Form 5305-Sep

Form 5305-Sep - Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. No plan tax filings with irs. Web employers must fill out and retain form 5305 sep (pdf) in their records. Complete, edit or print tax forms instantly. Web there are three document format options for sep plans: This form is for income earned in tax year 2022, with tax returns due. Web what does this mean to me? Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed.

Web there are three document format options for sep plans: Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. This form is for income earned in tax year 2022, with tax returns due. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web employers must fill out and retain form 5305 sep (pdf) in their records. It cannot be a simple ira (an ira designed to. This form is for income earned in tax year 2022, with tax returns due. No plan tax filings with irs. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed.

It cannot be a simple ira (an ira designed to. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Web employers must fill out and retain form 5305 sep (pdf) in their records. This form is for income earned in tax year 2022, with tax returns due. Web what does this mean to me? Each employee must open an individual sep ira account. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due. Complete, edit or print tax forms instantly. Web there are three document format options for sep plans:

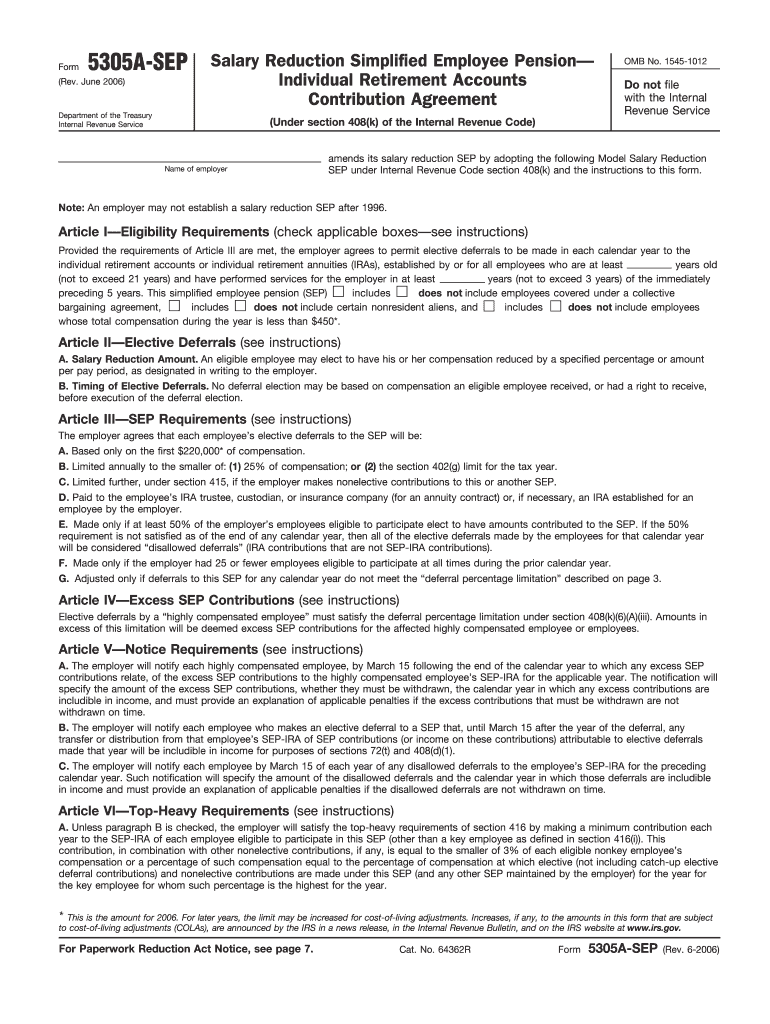

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

No plan tax filings with irs. Web there are three document format options for sep plans: Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. It cannot be a simple ira (an ira designed to. Here is the irs faq for sep plans, which includes links to the.

20062022 Form IRS 5305ASEP Fill Online, Printable, Fillable, Blank

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Here is the irs faq.

Ea Form 2016 Pdf Latest Ea Form C P 8a Pin Technology Centre

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return,.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Each employee must open an individual sep ira account. Web employers must fill out and retain form 5305 sep (pdf) in their records. It cannot be a simple ira (an ira designed to. Get ready for tax season deadlines by completing any required tax forms today. Here is the irs faq for sep plans, which includes links to the most.

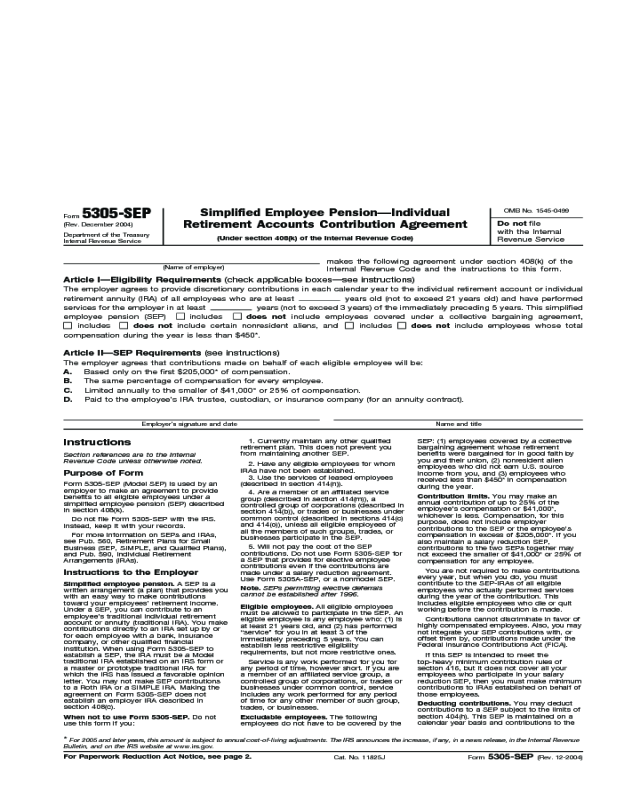

Form 5305SEP Edit, Fill, Sign Online Handypdf

Web what does this mean to me? This form is for income earned in tax year 2022, with tax returns due. Complete, edit or print tax forms instantly. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Web there are three document format options for sep plans:

How a SEP IRA Works Contributions, Benefits, Obligations and IRS Form

Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. No plan tax filings with irs. This form is for income earned in tax year 2022, with tax returns due. Here is the irs faq for sep plans, which includes links to the most current form and instructions:. Web.

Fill Free fillable Fidelity Investments PDF forms

Web what does this mean to me? Here is the irs faq for sep plans, which includes links to the most current form and instructions:. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. This form is for income earned in tax year 2022, with tax returns due..

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Here is the irs faq for sep plans, which includes links to the most current form and instructions:. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Web there are three document format options for sep plans: No plan tax filings with irs. Web employers must fill out.

Form 5305SEP Simplified Employee PensionIndividual Retirement

Each employee must open an individual sep ira account. Complete, edit or print tax forms instantly. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Web there are three document format options for sep plans: This form is for income earned in tax year 2022, with tax.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Each employee must open an individual sep ira account. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Web there are three document format options for sep plans: Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Web Employers Must Fill Out And Retain Form 5305 Sep (Pdf) In Their Records.

Each employee must open an individual sep ira account. No plan tax filings with irs. Complete, edit or print tax forms instantly. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

This form is for income earned in tax year 2022, with tax returns due. Here is the irs faq for sep plans, which includes links to the most current form and instructions:. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Web there are three document format options for sep plans:

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due.

Web what does this mean to me? It cannot be a simple ira (an ira designed to.