Form 13873 E

Form 13873 E - Only list a spouse if their own. Web ein and “2022 form 1041” on the payment. For filers of form 1120, include the amount. Online, by telephone, or by. Any version of irs form 13873 that clearly states that the form is provided to the. Qualifying foreign trade income generally, qualifying. The income verification express service (ives) program is used by mortgage lenders and others within the financial. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Irs has no record of a tax return. Web there are several versions of irs form 13873 (e.g.

Web there are several versions of irs form 13873 (e.g. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of schedule e. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the. Online, by telephone, or by. Irs has no record of a tax return. Web what is irs form 13873 e? Signatures are required for any taxpayer listed. Section a — foreign trade income. For filers of form 1120, include the amount.

Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web the authorization must come from you in form of signed 4506t or power of attorney. Online, by telephone, or by. Signatures are required for any taxpayer listed. If you are not using marginal costing, skip part iii and go to part iv. Irs has no record of a tax return. Only list a spouse if their own. Web executive order 13873 of may 15, 2019 securing the information and communications technology and services supply chain It sounds like a fraud. Any version of irs form 13873 that clearly states that the form is provided to the.

2010 Form IRS 433F Fill Online, Printable, Fillable, Blank PDFfiller

Signatures are required for any taxpayer listed. If you are not using marginal costing, skip part iii and go to part iv. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of schedule e. Online, by telephone, or by. Any version of irs form 13873.

Irs W9 Forms 2020 Printable Pdf Example Calendar Printable

The address is for kansas city 1040 processing center. Web the authorization must come from you in form of signed 4506t or power of attorney. Web there are several versions of irs form 13873 (e.g. Web income verification express service. It sounds like a fraud.

13873 E Lehigh Ave C, Aurora, CO 2 Bed, 1 Bath Condo 11 Photos

Web what is irs form 13873 e? Web ein and “2022 form 1041” on the payment. The income verification express service (ives) program is used by mortgage lenders and others within the financial. Web there are several versions of irs form 13873 (e.g. If you are not using marginal costing, skip part iii and go to part iv.

EDGAR Filing Documents for 000075068620000052

Web there are several versions of irs form 13873 (e.g. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of schedule e. The address is for kansas city 1040 processing center. Online, by telephone, or by. Any version of irs form 13873 that clearly states.

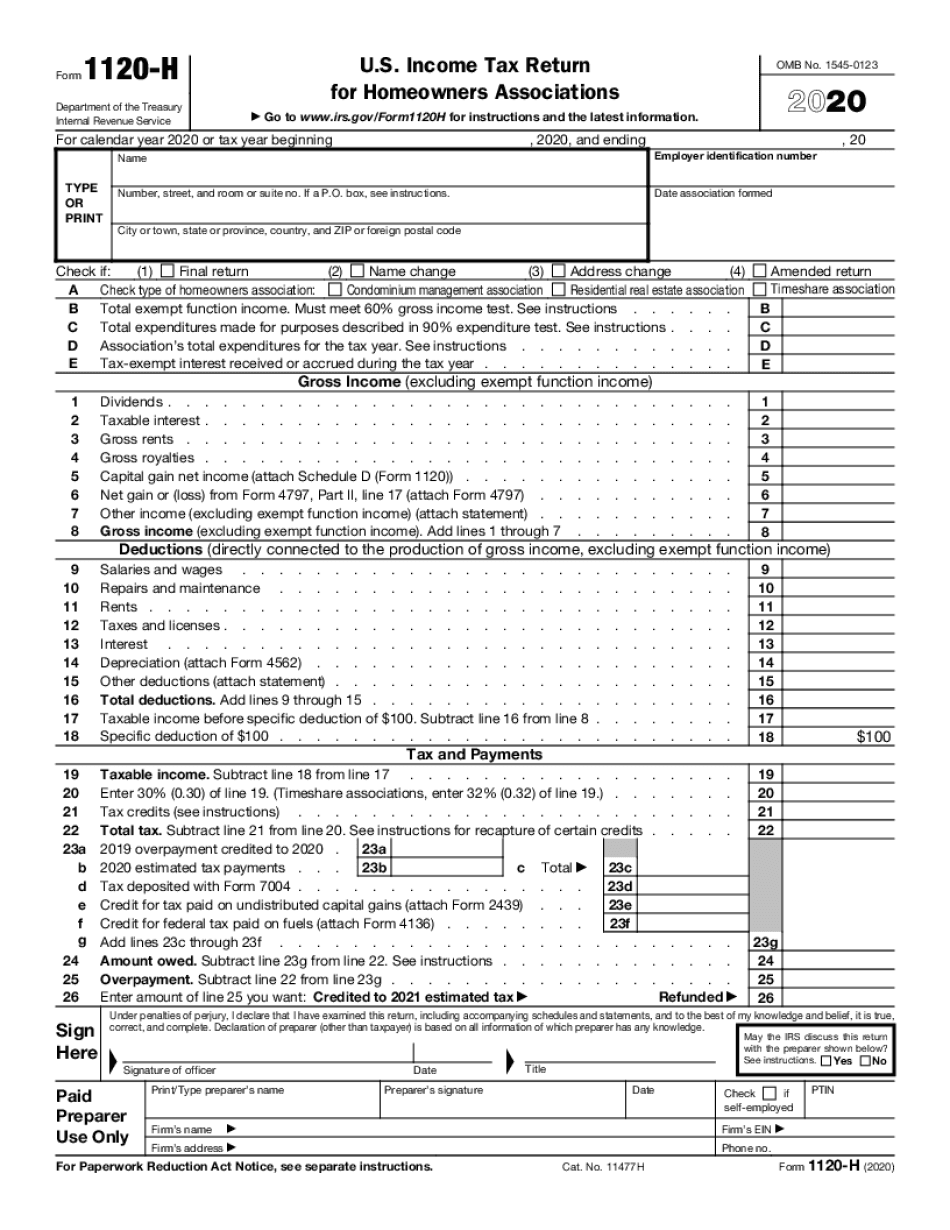

Edit Document Form 1120 With Us Fastly, Easyly, And Securely

The income verification express service (ives) program is used by mortgage lenders and others within the financial. If you are not using marginal costing, skip part iii and go to part iv. Web executive order 13873 of may 15, 2019 securing the information and communications technology and services supply chain Web there are several versions of irs form 13873 (e.g..

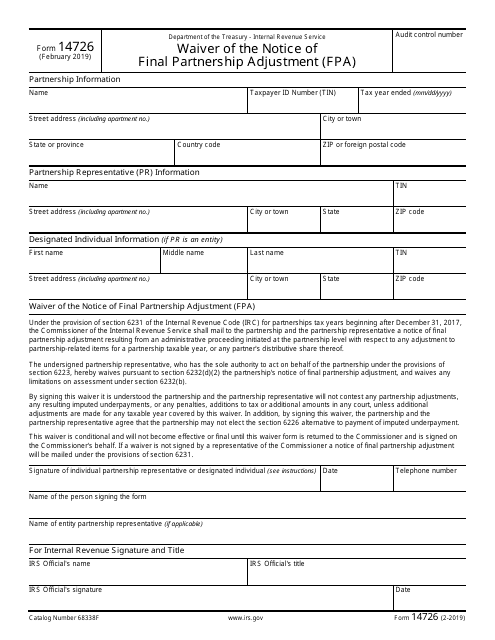

IRS Form 14726 Download Fillable PDF or Fill Online Waiver of the

Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of schedule e. Web the authorization must come from you in form of signed 4506t or power of attorney. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying.

Form 4506t Printable

If you are not using marginal costing, skip part iii and go to part iv. Signatures are required for any taxpayer listed. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. It sounds like a fraud. Only list a spouse if their own.

2014 Form IRS 14653 Fill Online, Printable, Fillable, Blank pdfFiller

Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Web the authorization must come from you in form of signed 4506t or power of attorney. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i.

Compilation Error undeclared identifier trying to pass values from

Any version of irs form 13873 that clearly states that the form is provided to the. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Online, by telephone, or by. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web.

IRS Identity Theft Forms National Affinity Services

Signatures are required for any taxpayer listed. If you are not using marginal costing, skip part iii and go to part iv. Only list a spouse if their own. Online, by telephone, or by. Web the authorization must come from you in form of signed 4506t or power of attorney.

Qualifying Foreign Trade Income Generally, Qualifying.

Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. The address is for kansas city 1040 processing center. Web there are several versions of irs form 13873 (e.g. Section a — foreign trade income.

Online, By Telephone, Or By.

Web income verification express service. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of schedule e. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Any version of irs form 13873 that clearly states that the form is provided to the.

Web Ein And “2022 Form 1041” On The Payment.

It sounds like a fraud. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web what is irs form 13873 e? Web the authorization must come from you in form of signed 4506t or power of attorney.

If You Are Not Using Marginal Costing, Skip Part Iii And Go To Part Iv.

Only list a spouse if their own. Web there are several versions of irs form 13873 (e.g. For filers of form 1120, include the amount. Signatures are required for any taxpayer listed.