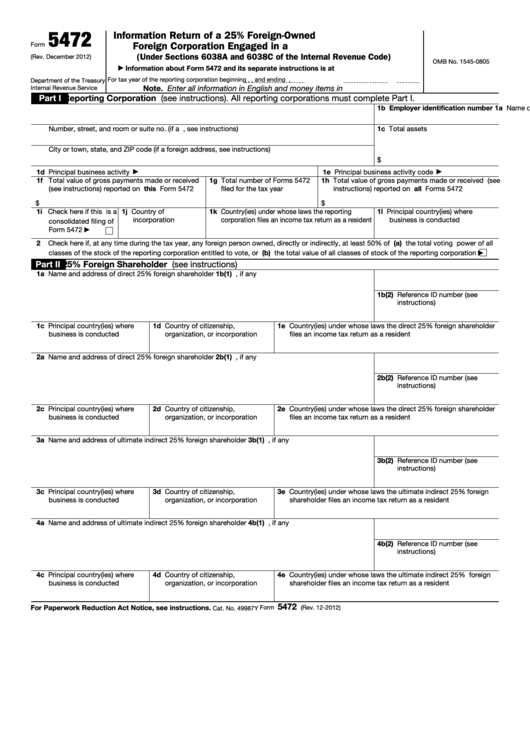

Form 5472 Example

Form 5472 Example - Web for example, in the case of a merger or acquisition involving a 25% foreign shareholder or related foreign party, a form 5472 filer must use a reference id number that correlates the previous reference id number with the new reference id number assigned to the 25% foreign shareholder or related foreign party. For instructions and the latest information. Check here if this is a consolidated filing of form 5472. Corporation and a foreign owner Your llc must have an ein in order to file form 5472 and form 1120. Web for example, if a uk limited company owns 100% of a us limited liability company, absent a “check the box” election, the existence of the us llc would be ignored for most tax purposes. Web irs form 5472 examples. Web what information is required? Web there are a few exceptions to filing, examples of which include: How to get an ein without an ssn or itin.

De that fails to timely file form 5472 or files a substantially incomplete form 5472. Web what information is required? Web there are a few exceptions to filing, examples of which include: To better understand what businesses should file form 5472, let’s look at some examples. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. If the company had no reportable transactions that year. Check here if this is a consolidated filing of form 5472. Total number of forms 5472 filed for the tax year. Technically, the form is referred to as the:

An exchange of property or money, including rental income, payments, remuneration, sales transactions, commissions and capital contributions a foreign owner or related party’s use of a u.s. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the consolidated filing of form 5472. Corporation and a foreign owner Exchange money, payments, rental income, commission, or sales transactions pay for expenses on behalf of the foreign entity premiums received or paid You can find what counts as a reportable transaction on the irs’ website. Web examples of using form 5472 there are several types of reportable transactions between the foreign entity and the company that would require the use of form 5472, such as: How to get an ein without an ssn or itin. A reporting corporation is not required to file form 5472 if any of the following apply. Your llc must have an ein in order to file form 5472 and form 1120. Start by making sure that you understand your irs reporting obligations.

Form 5472 What is a Reportable Transaction and do I have to File This

Provides the irs data on related party transactions and pricing. Total number of forms 5472 filed for the tax year. A reporting corporation is not required to file form 5472 if any of the following apply. De that fails to timely file form 5472 or files a substantially incomplete form 5472. Matt, sarah, and jack each own an equal stake.

form 5472 instructions 2018 Fill Online, Printable, Fillable Blank

A reporting corporation is not required to file form 5472 if any of the following apply. How to get an ein without an ssn or itin. Web form 5472 a schedule stating which members of the u.s. Matt and sarah are both us citizens, while jack is an australian citizen. It had no reportable transactions of the types listed in.

Form 5472 2022 IRS Forms

Penalties for not complying with form 5472 filing obligations can be significant. It had no reportable transactions of the types listed in parts iv and vi of the form. Provides the irs data on related party transactions and pricing. Exchange money, payments, rental income, commission, or sales transactions pay for expenses on behalf of the foreign entity premiums received or.

Should You File a Form 5471 or Form 5472? Asena Advisors

Citizens (foreigners) who have formed an llc in the u.s. Web form 5472 if it had a reportable transaction with a foreign or domestic related party. Your llc must have an ein in order to file form 5472 and form 1120. Check here if this is the initial year for which the u.s. A reporting corporation is not required to.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

For instructions and the latest information. Penalties for not complying with form 5472 filing obligations can be significant. Identification of the foreign stockholder of the reporting corporation, including the country of organization, the countries where it conducts business, and countries where it files its income tax returns. Web form 5472 a schedule stating which members of the u.s. Web where.

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

To better understand what businesses should file form 5472, let’s look at some examples. Provides the irs data on related party transactions and pricing. Citizens (foreigners) who have formed an llc in the u.s. Web as provided by the irs: The schedule must show the name, address, and employer identification number (ein) of each member who is including transactions on.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Web what information is required? The name and address of the reporting corporation, and its employer identification number. Form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Web examples of using form 5472 there are several.

FM 2391 Chptr 14 Special Considerations

Web form 5472 a schedule stating which members of the u.s. How to get an ein without an ssn or itin. Web there are a few exceptions to filing, examples of which include: Check here if this is the initial year for which the u.s. If the company had no reportable transactions that year.

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Web form 5472 a schedule stating which members of the u.s. The schedule must show the name, address, and employer identification number (ein) of each member who is including transactions on the. December 2022) department of the treasury internal revenue service. A reporting corporation is not required to file form 5472 if any of the following apply. Web examples of.

IRS Form 5472 File taxes for offshore LLCs How To Guide

Exchange money, payments, rental income, commission, or sales transactions pay for expenses on behalf of the foreign entity premiums received or paid Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Identification of the foreign stockholder of the reporting corporation, including the country of.

Matt, Sarah, And Jack Each Own An Equal Stake In Company A, A Us Domestic Corporation.

Citizens (foreigners) who have formed an llc in the u.s. Your llc must have an ein in order to file form 5472 and form 1120. Web for example, in the case of a merger or acquisition involving a 25% foreign shareholder or related foreign party, a form 5472 filer must use a reference id number that correlates the previous reference id number with the new reference id number assigned to the 25% foreign shareholder or related foreign party. Total value of gross payments made or received reported on.

A Reporting Corporation Is Not Required To File Form 5472 If Any Of The Following Apply.

Web form 5472 a schedule stating which members of the u.s. How do you prevent form 5472 penalties? It had no reportable transactions of the types listed in parts iv and vi of the form. Web where a penalty has been assessed by the irs, it is often worthwhile to verify whether the relevant information return was in fact timely and correctly filed, and whether there is simply a mismatch between taxpayer and irs records — for example, where a form 7004, application for automatic extension of time to file certain business income.

An Exchange Of Property Or Money, Including Rental Income, Payments, Remuneration, Sales Transactions, Commissions And Capital Contributions A Foreign Owner Or Related Party’s Use Of A U.s.

Web there are a few exceptions to filing, examples of which include: Web information about form 5472, including recent updates, related forms, and instructions on how to file. To better understand what businesses should file form 5472, let’s look at some examples. Exchange money, payments, rental income, commission, or sales transactions pay for expenses on behalf of the foreign entity premiums received or paid

Your Llc Must Have An Ein In Order To File Form 5472 And Form 1120.

Check here if this is a consolidated filing of form 5472. Web for example, if a uk limited company owns 100% of a us limited liability company, absent a “check the box” election, the existence of the us llc would be ignored for most tax purposes. Provides the irs data on related party transactions and pricing. If you don’t have an ssn or itin you can still get an ein for your llc.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity.jpg)