Form 3849 Instructions 2021

Form 3849 Instructions 2021 - Hand off your taxes, get expert help, or do it yourself. 2021 franchise tax board repayment limitation table for the california premium assistance subsidy. Use schedules 1 through 5 to claim refunds for nontaxable uses (or sales) of fuels. Web purpose to document the specifications for the procurement process. Reports information about each individual who is covered under your policy. What forms do i need to complete the 3849? Reconciling your state subsidy/state premium assistance subsidy on form ftb 3849 1. Web why are forms 3849 and 3853 not available to complete my california state return? Beginning with tax year 2020, the state of california requires residents and their dependents to obtain qualifying health care coverage, also referred to as minimum essential coverage (mec). Reminders • you can electronically file form 8849 through any electronic return originator (ero), transmitter,.

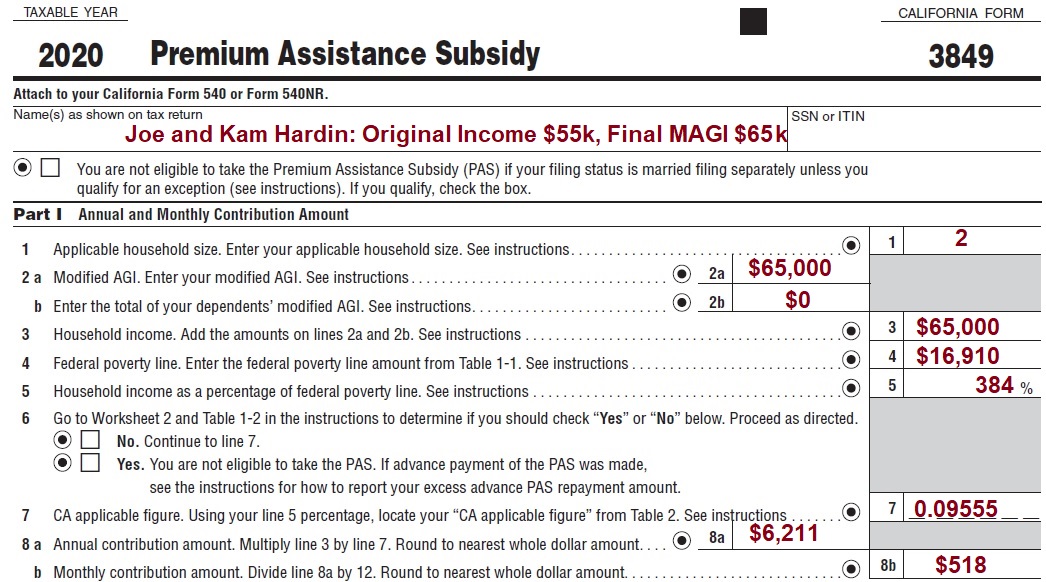

Web taxpayers can use the ftb 3849 form to determine how much california premium assistance subsidy they will need to pay back with their tax return. Form 8849 lists the schedules by number and title. Web 2021premium assistance subsidy attach to your california form 540 or form 540nr. Web 2020 premium assistance subsidy attach to your california form 540 or form 540nr. • your applicable household size equals the number of individuals in your apas was paid for you or another individual in your applicable household. Instead, see where to file below. Name(s) as shown on your california tax return california form 3849 ssn or i t i n you are not eligible to take the premium assistance subsidy (pas) if your filing status is married filing separately unless you qualify for an exception (see instructions). Web advance payment of the premium assistance subsidy, get form ftb 3849 for instructions. Web giving evidence of health care coverage, federal form 8962, does not remove the requirement to file california form 3849. Reconciling your state subsidy/state premium assistance subsidy on form ftb 3849 1.

You would also use form 8849 if your vehicle was stolen, destroyed or for any vehicle on which the tax was paid on form 2290 if the vehicle was used 5,000 miles or less on public highways. # form ftb 3849, premium assistance subsidy # form ftb 3853, health coverage exemptions and individual shared responsibility penalty # form ftb 3895, california health insurance marketplace statement # publication 3849a, premium assistance subsidy (pas) Use schedule 6 for other claims, including refunds of excise taxes reported on: Hand off your taxes, get expert help, or do it yourself. Web you must file form ftb 3849 to reconcile any pas advanced to you with the actual pas amount allowed based on your actual household income for the applicable taxable year, less federal premium tax credit (ptc) amounts. This information includes the name, ssn, date of birth, and the starting and ending dates of coverage for each covered What’s new changes are discussed under what’s new in the instructions for each schedule. Use schedules 1 through 5 to claim refunds for nontaxable uses (or sales) of fuels. Reports information about each individual who is covered under your policy. Web taxpayers can use the ftb 3849 form to determine how much california premium assistance subsidy they will need to pay back with their tax return.

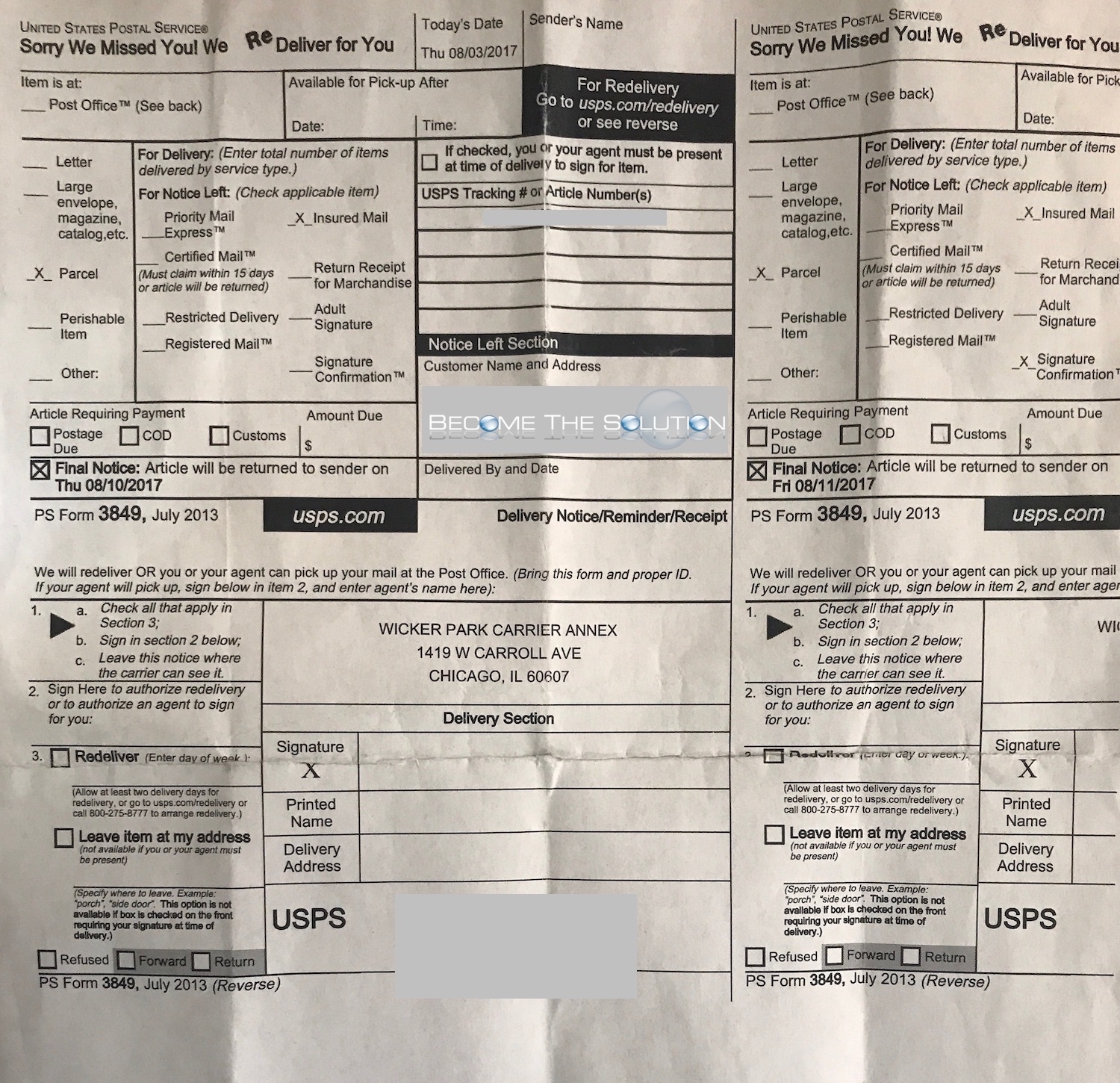

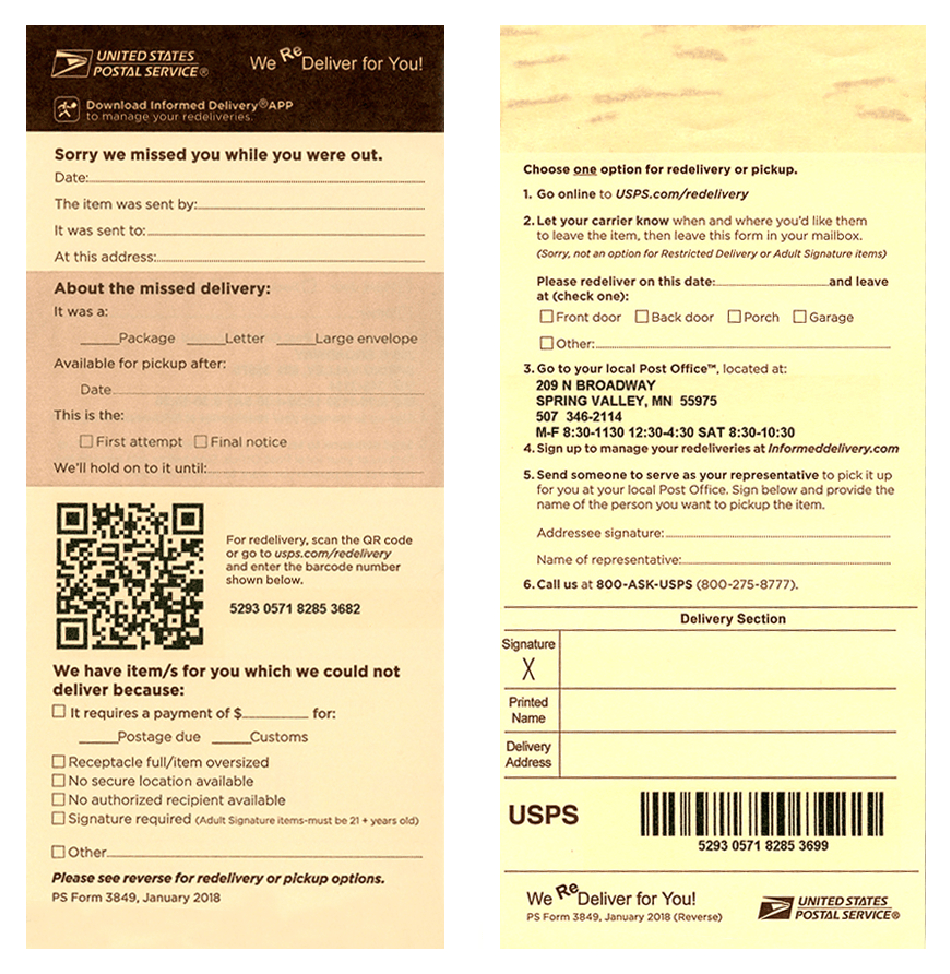

USPS Form 3849 Notice Left Section in Mailbox But Package Not at

Reminders • you can electronically file form 8849 through any electronic return originator (ero), transmitter,. Web why are forms 3849 and 3853 not available to complete my california state return? You would also use form 8849 if your vehicle was stolen, destroyed or for any vehicle on which the tax was paid on form 2290 if the vehicle was used.

Ps Form 3849 Printable Printable Form 2022

Get form ftb 3895 by mail or online from covered california. You would also use form 8849 if your vehicle was stolen, destroyed or for any vehicle on which the tax was paid on form 2290 if the vehicle was used 5,000 miles or less on public highways. For consumers who received thousands of dollars in cpas, it may be.

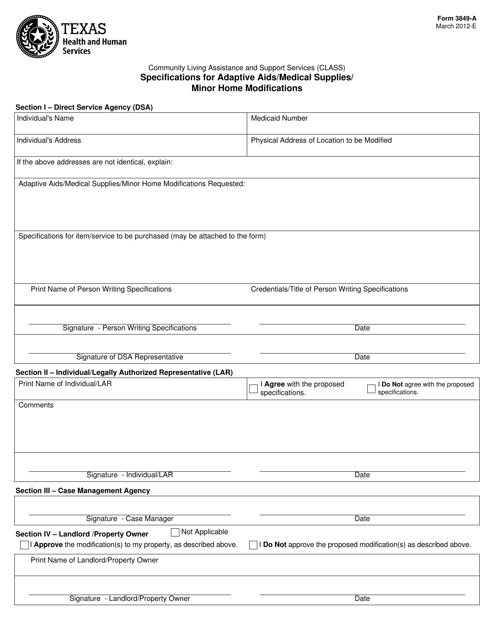

Form 3849A Download Fillable PDF or Fill Online Specifications for

Web form 3849 is not required after tax year 2021. You would also use form 8849 if your vehicle was stolen, destroyed or for any vehicle on which the tax was paid on form 2290 if the vehicle was used 5,000 miles or less on public highways. Form 8849 lists the schedules by number and title. Web 2020 premium assistance.

What is bad design? Ryan Greenberg

• your applicable household size equals the number of individuals in your apas was paid for you or another individual in your applicable household. General instructions use form 8849 to claim refunds of excise taxes you reported on form 720, 730, or 2290, including the repealed luxury taxes. You would also use form 8849 if your vehicle was stolen, destroyed.

Out with the blue USPS News Link

Covered california will issue a ftb 3895 form to california subsidy recipients. This information includes the name, ssn, date of birth, and the starting and ending dates of coverage for each covered Web advance payment of the premium assistance subsidy, get form ftb 3849 for instructions. Procedure when to prepare the direct service agency (dsa) must complete this form prior.

Package perks USPS News Link

Advance payment of the premium assistance subsidy (apas). State april 11, 2021, 10:00 pm california ftb releases individual income tax form 3849, premium assistance subsidy the california franchise tax board april 1 released form 3849, premium assistance subsidy,. Covered california will issue a ftb 3895 form to california subsidy recipients. Web take as a credit on schedule c (form 720).

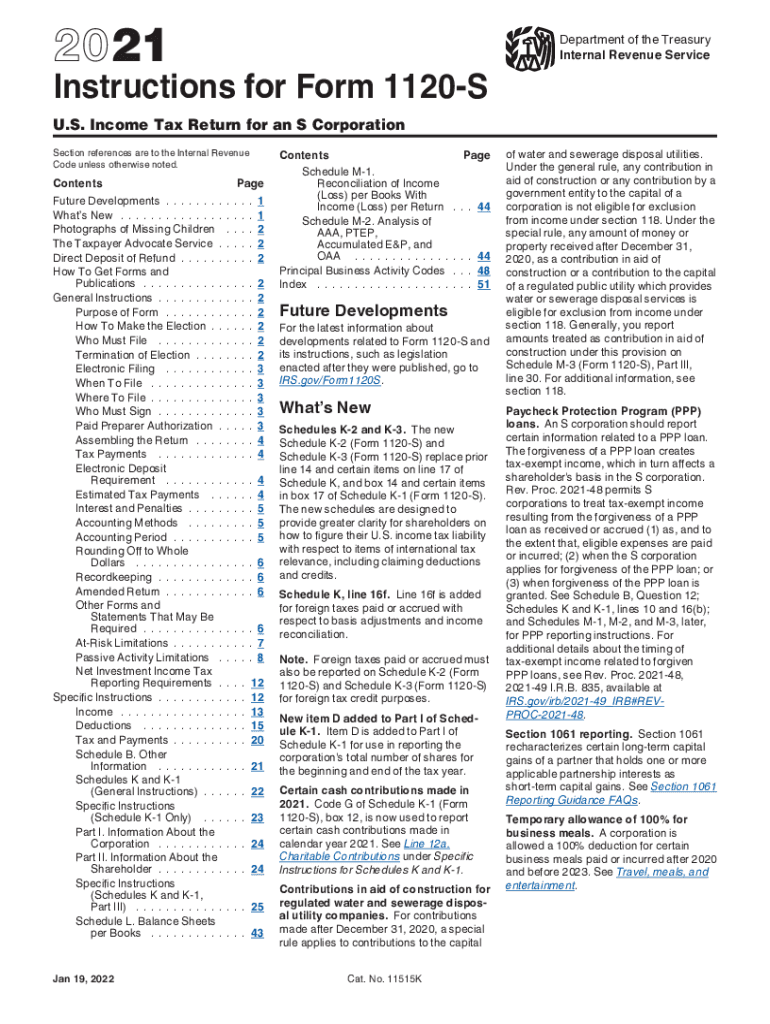

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Beginning with tax year 2020, the state of california requires residents and their dependents to obtain qualifying health care coverage, also referred to as minimum essential coverage (mec). Sign in to your coveredca.com account and click on “view [tax year] california tax form. State april 11, 2021, 10:00 pm california ftb releases individual income tax form 3849, premium assistance subsidy.

How Is The California Premium Assistance Subsidy Calculated With FTB

Web purpose to document the specifications for the procurement process. Web follow these steps to reconcile your state subsidy if you need to amend your 2020 or 2021 state tax return. Web you must file form ftb 3849 with your income tax return (form 540 or form 540nr) if any of the following apply to you: • you are taking.

2008 Form USPS PS 3849 Fill Online, Printable, Fillable, Blank PDFfiller

Name(s) as shown on your california tax return california form 3849 ssn or i t i n you are not eligible to take the premium assistance subsidy (pas) if your filing status is married filing separately unless you qualify for an exception (see instructions). What’s new changes are discussed under what’s new in the instructions for each schedule. Web follow.

USPS News Link

Web 2021premium assistance subsidy attach to your california form 540 or form 540nr. If you sell a vehicle after you have filed your form 2290 return, you would need to file form 8849, schedule 6 in order to claim your credit. Form 8849 lists the schedules by number and title. Use schedule 6 for other claims, including refunds of excise.

What Forms Do I Need To Complete The 3849?

Turbotax live assisted business taxes itsdeductible donation tracker turbotax vs taxact reviews © 2021 intuit, inc. Name(s) as shown on tax return california form 3849 ssn or i t i n you are not eligible to take the premium assistance subsidy (pas) if your filing status is married filing separately unless you qualify for an exception (see instructions). Procedure when to prepare the direct service agency (dsa) must complete this form prior to procuring bids for adaptive aids or medical supplies costing $500 or more or minor home modifications regardless of the estimated cost. Web daily tax report:

Also Use Form 8849 To Claim Refunds Of Excise Taxes Imposed On Fuels, Chemicals, And Other Articles That

Web 2021premium assistance subsidy attach to your california form 540 or form 540nr. Instead, see where to file below. Web form 3849 is not required after tax year 2021. Web purpose to document the specifications for the procurement process.

Web Households Who Received $111.08 In California Premium Assistance Subsidy Must Be Repaid As Reconciled On Form Ftb 3849.

Your income level was below 100% of the federal poverty level; Web take as a credit on schedule c (form 720) or form 4136. What’s new changes are discussed under what’s new in the instructions for each schedule. Form 8849 lists the schedules by number and title.

For Consumers Who Received Thousands Of Dollars In Cpas, It May Be Subject To A Repayment Limitation.

Ask questions and learn more about your taxes and finances. Web 2020 premium assistance subsidy attach to your california form 540 or form 540nr. That version allowed carriers to check parcel locker eligible if a customer is eligible to have their items redelivered to. Reminders • you can electronically file form 8849 through any electronic return originator (ero), transmitter,.