Form 3520 Example

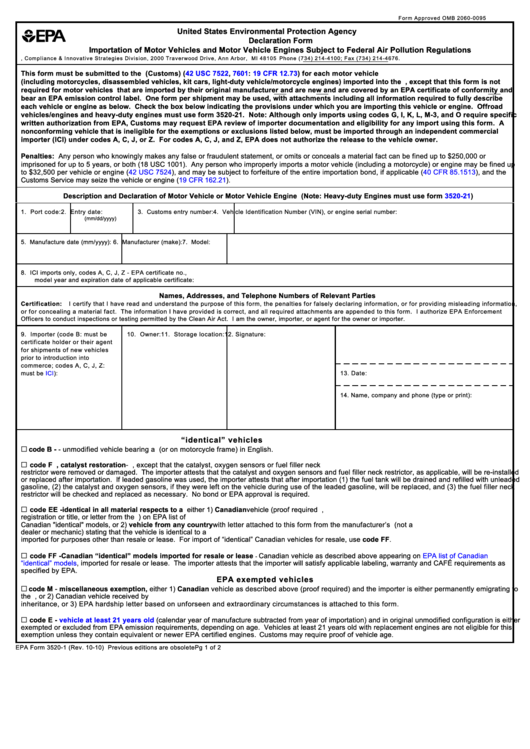

Form 3520 Example - If you transfer any assets (money and property, for example) to a foreign trust. If you filed form 3520 concerning transactions with a foreign trust and that trust terminated within the tax year, then the form 3520 for the year in which the trust terminated would be a final return. File a separate form 3520 for each foreign trust. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Web form 3520 for u.s. Transferor does not immediately recognize all of the gain on the property transferred, transfers involving a. Receipt of certain large gifts or bequests from certain foreign persons. His grandfather (not a us citizen or resident) lives in spain and wants to give alex $15,000. Decedents) file form 3520 to report: Certain transactions with foreign trusts.

Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. David is from taiwan and now resides in the u.s. If you transfer any assets (money and property, for example) to a foreign trust. Form 3520 is due the fourth month following the end of the person's tax year, typically april 15. His grandfather (not a us citizen or resident) lives in spain and wants to give alex $15,000. He timely filed form 4868 to request an extension to file his income tax return to october 15. There are three main types of transactions with a foreign trust you need to report on: Initial return final returnamended return b check box that applies to person filing return: Alex, a us citizen, lives in kansas with his parents. About our international tax law firm form 3520 the irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section 6039f is a deceptive international information reporting form.

Persons (and executors of estates of u.s. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: There are three main types of transactions with a foreign trust you need to report on: Taxpayer transactions with a foreign trust. Initial return final returnamended return b check box that applies to person filing return: Receipt of certain large gifts or bequests from certain foreign persons. He timely filed form 4868 to request an extension to file his income tax return to october 15. You receive direct or indirect distributions from a foreign trust. His grandfather (not a us citizen or resident) lives in spain and wants to give alex $15,000. About our international tax law firm form 3520 the irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section 6039f is a deceptive international information reporting form.

Understanding Form 3520 for Foreign Trusts and Gifts & Penalties YouTube

He timely filed form 4868 to request an extension to file his income tax return to october 15. If you transfer any assets (money and property, for example) to a foreign trust. There are three main types of transactions with a foreign trust you need to report on: Web form 3520 for u.s. Certain transactions with foreign trusts.

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Show all amounts in u.s. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. You receive direct or indirect distributions from a foreign trust. File a separate form 3520 for each foreign trust. Alex, a us citizen, lives in kansas with his parents.

Form 3520 Blank Sample to Fill out Online in PDF

Transferor does not immediately recognize all of the gain on the property transferred, transfers involving a. Initial return final returnamended return b check box that applies to person filing return: Assume that john has an income tax filing requirement and a form 3520 filing requirement. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Citizen residing outside the united states. Foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation. Web form 3520 for u.s. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. David is from taiwan and now resides in.

24 United States Environmental Protection Agency Forms And Templates

You receive direct or indirect distributions from a foreign trust. Web form 3520 example #1. He timely filed form 4868 to request an extension to file his income tax return to october 15. If you transfer any assets (money and property, for example) to a foreign trust. His grandfather (not a us citizen or resident) lives in spain and wants.

3.21.19 Foreign Trust System Internal Revenue Service

For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Persons (and executors of estates of u.s. If you transfer any assets (money and property, for example) to a foreign trust. Taxpayer transactions with a foreign trust. File a separate form 3520 for each foreign trust.

3.21.19 Foreign Trust System Internal Revenue Service

Taxpayer transactions with a foreign trust. Assume that john has an income tax filing requirement and a form 3520 filing requirement. Show all amounts in u.s. Decedents) file form 3520 to report: Alex, a us citizen, lives in kansas with his parents.

IRS Form 3520Reporting Transactions With Foreign Trusts

Web form 3520 for u.s. If you filed form 3520 concerning transactions with a foreign trust and that trust terminated within the tax year, then the form 3520 for the year in which the trust terminated would be a final return. Persons (and executors of estates of u.s. Assume that john has an income tax filing requirement and a form.

2010 Form IRS 3520 Fill Online, Printable, Fillable, Blank pdfFiller

There are three main types of transactions with a foreign trust you need to report on: His grandfather has a foreign grantor trust, and the trustee accordingly sends alex $15,000 from the trust. Initial return final returnamended return b check box that applies to person filing return: Current revision form 3520 pdf Assume that john has an income tax filing.

Steuererklärung dienstreisen Form 3520

His grandfather has a foreign grantor trust, and the trustee accordingly sends alex $15,000 from the trust. Certain transactions with foreign trusts. Assume that john has an income tax filing requirement and a form 3520 filing requirement. Initial return final returnamended return b check box that applies to person filing return: For calendar year 2022, or tax year beginning ,.

Web However, Some Fmv Transfers Must Nevertheless Be Reported On Form 3520 (For Example, Transfers In Exchange For Obligations That Are Treated As Qualified Obligations, Transfers Of Appreciated Property To A Foreign Trust For Which The U.s.

You receive direct or indirect distributions from a foreign trust. Taxpayer transactions with a foreign trust. Certain transactions with foreign trusts. Foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation.

Form 3520 Is Due The Fourth Month Following The End Of The Person's Tax Year, Typically April 15.

Receipt of certain large gifts or bequests from certain foreign persons. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: About our international tax law firm form 3520 the irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section 6039f is a deceptive international information reporting form.

Ownership Of Foreign Trusts Under The Rules Of Sections Internal Revenue Code 671 Through 679.

Transferor does not immediately recognize all of the gain on the property transferred, transfers involving a. Alex, a us citizen, lives in kansas with his parents. Web form 3520 example #1. His grandfather has a foreign grantor trust, and the trustee accordingly sends alex $15,000 from the trust.

For Calendar Year 2022, Or Tax Year Beginning , 2022, Ending , 20 A Check Appropriate Boxes:

Show all amounts in u.s. Web 8 golding & golding: David is from taiwan and now resides in the u.s. There are three main types of transactions with a foreign trust you need to report on: