Form 2350 Vs 4868

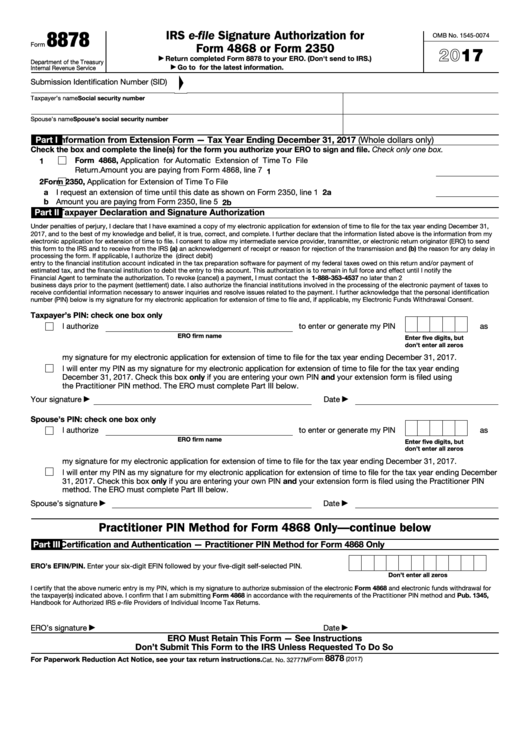

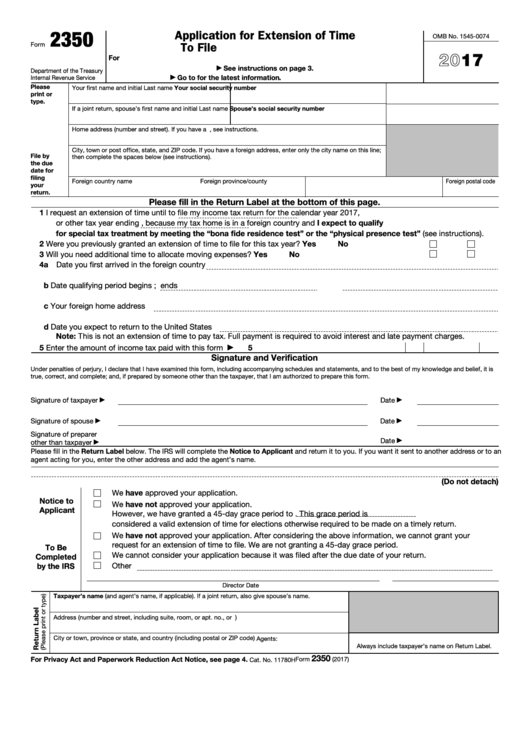

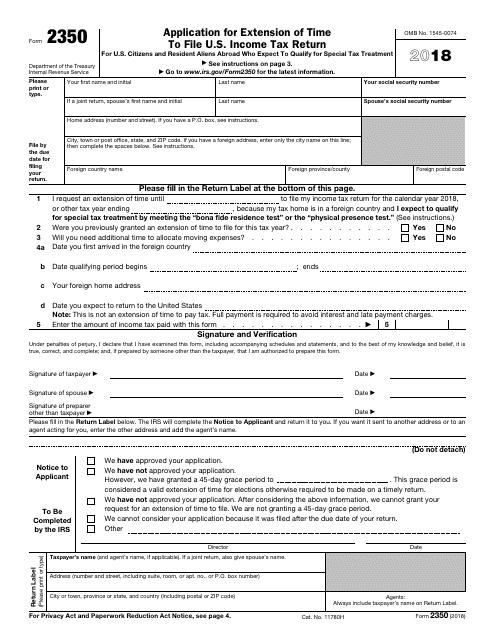

Form 2350 Vs 4868 - Citizens and resident aliens abroad. Citizens and resident aliens abroad who expect to qualify for special tax treatment) • tax form 8868 (application for extension of time to file exempt. You must meet specific criteria to use form 2350, so. Amount you are paying from form 4868, line 7. Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate the taxpayer’s personal. For a list of due dates, see 1040 irs. Web general instructions purpose of form use form 4868 to apply for 6 more months (4 if “out of the country” (defined on page 2) and a u.s. Enter a due date in the extended due date field on the ext screen. 1 form 2350, application for extension of time to file u.s. On the other hand, irs form 2350 is designed to aid new expatriates in qualifying for the foreign earned income exclusion.

Web • tax form 2350 (application for automatic extension of time to file u. Income tax return i request an extension. Citizen or resident files this form to request an automatic extension of time to file a u.s. For a list of due dates, see 1040 irs. Amount you are paying from form 4868, line 7. Complete, edit or print tax forms instantly. Upload, modify or create forms. Enter a due date in the extended due date field on the ext screen. Also, there are many key distinctions between them. If you are unable to file the fbar by the deadline, you may request an extension until october 15, 2023 by submitting form 4868, application for automatic extension of time to file u.s.

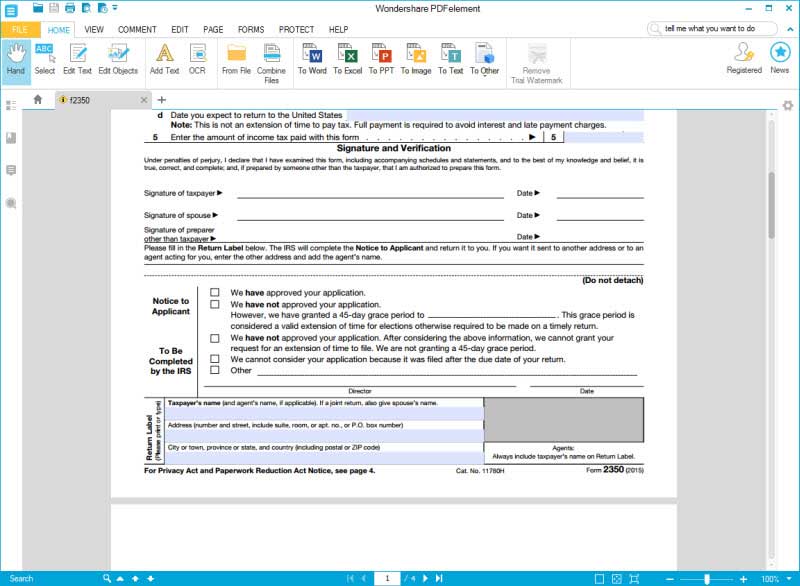

Web if, after meeting the qualifications for the “bona fide residence test” or the “physical presence test,” you remain abroad continuously for the following tax year (s) and require an extension, file form 4868. Web ultratax cs handles due dates for form 4868 and form 2350 differently. Income tax return i request an extension. The tables below show the reporting requirements for each form based upon how the pin is. 1 form 2350, application for extension of time to file u.s. For a list of due dates, see 1040 irs. Form 4868 is the regular extension form that is used. Try it for free now! Web • form 8878: Form 2350 is only to be used when you need additional time to file your return in order to qualify for the special tax treatment using the bona fide residence test or the physical presence test.

IRS Form 2350 Fill it with the Best Form Filler

Form 4868 is used to imply a standard extension to. Web what is form 4868 instructions? Form 4868 is the regular extension form that is used. The latter form is for taxpayers living outside the united states. Web extension of time to file (form 4868 or form 2350).

Form 2350 amulette

Citizen or resident files this form to request an automatic extension of time to file a u.s. Web form 4868, application for automatic extension of time to file u.s. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Income tax return i request an extension.

Fillable Form 8878 Irs EFile Signature Authorization For Form 4868

Web 1 best answer. Form 4868 is used to imply a standard extension to. Form 2350 doesn’t extend the time to pay taxes. Web this is the due date for filing the fbar for tax year 2022. Citizen or resident files this form to request an automatic extension of time to file a u.s.

Form 2350 Application for Extension of Time to File U.S. Tax

Web extension of time to file (form 4868 or form 2350). The latter form is for taxpayers living outside the united states. 1 form 2350, application for extension of time to file u.s. Web • tax form 2350 (application for automatic extension of time to file u. Web ultratax cs handles due dates for form 4868 and form 2350 differently.

Form 2350 Application for Extension of Time to File U.S. Tax

Ultratax cs automatically calculates the extension due date. Citizen or resident files this form to request an automatic extension of time to file a u.s. Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate the taxpayer’s personal. 1 form 2350,.

Fillable Form 2350 Application For Extension Of Time To File U.s

If you are unable to file the fbar by the deadline, you may request an extension until october 15, 2023 by submitting form 4868, application for automatic extension of time to file u.s. Income tax return i request an extension. On the other hand, irs form 2350 is designed to aid new expatriates in qualifying for the foreign earned income.

Form 2350 vs. Form 4868 What Is the Difference?

Web what is the difference between form 2350 and form 4868? If you are unable to file the fbar by the deadline, you may request an extension until october 15, 2023 by submitting form 4868, application for automatic extension of time to file u.s. Form 4868 is used to imply a standard extension to. The tables below show the reporting.

IRS Form 2350 2018 Fill Out, Sign Online and Download Fillable PDF

Complete, edit or print tax forms instantly. Form 4868 is the regular extension form that is used. Web • form 8878: Citizen or resident files this form to request an automatic extension of time to file a u.s. Amount you are paying from form 4868, line 7.

EFile Form 7004 and Form 4868 Today! YouTube

Web this is the due date for filing the fbar for tax year 2022. If you are unable to file the fbar by the deadline, you may request an extension until october 15, 2023 by submitting form 4868, application for automatic extension of time to file u.s. Web what is form 4868 instructions? Web if, after meeting the qualifications for.

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Ultratax cs automatically calculates the extension due date. Upload, modify or create forms. The tables below show the reporting requirements for each form based upon how the pin is. Web • tax form 2350 (application for automatic extension of time to file u. Web form 4868 is used for requesting for a normal extension until october 15.

Web 1 Best Answer.

Amount you are paying from form 4868, line 7. Web if, after meeting the qualifications for the “bona fide residence test” or the “physical presence test,” you remain abroad continuously for the following tax year (s) and require an extension, file form 4868. Ultratax cs automatically calculates the extension due date. Also, there are many key distinctions between them.

Online Technologies Make It Easier To Organize Your File Management And Boost The Efficiency Of The Workflow.

Income tax return i request an extension. Web • tax form 2350 (application for automatic extension of time to file u. Enter a due date in the extended due date field on the ext screen. Web what is the difference between form 2350 and form 4868?

Citizens And Resident Aliens Abroad Who Expect To Qualify For Special Tax Treatment) • Tax Form 8868 (Application For Extension Of Time To File Exempt.

Form 4868 is used to imply a standard extension to. Web extension of time to file (form 4868 or form 2350). Web ultratax cs handles due dates for form 4868 and form 2350 differently. For a list of due dates, see 1040 irs.

Web General Instructions Purpose Of Form Use Form 4868 To Apply For 6 More Months (4 If “Out Of The Country” (Defined On Page 2) And A U.s.

Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! You must meet specific criteria to use form 2350, so. Web this is the due date for filing the fbar for tax year 2022.