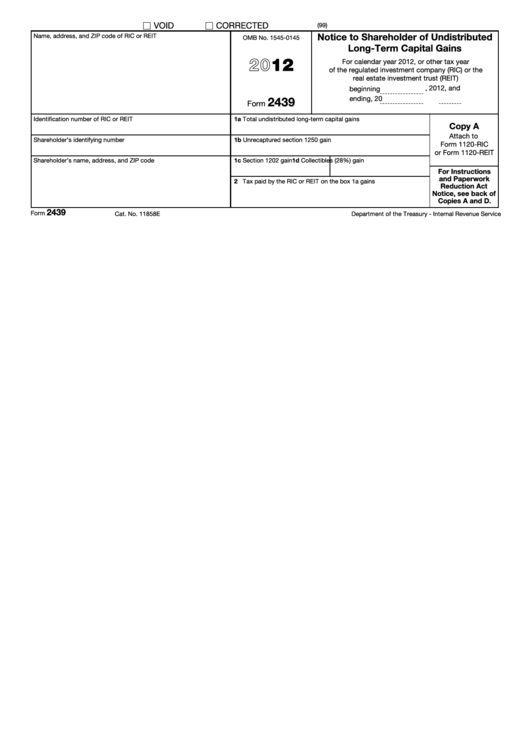

Form 2439 Reporting

Form 2439 Reporting - To enter form 2439 go to investment. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Web entering form 2439 in proconnect. From the dispositions section select form 2439. Meaning of form 2439 as a finance term. Web updated for tax year 2022 • june 2, 2023 08:41 am overview cost basis or tax basis? Web report the capital gain on your income tax return for the year. Web the information on form 2439 is reported on schedule d. Attach copy b of form 2439 to your completed tax return. •to report a gain or loss from form 4684, 6781, or 8824;

Turbotax helps you figure it out, and. To enter form 2439 go to investment. •to report a gain or loss from a partnership, s. Meaning of form 2439 as a finance term. Web to enter form 2439 capital gains, complete the following: Web or for reporting the tax paid only from form 2439 go to the payments/penalties > payments worksheet. Web ask for the information on this form to carry out the internal revenue laws of the united states. We need it to ensure that you are. Web report the capital gain on your income tax return for the year. From the dispositions section select form 2439.

Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits and. Furnish copies b and c of form 2439 to the. •to report a gain or loss from a partnership, s. Web •to report a gain from form 2439 or 6252 or part i of form 4797; Web gain from form 2439. From the dispositions section select form 2439. Web entering form 2439 in proconnect. Web the information on form 2439 is reported on schedule d. Attach copy b of form 2439 to your completed tax return. Meaning of form 2439 as a finance term.

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

To enter form 2439 go to investment. Web entering form 2439 in proconnect. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Web ask for the information on this form to carry out the internal revenue.

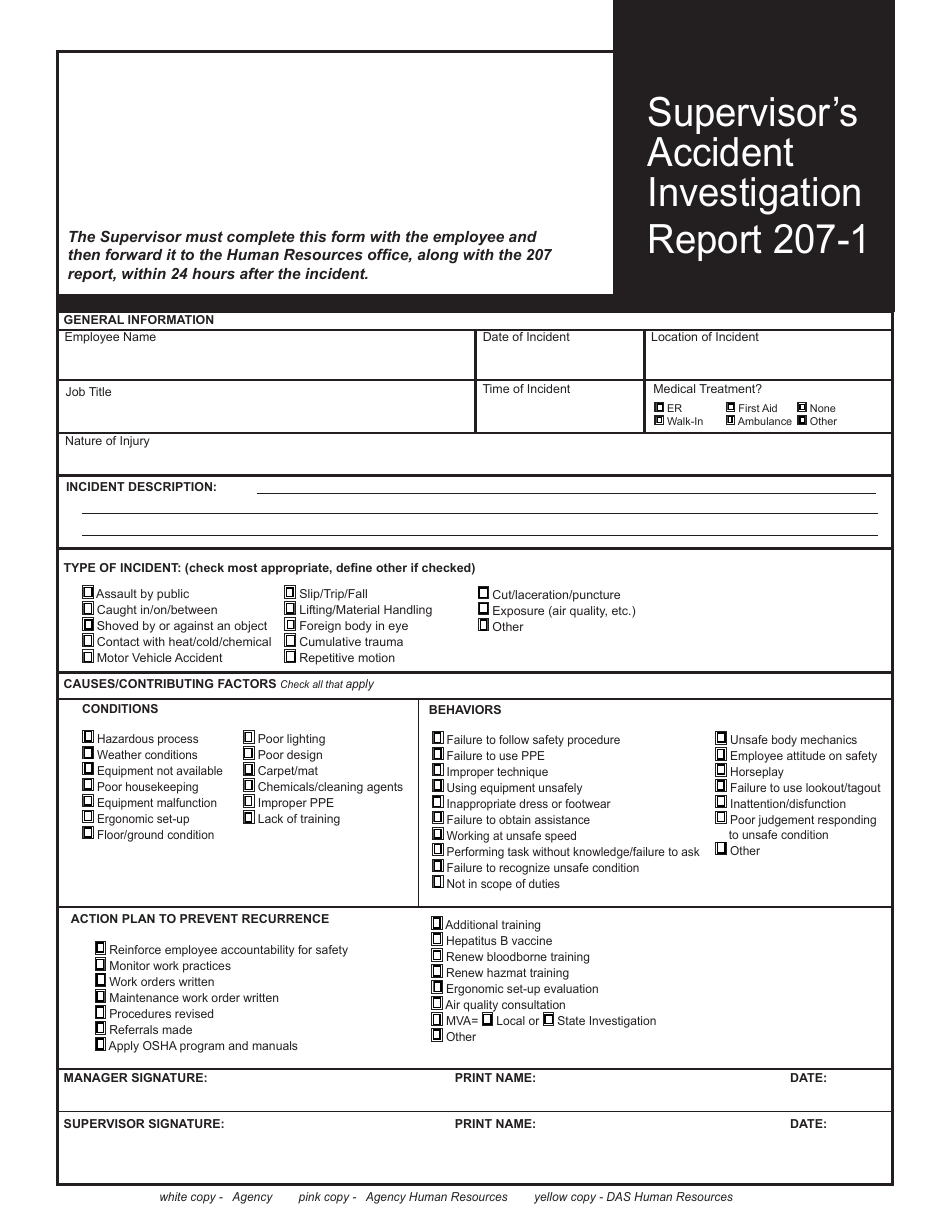

Days Since Last Accident Template Master of Documents

Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits and. Web or for reporting the tax paid only from form 2439 go to the payments/penalties > payments worksheet. Furnish copies b and c.

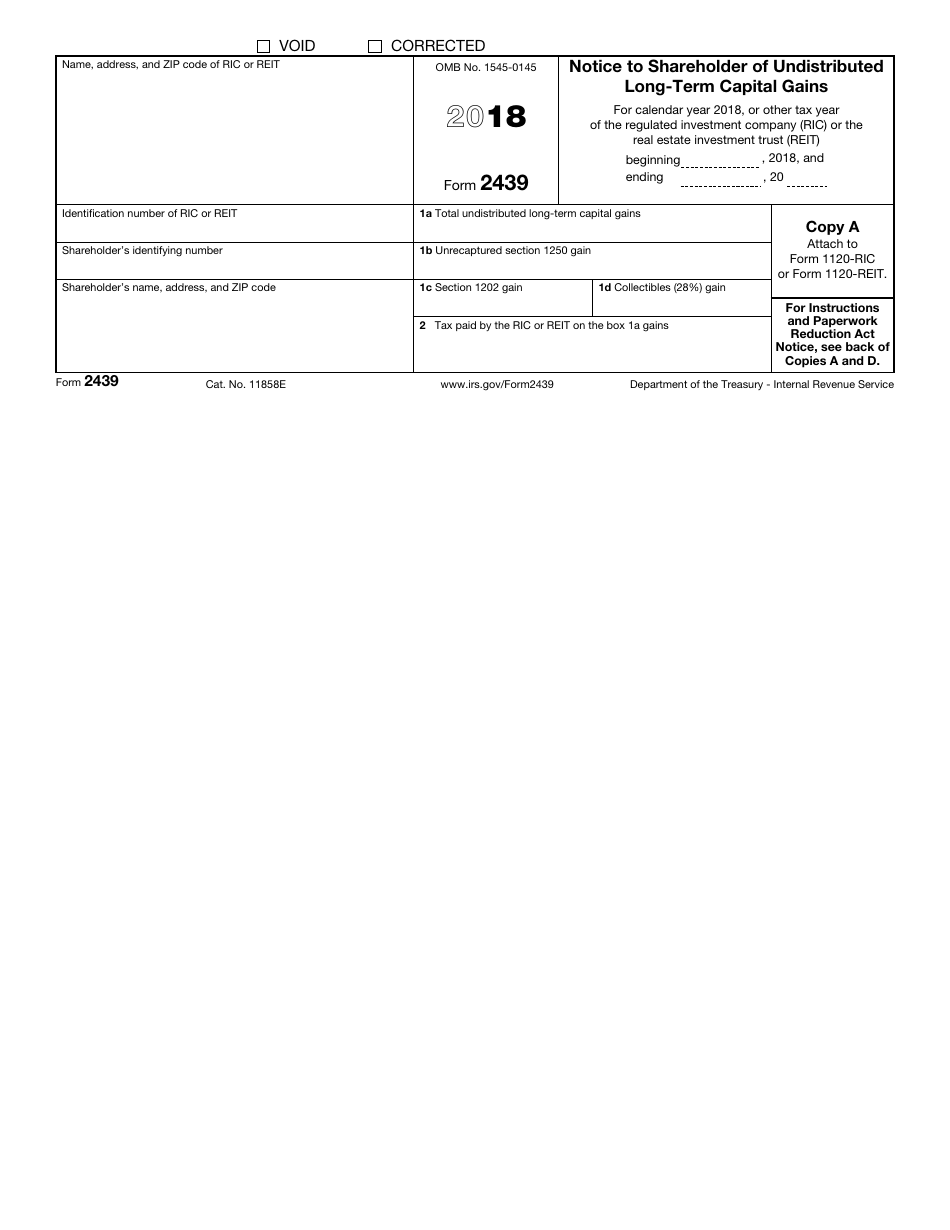

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Furnish copies b and c of form 2439 to the. Web ask for the information on this form to carry out the internal revenue laws of the united states. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section.

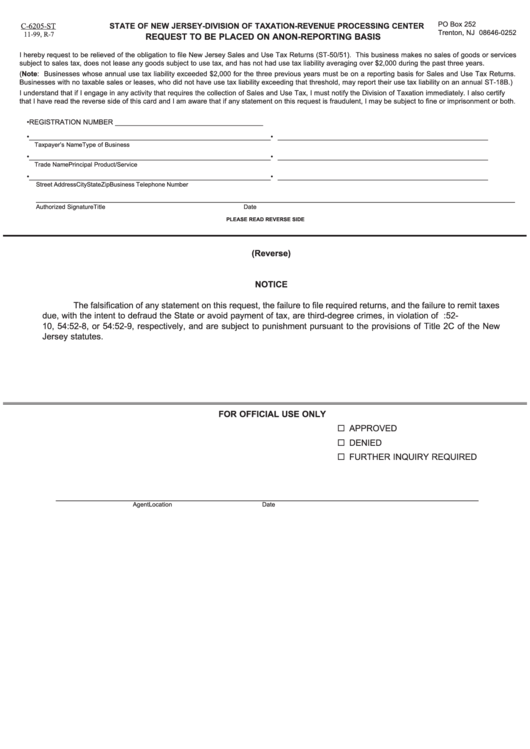

Fillable Form C6205St Request To Be Placed On A NonReporting Basis

Web or for reporting the tax paid only from form 2439 go to the payments/penalties > payments worksheet. Turbotax helps you figure it out, and. Web entering form 2439 in proconnect. Complete copies a, b, c, and d for each shareholder for whom the regulated investment company (ric) or real estate investment trust (reit) paid tax. Solved•by intuit•updated 5 hours.

Form 2071 Download Fillable PDF or Fill Online Supervisor's Accident

From the dispositions section select form 2439. Go to the input return. Solved•by intuit•updated 5 hours ago. Whatever you call it, don't fear it. To enter the 2439 in the individual module:

Fill Free fillable IRS PDF forms

Claim a credit for the tax paid by the mutual fund. Attach copy b of form 2439 to your completed tax return. Whatever you call it, don't fear it. Complete copies a, b, c, and d for each shareholder for whom the regulated investment company (ric) or real estate investment trust (reit) paid tax. Web report the capital gain on.

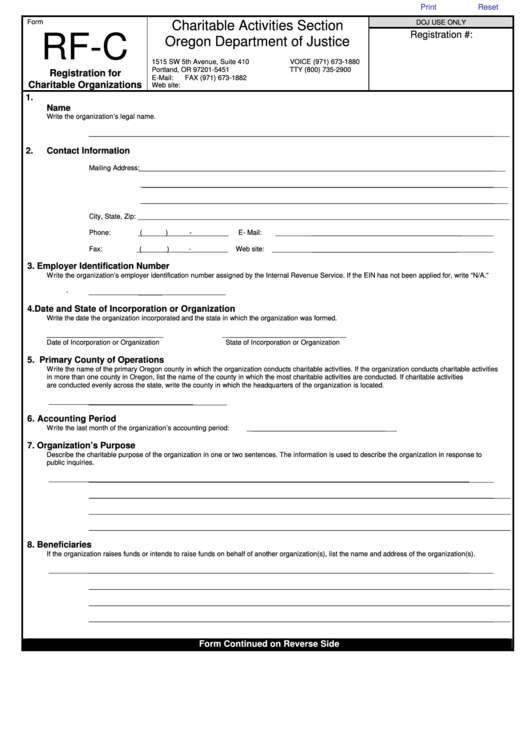

Fillable Form RfC Registration For Charitable Organizations (2011

Furnish copies b and c of form 2439 to the. Web entering form 2439 in proconnect. It will flow to your schedule d when it is entered into turbotax. To enter form 2439 go to investment. Turbotax helps you figure it out, and.

Fillable Form 2439 Notice To Shareholder Of Undistributed LongTerm

Solved•by intuit•updated 5 hours ago. Web •to report a gain from form 2439 or 6252 or part i of form 4797; Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits and. Complete copies.

Breanna Form 2439 Instructions 2019

Web ask for the information on this form to carry out the internal revenue laws of the united states. Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits and. •to report a gain.

10++ Capital Gains Tax Worksheet

Meaning of form 2439 as a finance term. Web the information on form 2439 is reported on schedule d. Turbotax helps you figure it out, and. Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040).

Web Entering Form 2439 In Proconnect.

Web ask for the information on this form to carry out the internal revenue laws of the united states. To enter the 2439 in the individual module: Web the information on form 2439 is reported on schedule d. •to report a gain or loss from form 4684, 6781, or 8824;

Turbotax Helps You Figure It Out, And.

Solved•by intuit•updated 5 hours ago. Claim a credit for the tax paid by the mutual fund. Go to the input return. Web report the capital gain on your income tax return for the year.

To Enter Form 2439 Go To Investment.

You are required to give us the information. Attach copy b of form 2439 to your completed tax return. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Web to enter form 2439 capital gains, complete the following:

Web •To Report A Gain From Form 2439 Or 6252 Or Part I Of Form 4797;

Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits and. Web to enter the 2439 in the individual module: •to report a gain or loss from a partnership, s. It will flow to your schedule d when it is entered into turbotax.