Form 4562 Instructions 2022

Form 4562 Instructions 2022 - Web solved•by turbotax•1623•updated january 13, 2023. Georgia doe s not allow any additional depreciation benefits provided by i.r.c. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web the new rules allow for 100% bonus expensing of assets that are new or used. There is no single place. Once you understand what each part of this tax form does, you can plan ways to use it to reduce your tax burden. Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions. After 2026 there is no further bonus depreciation. Irs form 4562 is used to calculate and claim deductions for depreciation and amortization. A section 179 deduction is an additional depreciation deduction for all or part of depreciation in the first year you own and use some types of business property.

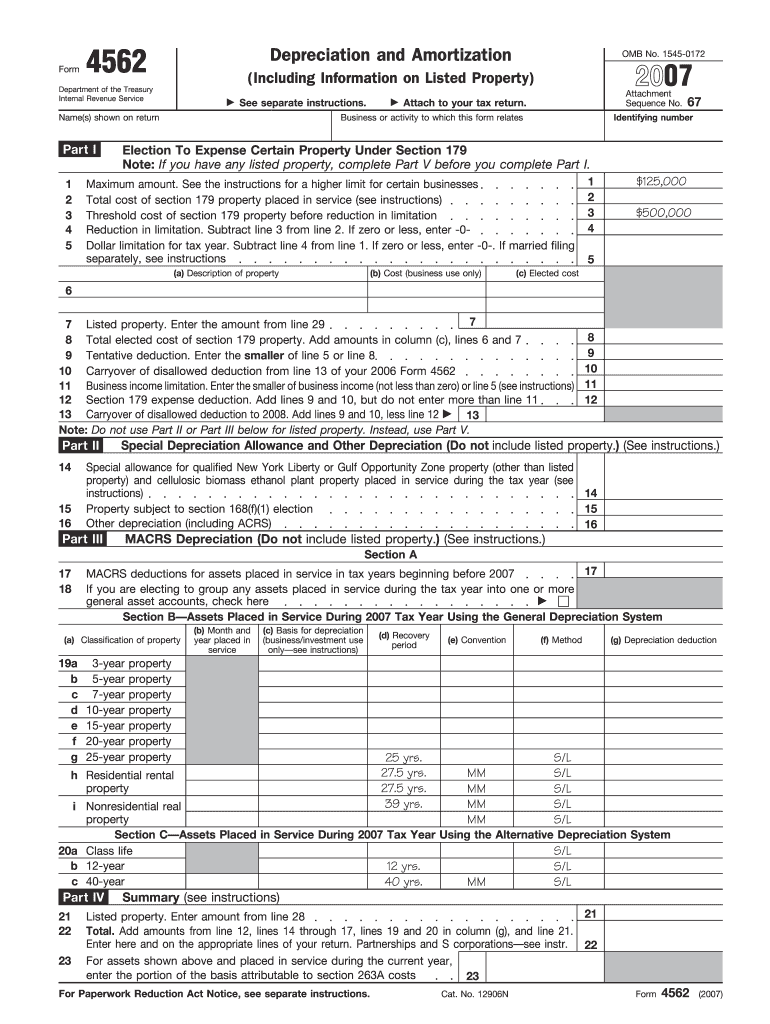

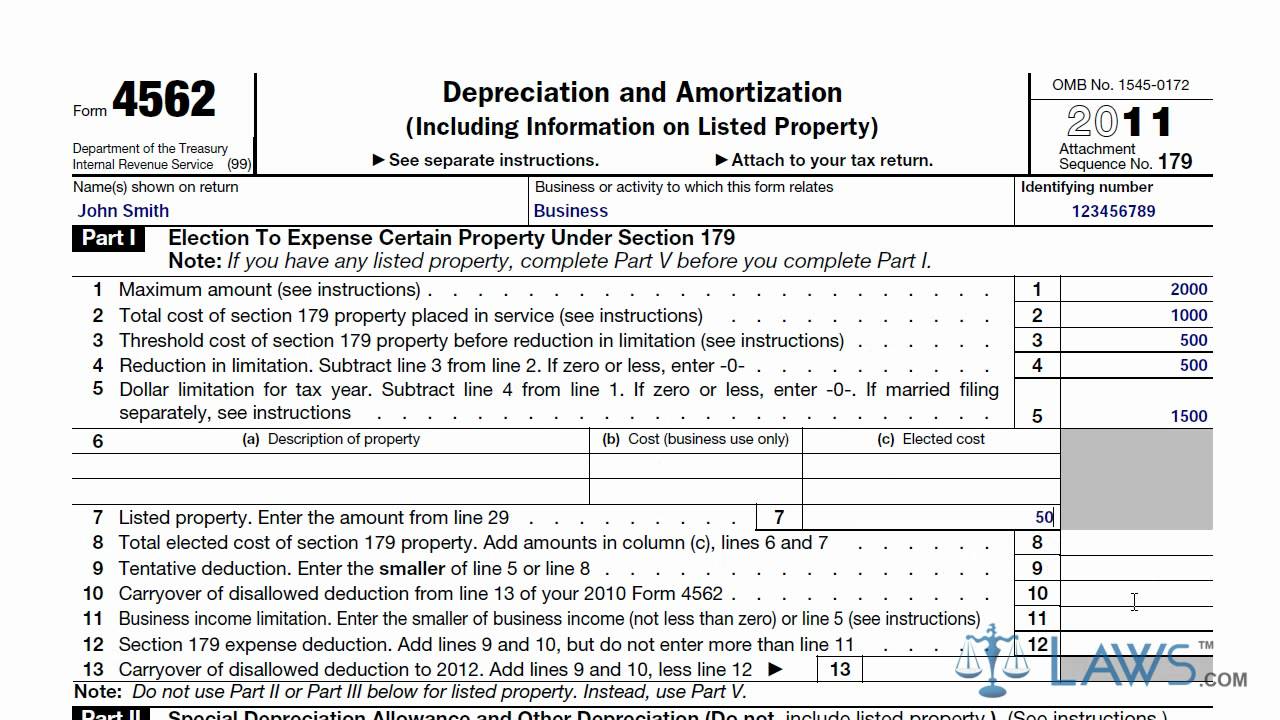

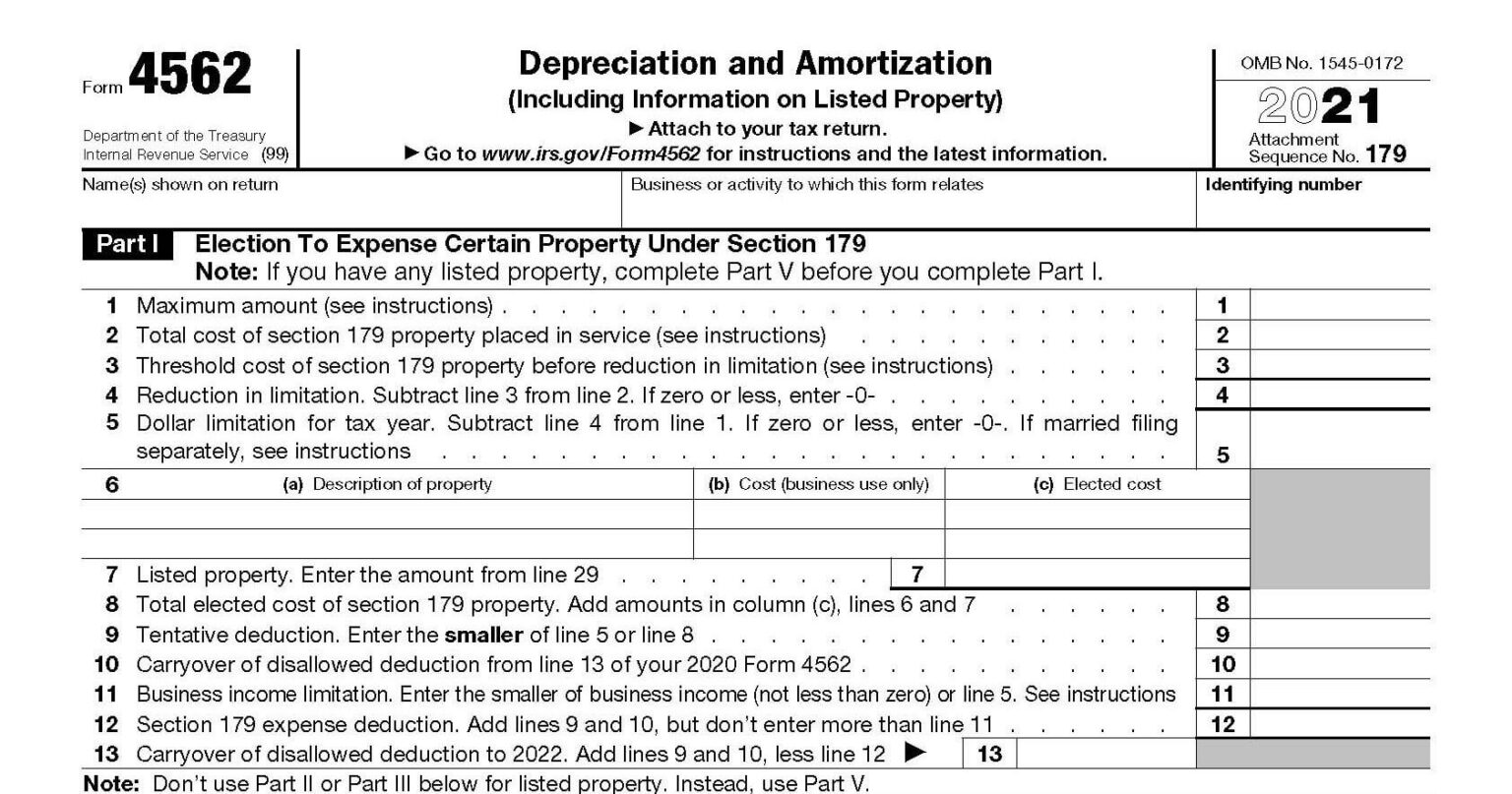

After 2026 there is no further bonus depreciation. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Section 179 deductions this is the section 179 deduction, including section 179 deductions for the listed property. Irs form 4562, depreciation and amortization, is used to depreciate or amortize property you’ve bought for your business. Section 179 deductions if you’ve purchased a large item but decide that you would rather write off a large chunk of the expense rather than depreciate it in full, you need to complete part. Once you understand what each part of this tax form does, you can plan ways to use it to reduce your tax burden. Irs form 4562 is used to calculate and claim deductions for depreciation and amortization. General information what is the purpose of this form? Web 4562 georgia depreciation andamortization form (rev. When you enter depreciable assets—vehicles, buildings, farm equipment, intellectual property, etc.—we'll generate form 4562 and apply the correct depreciation method.

After 2026 there is no further bonus depreciation. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. There is no single place. Web 4562 georgia depreciation andamortization form (rev. A section 179 deduction is an additional depreciation deduction for all or part of depreciation in the first year you own and use some types of business property. Section 179 deductions this is the section 179 deduction, including section 179 deductions for the listed property. Georgia doe s not allow any additional depreciation benefits provided by i.r.c. Section 179 deductions if you’ve purchased a large item but decide that you would rather write off a large chunk of the expense rather than depreciate it in full, you need to complete part. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Once you understand what each part of this tax form does, you can plan ways to use it to reduce your tax burden.

2021 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%, 2025 to 40%, and 2026 to 20%. Irs form 4562 is used to calculate and claim deductions for depreciation and amortization. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Irs form 4562, depreciation and amortization,.

4562 Form 2021

Web solved•by turbotax•1623•updated january 13, 2023. Web instructions for form 4562 (2022) depreciation and amortization (including information on listed. Section 179 deductions if you’ve purchased a large item but decide that you would rather write off a large chunk of the expense rather than depreciate it in full, you need to complete part. What are depreciation and amortization? Web form.

Formulario 4562 depreciation and amortization Actualizado mayo 2022

Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. When you enter depreciable assets—vehicles, buildings, farm equipment, intellectual property, etc.—we'll generate form 4562 and apply the correct depreciation method. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the.

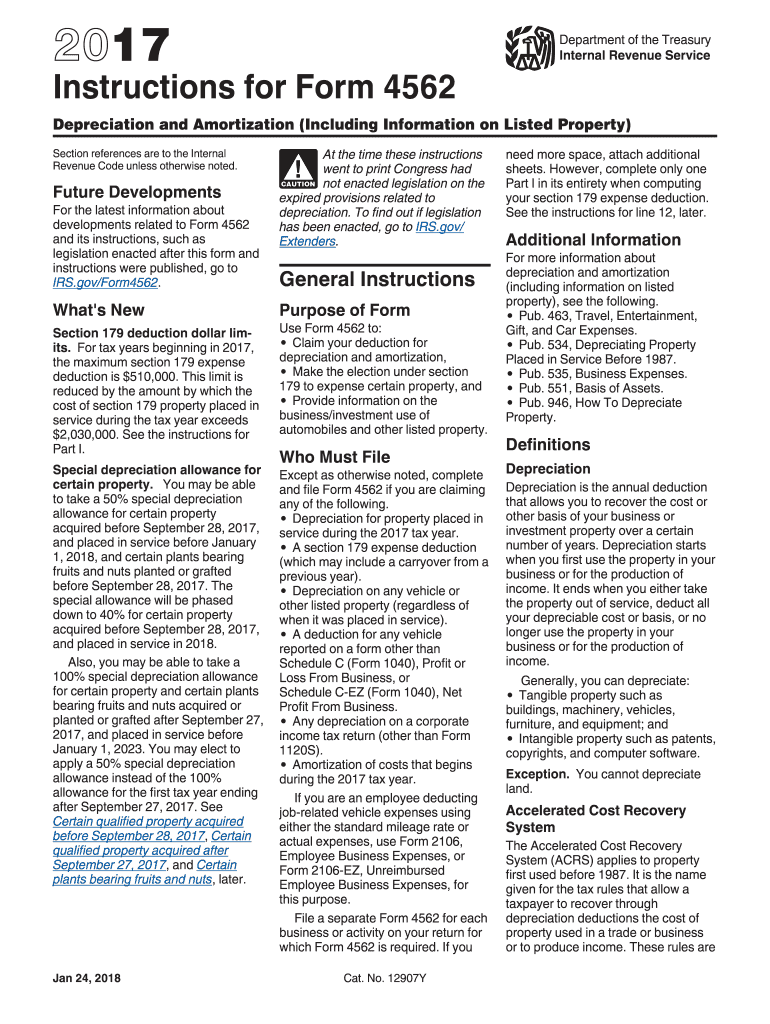

2017 Instructions 4562 Fill Out and Sign Printable PDF Template signNow

This form has been modified to include calculations for property placed in service after december 31, 2022, and before january 1, 2024, subject to 80 percent federal bonus depreciation. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%, 2025 to 40%, and 2026 to 20%. Irs form 4562 is used to calculate and claim deductions.

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

This form has been modified to include calculations for property placed in service after december 31, 2022, and before january 1, 2024, subject to 80 percent federal bonus depreciation. Web solved•by turbotax•1623•updated january 13, 2023. There is no single place. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to.

Form 4562 YouTube

05/26/22) (including informatio n on listed property) note: A section 179 deduction is an additional depreciation deduction for all or part of depreciation in the first year you own and use some types of business property. Web 4562 georgia depreciation andamortization form (rev. Web solved•by turbotax•1623•updated january 13, 2023. This form has been modified to include calculations for property placed.

Tax Forms Depreciation Guru

Irs form 4562, depreciation and amortization, is used to depreciate or amortize property you’ve bought for your business. There is no single place. Web solved•by turbotax•1623•updated january 13, 2023. After 2026 there is no further bonus depreciation. Irs form 4562 is used to calculate and claim deductions for depreciation and amortization.

How to Complete IRS Form 4562

Section 179 deductions this is the section 179 deduction, including section 179 deductions for the listed property. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. Irs form 4562 is used to calculate and claim deductions for depreciation and amortization. Section 179 deductions if you’ve purchased a large.

Form 4562 Do I Need to File Form 4562? (with Instructions)

When you enter depreciable assets—vehicles, buildings, farm equipment, intellectual property, etc.—we'll generate form 4562 and apply the correct depreciation method. This form has been modified to include calculations for property placed in service after december 31, 2022, and before january 1, 2024, subject to 80 percent federal bonus depreciation. Irs form 4562, depreciation and amortization, is used to depreciate or.

Irs Form 4562 Instructions Universal Network

Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. When you enter depreciable assets—vehicles, buildings, farm equipment, intellectual property, etc.—we'll generate form 4562 and apply the correct depreciation method. What are depreciation and amortization? Section 179 deductions this is the section 179 deduction, including section 179 deductions for.

The Percentage Of Bonus Depreciation Phases Down In 2023 To 80%, 2024 To 60%, 2025 To 40%, And 2026 To 20%.

Web the new rules allow for 100% bonus expensing of assets that are new or used. Irs form 4562 is used to calculate and claim deductions for depreciation and amortization. There is no single place. Section 179 deductions if you’ve purchased a large item but decide that you would rather write off a large chunk of the expense rather than depreciate it in full, you need to complete part.

Web Solved•By Turbotax•1623•Updated January 13, 2023.

This form has been modified to include calculations for property placed in service after december 31, 2022, and before january 1, 2024, subject to 80 percent federal bonus depreciation. 05/26/22) (including informatio n on listed property) note: Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Once you understand what each part of this tax form does, you can plan ways to use it to reduce your tax burden.

A Section 179 Deduction Is An Additional Depreciation Deduction For All Or Part Of Depreciation In The First Year You Own And Use Some Types Of Business Property.

Irs form 4562, depreciation and amortization, is used to depreciate or amortize property you’ve bought for your business. When you enter depreciable assets—vehicles, buildings, farm equipment, intellectual property, etc.—we'll generate form 4562 and apply the correct depreciation method. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. General information what is the purpose of this form?

What Are Depreciation And Amortization?

Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions. Web instructions for form 4562 (2022) depreciation and amortization (including information on listed. Go to www.irs.gov/form4562 for instructions and the latest information. After 2026 there is no further bonus depreciation.