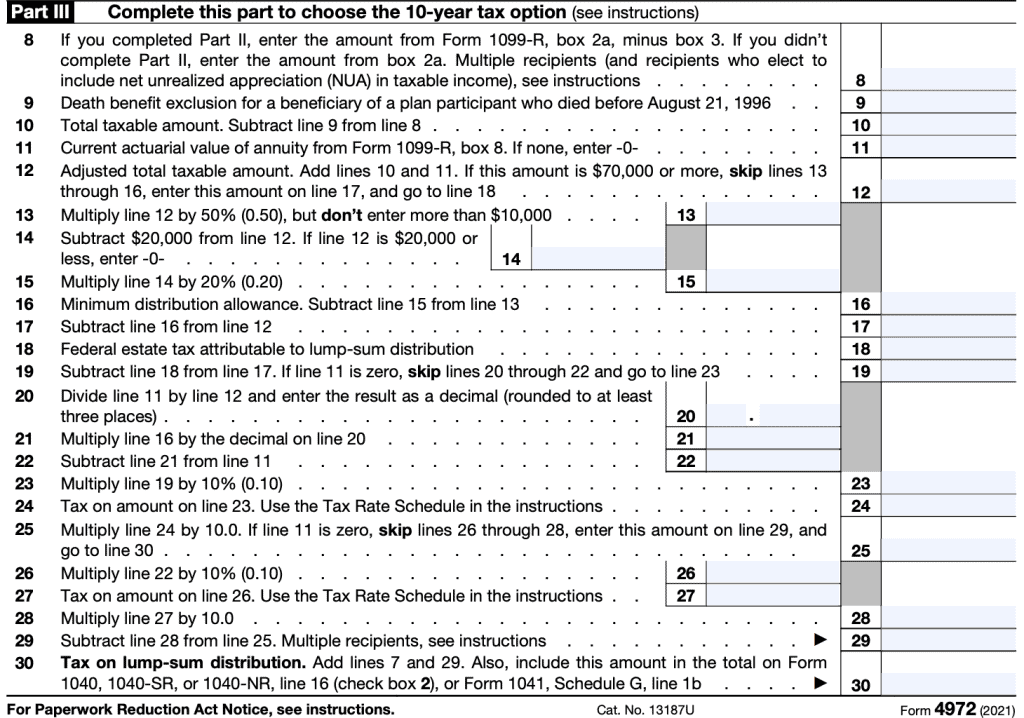

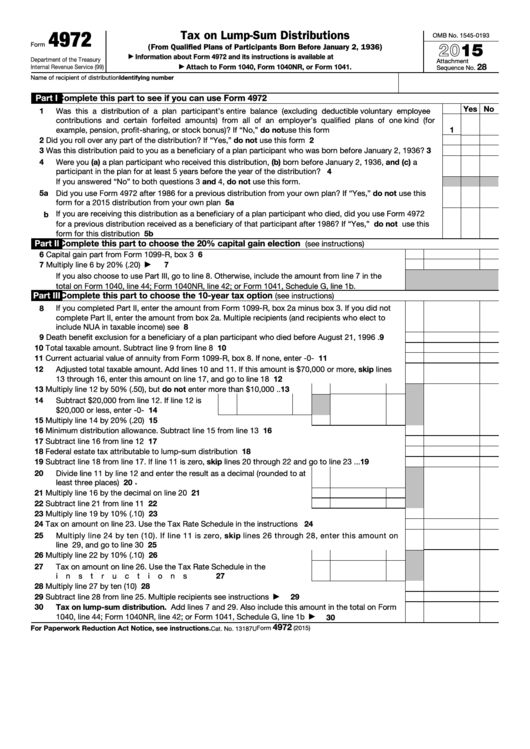

Form 4972 Tax Form

Form 4972 Tax Form - This form is usually required when:. The following choices are available. Tax form 4972 is used for reducing taxes. It asks if the entire. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Use distribution code a and answer all. Multiply line 17 by 10%.21. To see if you qualify, you must first determine if your distribution is a. This may result in a smaller tax than you would pay by reporting the taxable amount of. This form is for income earned in tax year 2022, with tax returns due in april.

Use screen 1099r in the income folder to complete form 4972. Tax form 4972 is used for reducing taxes. It asks if the entire. Edit, sign and print tax forms on any device with uslegalforms. Complete, edit or print tax forms instantly. Use this form to figure the. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. This form is usually required when:. Web who can use the form, you can use form 4972 to figure your tax by special methods.

This may result in a smaller tax than you would pay by reporting the taxable amount of. Complete, edit or print tax forms instantly. Web form 4972 1 form 4972 eligibility requirements. This form is usually required when:. The following choices are available. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Complete, edit or print tax forms instantly. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Use distribution code a and answer all. You can download or print current.

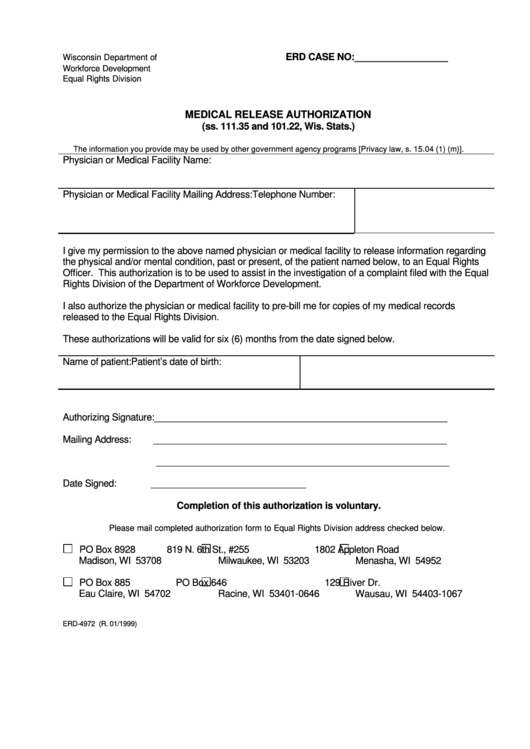

Form Erd4972 Medical Release Authorization printable pdf download

The following choices are available. Web who can use the form, you can use form 4972 to figure your tax by special methods. Complete, edit or print tax forms instantly. Tax form 4972 is used for reducing taxes. Use distribution code a and answer all.

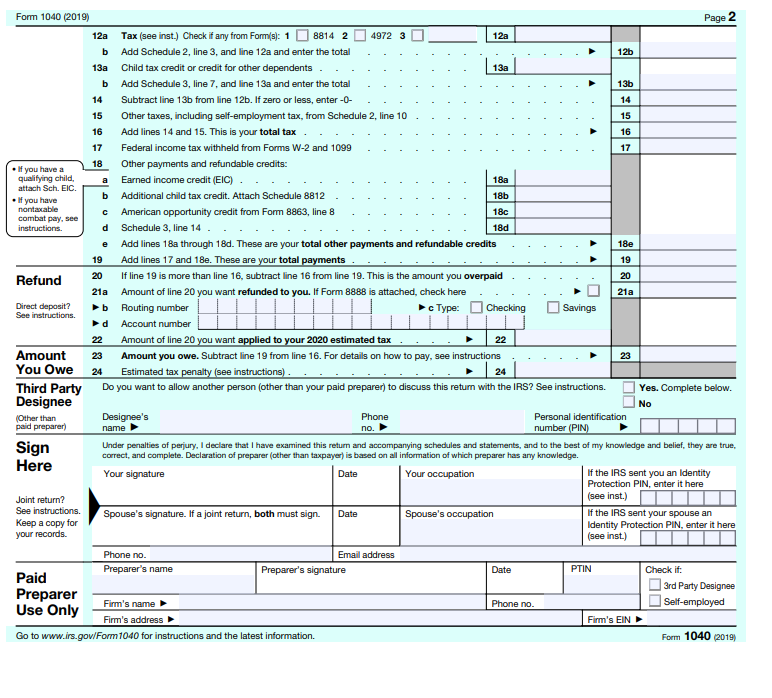

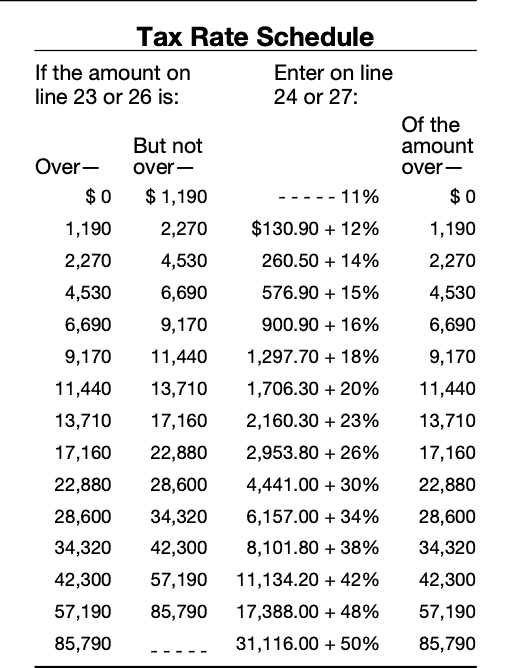

Solved USE 2020 TAX SCHEDULE, FILL OUT SPACES THAT APPLY ON

Web how to complete form 4972 in lacerte. To see if you qualify, you must first determine if your distribution is a. Use screen 1099r in the income folder to complete form 4972. Use this form to figure the. Tax form 4972 is used for reducing taxes.

IRS Form 4972A Guide to Tax on LumpSum Distributions

Use screen 1099r in the income folder to complete form 4972. Web how to complete form 4972 in lacerte. Web form 4972 1 form 4972 eligibility requirements. Multiply line 17 by 10%.21. Tax form 4972 is used for reducing taxes.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Use screen 1099r in the income folder to complete form 4972. Multiply line 17 by 10%.21. The first part of form 4972 asks a series of questions to determine if you are eligible to use the form. This form is usually required when:. To see if you qualify, you must first determine if your distribution is a.

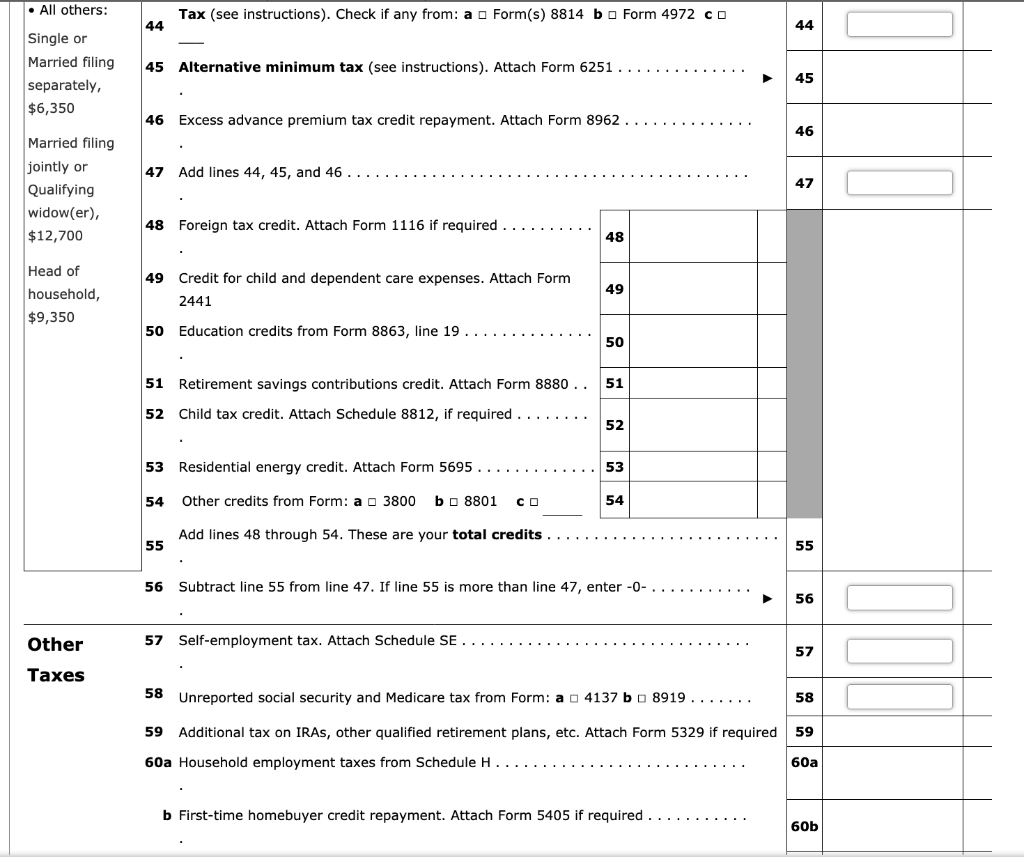

Irs form 8814 instructions

Web form 4972 1 form 4972 eligibility requirements. Complete, edit or print tax forms instantly. It asks if the entire. Web how to complete form 4972 in lacerte. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Use this form to figure the. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. The following choices are available. This form is usually required when:. Use distribution code a and answer all.

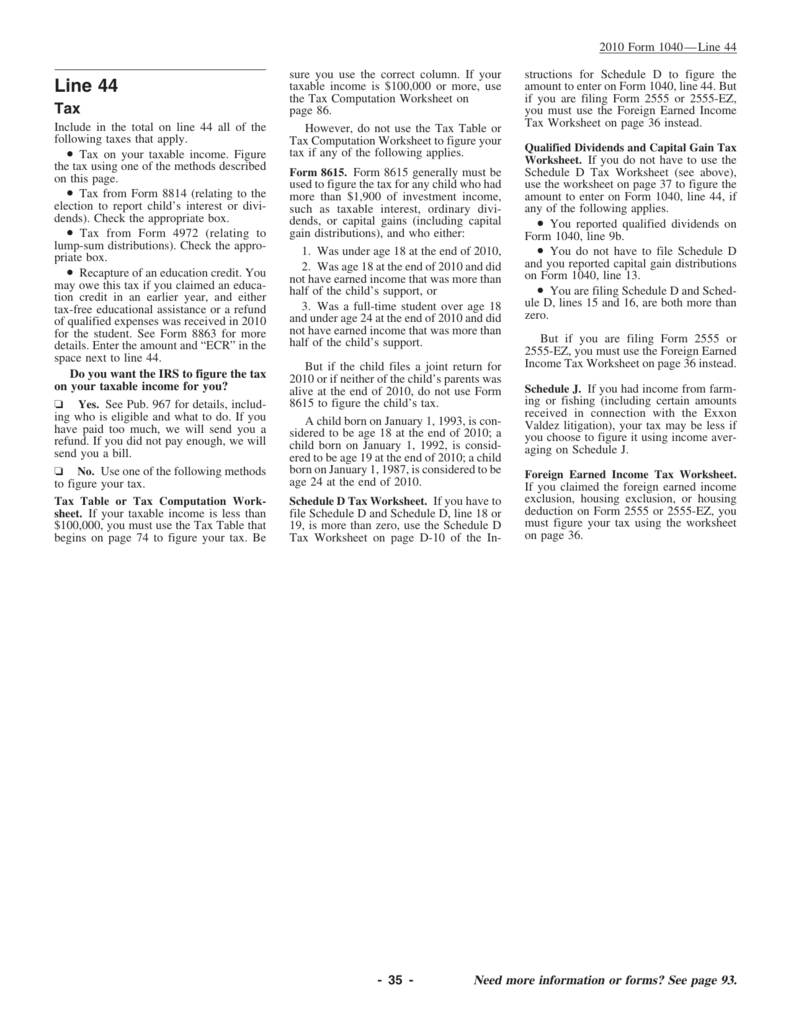

instructions for line 44

You can download or print current. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Complete, edit or print tax forms instantly. Edit, sign and print tax forms on any device with uslegalforms. This form is for income earned in tax year 2022, with tax returns due in april.

IRS Form 4972A Guide to Tax on LumpSum Distributions

You can download or print current. Web how to complete form 4972 in lacerte. Use this form to figure the. This form is for income earned in tax year 2022, with tax returns due in april. Web form 4972 1 form 4972 eligibility requirements.

Fillable Form 4972 Tax On LumpSum Distributions 2015 printable pdf

The following choices are available. Tax form 4972 is used for reducing taxes. Edit, sign and print tax forms on any device with uslegalforms. The first part of form 4972 asks a series of questions to determine if you are eligible to use the form. It asks if the entire.

Note This Problem Is For The 2017 Tax Year. Janic...

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Multiply line 17 by 10%.21. Use this form to figure the. Do not misread the statement, it means that the form is filled and submitted to reduce the.

Use Distribution Code A And Answer All.

This form is for income earned in tax year 2022, with tax returns due in april. Multiply line 17 by 10%.21. Use this form to figure the. Edit, sign and print tax forms on any device with uslegalforms.

Tax Form 4972 Is Used For Reducing Taxes.

Web who can use the form, you can use form 4972 to figure your tax by special methods. The first part of form 4972 asks a series of questions to determine if you are eligible to use the form. Web form 4972 1 form 4972 eligibility requirements. Complete, edit or print tax forms instantly.

Do Not Misread The Statement, It Means That The Form Is Filled And Submitted To Reduce The Tax For Enormous Distributions.

Complete, edit or print tax forms instantly. This form is usually required when:. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. This may result in a smaller tax than you would pay by reporting the taxable amount of.

The Following Choices Are Available.

Ad access irs tax forms. To see if you qualify, you must first determine if your distribution is a. Use screen 1099r in the income folder to complete form 4972. It asks if the entire.