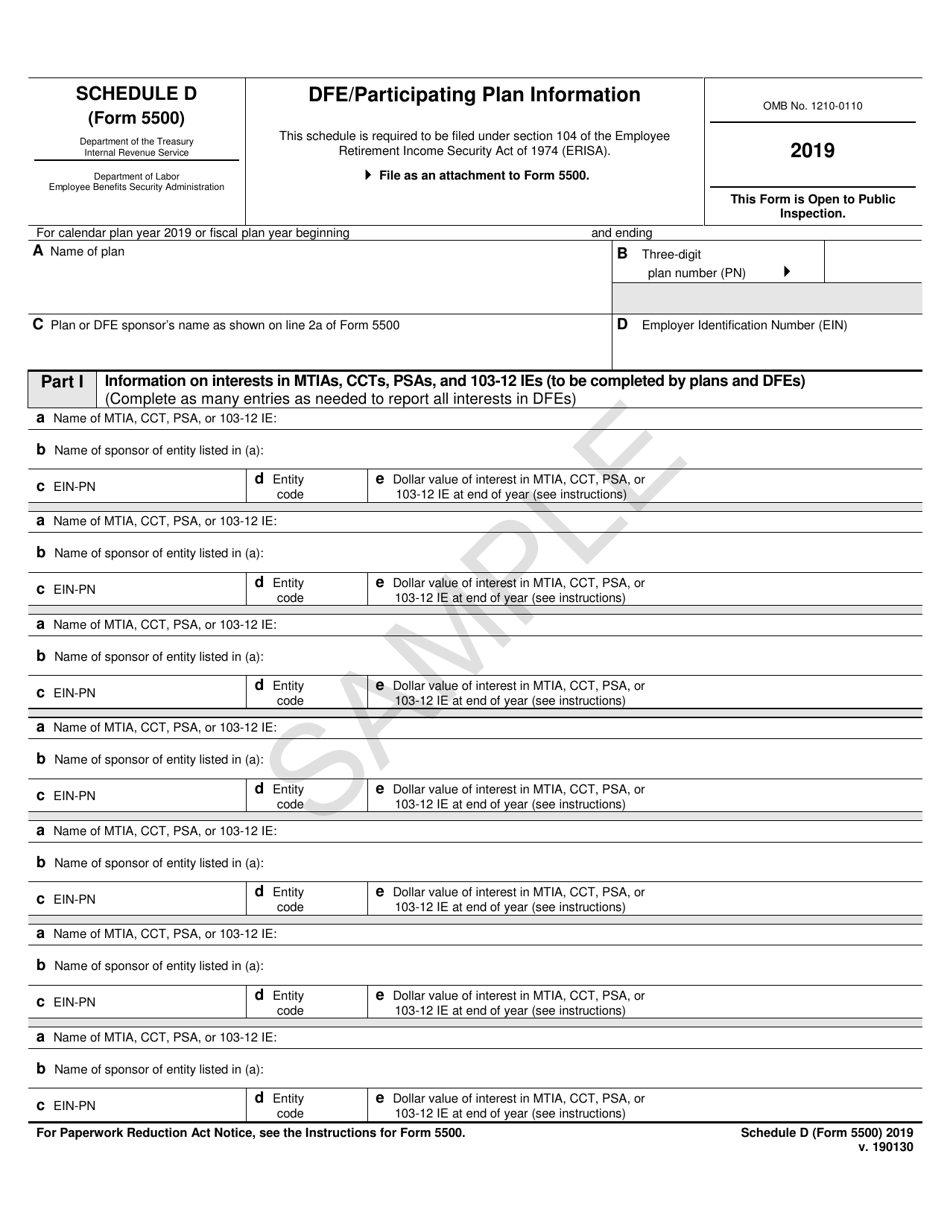

IRS Form 5500 Schedule D Download Fillable PDF or Fill Online Dfe

Phase iii, similar to the september 2021 proposal, adds breakout categories to the administrative expenses category of the income and expenses section of the schedule h (financial information) balance sheet to improve fee and expense transparency. To insurance carriers for the provision of benefits other real estate page Schedule h (form 1040) for figuring your household employment taxes. (a) beginning.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

If schedule h is filed, part iii of the schedule, regarding the independent qualified public accountant's (iqpa) report and opinion, must be completed. Web schedule h (form 5500) 2001 directly to participants or beneficiaries, including direct rollovers through if an accountant's opinion is attached, enter the name and ein of the accountant (or accounting firm) other total unrealized appreciation (depreciation).

Schedule MB IRS Form 5500 (2015) IUPAT

(a) beginning of year (b) end of year (1) Schedule h (form 1040) for figuring your household employment taxes. Phase iii, similar to the september 2021 proposal, adds breakout categories to the administrative expenses category of the income and expenses section of the schedule h (financial information) balance sheet to improve fee and expense transparency. Web here is a list.

This Website Provides The Forms, Schedules, And.

If schedule h is filed, part iii of the schedule, regarding the independent qualified public accountant's (iqpa) report and opinion, must be completed. To insurance carriers for the provision of benefits other real estate page Web schedule h (form 5500) 2001 directly to participants or beneficiaries, including direct rollovers through if an accountant's opinion is attached, enter the name and ein of the accountant (or accounting firm) other total unrealized appreciation (depreciation) of assets: Schedule h (form 5500) 2020 v.200204.

Web Form 5500, Annual Return/Report Of Employee Benefit Plan (Form And Instructions) Who Files The Employer Maintaining The Plan Or The Plan Administrator Of A Pension Or Welfare Benefit Plan Covered By Erisa.

Phase iii, similar to the september 2021 proposal, adds breakout categories to the administrative expenses category of the income and expenses section of the schedule h (financial information) balance sheet to improve fee and expense transparency. Web for paperwork reduction act notice, see the instructions for form 5500. (a) beginning of year (b) end of year (1) The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted.

Schedule H (Form 5500) 2020 Page.

Filings for plan years prior to 2009 are not displayed through this website. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Schedule h (form 1040) for figuring your household employment taxes. Web schedule h breakout of administrative expenses.

Web Form 5500, Line 2D.

Web here is a list of forms that household employers need to complete. Web form 5500 annual return/report of employee benefit plan | instructions;