Form 2848 Example

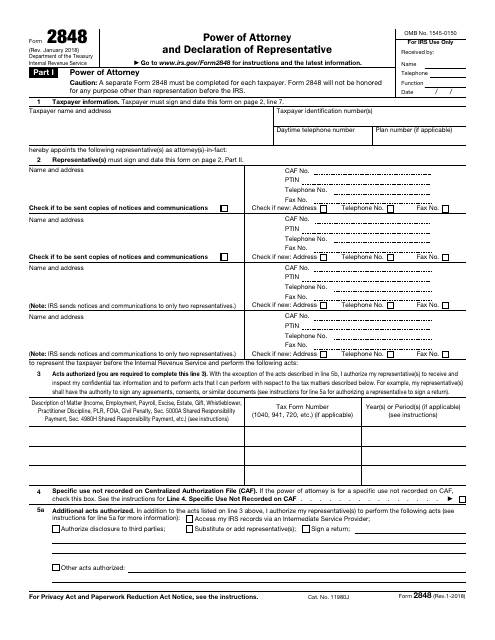

Form 2848 Example - Form 2848 will not be honored for any purpose other than representation. Web the instructions include examples of various specific uses that may be authorized here. Web part i power of attorney caution: Get ready for tax season deadlines by completing any required tax forms today. Web form 2848 will not be honored for any purpose other than representation before the irs. This form will be used in various situations related to tax filing or tax audits. Ad access irs tax forms. Web 2848 form 📝 irs form 2848 printable: Download or email irs 2848 & more fillable forms, register and subscribe now! Web a form 2848 is also known as a power of attorney and declaration of representative form.

Web irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Web 2848 form 📝 irs form 2848 printable: Power of attorney and declaration of representative. Complete, edit or print tax forms instantly. This form will be used in various situations related to tax filing or tax audits. A separate form 2848 should be completed for each taxpayer. Web what is a form 2848? Web a form 2848 is also known as a power of attorney and declaration of representative form. Get ready for tax season deadlines by completing any required tax forms today. Web the instructions include examples of various specific uses that may be authorized here.

You may, for example, hire a tax attorney to represent you in an audit. Get ready for tax season deadlines by completing any required tax forms today. Form 2848 allows taxpayers to name someone to represent them before the irs. Web there are several more examples of specific use and they're listed in the instructions for form 2848. Power of attorney and declaration of representative. Web a form 2848 is also known as a power of attorney and declaration of representative form. Power of attorney and declaration of representative instructions on form 2848, enter the following information: A separate form 2848 should be completed for each taxpayer. When you do a 2848 for a specific use, the deal is that it's not recorded on. Web part i power of attorney caution:

ICANN Application for TaxExempt Status (U.S.) Form 2848 Page 2

A separate form 2848 should be completed for each taxpayer. Get ready for tax season deadlines by completing any required tax forms today. When you do a 2848 for a specific use, the deal is that it's not recorded on. Web form 2848 will not be honored for any purpose other than representation before the irs. Web the agency can.

What is the Form 2848? Why Do I Need a Form 2848?

Web sample irs power of attorney form 2848 sample irs power of attorney form 2848. If your parent is no longer competent and you are your parent’s. Get ready for tax season deadlines by completing any required tax forms today. If the box on line 4 is checked, the representative should mail or fax the. Web irs power of attorney.

Famous People « TaxExpatriation

If the box on line 4 is checked, the representative should mail or fax the. Web additionally, the website offers a form 2848 example completed, a practical illustration for taxpayers to better grasp the process of correctly filling out the blank template. Form 2848 will not be honored for any purpose other than representation. Power of attorney and declaration of.

2848 Pdf Fill Out and Sign Printable PDF Template signNow

Download or email irs 2848 & more fillable forms, register and subscribe now! Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Web form 2848 will not be honored for any purpose other than representation before the irs. Complete, edit or print tax forms instantly. Taxpayer.

IRS Form 2848 Download Fillable PDF or Fill Online Power of Attorney

Web 2848 form 📝 irs form 2848 printable: If the box on line 4 is checked, the representative should mail or fax the. Download or email irs 2848 & more fillable forms, register and subscribe now! When you do a 2848 for a specific use, the deal is that it's not recorded on. Form 2848 will not be honored for.

Breanna Form 2848 Irs Instructions

Power of attorney and declaration of representative. Web form 2848 will not be honored for any purpose other than representation before the irs. This form will be used in various situations related to tax filing or tax audits. Get ready for tax season deadlines by completing any required tax forms today. Web a form 2848 is also known as a.

Form 2848 Example

Complete, edit or print tax forms instantly. Instructions, pdf example, online sample irs form 2848 printable get now power of attorney and declaration of representative. Web what is a form 2848? Power of attorney and declaration of representative. If the box on line 4 is checked, the representative should mail or fax the.

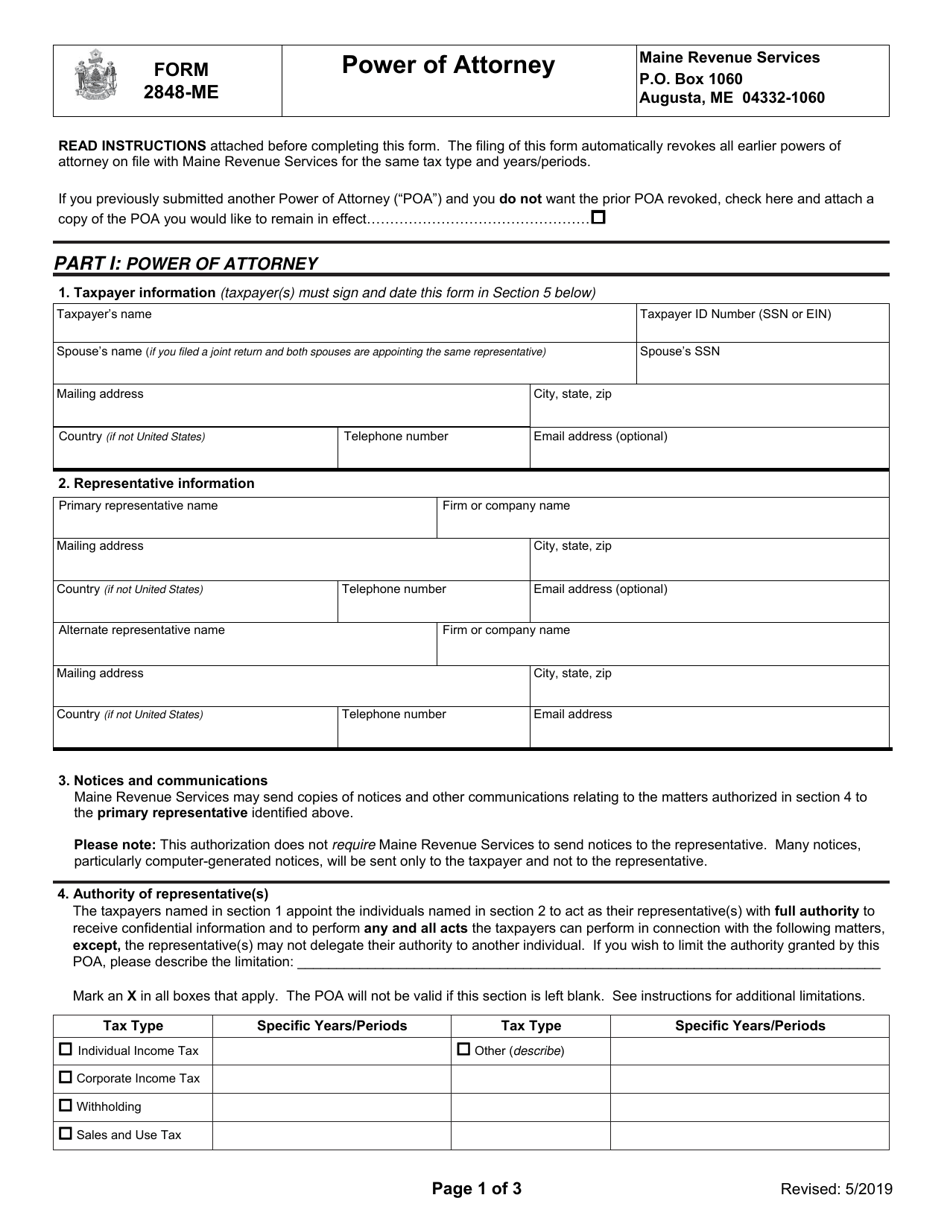

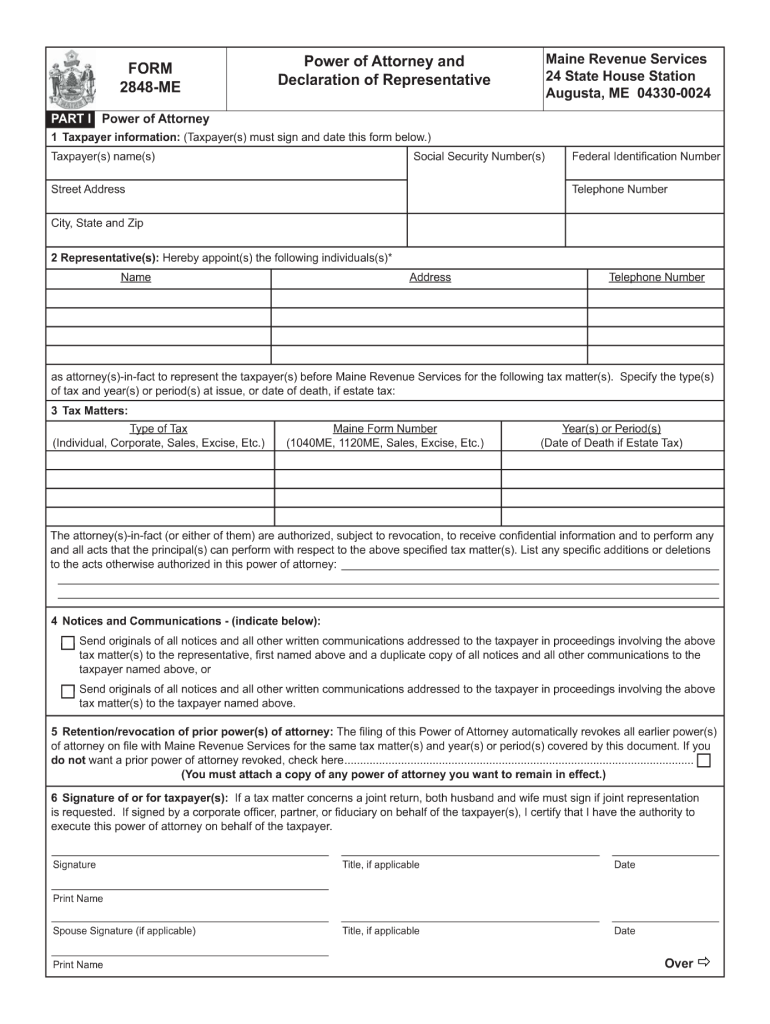

Form 2848ME Download Fillable PDF or Fill Online Power of Attorney

Form 2848 will not be honored for any purpose other than representation. Ad access irs tax forms. Web form 2848 will not be honored for any purpose other than representation before the irs. Taxpayer must sign and date this form on page 2, line 7. You may authorize a student who works in a qualified low income taxpayer clinic.

Power Of Attorney Pdf Irs

Web part i power of attorney caution: If the box on line 4 is checked, the representative should mail or fax the. Web irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Form 2848 will not be honored for any purpose other than.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Download or email irs 2848 & more fillable forms, register and subscribe now! You may, for example, hire a tax attorney to represent you in an audit. A separate form 2848 should be completed for each taxpayer. Complete, edit or print tax forms instantly. If the box on line 4 is checked, the representative should mail or fax the.

Complete, Edit Or Print Tax Forms Instantly.

You may, for example, hire a tax attorney to represent you in an audit. When you do a 2848 for a specific use, the deal is that it's not recorded on. Web 2848 form 📝 irs form 2848 printable: Power of attorney and declaration of representative instructions on form 2848, enter the following information:

Web Form 2848 Will Not Be Honored For Any Purpose Other Than Representation Before The Irs.

Web part i power of attorney caution: This form will be used in various situations related to tax filing or tax audits. Web there are several more examples of specific use and they're listed in the instructions for form 2848. Taxpayer must sign and date this form on page 2, line 7.

Web Information About Form 2848, Power Of Attorney And Declaration Of Representative, Including Recent Updates, Related Forms, And Instructions On How To File.

Get ready for tax season deadlines by completing any required tax forms today. You may authorize a student who works in a qualified low income taxpayer clinic. Web the agency can only share it with a third party if you authorize it to do so. Web what is a form 2848?

Instructions, Pdf Example, Online Sample Irs Form 2848 Printable Get Now Power Of Attorney And Declaration Of Representative.

Download or email irs 2848 & more fillable forms, register and subscribe now! Form 2848 allows taxpayers to name someone to represent them before the irs. If your parent is no longer competent and you are your parent’s. Complete, edit or print tax forms instantly.

/4868-ApplicationofExtensionofTime-1-088a69a2d6454cb5837a3a801d330a8d.png)