Form 2555 Online

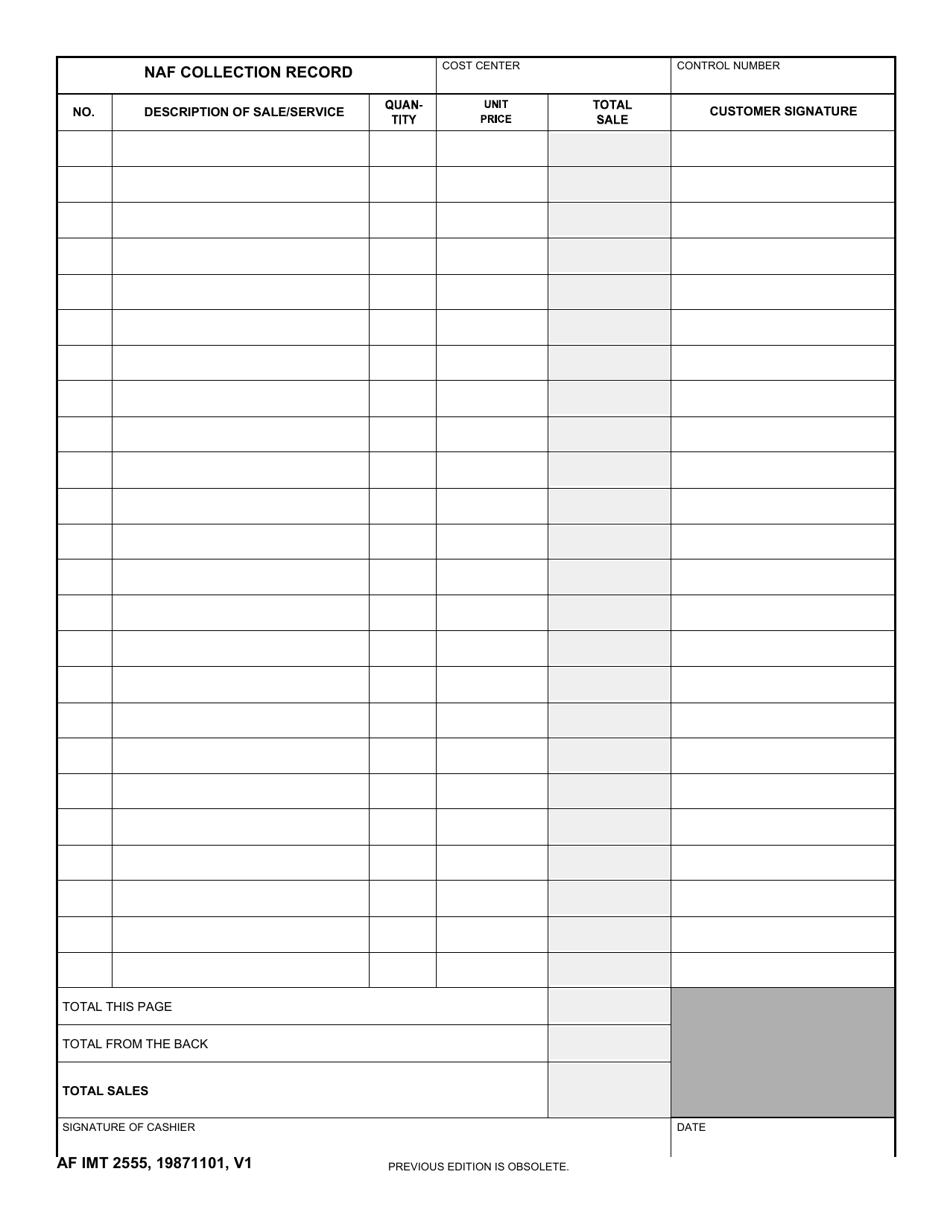

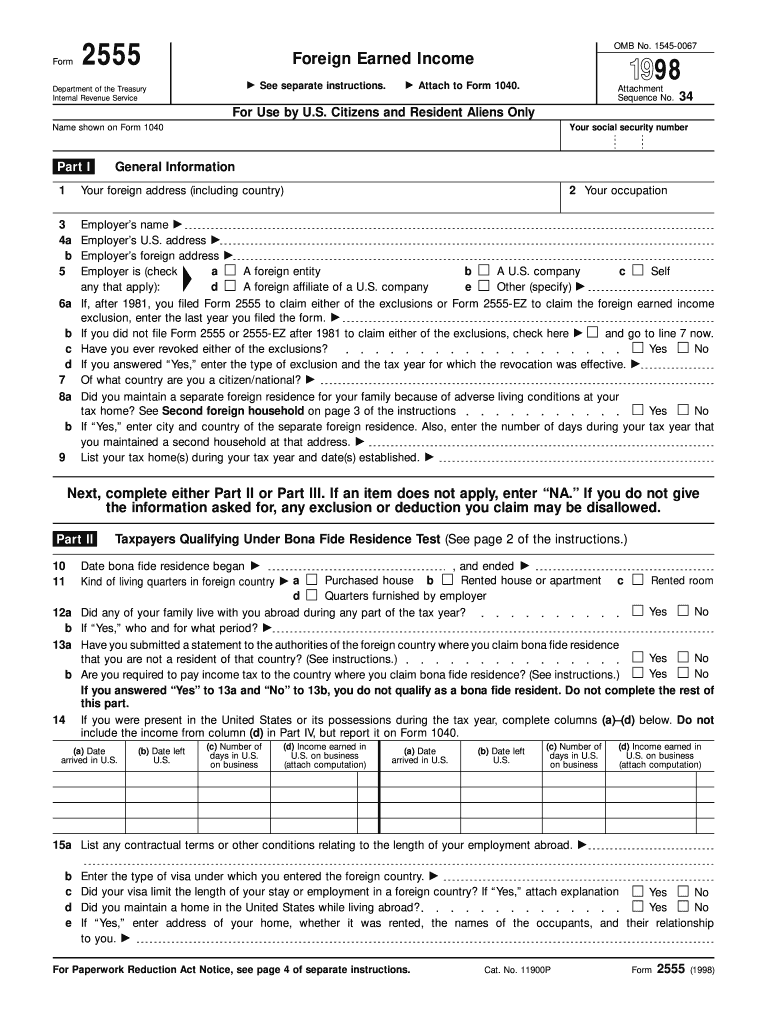

Form 2555 Online - Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Get ready for tax season deadlines by completing any required tax forms today. Resident alien living and working in a foreign country. Company e other (specify) 6 a if you previously filed form 2555 or. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: Web download or print the 2022 federal form 2555 (foreign earned income) for free from the federal internal revenue service. Fill all required lines in your document making use of our powerful pdf. Web 235 rows purpose of form. D a foreign affiliate of a u.s. If eligible, you can also use form 2555 to request the foreign housing exclusion or.

Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. Web 235 rows purpose of form. Get ready for tax season deadlines by completing any required tax forms today. You cannot exclude or deduct more than the. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: Web 5 employer is (check a a foreign entity b a u.s. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Complete, edit or print tax forms instantly. If eligible, you can also use form 2555 to request the foreign housing exclusion or. Fill all required lines in your document making use of our powerful pdf.

Web 235 rows purpose of form. Web submit your completed form 2555 to the irs: Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. If you qualify, you can use form 2555 to figure your foreign. Click on the button get form to open it and start editing. Web download or print the 2022 federal form 2555 (foreign earned income) for free from the federal internal revenue service. Company c self any that apply): Fill all required lines in your document making use of our powerful pdf. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

Breanna Tax Form 2555 Ez 2019

Fill all required lines in your document making use of our powerful pdf. Web edit, sign, and share form 2555 online. Who should use the foreign earned income exclusion? Web the foreign earned income exclusion (feie) is an irs tax benefit program that allows american expats to exclude their foreign earned income from their us tax. Web 5 employer is.

2017 Form 2555 Edit, Fill, Sign Online Handypdf

You cannot exclude or deduct more than the. Company e other (specify) 6 a if you previously filed form 2555 or. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web submit your completed form 2555 to the irs: Web 5 employer is (check a a foreign.

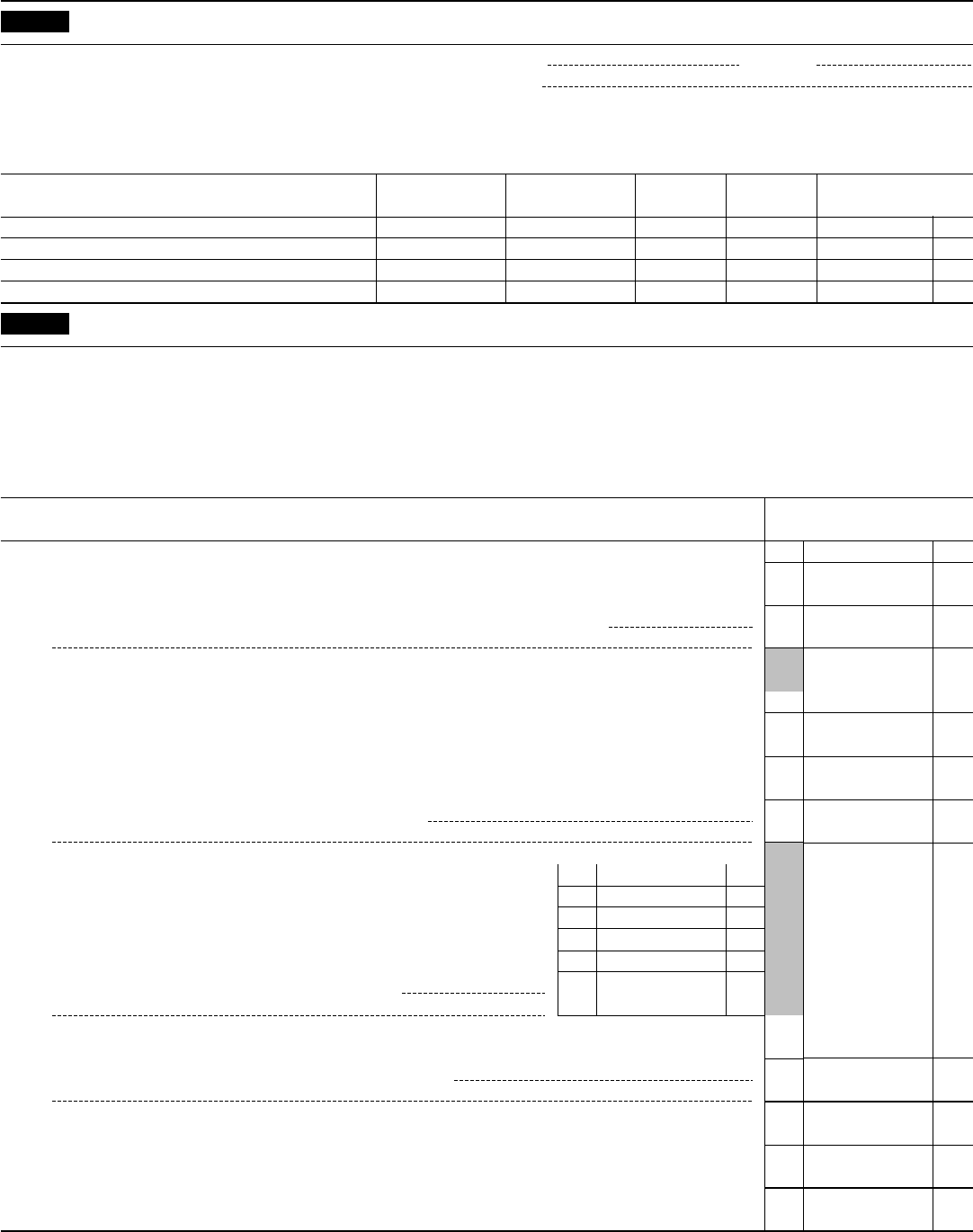

AF IMT Form 2555 Download Fillable PDF or Fill Online NAF Collection

If you qualify, you can use form 2555 to figure your foreign. Ad complete irs tax forms online or print government tax documents. Company c self any that apply): Company e other (specify) 6 a if you previously filed form 2555 or. No need to install software, just go to dochub, and sign up instantly and for free.

physical presence test form 2555 Fill Online, Printable, Fillable

Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. Complete, edit or print tax forms instantly. Web 5 employer is (check a a foreign entity b a u.s. Web irs form 2555 is used to claim the.

Instructions for form 2555 2013

Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. Web the foreign earned income exclusion (feie) is an irs tax benefit program that allows american expats to exclude their foreign earned income from their us tax. Fill all required lines in your document making use of our powerful pdf. Web tax form 2555.

Form 2555 2023 Fill online, Printable, Fillable Blank

If eligible, you can also use form 2555 to request the foreign housing exclusion or. Web edit, sign, and share form 2555 online. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: Go to www.irs.gov/form2555 for instructions and the latest. The feie is ideal for people working.

1998 2014 form 2555 Fill out & sign online DocHub

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Resident alien living and working in a foreign country. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: Web tax form 2555 is used to claim this exclusion and the.

Ssurvivor Form 2555 Instructions 2016

Resident alien living and working in a foreign country. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Who should use the foreign earned income exclusion? If you qualify, you can use form 2555 to figure your foreign. Ad complete irs tax forms online or print government tax documents.

Ssurvivor Form 2555 Instructions

Ad complete irs tax forms online or print government tax documents. Go to www.irs.gov/form2555 for instructions and the latest. Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Fill all required lines in your.

Form 2555 Instructions and Tips for US Expat Tax Payers YouTube

The feie is ideal for people working. Complete, edit or print tax forms instantly. Web the foreign earned income exclusion (feie) is an irs tax benefit program that allows american expats to exclude their foreign earned income from their us tax. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing.

Web Irs Form 2555 Is Used To Claim The Foreign Earned Income Exclusion (Feie).

Fill all required lines in your document making use of our powerful pdf. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. Company c self any that apply): Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude.

Company E Other (Specify) 6 A If You Previously Filed Form 2555 Or.

Click on the button get form to open it and start editing. Web download or print the 2022 federal form 2555 (foreign earned income) for free from the federal internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents.

You Cannot Exclude Or Deduct More Than The.

Web submit your completed form 2555 to the irs: If eligible, you can also use form 2555 to request the foreign housing exclusion or. Web edit, sign, and share form 2555 online. Web 5 employer is (check a a foreign entity b a u.s.

No Need To Install Software, Just Go To Dochub, And Sign Up Instantly And For Free.

After sign into your account, select take me to my return. Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: D a foreign affiliate of a u.s.