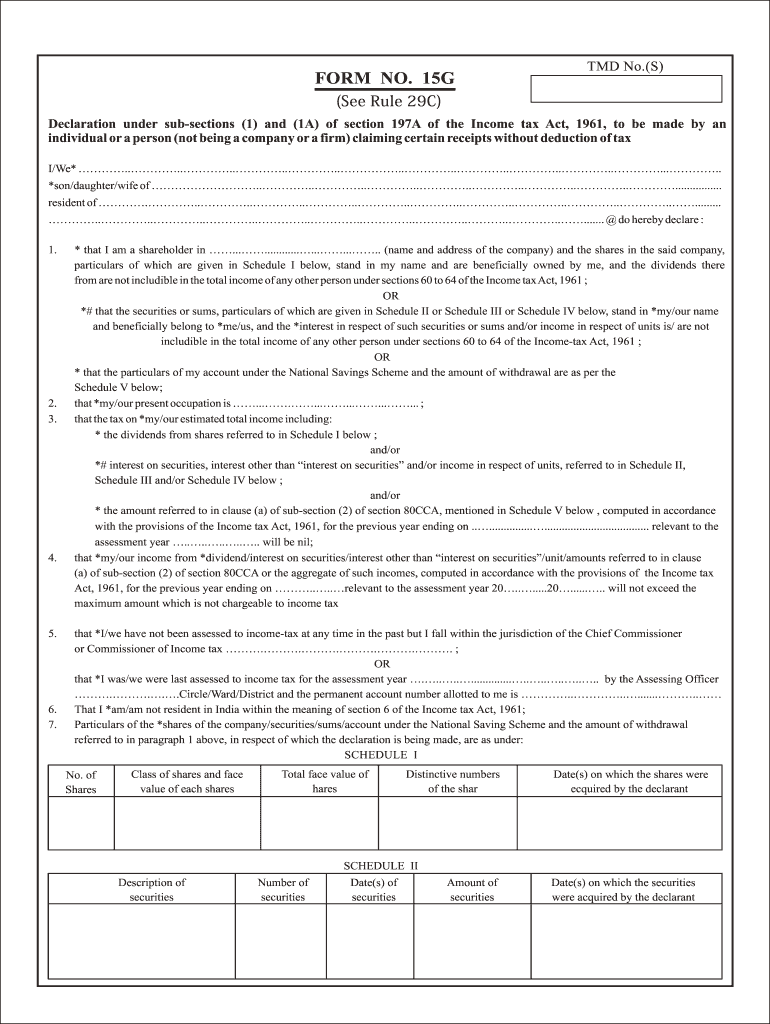

Form 15G For Pf Withdrawal Pdf

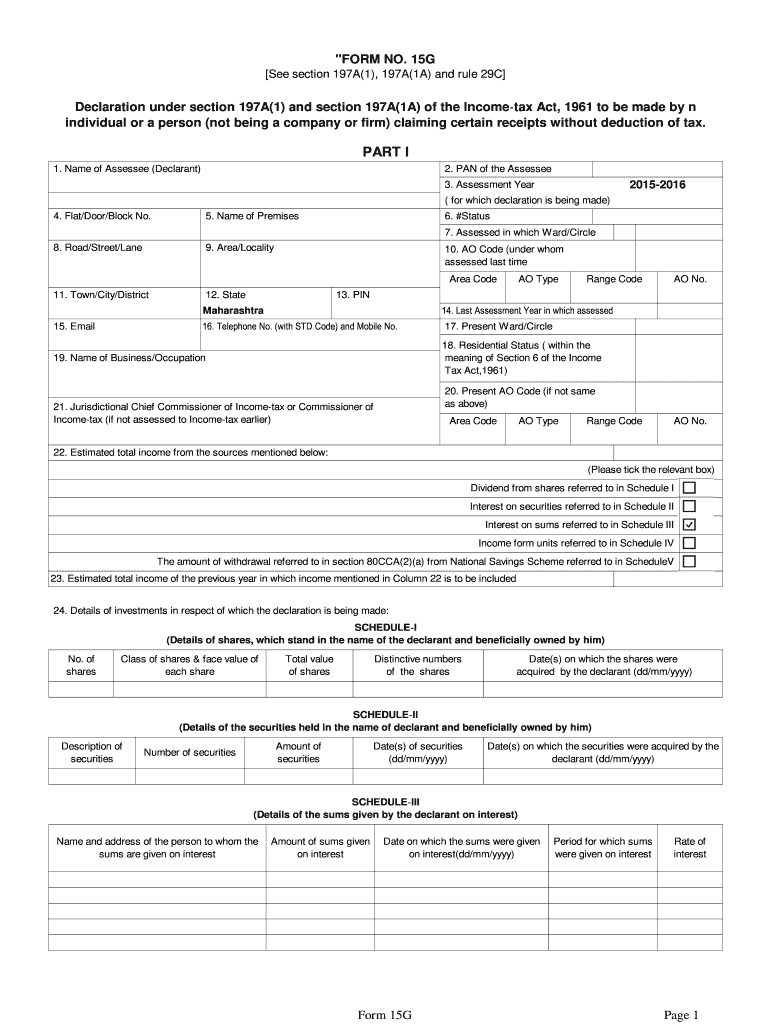

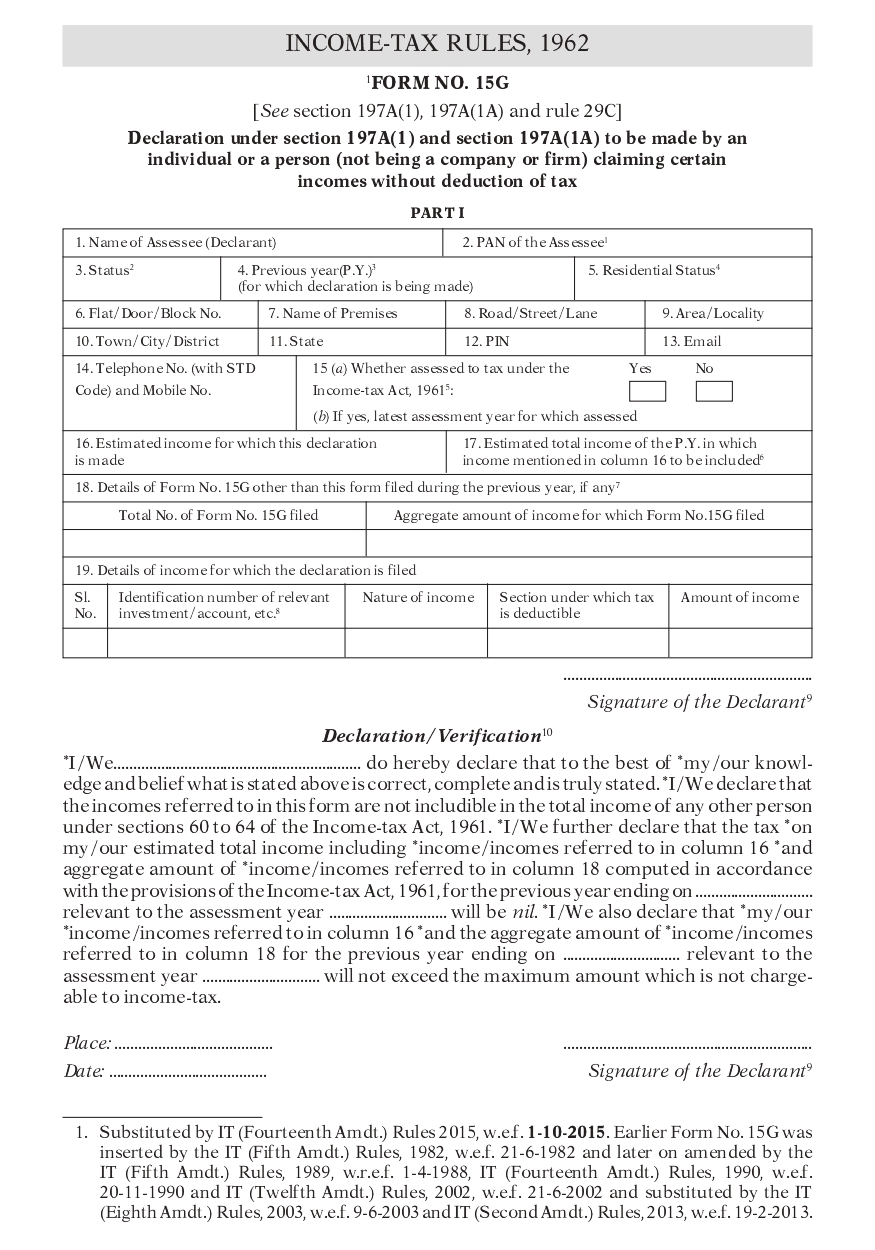

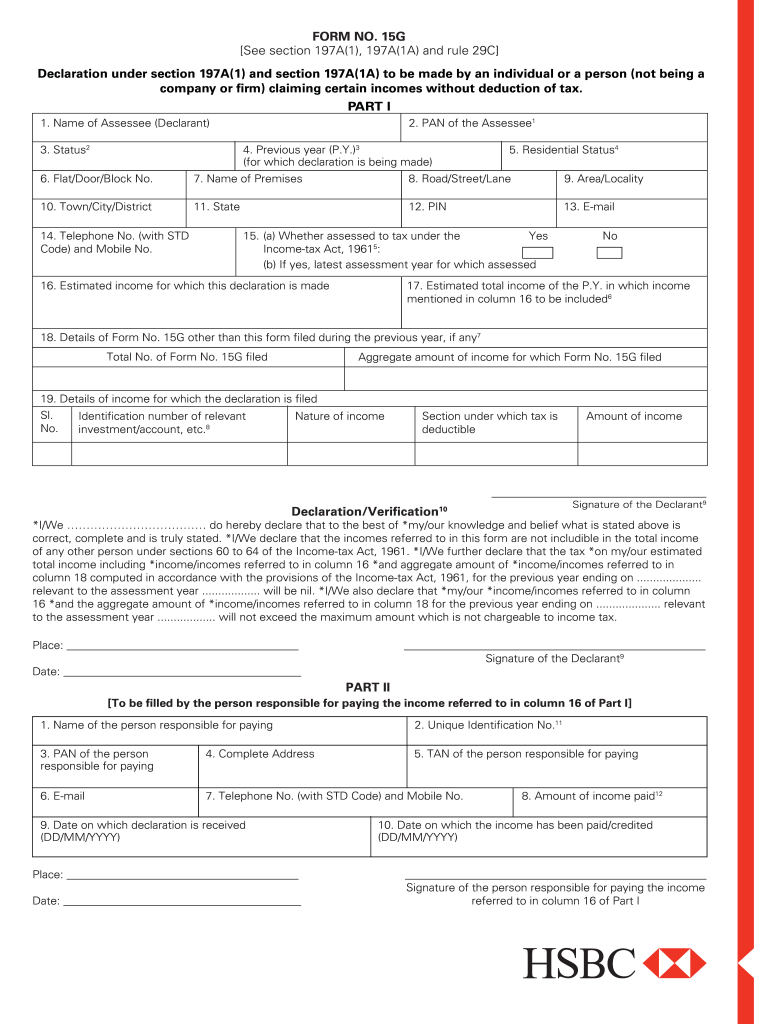

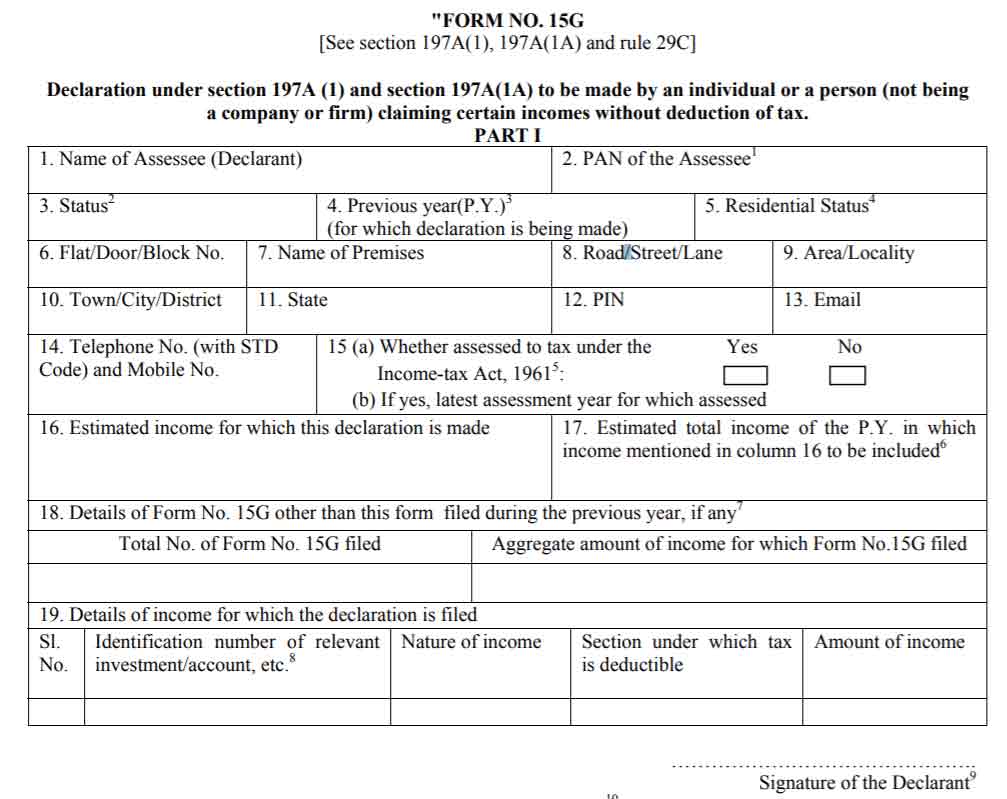

Form 15G For Pf Withdrawal Pdf - Web how to download form 15g for pf withdrawal? B) tds will be deducted @ maximum marginal rate (i:e. How to fill form 15g, download form 15g for pf withdrawal. The steps to upload form 15g in the portal are given below: Make sure your form 15g is less than 1 mb. Field 1 (name of the assessee): Furthermore, you can also visit the income tax department’s official website for the same. Fill the part 1 of the form and convert it into pdf. Name of assesse (declarant) status (an individual or huf) previous year residential status address details along with pin code, email, and telephone number. Upload the pdf copy of the form while making an online claim.

Form 15h is for senior citizens. Make sure your form 15g is less than 1 mb. The steps to upload form 15g in the portal are given below: Below the option, 'i want to apply for', click on upload form 15g as depicted in the image. Field 2 (pan of the assessee): Web how to fill form 15g for pf withdrawal login to epfo uan unified portal for members. Field 1 (name of the assessee): It is more than rs. Form 15g download in word format for pf withdrawal 2020. How to fill form 15g.

Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to ensure that no tds (tax deduction at source) is deducted from their interest income in a year. It is more than rs. How to fill form 15g for pf withdrawal 2020. Name of the person who is withdrawing pf amount. This facility is available on the unified member portal. Part i name of assessee (declarant) pan of the assessee Search for the “upload form 15g” option to obtain the form downloaded on your pc or mobile. Web criteria your age should be less then 60 years. Web form 15g is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and huf) to ensure that no tds (tax deduction at source) is deducted from their interest income for the fiscal. Form 15h is for senior citizens.

Perfect Programs Storage 15G FOR PF WITHDRAWAL FREE DOWNLOAD

Web from where to get form15g in pdf or excel? Web form 15g sample pdf download. Furthermore, you can also visit the income tax department’s official website for the same. 10,000 in a financial year. It is more than rs.

Form 15g For Pf Withdrawal Pdf Fill Online, Printable, Fillable

Tds will be deducted under section 192a of income tax act, 1961. Web to fill the form 15g for pf withdrawal, you will need to add the following detials. Then you can fill form 15g epfo. Web form 15g sample pdf download. Tds will be deducted at the rate of 10 per cent provided pan is submitted.

Form 15G How to Fill Form 15G for PF Withdrawal MoneyPiP

As an exception if your income is below the taxable limit you can submit self. Learn all the basics how to fill, eligibility, download and rules Web form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal. 34.608%) if employee.

Sample Filled Form 15G & 15H for PF Withdrawal in 2021 Invoice Format

It is more than rs. Pan number of the person withdrawing pf. Furthermore, you can also visit the income tax department’s official website for the same. The steps to upload form 15g in the portal are given below: Form 15h is for senior citizens.

Form 15g Sample Pdf Download Fill Online, Printable, Fillable, Blank

How to upload form 15g for pf withdrawl? 10,000 in a financial year. Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to ensure that no tds (tax deduction at source) is deducted from their interest income in a year. Name of assesse (declarant) status.

Form 15g for pf withdrawal download

Upload the pdf copy of the form while making an online claim. Incometaxindia.gov.in is an official government website for income tax needs. B) tds will be deducted @ maximum marginal rate (i:e. Tds will be deducted at the rate of 10 per cent provided pan is submitted. It is more than rs.

KNOWLEDGE BLOG ON "INDIAN LABOUR LAW AND HUMAN RESOURCE" ADVOCATE

B) tds will be deducted @ maximum marginal rate (i:e. Now login to the uan website with the help of your. Upload the pdf copy of the form while making an online claim. Make sure your form 15g is less than 1 mb. Web verify the last 4 digits of the phone number, and your pf withdrawal form will be.

Form 15G for PF withdrawal a simple way of filling online Anamika

Web income tax department 15g form download pdf here. As an exception if your income is below the taxable limit you can submit self. 34.608%) if employee fails to submit pan. How to submit form 15g online for pf withdrawal. You can get form 15g from epfo’s online portal or the websites of major banks.

[PDF] PF Withdrawal Form 15G PDF Download

Field 2 (pan of the assessee): As an exception if your income is below the taxable limit you can submit self. Web form 15g sample pdf download. Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to ensure that no tds (tax deduction at source).

Form 15g Download In Word Format Fill Online, Printable, Fillable

How to fill form 15g for pf withdrawal 2020. Below the option, 'i want to apply for', click on upload form 15g as depicted in the image. Web form 15g sample pdf download. Web download 15g form pdf for pf withdrawal. Web how to fill form 15g for pf withdrawal in 2022.

Web How To Fill Form 15G For Pf Withdrawal In 2022.

Below the option, 'i want to apply for', click on upload form 15g as depicted in the image. Part i name of assessee (declarant) pan of the assessee You can get form 15g from epfo’s online portal or the websites of major banks. Web income tax department 15g form download pdf here.

Tds Will Be Deducted Under Section 192A Of Income Tax Act, 1961.

Web form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal. Form 15g download in word format for pf withdrawal 2020. Pan number of the person withdrawing pf. How to submit form 15g online for pf withdrawal.

Web To Fill The Form 15G For Pf Withdrawal, You Will Need To Add The Following Detials.

Field 1 (name of the assessee): Name of the person who is withdrawing pf amount. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. How to fill form 15g, download form 15g for pf withdrawal.

How To Fill Form 15G For Pf Withdrawal 2020.

Tds will be deducted at the rate of 10 per cent provided pan is submitted. Declaration under section 197a (1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax. 34.608%) if employee fails to submit pan. Click on the online services option \u2013 claim (form 31, 19, 10c).

![[PDF] PF Withdrawal Form 15G PDF Download](https://pdfcity.in/wp-content/uploads/2021/10/PF-Withdrawal-Form-15G.png)