Form 2441 For 2021

Form 2441 For 2021 - From within your taxact return ( online or desktop), click federal (on smaller devices, click in. Web bif you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income. The amount shown as paid to the provider (s) must equal the amount entered as qualified expenses for your dependent (s). See the instructions for line 13. The maximum child tax credit increased to $3,600 for children under the age of 6 and to $3,000 per. Web to complete form 2441 child and dependent care expenses in the taxact program: Web form 2441 based on the income rules listed in the instructions under. Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441. Once your adjusted gross income is over $43,000,. Ad edit, fill, sign 2441 2010 form & more fillable forms.

Ad edit, fill, sign 2441 2010 form & more fillable forms. See the instructions for line 13. Web jo willetts, ea director, tax resources published on: Web to complete form 2441 child and dependent care expenses in the taxact program: The credit amounts will increase for many taxpayers. Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441. A qualifying child under age 13 whom you can claim as a dependent. Form 2441 is used to by. Web for more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and. The child and dependent care credit is a percentage of your qualified expenses.

Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441. See the instructions for line 13. March 02, 2021 share on social do you have a child or dependent to report on your tax return? Your expenses are subject to both the earned income limit and the. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. The credit amounts will increase for many taxpayers. If you or your spouse was a student or disabled, check this box. Web bif you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income. Once your adjusted gross income is over $43,000,. Web form 2441 based on the income rules listed in the instructions under.

2441 Form 2022

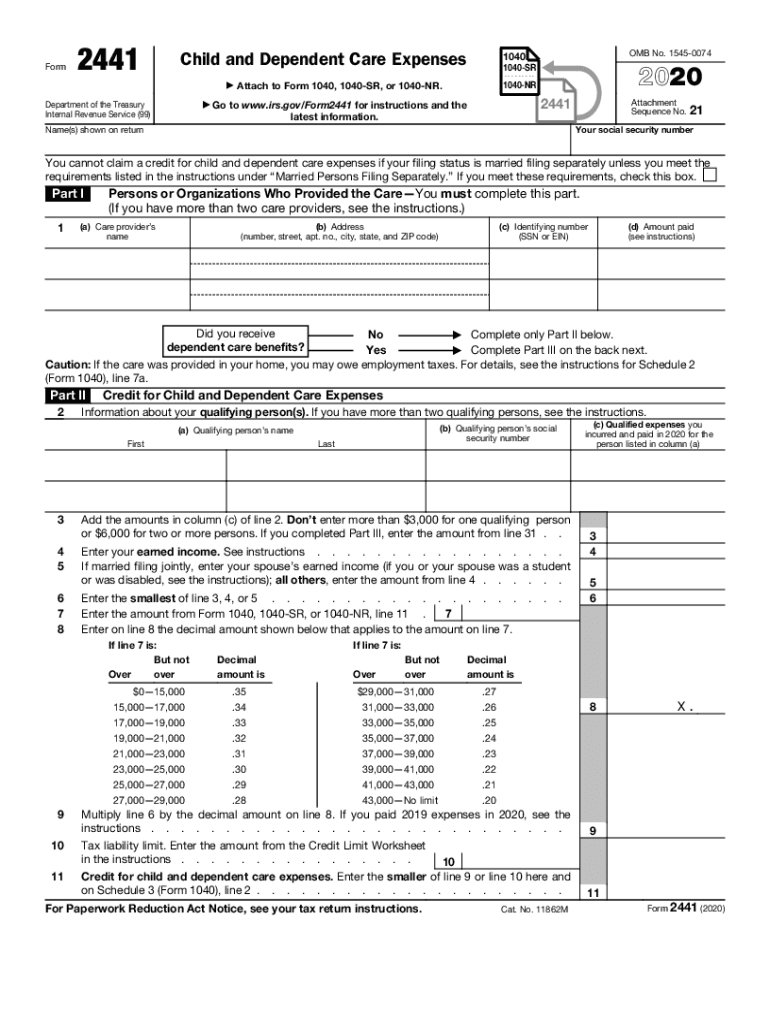

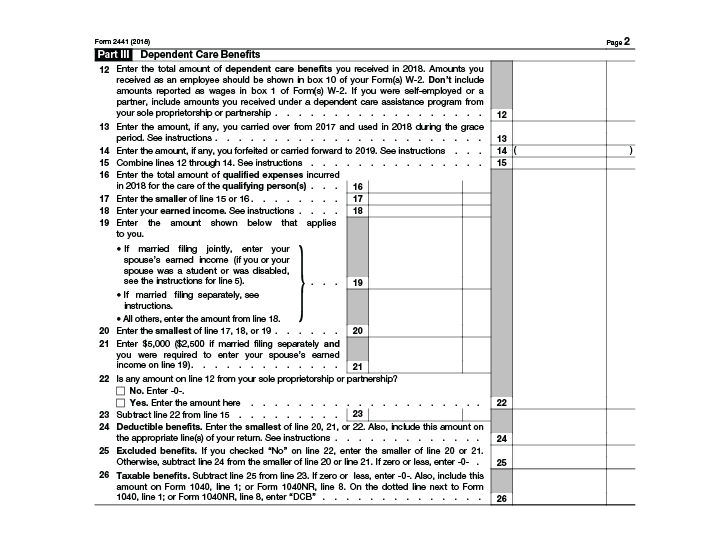

The child and dependent care credit is a percentage of your qualified expenses. The amount shown as paid to the provider (s) must equal the amount entered as qualified expenses for your dependent (s). Web 2021 are added to the maximum amount of dependent care benefits that are allowed for 2022. Your expenses are subject to both the earned income.

Ssurvivor Form 2441 Child And Dependent Care Expenses

Web taxes advertiser disclosure the child and dependent care credit is worth up to $8,000 this tax season ellen chang, kemberley washington contributor, editor. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web to complete form 2441 child and dependent care expenses in the taxact program: Web.

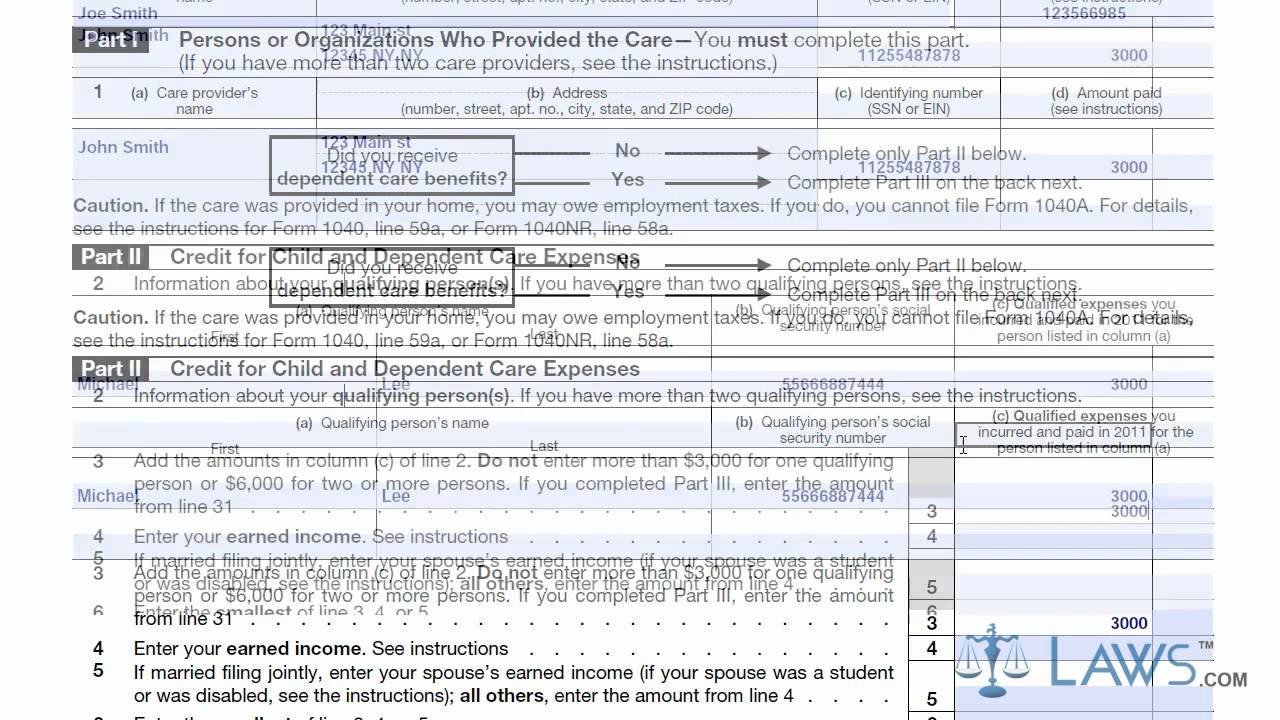

Learn How to Fill the Form 2441 Dependent Care Expenses YouTube

A qualifying child under age 13 whom you can claim as a dependent. If you paid 2021 expenses. Ad edit, fill, sign 2441 2010 form & more fillable forms. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web form 2441 based on the income rules listed in.

Irs form 2441 instructions Canadian Manuals Stepbystep Guidelines

If you or your spouse was a student or disabled, check this box. If the child turned 13 during the year, the child is a qualifying. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. Form 2441 is used to by. The amount shown as paid to the provider (s) must equal the.

Form 2441 Fill Out and Sign Printable PDF Template signNow

Your expenses are subject to both the earned income limit and the. The amount shown as paid to the provider (s) must equal the amount entered as qualified expenses for your dependent (s). See the instructions for line 13. Ad edit, fill, sign 2441 2010 form & more fillable forms. The child and dependent care credit is a percentage of.

ACC124 2021 Form 2441 YouTube

Web qualifying person (s) a qualifying person is: Web taxes advertiser disclosure the child and dependent care credit is worth up to $8,000 this tax season ellen chang, kemberley washington contributor, editor. If the child turned 13 during the year, the child is a qualifying. March 02, 2021 share on social do you have a child or dependent to report.

All About IRS Form 2441 SmartAsset

Web jo willetts, ea director, tax resources published on: Ad download or email irs 2441 & more fillable forms, register and subscribe now! From within your taxact return ( online or desktop), click federal (on smaller devices, click in. The credit amounts will increase for many taxpayers. The maximum child tax credit increased to $3,600 for children under the age.

2020 Tax Form 2441 Create A Digital Sample in PDF

Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web bif you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income. Web irs releases 2021 form 2441 and.

Irs Form 2441 2023 Fill online, Printable, Fillable Blank

If you or your spouse was a student or disabled, check this box. Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441. The child and dependent care credit is a percentage of your qualified expenses. Web taxes advertiser disclosure the child and dependent.

David Fleming is a single taxpayer living at 169 Trendie Street

Form 2441 is used to by. See the instructions for line 13. Your expenses are subject to both the earned income limit and the. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. Web to complete form 2441 child and dependent care expenses in the taxact program:

Web Irs Releases 2021 Form 2441 And Instructions For Reporting Child And Dependent Care Expenses Ebia December 22, 2021 · 5 Minute Read Irs Form 2441.

If the child turned 13 during the year, the child is a qualifying. Ad download or email irs 2441 & more fillable forms, register and subscribe now! The child and dependent care credit is a percentage of your qualified expenses. Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return.

March 02, 2021 Share On Social Do You Have A Child Or Dependent To Report On Your Tax Return?

If you paid 2021 expenses. There is a new line b that has a. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. The credit amounts will increase for many taxpayers.

Web Bif You Or Your Spouse Was A Student Or Was Disabled During 2022 And You’re Entering Deemed Income Of $250 Or $500 A Month On Form 2441 Based On The Income.

Once your adjusted gross income is over $43,000,. See the instructions for line 13. Get ready for tax season deadlines by completing any required tax forms today. If you or your spouse was a student or disabled, check this box.

Web For More Information On The Percentage Applicable To Your Income Level, Please Refer To The 2021 Instructions For Form 2441 Or Irs Publication 503, Child And.

Web 2021 are added to the maximum amount of dependent care benefits that are allowed for 2022. Your expenses are subject to both the earned income limit and the. Web taxes advertiser disclosure the child and dependent care credit is worth up to $8,000 this tax season ellen chang, kemberley washington contributor, editor. A qualifying child under age 13 whom you can claim as a dependent.