Form 2439 Turbotax

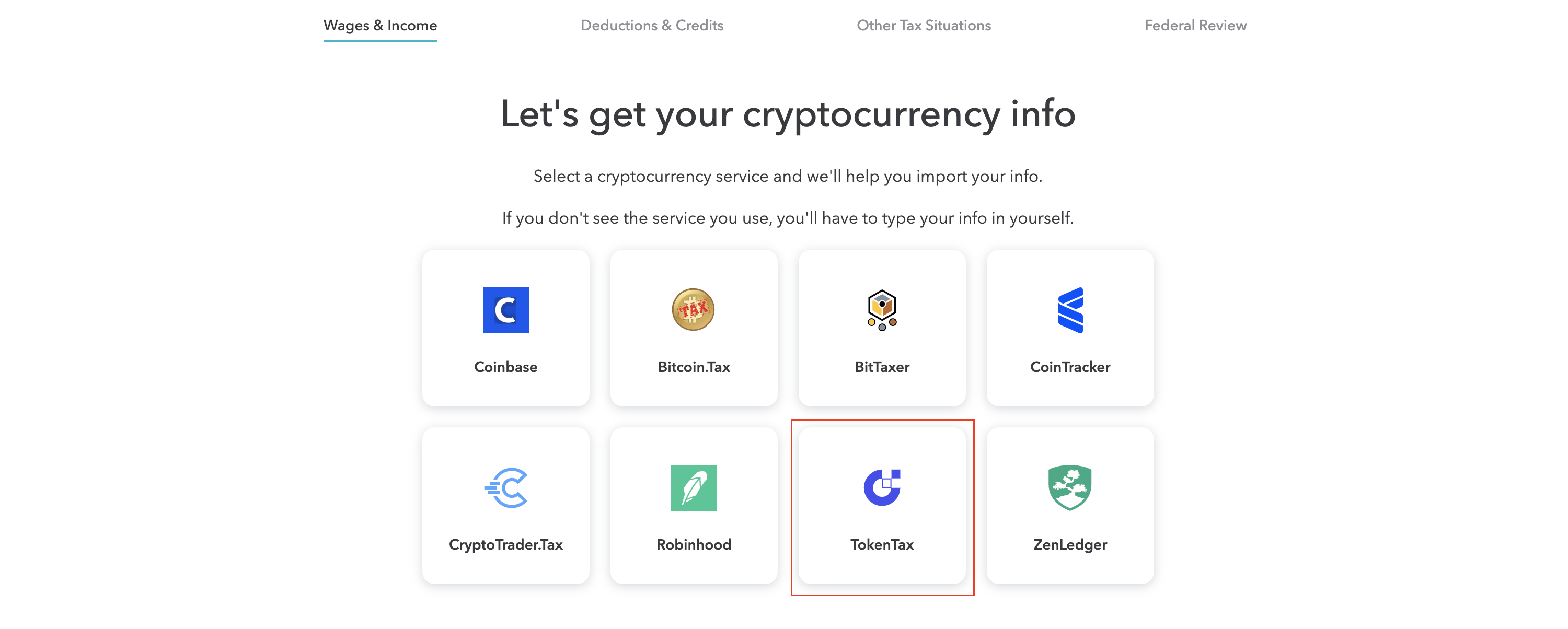

Form 2439 Turbotax - In turbotax enter 2439 in the. Go to screen 22.1 dispositions (schedule d, 4797, etc.). Web action date signature o.k. Ad get instant access to certified tax advisors 24/7. Web to enter the 2439 in the fiduciary module: The mutual fund company reports these gains on. Web truncation is not allowed on the form 2439 the ric or reit files with the irs. Resolve tax problems w/ professional help. Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. Click the orange button that says take me to my return. go to.

Web to add form 14039 (identity theft affidavit) in turbotax online: Also, the ric or reit cannot truncate its own identification number on any form. Form 2439 is a form used by the irs to request an extension of time to file a return. Premium federal filing is 100% free with no upgrades for premium taxes. Ad get instant access to certified tax advisors 24/7. Max refund is guaranteed and 100% accurate. Sign into your online acccount. I keep looping between questions in the wages and income. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. The mutual fund company reports these gains on.

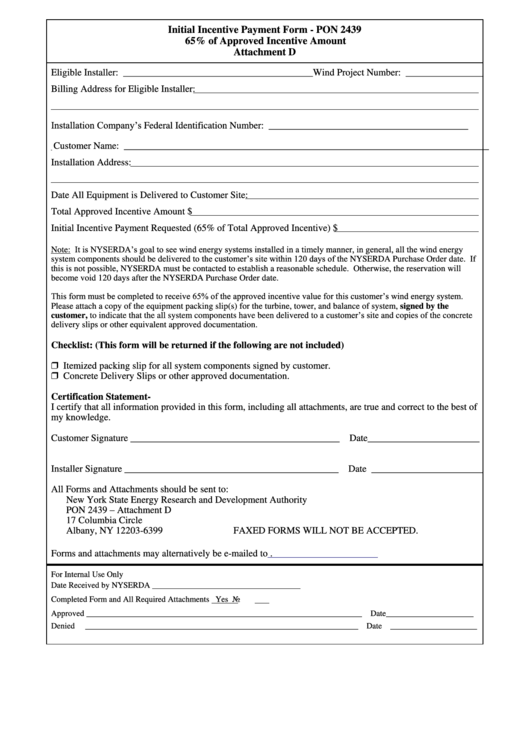

Also, the ric or reit cannot truncate its own identification number on any form. Form 2439 is a form used by the irs to request an extension of time to file a return. From the dispositions section select form 2439. In turbotax enter 2439 in the. To print revised proofs requested for paperwork reduction act notice, see back of copy a. The amounts entered in boxes 1b, 1c, and 1d and. Ad get instant access to certified tax advisors 24/7. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. 11858e form 2439 (1991) 2 i.r.s. Web action date signature o.k.

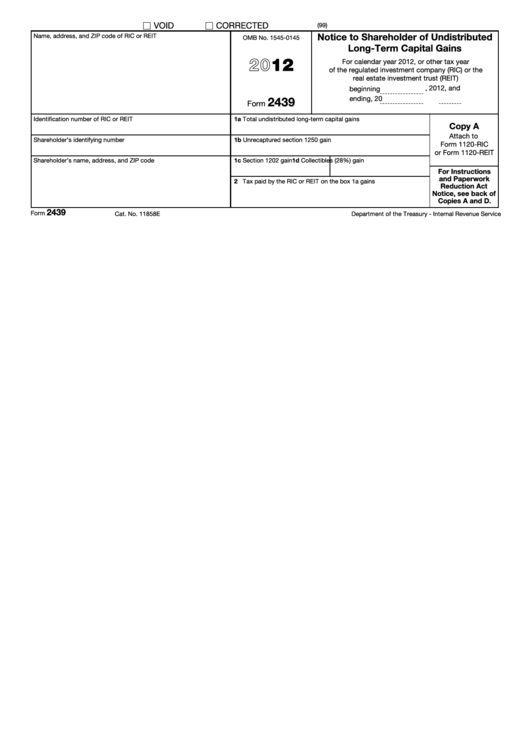

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

I keep looping between questions in the wages and income. Web to enter the 2439 in the fiduciary module: Ask certified tax pros online now. Go to screen 22.1 dispositions (schedule d, 4797, etc.). Web to add form 14039 (identity theft affidavit) in turbotax online:

TurboTax Cryptocurrency Filing Crypto Form 8949 TurboTax TokenTax

Web complete copies a, b, c, and d of form 2439 for each owner. Resolve tax problems w/ professional help. Web truncation is not allowed on the form 2439 the ric or reit files with the irs. Form 2439 is a form used by the irs to request an extension of time to file a return. Web if your mutual.

Fillable Form Pon 2439 Initial Incentive Payment Form New York

Max refund is guaranteed and 100% accurate. Premium federal filing is 100% free with no upgrades for premium taxes. From the dispositions section select form 2439. Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. Ad get instant access to certified tax advisors 24/7.

Fillable Form 2439 Notice To Shareholder Of Undistributed LongTerm

In turbotax enter 2439 in the. Sign into your online acccount. Web if your mutual fund sends you a form 2439: Go to screen 22.1 dispositions (schedule d, 4797, etc.). Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Web to add form 14039 (identity theft affidavit) in turbotax online: In turbotax enter 2439 in the. Web if your mutual fund sends you a form 2439: Max refund is guaranteed and 100% accurate. The amounts entered in boxes 1b, 1c, and 1d and.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Form 5498, ira contribution information; Web to enter the 2439 in the fiduciary module: Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. I keep looping between questions in the wages and income. Web to add form 14039 (identity theft affidavit) in turbotax online:

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

I keep looping between questions in the wages and income. The mutual fund company reports these gains on. Form 5498, ira contribution information; Web action date signature o.k. In turbotax enter 2439 in the.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web form 2439 is required by the u.s. The mutual fund company reports these gains on. Also, the ric or reit cannot truncate its own identification number on any form. Web to enter the 2439 in the fiduciary module: Form 5498, ira contribution information;

How TurboTax turns a dreadful user experience into a delightful one

Web if your mutual fund sends you a form 2439: A mutual fund usually distributes all its capital gains to its shareholders. Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. Click the orange button that says take me to my return. go to. Easily sort by irs forms to find the product that best fits.

TurboTax 2016 Deluxe Home and Business + All States Fix Free Download

The amounts entered in boxes 1b, 1c, and 1d and. Web to add form 14039 (identity theft affidavit) in turbotax online: Sign into your online acccount. Max refund is guaranteed and 100% accurate. Web complete copies a, b, c, and d of form 2439 for each owner.

Internal Revenue Service (Irs) For Use By Rics, Reits, Etfs, And Mutual Funds.

Max refund is guaranteed and 100% accurate. Web complete copies a, b, c, and d of form 2439 for each owner. Resolve tax problems w/ professional help. Web if your mutual fund sends you a form 2439:

11858E Form 2439 (1991) 2 I.r.s.

The mutual fund company reports these gains on. To print revised proofs requested for paperwork reduction act notice, see back of copy a. I keep looping between questions in the wages and income. Ad get instant access to certified tax advisors 24/7.

Form 2439 Is A Form Used By The Irs To Request An Extension Of Time To File A Return.

Premium federal filing is 100% free with no upgrades for premium taxes. Sign into your online acccount. Click the orange button that says take me to my return. go to. Also, the ric or reit cannot truncate its own identification number on any form.

A Mutual Fund Usually Distributes All Its Capital Gains To Its Shareholders.

Go to screen 22.1 dispositions (schedule d, 4797, etc.). In turbotax enter 2439 in the. Web truncation is not allowed on the form 2439 the ric or reit files with the irs. The amounts entered in boxes 1b, 1c, and 1d and.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)