Form 15111 Irs

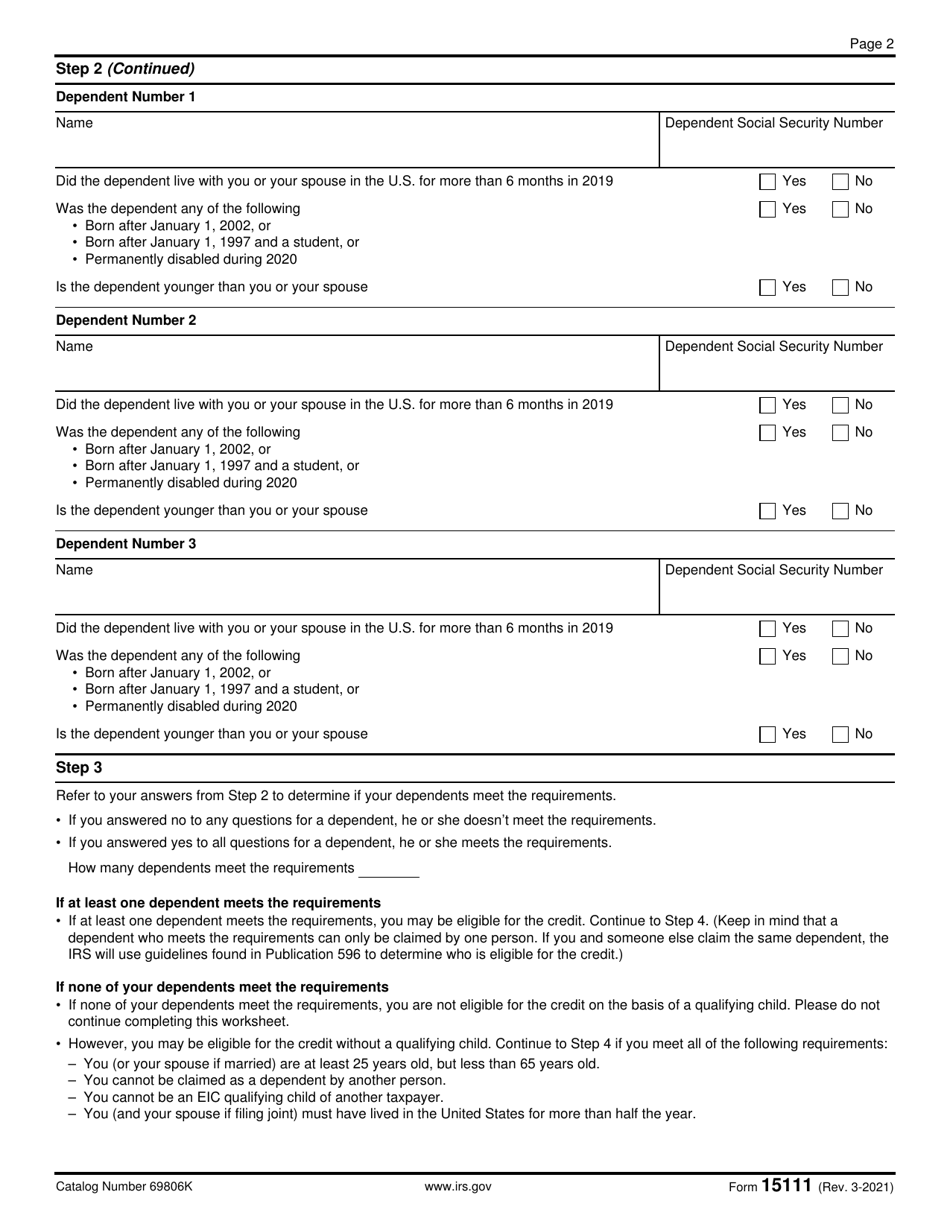

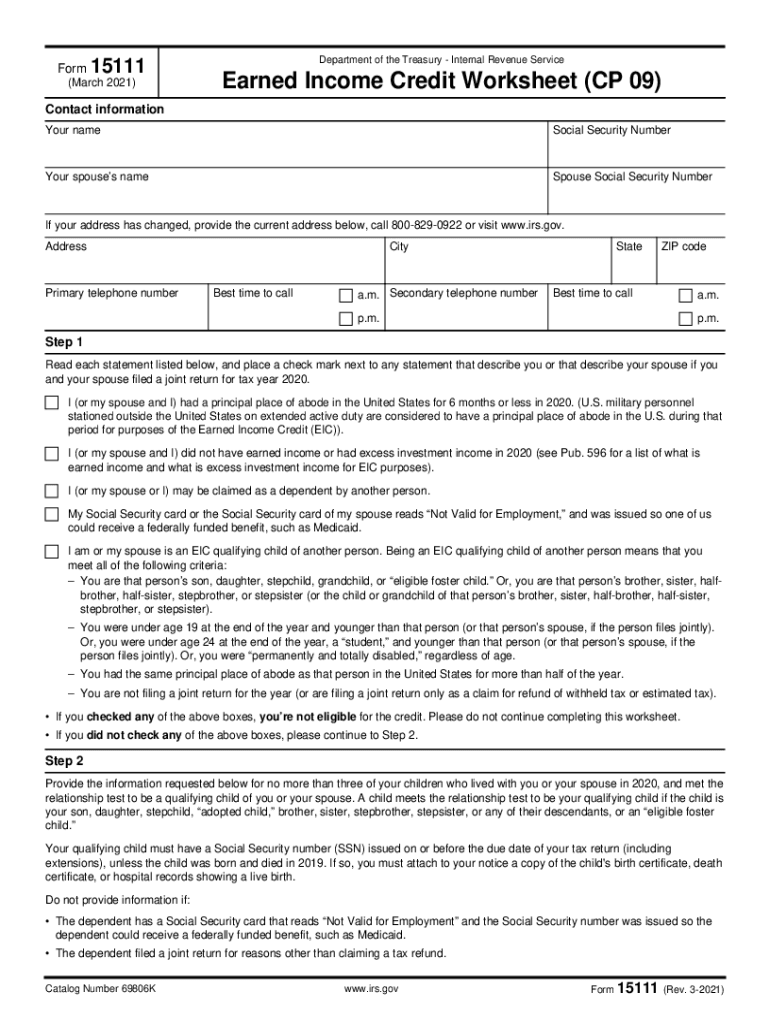

Form 15111 Irs - Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Did you receive a letter from the irs about the eitc? If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Find out what to do. In this article, we’ll walk you through: Earned income credit worksheet (cp 09) (irs) form is 3 pages long and contains: Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Refer to your notice cp09 for information on the document upload tool.

This is an irs internal form. Refer to your notice cp09 for information on the document upload tool. Earned income credit worksheet (cp 09) (irs) form is 3 pages long and contains: Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 : In this article, we’ll walk you through: Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the taxpayer within 6 to 8 weeks. Let’s begin with a brief rundown of this tax form.

Web in this case, you may need to complete irs form 15111 to determine your eligibility and to claim an eitc refund. Let’s begin with a brief rundown of this tax form. How to claim the eitc using irs form 15111. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web what you need to do. Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Refer to your notice cp09 for information on the document upload tool. This is an irs internal form.

I sent in my form 15111 for 2020 and i got an updated date on my

They should have sent it to you to complete if they wanted you to send it back to them. Form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. Let’s begin with a brief rundown of this tax form. This is an irs internal form. Web form.

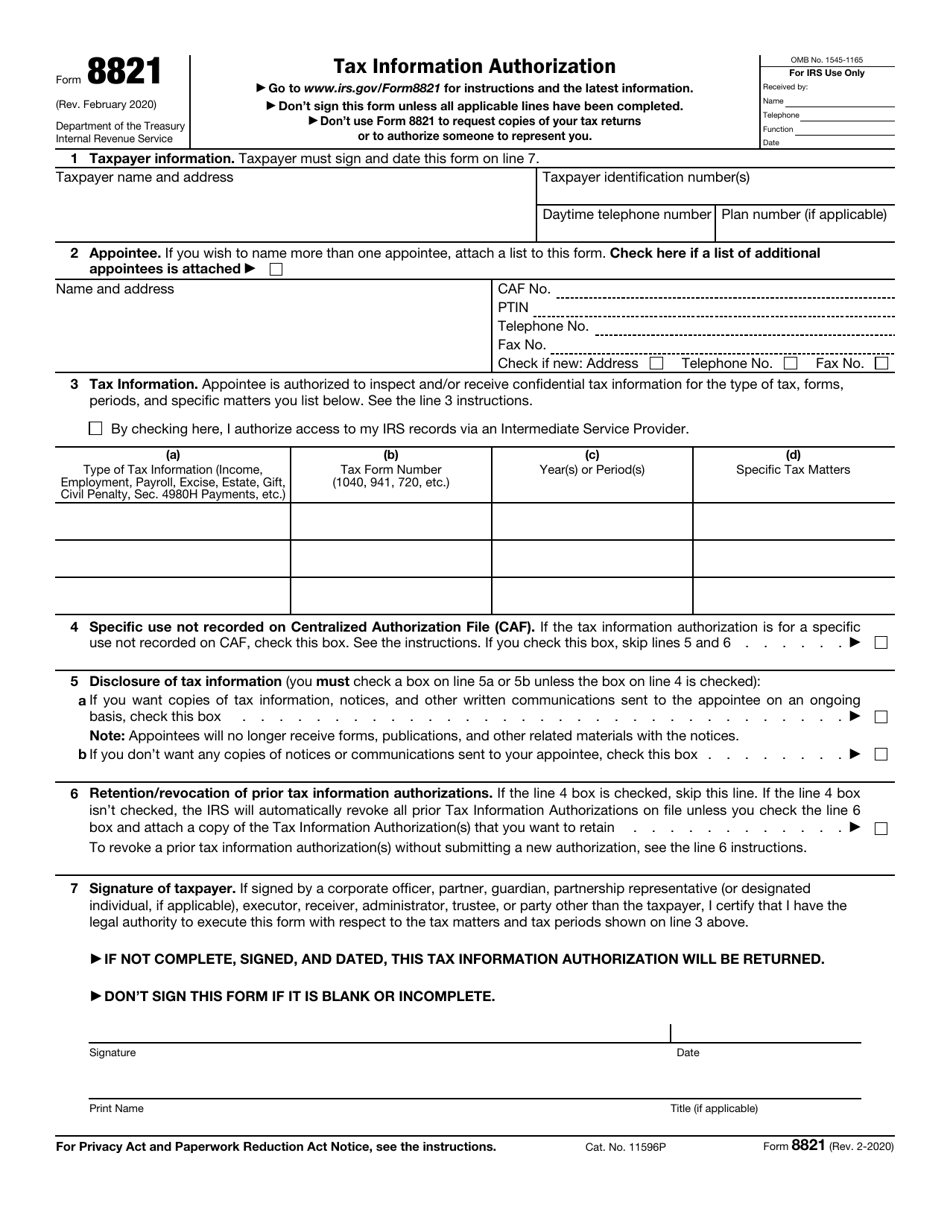

IRS Form 8821 Download Fillable PDF or Fill Online Tax Information

Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Find out what to do. Web what you need to do. How to claim the eitc using irs form 15111. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic.

Irs Form 1065 K1 Leah Beachum's Template

Refer to your notice cp09 for information on the document upload tool. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Web the irs will use the information in form 15111 along with the tax return to.

IRS Form 15111 Download Fillable PDF or Fill Online Earned

You can view a sample form 15111 worksheet on the irs website. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. They should have sent it to you to complete if they wanted you to send it back to them. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 :.

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Web if you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web what you need to do. You can view a sample form 15111.

Form 15111? r/IRS

This is an irs internal form. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Earned income credit worksheet (cp 09) (irs) form is 3 pages long and contains: You can view a sample form 15111 worksheet on the irs website. Web the irs will use the information in form 15111 along with.

15111 Form Fill Online, Printable, Fillable, Blank pdfFiller

They should have sent it to you to complete if they wanted you to send it back to them. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 : Complete earned income credit worksheet on form 15111, earned income credit.

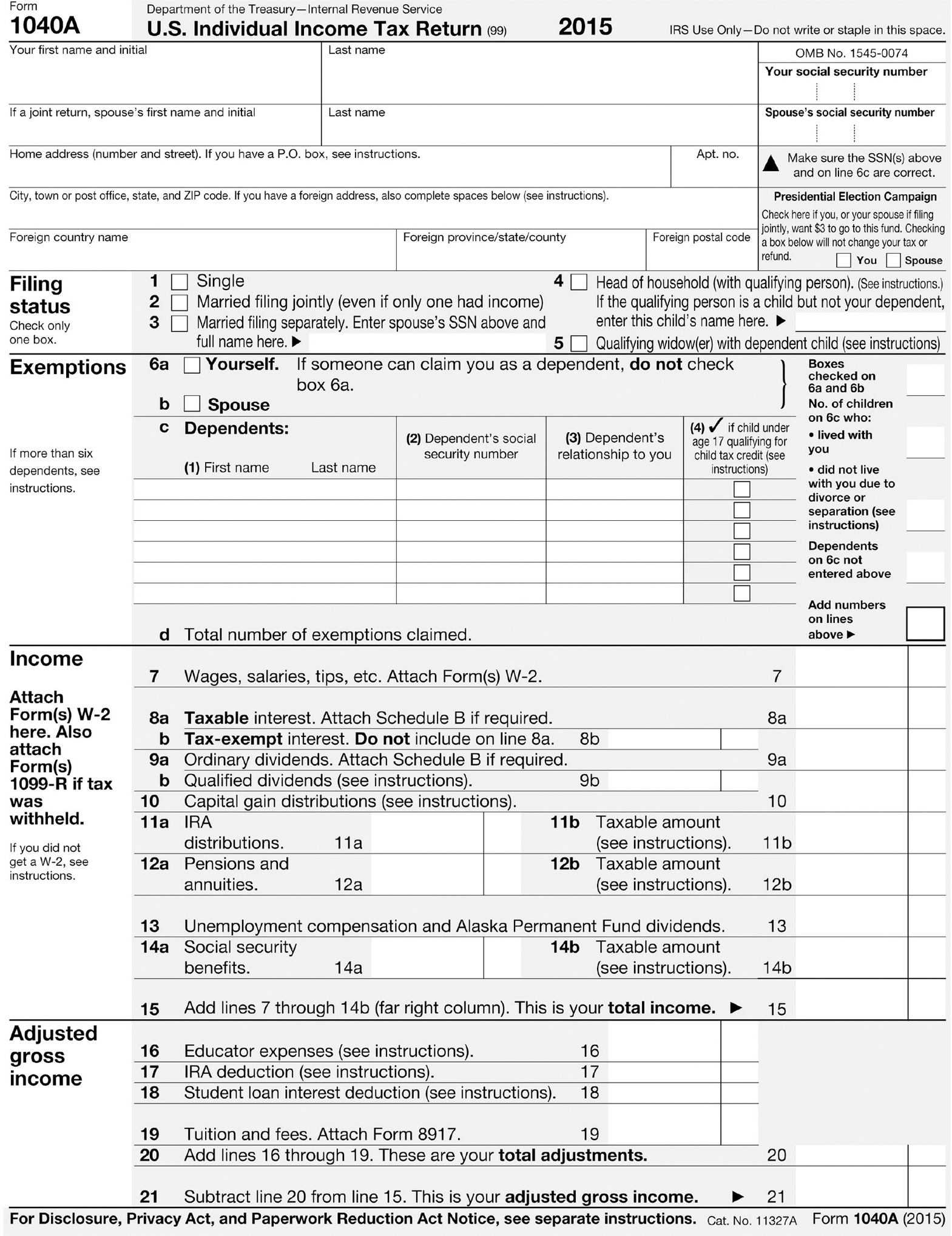

Sample Forms Paying for College Without Going Broke Princeton

Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web what you need to do. Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your.

IRS Form 1120C Download Fillable PDF or Fill Online U.S. Tax

Let’s begin with a brief rundown of this tax form. Earned income credit worksheet (cp 09) (irs) form is 3 pages long and contains: Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the taxpayer within.

Form 15111 (May be eligible for EIC) r/IRS

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 : Let’s begin with a brief rundown of this tax form. Earned income credit worksheet (cp 09) mar 2023 : Earned income.

Web The Irs Will Use The Information In Form 15111 Along With The Tax Return To Determine If The Taxpayer Qualifies For Eic And For How Much And Will Mail A Check To The Taxpayer Within 6 To 8 Weeks.

Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Web in this case, you may need to complete irs form 15111 to determine your eligibility and to claim an eitc refund. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. How to claim the eitc using irs form 15111.

Let’s Begin With A Brief Rundown Of This Tax Form.

Web if you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Refer to your notice cp09 for information on the document upload tool. Did you receive a letter from the irs about the eitc? They should have sent it to you to complete if they wanted you to send it back to them.

Web What You Need To Do.

You can view a sample form 15111 worksheet on the irs website. Find out what to do. This is an irs internal form. Earned income credit worksheet (cp 09) mar 2023 :

Form 15111 Is A Worksheet To Help You Determine Whether You Qualify For The Eic Based On The Dependents Listed On Your Return.

If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. In this article, we’ll walk you through: Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it.