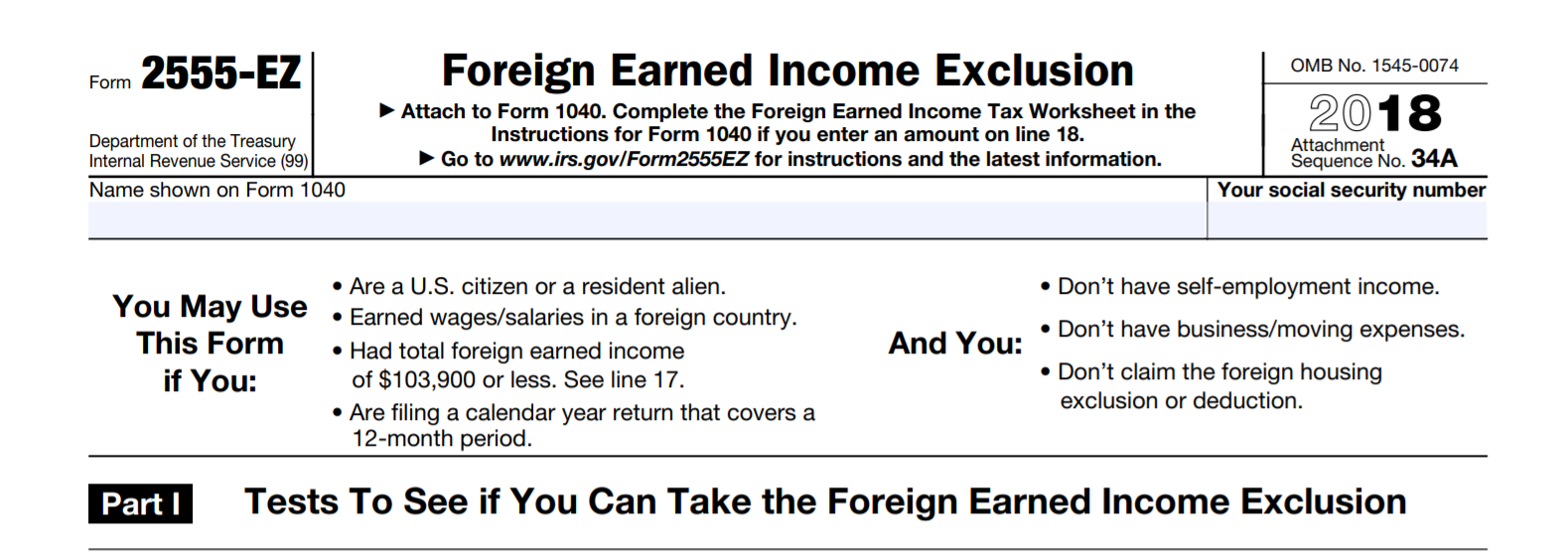

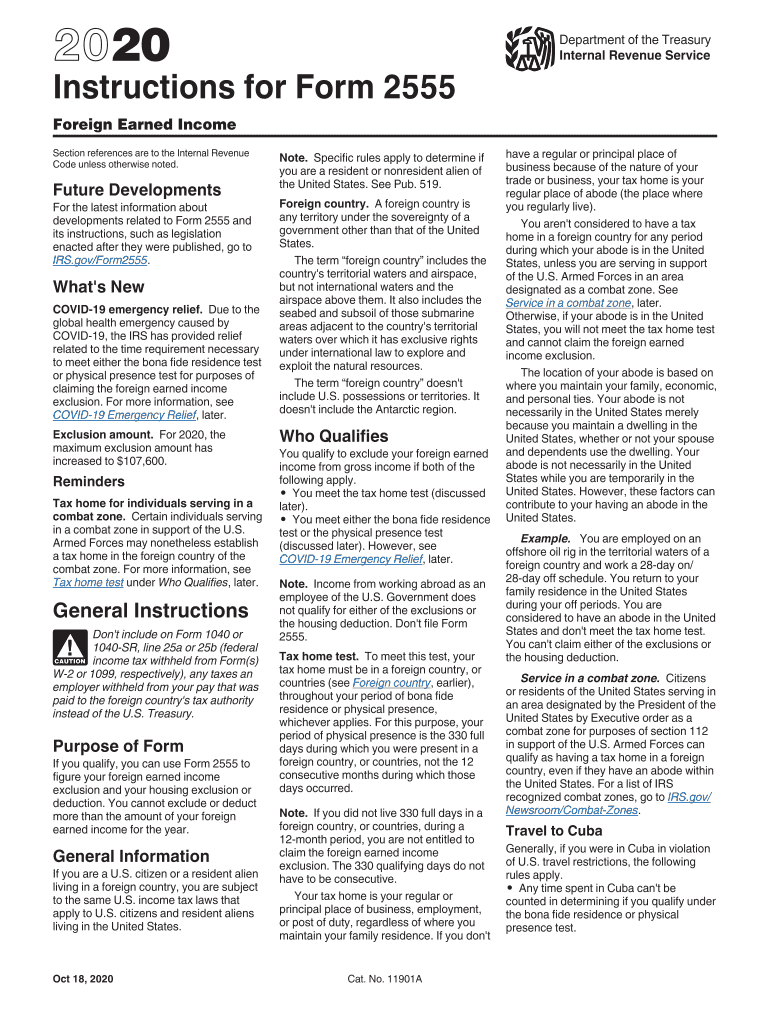

Form 2555 Ez 2021

Form 2555 Ez 2021 - Fill all required lines in your document making use of our powerful pdf. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Get ready for this year's tax season quickly and safely with pdffiller! Only form 2555 will be produced in future qualifying returns. The housing deduction is not being. Click on the button get form to open it and start editing. Ad signnow allows users to edit, sign, fill and share all type of documents online. Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is. Create legally binding electronic signatures on any device. Ad access irs tax forms.

Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in the foreign. Ad access irs tax forms. This form is for income earned in tax year 2022, with tax returns due. Complete, edit or print tax forms instantly. Only form 2555 will be produced in future qualifying returns. Upload, modify or create forms. Ad access irs tax forms. Web if form 1040, line 10, is zero, don’t complete this worksheet. Get ready for this year's tax season quickly and safely with pdffiller! Web about form 2555, foreign earned income.

Upload, modify or create forms. Earned wages/salaries in a foreign country. Click on the button get form to open it and start editing. Ad signnow allows users to edit, sign, fill and share all type of documents online. Complete, edit or print tax forms instantly. It is used to claim the foreign earned income exclusion and/or. Enter the amount from your (and your spouse's, if filing jointly). Only form 2555 will be produced in future qualifying returns. Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in the foreign. Complete, edit or print tax forms instantly.

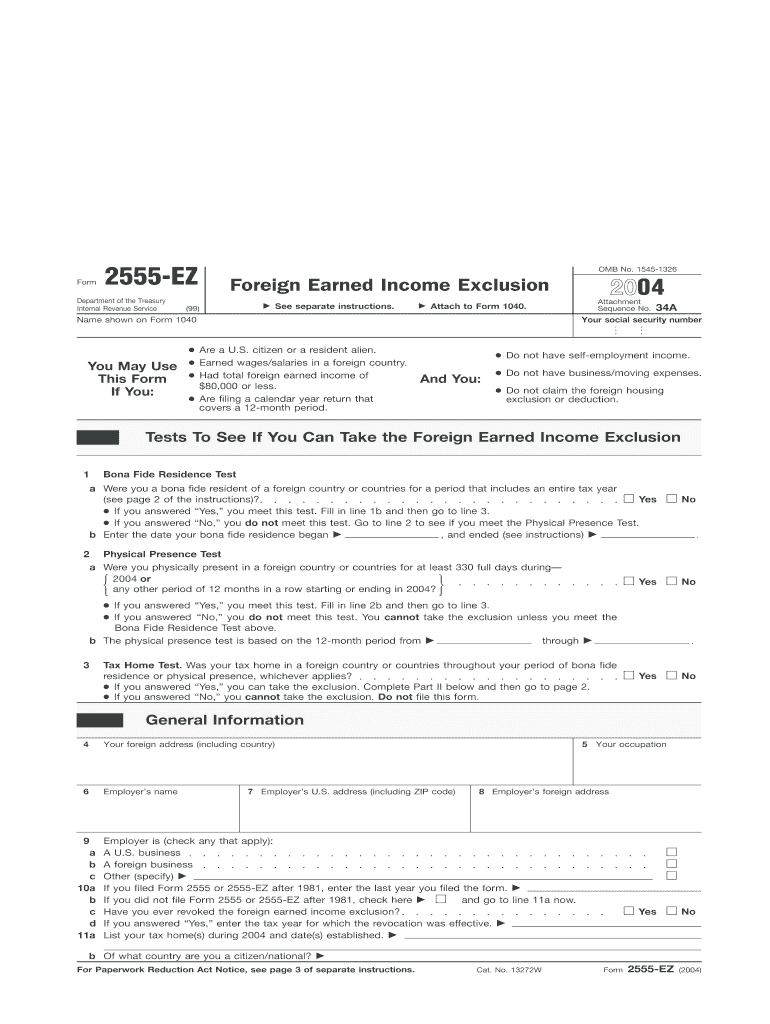

Form 2555 EZ SDG Accountant

Complete, edit or print tax forms instantly. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Web 235 rows purpose of form. Create legally binding electronic signatures on any device. Only form 2555 will be produced in future qualifying returns.

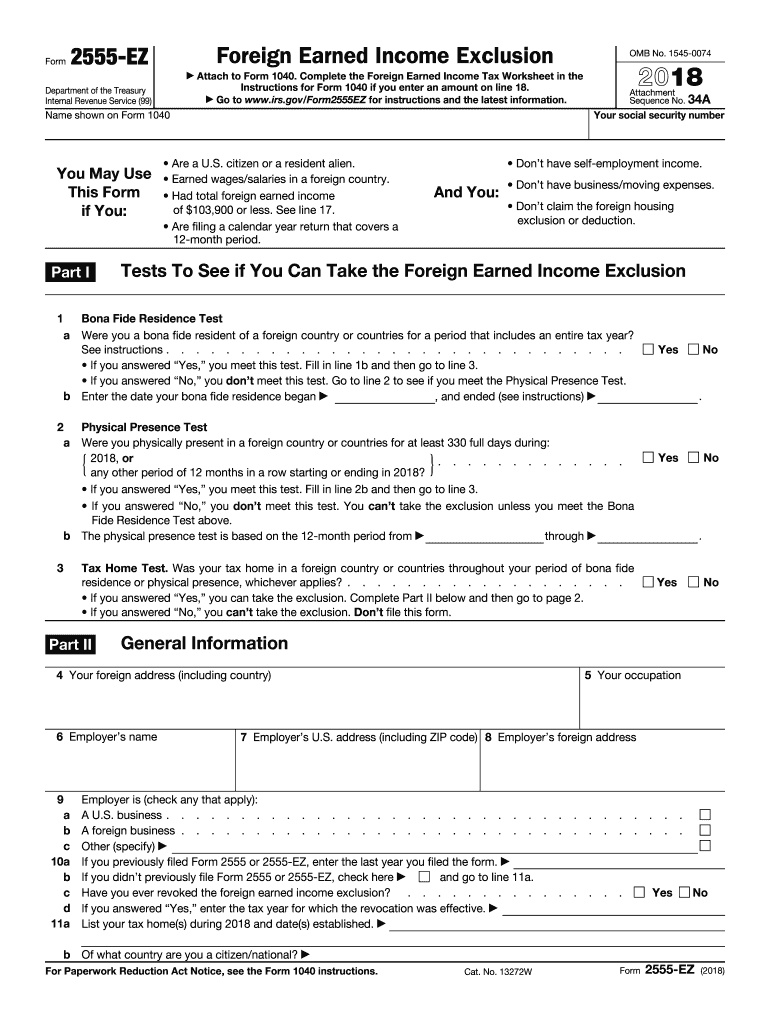

PDF Télécharger tax form f2555ez Gratuit PDF

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Fill all required lines in your document making use of our powerful pdf. It is used to claim the foreign earned income exclusion and/or. Ad access irs tax forms.

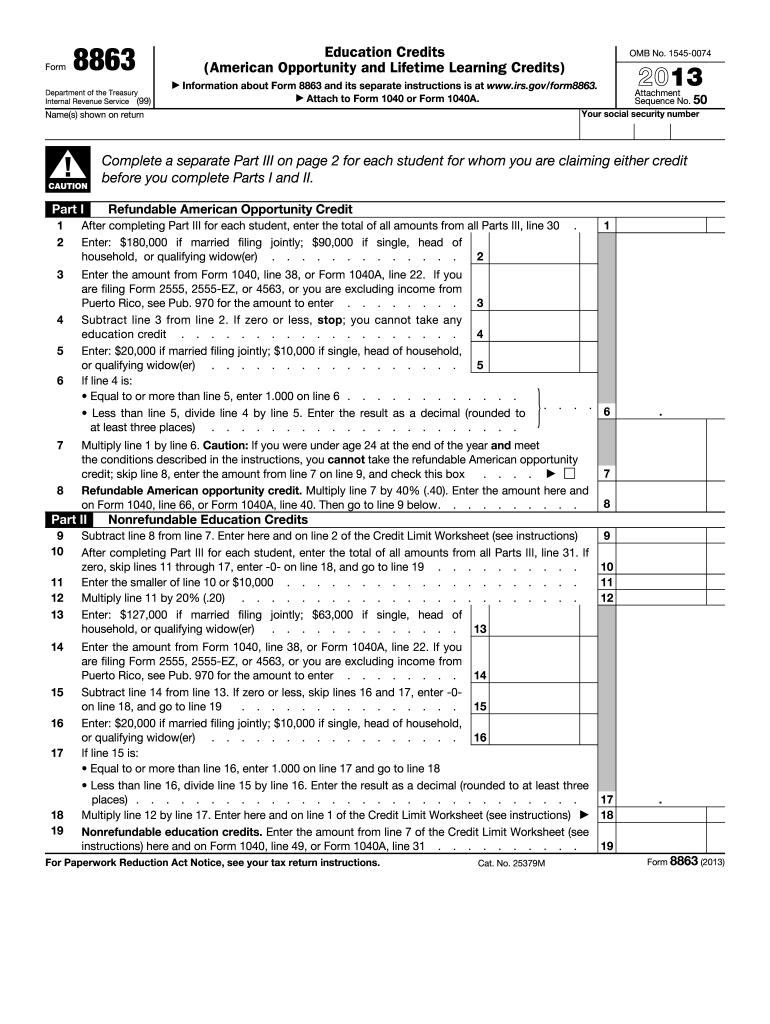

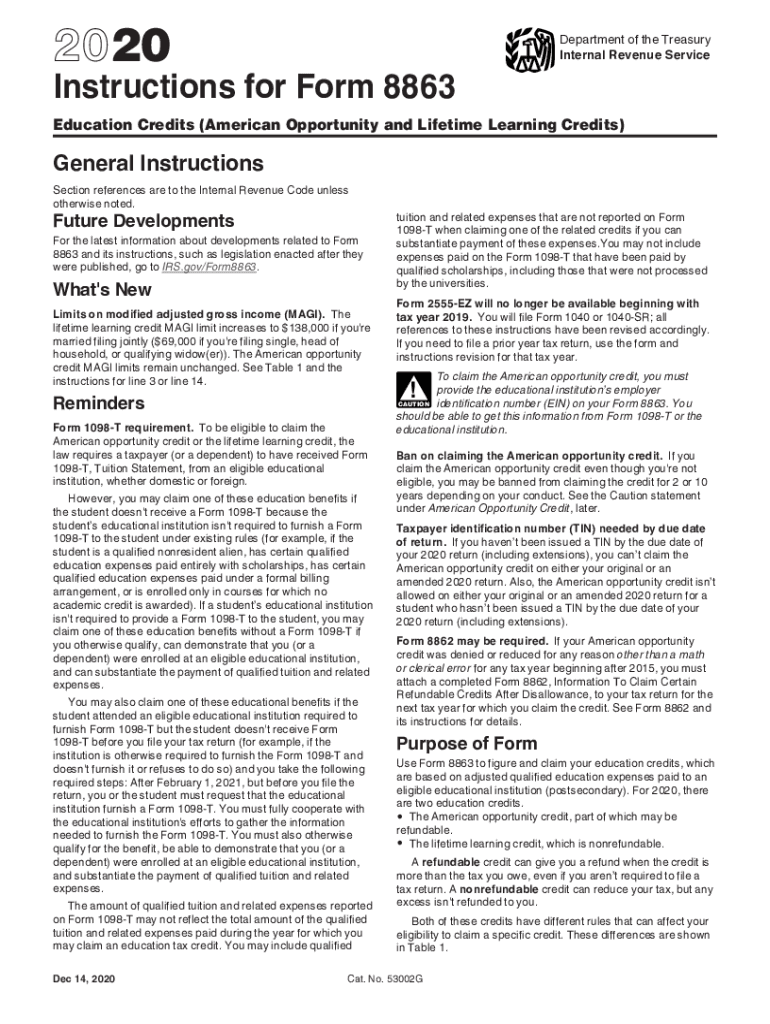

Form 8863 Fill Out and Sign Printable PDF Template signNow

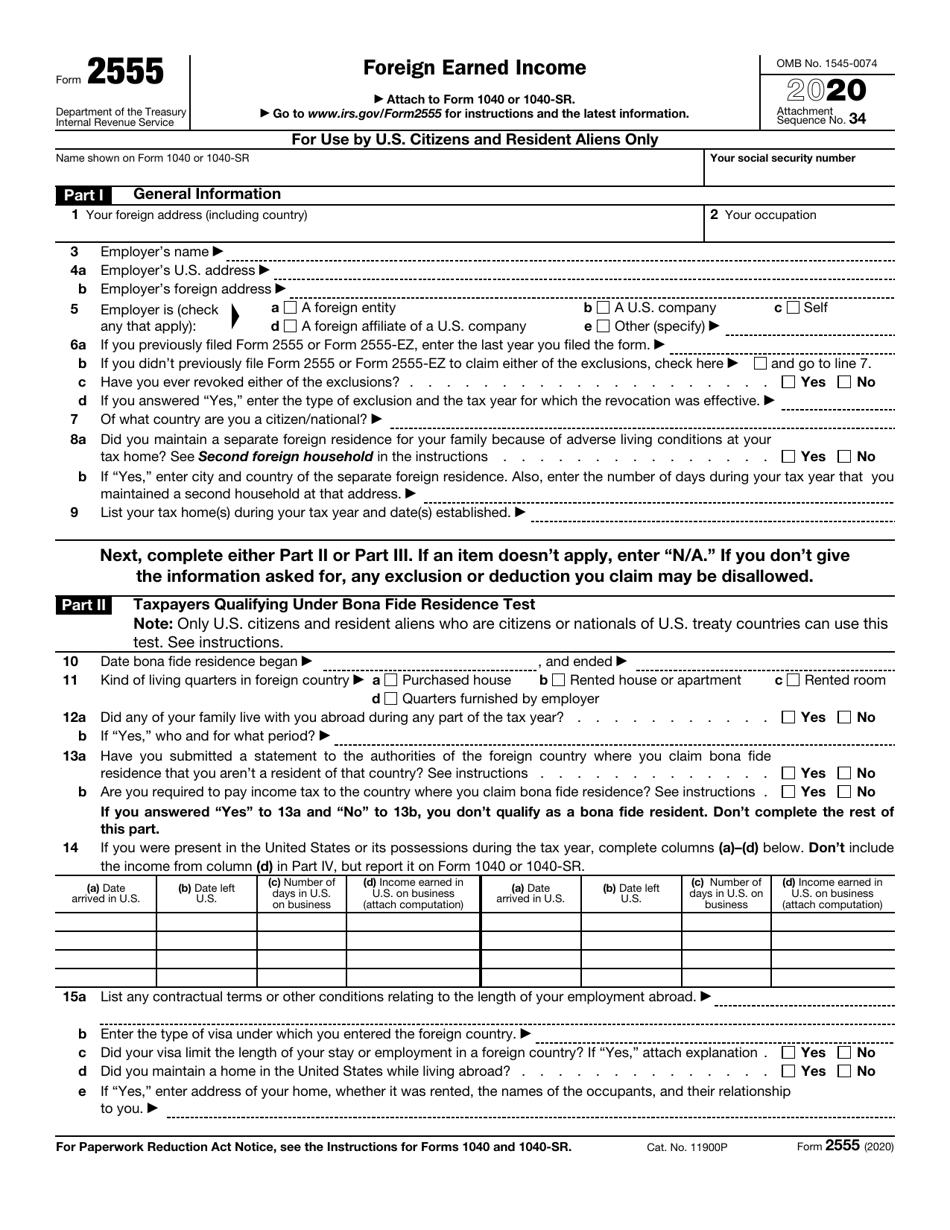

Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. The housing deduction is not being. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Go to www.irs.gov/form2555 for instructions and the. The form must be attached to a timely filed.

Irs Fillable Form 1040 / 1040 2020 Internal Revenue Service Robert

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or. Fill all required lines in your document making use of our powerful pdf. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Irs tax forms and instructions do i have.

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

Complete, edit or print tax forms instantly. Go to www.irs.gov/form2555 for instructions and the. Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is. Enter the amount from your (and your spouse's, if filing jointly). Web if form 1040, line 10, is zero, don’t complete this worksheet.

Ssurvivor Form 2555 Ez Instructions 2018

The exclusion is an election. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or. Complete, edit or print tax forms instantly. Go to www.irs.gov/form2555 for instructions and the. Ad access irs tax forms.

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is. Ad access irs tax forms. Enter the amount from form 1040, line 10.1. Complete, edit or print tax forms instantly. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united.

Instructions for IRS Form 2555EZ Foreign Earned Exclusion

Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in the foreign. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or. Go to www.irs.gov/form2555 for.

Form 2555 Ez Fill Out and Sign Printable PDF Template signNow

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or. Citizen or a resident alien. Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is. Click on the button get form to open it and start editing. The form must be.

IRS Instruction 8863 20202022 Fill out Tax Template Online US

Web about form 2555, foreign earned income. If you qualify, you can use form 2555 to figure your foreign. This form is for income earned in tax year 2022, with tax returns due. Only form 2555 will be produced in future qualifying returns. Earned wages/salaries in a foreign country.

Enter The Amount From Your (And Your Spouse's, If Filing Jointly).

Citizen or a resident alien. Complete, edit or print tax forms instantly. Try it for free now! Ad signnow allows users to edit, sign, fill and share all type of documents online.

Earned Wages/Salaries In A Foreign Country.

Web 235 rows purpose of form. Web about form 2555, foreign earned income. Create legally binding electronic signatures on any device. Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in the foreign.

Go To Www.irs.gov/Form2555 For Instructions And The.

Try it for free now! Ad access irs tax forms. Complete, edit or print tax forms instantly. The housing deduction is not being.

Fill All Required Lines In Your Document Making Use Of Our Powerful Pdf.

It is used to claim the foreign earned income exclusion and/or. Enter the amount from form 1040, line 10.1. If you qualify, you can use form 2555 to figure your foreign. Ad access irs tax forms.