Form 5498 Notification

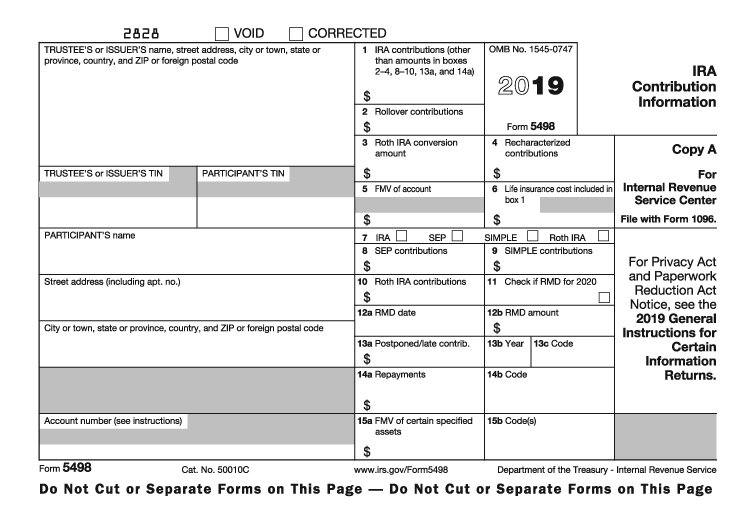

Form 5498 Notification - When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Form 5498 is prepared for ira. This form is for informational purposes only. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the prior year and the tax filing deadline of the. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required. Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. If an ira owner has an rmd due for 2023, the financial institution that is the trustee, custodian, or issuer maintaining the ira must file a 2022. Web form 5498 is due by the end of may for the prior year.

The irs requires trustees or issuers of contracts used for individual retirement accounts (iras) to submit form 5498 by may 31 each year. Web form 5498 is due by the end of may for the prior year. This form is for informational purposes only. Web what is a form 5498? Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web asset information reporting codes. So the 5498 for 2017 will be due may 31, 2018. If an ira owner has an rmd due for 2023, the financial institution that is the trustee, custodian, or issuer maintaining the ira must file a 2022.

Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the prior year and the tax filing deadline of the. Some ira providers file these right after the end of the year,. Any state or its agency or. Web what is a form 5498? Web form 5498 is due by the end of may for the prior year. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. The irs requires trustees or issuers of contracts used for individual retirement accounts (iras) to submit form 5498 by may 31 each year. So the 5498 for 2017 will be due may 31, 2018. It has a variety of fields for different types of information.

IRS Form 5498 What It Is and What The IRS Extension Means For Your IRA

Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. Web up to 10% cash back form 5498 provides the irs with information necessary for monitoring compliance with federal income tax laws. So the 5498 for 2017 will be due may 31, 2018. The.

IRS Form 5498 BoxbyBox — Ascensus

Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required. Web form 5498 is due by the end of may for the prior year. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web form 5498 is not issued until after the tax.

File Form 5498 Online in Few Minutes Efile Form 5498 for 2020 Tax Year

If an ira owner has an rmd due for 2023, the financial institution that is the trustee, custodian, or issuer maintaining the ira must file a 2022. Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. The trustee or custodian of your ira.

All About IRS Tax Form 5498 for 2020 IRA for individuals

The irs requires trustees or issuers of contracts used for individual retirement accounts (iras) to submit form 5498 by may 31 each year. Web up to 10% cash back form 5498 provides the irs with information necessary for monitoring compliance with federal income tax laws. So the 5498 for 2017 will be due may 31, 2018. Web what is a.

Form 5498 IRA Contribution Information Definition

The trustee or custodian of your ira reports. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required. Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the prior year and the tax filing deadline of the..

5498 Software to Create, Print & EFile IRS Form 5498

It has a variety of fields for different types of information. So the 5498 for 2017 will be due may 31, 2018. The irs requires trustees or issuers of contracts used for individual retirement accounts (iras) to submit form 5498 by may 31 each year. Web the ira contribution tax form, or tax form 5498, is an official document containing.

File 2020 Form 5498SA Online EFile as low as 0.50/Form

This form is for informational purposes only. Why would i receive form 5498? Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year.

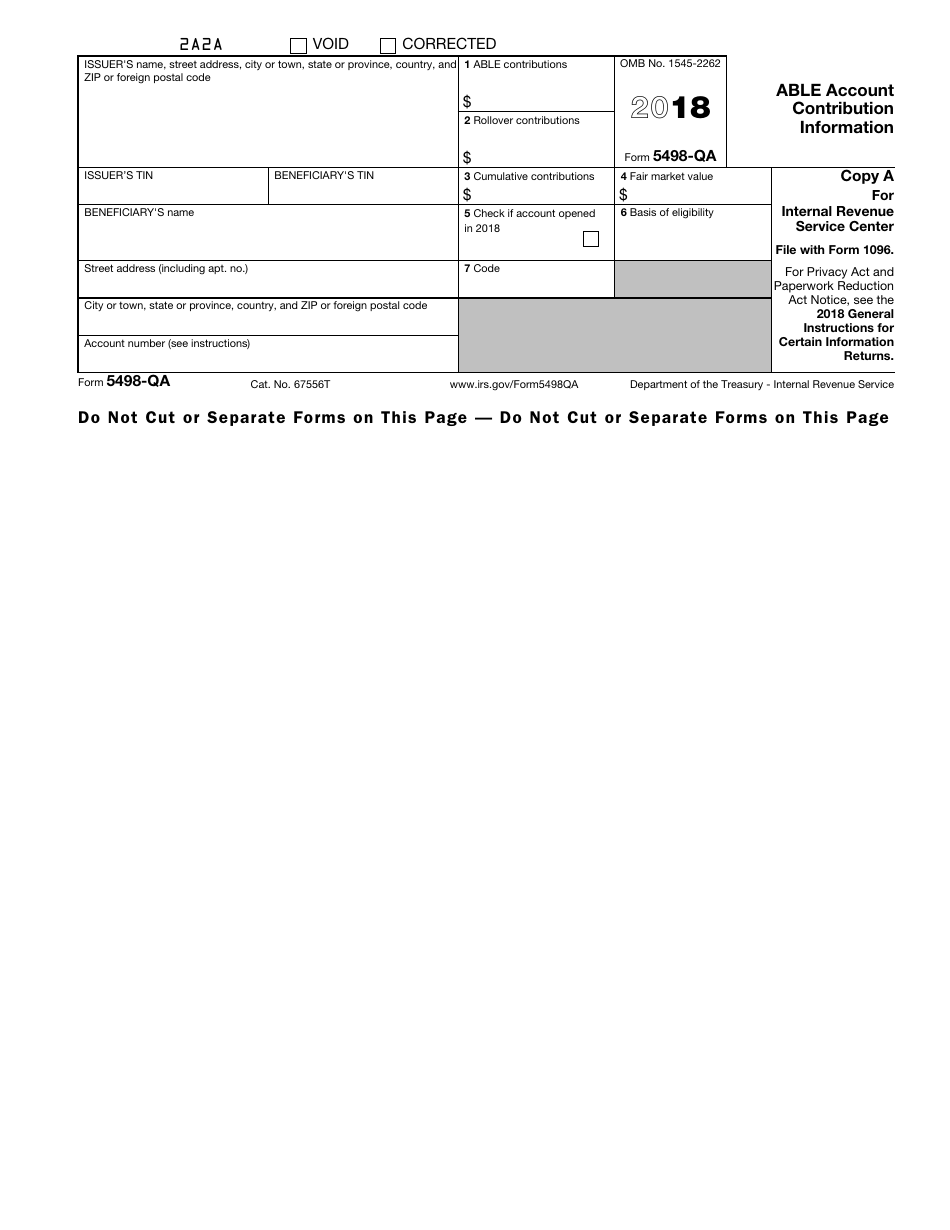

IRS Form 5498QA Download Fillable PDF or Fill Online Able Account

Web asset information reporting codes. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Some ira providers file these right after the end of the year,. Form 5498 is prepared for ira. So the 5498 for 2017 will be due may 31, 2018.

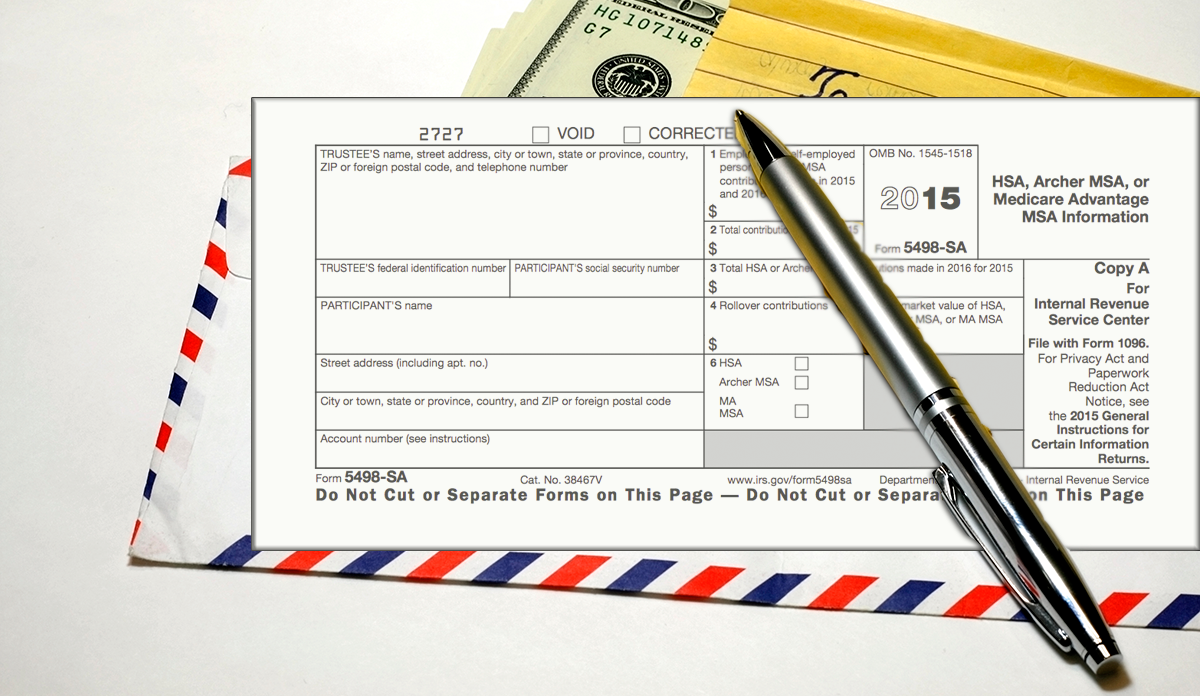

What is IRS Form 5498SA? BRI Benefit Resource

Any state or its agency or. Web form 5498 is due by the end of may for the prior year. Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. It has a variety of fields for different types of information. If an ira.

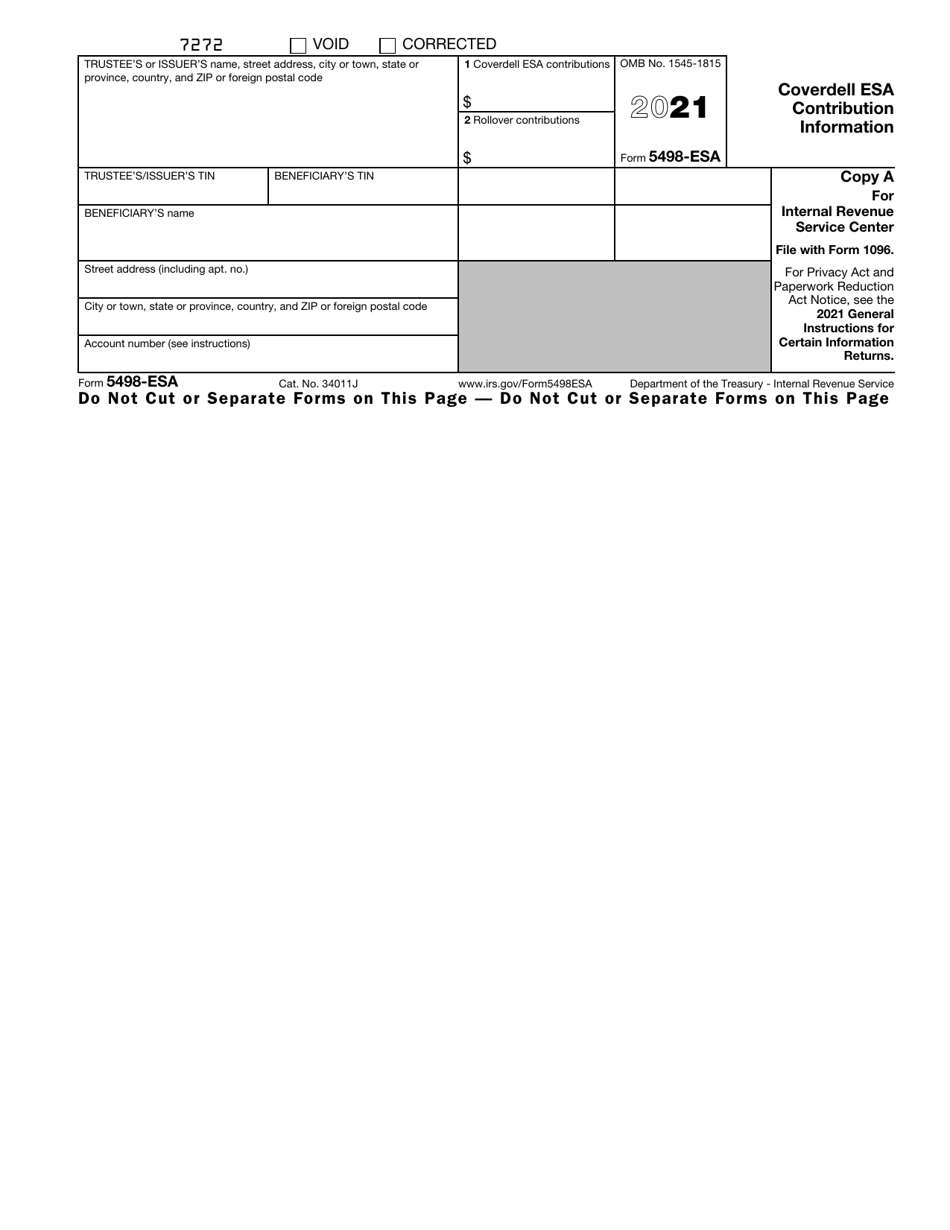

IRS Form 5498ESA Download Fillable PDF or Fill Online Coverdell Esa

Web what is a form 5498? Any state or its agency or. So the 5498 for 2017 will be due may 31, 2018. Web asset information reporting codes. Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the prior year and the tax filing.

Web The Information On Form 5498 Is Submitted To The Internal Revenue Service By The Trustee Or Issuer Of Your Individual Retirement Arrangement (Ira) To Report Contributions, Including.

Why would i receive form 5498? Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the prior year and the tax filing deadline of the. Web asset information reporting codes. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required.

The Trustee Or Custodian Of Your Ira Reports.

Web form 5498 is not issued until after the tax filing deadline, due to the fact that ira contributions can be made up until tax day. It has a variety of fields for different types of information. Web what is a form 5498? Any state or its agency or.

If An Ira Owner Has An Rmd Due For 2023, The Financial Institution That Is The Trustee, Custodian, Or Issuer Maintaining The Ira Must File A 2022.

Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. The irs requires trustees or issuers of contracts used for individual retirement accounts (iras) to submit form 5498 by may 31 each year. Web up to 10% cash back form 5498 provides the irs with information necessary for monitoring compliance with federal income tax laws. Some ira providers file these right after the end of the year,.

When You Save For Retirement With An Individual Retirement Arrangement (Ira), You Probably Receive A Form 5498 Each Year.

Form 5498 is prepared for ira. Web form 5498 is due by the end of may for the prior year. So the 5498 for 2017 will be due may 31, 2018. This form is for informational purposes only.

+Copy+A+750px.jpg)

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)