Form 2553 Fillable

Form 2553 Fillable - To complete this form, you’ll need the following. Edit your fillable form 2553 online. December 2017) department of the treasury internal revenue service. Ad download, print or email irs 2553 tax form on pdffiller for free. Web what is form 2553? For example, if you want. If necessary, use our form. Web how to file the irs form 2553. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Check the entered data several times.

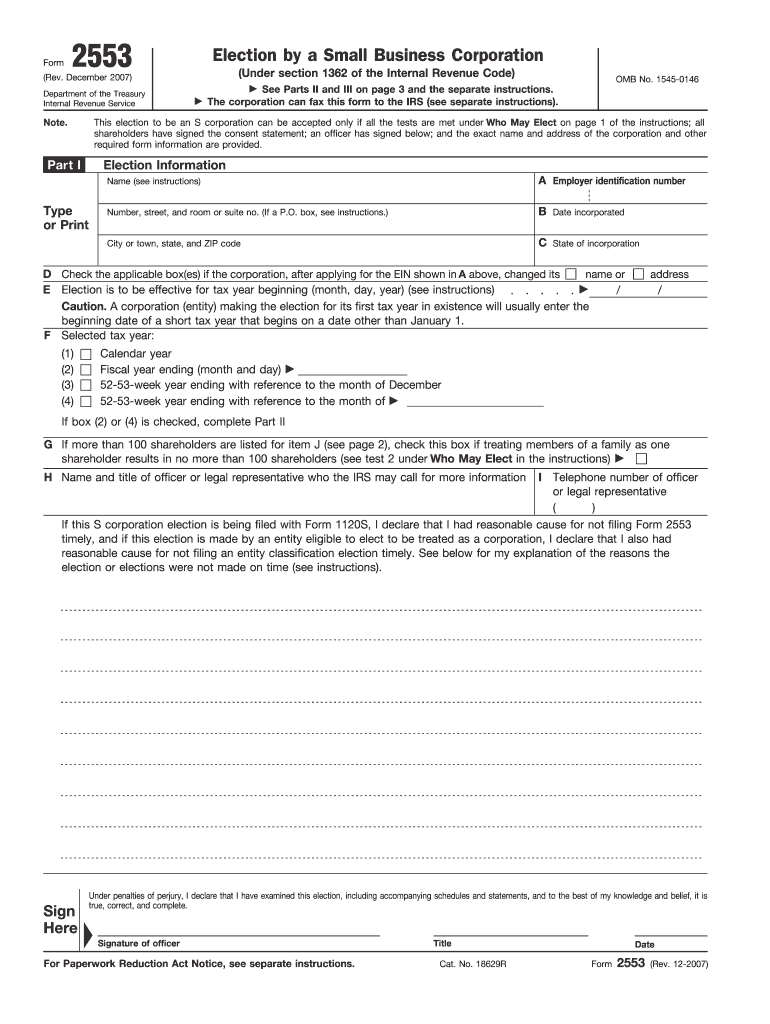

Check the entered data several times. The form consists of several parts requiring the following information: Form 2553, get ready for tax deadlines by filling online any tax form for free. December 2017) department of the treasury internal revenue service. If necessary, use our form. Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your organization. Ad elect your company to s corporation with just a few clicks. A corporation or other entity. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Election by a small business corporation (under section 1362 of the internal revenue.

Complete, edit or print tax forms instantly. Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Ad elect your company to s corporation with just a few clicks. Web how to file the irs form 2553. Selection of fiscal tax year;. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. Web how to fill out form 2553. Election by a small business corporation (under section 1362 of the internal revenue.

Ssurvivor Form 2553 Sample

A corporation or other entity. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. (see, irc section 1362(a)) toggle navigation. The form consists of several parts requiring the following information: Web form 2553 is used by qualifying small business corporations.

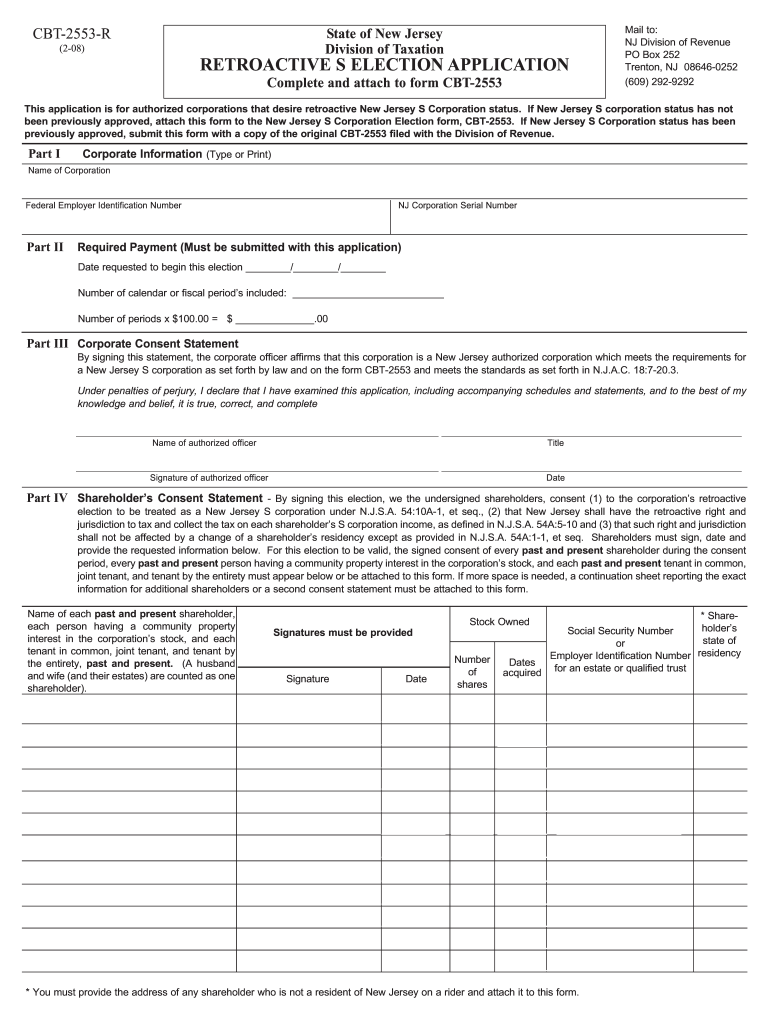

Cbt 2553 Fill Out and Sign Printable PDF Template signNow

Web how to fill out form 2553. The form should be filed before the 16th day of the third. Web all of the following conditions must be true in order to file form 2553: Currently, an online filing option does not exist for this form. Web form 2553 is an irs form.

Fill Free fillable form 2553 election by a small business corporation

Sign it in a few clicks. This means that all income and. (see, irc section 1362(a)) toggle navigation. The business is a domestic corporation or domestic entity (such as an llc) that is eligible to. Ad complete irs tax forms online or print government tax documents.

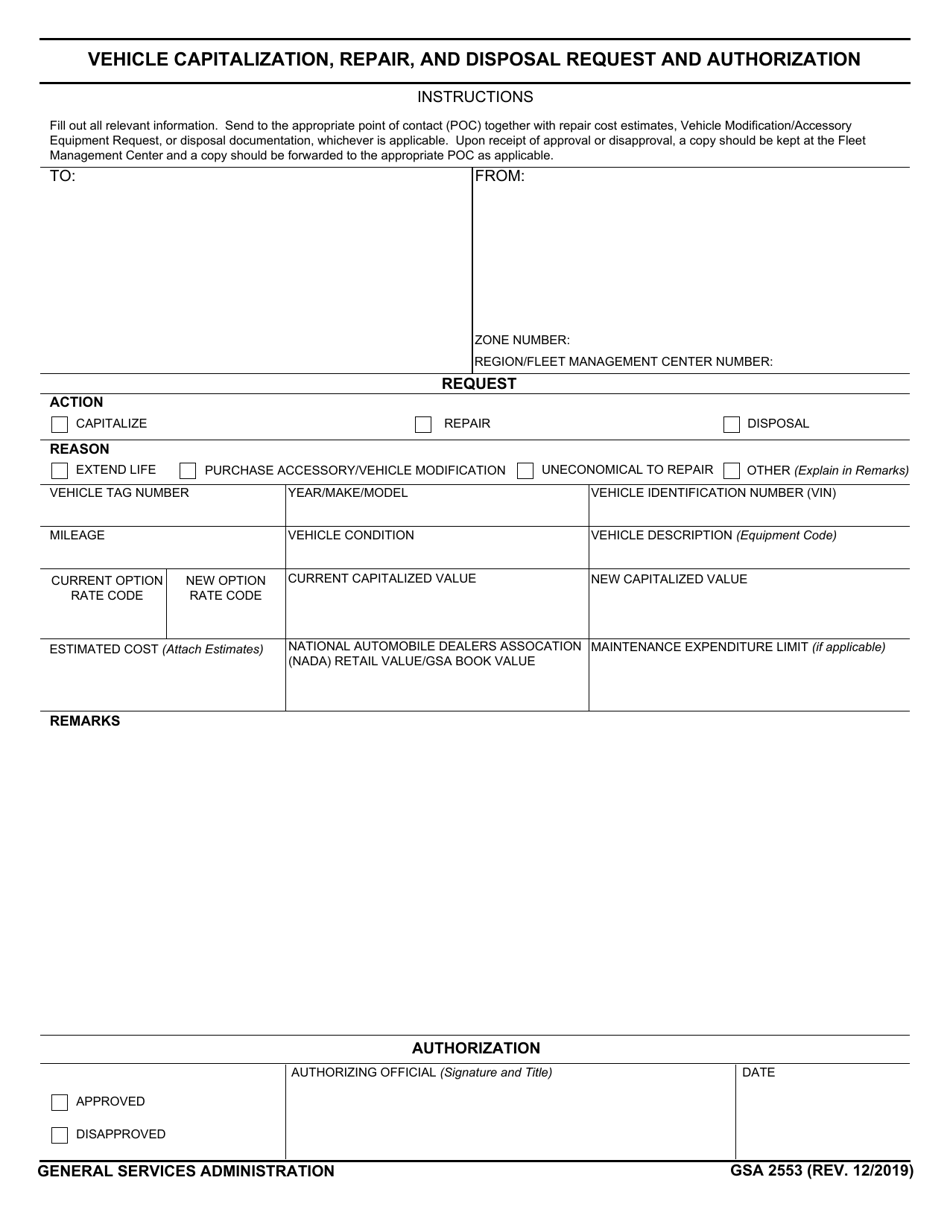

GSA Form 2553 Download Fillable PDF or Fill Online Vehicle

Sign it in a few clicks. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Check the entered data several times. Web all of the following conditions must be true in order to file form 2553: December 2017) department of the treasury internal revenue.

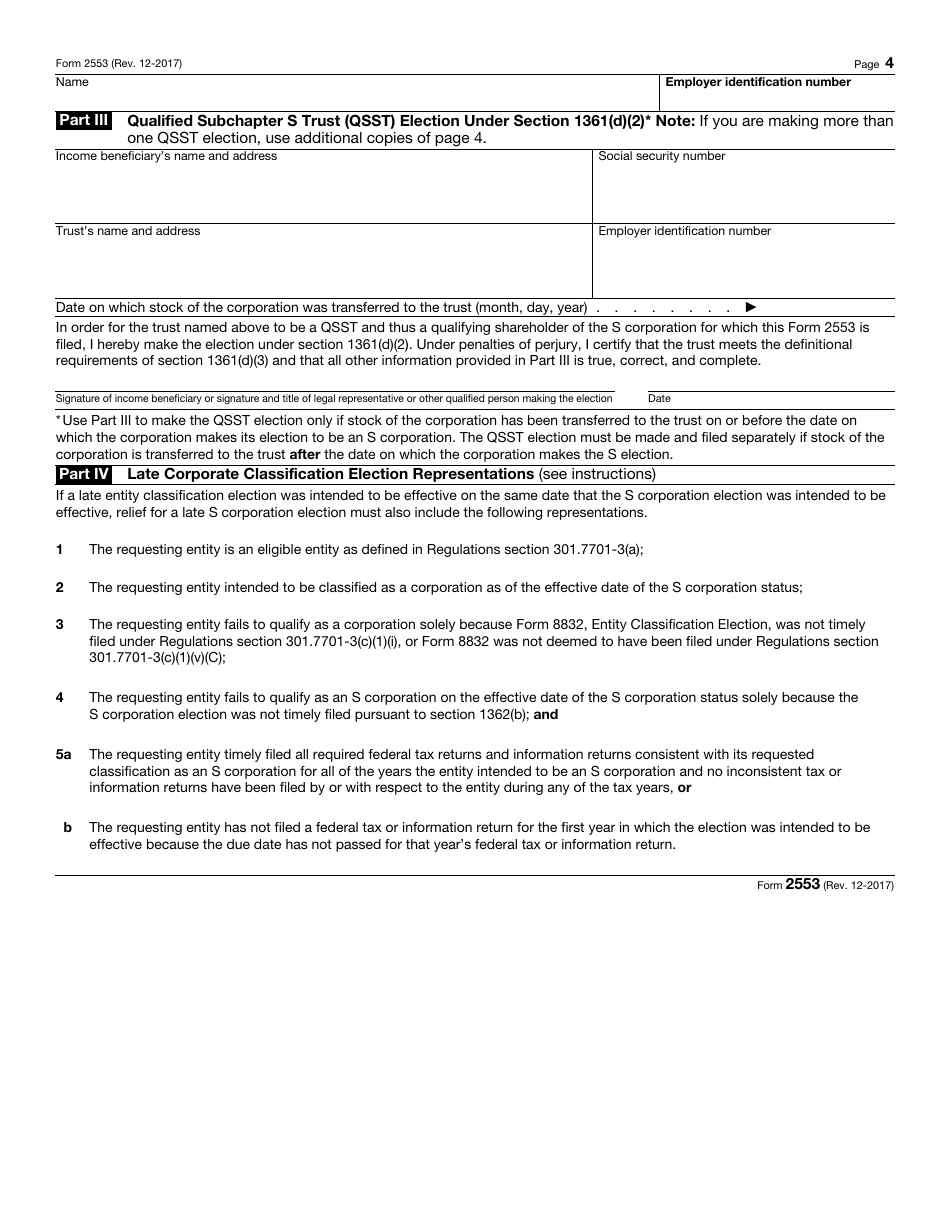

IRS Form 2553 Download Fillable PDF or Fill Online Election by a Small

A corporation or other entity. Election by a small business corporation (under section 1362 of the internal revenue. Web filling out irs 2553. Ad elect your company to s corporation with just a few clicks. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take.

Fillable Form 2553 (2017) Edit, Sign & Download in PDF PDFRun

Edit your fillable form 2553 online. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Irs form 2553 can be filed with the irs by either mailing or faxing the form. The form should be filed before the 16th day of the third. For example, if you want.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

A corporation or other entity. If necessary, use our form. Currently, an online filing option does not exist for this form. Web how to fill out form 2553. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months.

Form 2553 Fill Out and Sign Printable PDF Template signNow

Web what is form 2553? A corporation or other entity. This means that all income and. Currently, an online filing option does not exist for this form. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start.

2013 Form IRS 2553 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15. Type text, add images, blackout confidential details, add comments, highlights and more. Election information and employer identification number; For example, if you want. Web form 2553.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Web how to file the irs form 2553. To complete this form, you’ll need the following. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Form 2553, get ready for tax deadlines by filling online any tax form for free. Web form 2553 must be filed either during the tax year.

Web Like Most Irs Forms, The First Fillable Page Of Form 2553 Is Meant To Identify And Learn More About Your Organization.

A corporation or other entity. The business is a domestic corporation or domestic entity (such as an llc) that is eligible to. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. (see, irc section 1362(a)) toggle navigation.

If Necessary, Use Our Form.

Ad complete irs tax forms online or print government tax documents. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Currently, an online filing option does not exist for this form. Election by a small business corporation (under section 1362 of the internal revenue.

Election Information And Employer Identification Number;

The form consists of several parts requiring the following information: Web how to file the irs form 2553. Sign it in a few clicks. This means that all income and.

Web Irs Form 2553 Is An Election To Have Your Business Entity Recognized As An S Corporation For Tax Purposes.

Web filling out irs 2553. Ad elect your company to s corporation with just a few clicks. To complete this form, you’ll need the following. For example, if you want.