Form 2848 Electronic Signature

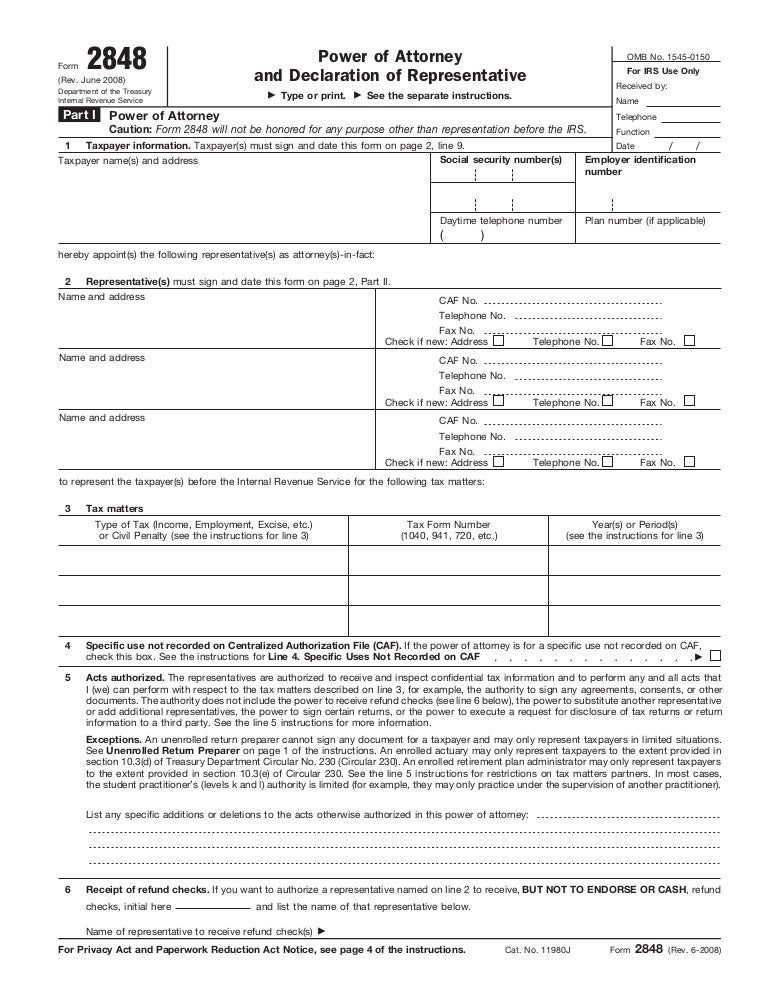

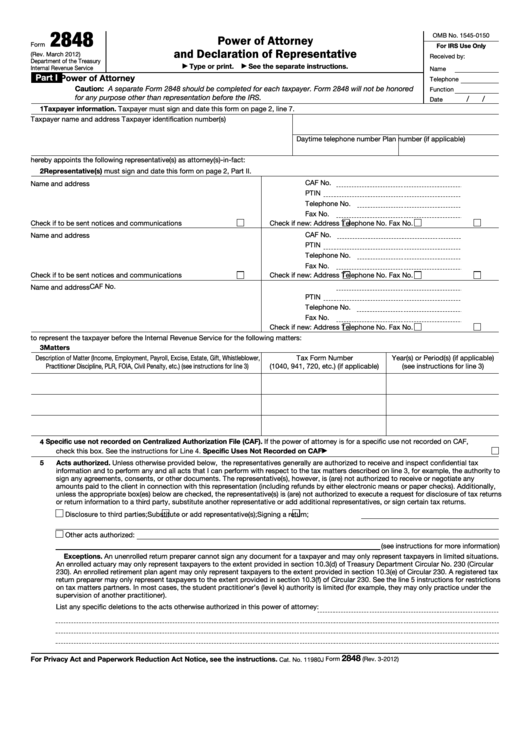

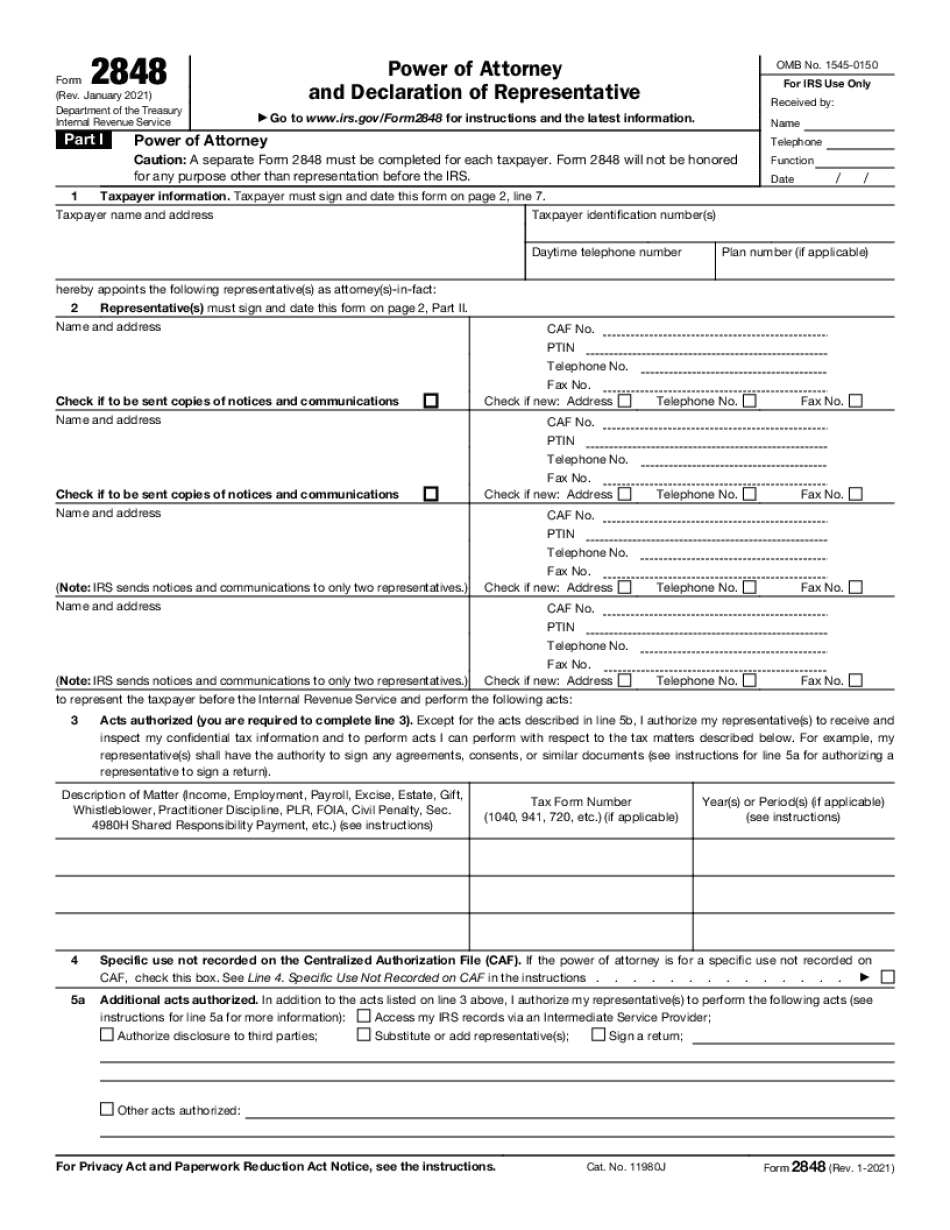

Form 2848 Electronic Signature - January 2021) department of the treasury internal revenue service. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. Web if you use an electronic signature (see electronic signatures below), you must submit your form 2848 online. If you complete form 2848 for electronic signature authorization, do not file form 2848 with the irs. For instructions and the latest information. Below is information to help you, as a tax professional, learn the basics about this new tool. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. Date / / part i power of attorney.

Date / / part i power of attorney. The form 2848 is submitted online to www.irs.gov/submit2848. For more information on secure access, go to irs.gov/secureaccess. Tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Web as long as you can create a secure access account and follow authentication procedures, you may submit a form 2848 or 8821 with an image of an electronic signature. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. Power of attorney and declaration of representative.

Web however, a representative of the irs has confirmed that that if the taxpayer signs the form 2848 poa and scans and emails tax counsel the scanned signature, that will constitute a “wet ink” signature. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. January 2021) department of the treasury internal revenue service. Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. Submit your form 2848 securely at irs.gov/submit2848. You will need to have a secure access account to submit your form 2848 online. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Below is information to help you, as a tax professional, learn the basics about this new tool. Web if you use an electronic signature (see electronic signatures below), you must submit your form 2848 online.

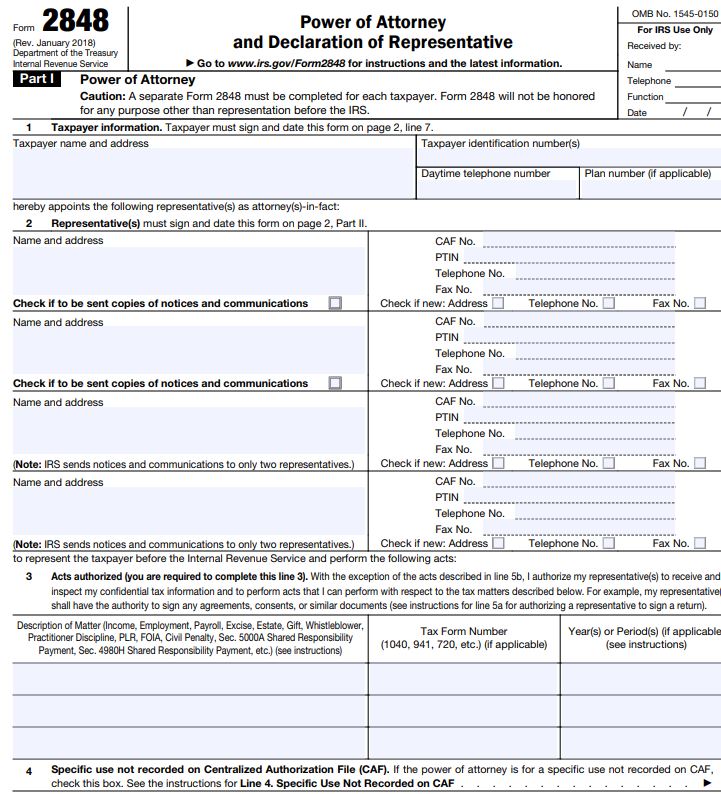

2018 Form IRS 2848 Fill Online, Printable, Fillable, Blank pdfFiller

Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Power of attorney and declaration of representative. Web if you.

Breanna Form 2848 Fax Number Irs

Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. The form 2848 is submitted online to www.irs.gov/submit2848. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. Power of attorney and declaration of representative. Instead, use.

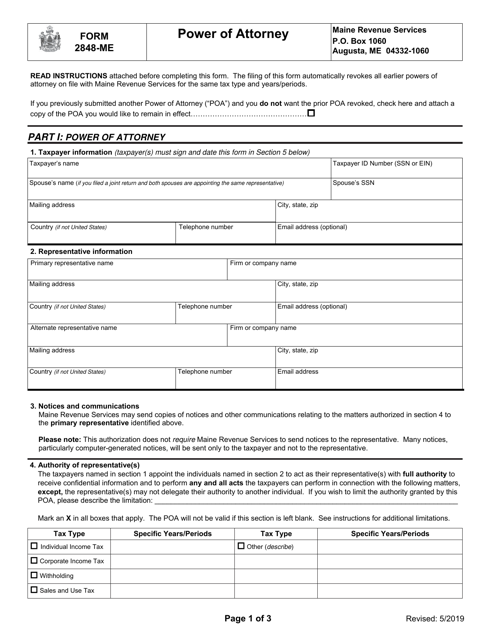

Form 2848ME Download Fillable PDF or Fill Online Power of Attorney

These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. For more information on secure access, go to irs.gov/secureaccess. Web effective january, 2021, form 2848, power of attorney and declaration of representative may be executed electronically, provided: Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form.

Breanna Form 2848 Power Of Attorney And Declaration Of Representative

Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Web the taxpayer first act (tfa) of 2019 requires the.

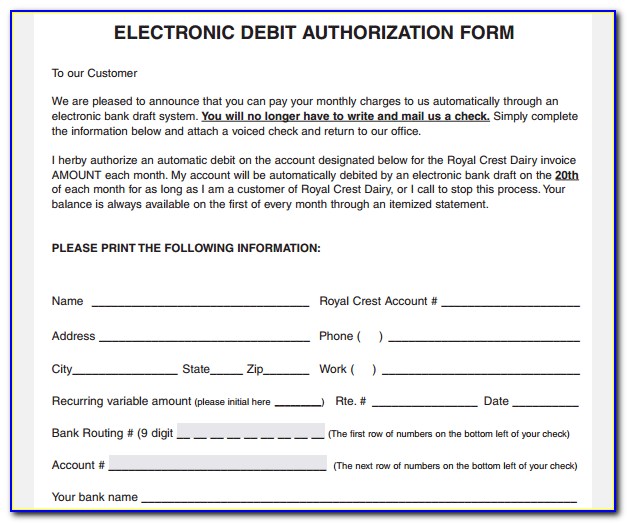

Electronic Signature Consent Form Form Resume Examples a15qwxakeQ

Power of attorney and declaration of representative. Tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. Submit your form 2848 securely at irs.gov/submit2848. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. If you complete form 2848 for electronic signature authorization, do not file form 2848.

Top 12 Form 2848 Templates free to download in PDF format

The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. The form 2848 is submitted online to www.irs.gov/submit2848. For more information on secure access, go to irs.gov/secureaccess. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form.

The Fastest Way To Convert PDF To Fillable IRS Form 2848

Submit your form 2848 securely at irs.gov/submit2848. Web as long as you can create a secure access account and follow authentication procedures, you may submit a form 2848 or 8821 with an image of an electronic signature. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and.

Form 2848 Edit, Fill, Sign Online Handypdf

Below is information to help you, as a tax professional, learn the basics about this new tool. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. January 2021) department of the treasury internal revenue service. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848,.

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

Web as long as you can create a secure access account and follow authentication procedures, you may submit a form 2848 or 8821 with an image of an electronic signature. Submit your form 2848 securely at irs.gov/submit2848. Web however, a representative of the irs has confirmed that that if the taxpayer signs the form 2848 poa and scans and emails.

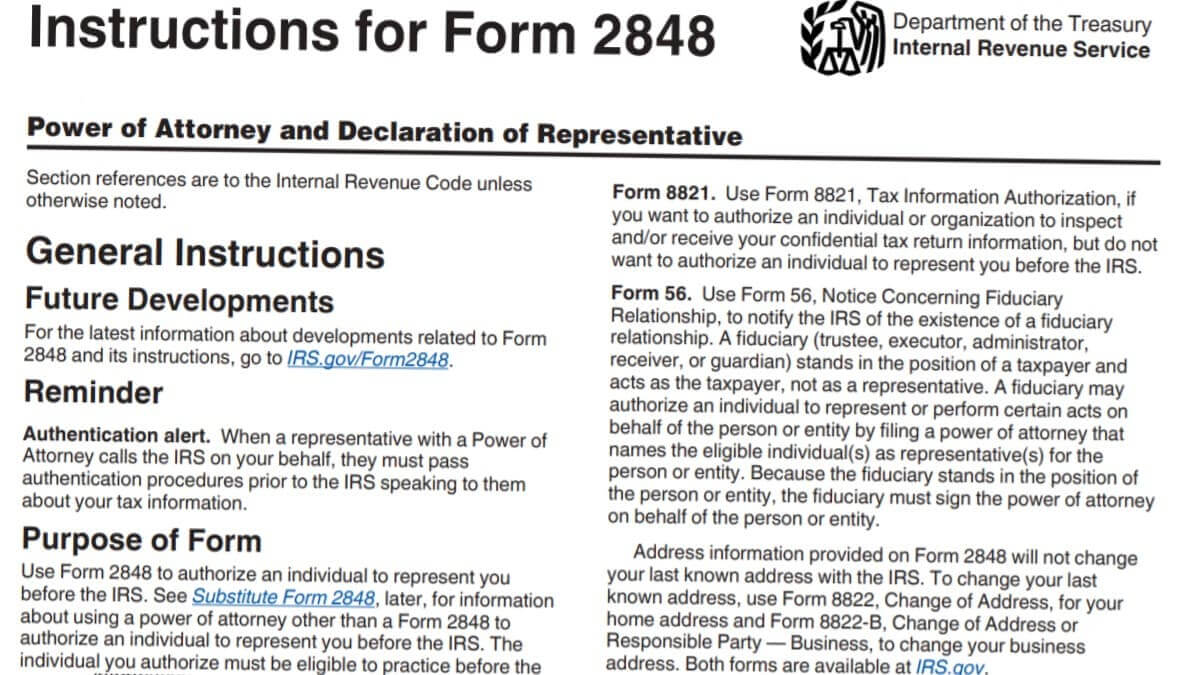

Form 2848 Instructions

Power of attorney and declaration of representative. Date / / part i power of attorney. Web if you use an electronic signature (see electronic signatures below), you must submit your form 2848 online. If you complete form 2848 for electronic signature authorization, do not file form 2848 with the irs. These improvements will help individual taxpayers, business taxpayers, and the.

The Form 2848 Is Submitted Online To Www.irs.gov/Submit2848.

Submit your form 2848 securely at irs.gov/submit2848. Web however, a representative of the irs has confirmed that that if the taxpayer signs the form 2848 poa and scans and emails tax counsel the scanned signature, that will constitute a “wet ink” signature. Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document. Web if you use an electronic signature (see electronic signatures below), you must submit your form 2848 online.

The Third Party Submitting The Form 2848 On Behalf Of The Taxpayer Attests That S/He Authenticated The Taxpayer’s Identity.

Date / / part i power of attorney. You will need to have a secure access account to submit your form 2848 online. January 2021) department of the treasury internal revenue service. For instructions and the latest information.

Web As Long As You Can Create A Secure Access Account And Follow Authentication Procedures, You May Submit A Form 2848 Or 8821 With An Image Of An Electronic Signature.

If you complete form 2848 for electronic signature authorization, do not file form 2848 with the irs. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. For more information on secure access, go to irs.gov/secureaccess. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization.

Web Effective January, 2021, Form 2848, Power Of Attorney And Declaration Of Representative May Be Executed Electronically, Provided:

These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. Tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Below is information to help you, as a tax professional, learn the basics about this new tool.