Form 1120F Instructions

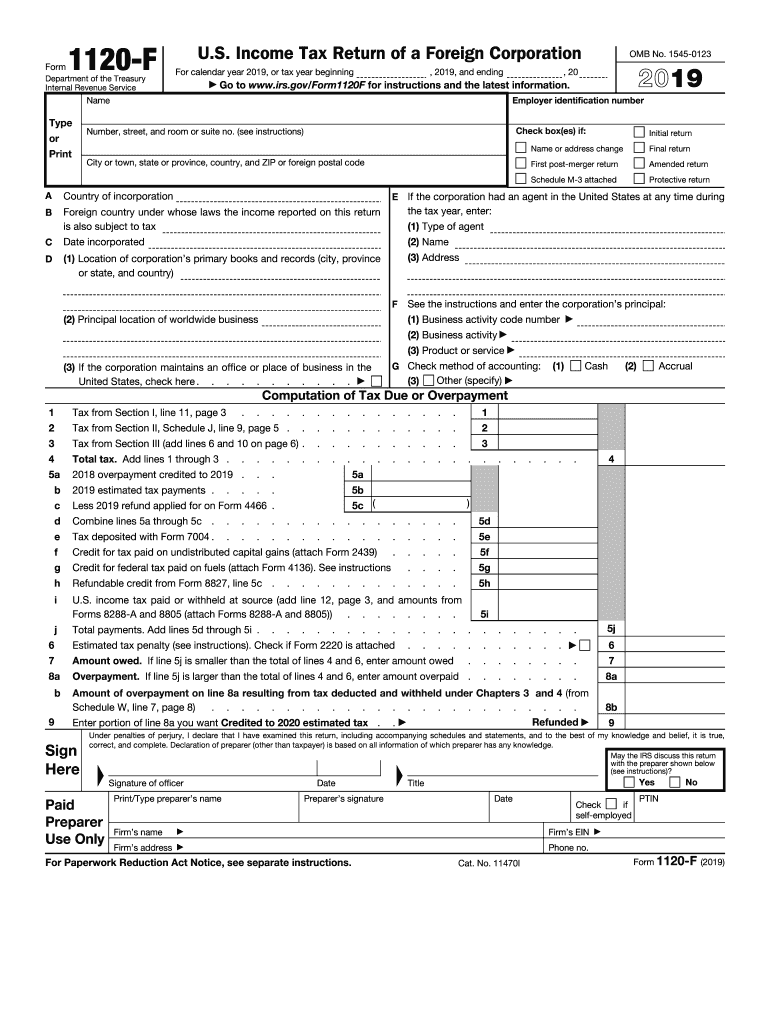

Form 1120F Instructions - Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Depreciation of qualified improvement property (see instructions) 10. Eligible net income of an international banking facility (see instructions) 8. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Number, street, and room or suite no. Prior versions will be available on irs.gov. For instructions and the latest information. Income tax liability of a foreign corporation. Film, television, and live theatrical production expenses (see instructions) 11. A foreign corporation files this form to report their income, gains, losses, deductions, credits, and to.

Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending, 20. Income tax liability of a foreign corporation. For instructions and the latest information. 168(k), irc, special bonus depreciation (see instructions) 9. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Number, street, and room or suite no. Prior versions will be available on irs.gov. Eligible net income of an international banking facility (see instructions) 8.

A foreign corporation files this form to report their income, gains, losses, deductions, credits, and to. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending, 20. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. For instructions and the latest information. 168(k), irc, special bonus depreciation (see instructions) 9. Number, street, and room or suite no. Eligible net income of an international banking facility (see instructions) 8. Depreciation of qualified improvement property (see instructions) 10. Prior versions will be available on irs.gov.

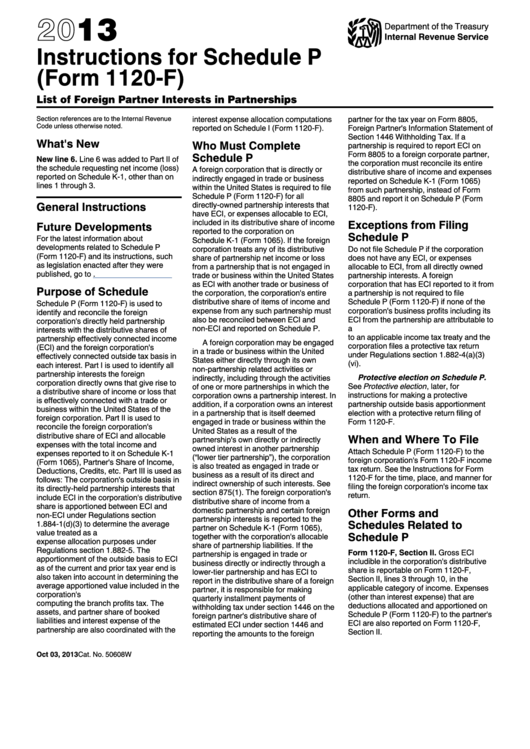

Form 1120F Instructions For Schedule P List Of Foreign Partner

168(k), irc, special bonus depreciation (see instructions) 9. For instructions and the latest information. Eligible net income of an international banking facility (see instructions) 8. Income tax liability of a foreign corporation. Prior versions will be available on irs.gov.

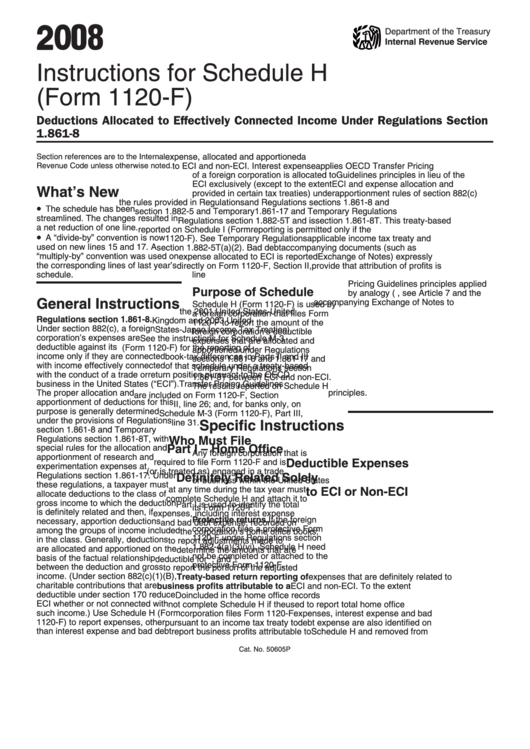

Instructions For Schedule H (Form 1120F) 2008 printable pdf download

For instructions and the latest information. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. A foreign corporation files this form to report their income, gains, losses, deductions, credits,.

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending, 20. 168(k), irc, special bonus depreciation (see instructions) 9. Prior versions will be available on irs.gov. Income tax liability of a foreign corporation. Film, television, and live theatrical production expenses (see instructions) 11.

Form 1120 instructions 2016

Prior versions will be available on irs.gov. Depreciation of qualified improvement property (see instructions) 10. Income tax liability of a foreign corporation. Number, street, and room or suite no. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending, 20.

Fill Free fillable form 1120w estimated tax for corporations 2019

A foreign corporation files this form to report their income, gains, losses, deductions, credits, and to. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Income tax liability of a foreign corporation. Eligible net income of an international banking facility (see instructions) 8. Corporation income tax return, to report the income, gains, losses, deductions,.

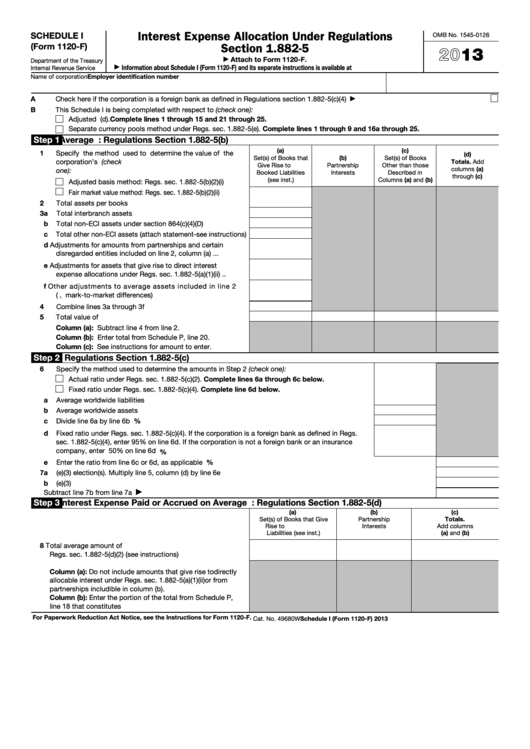

Fillable Schedule I (Form 1120F) Interest Expense Allocation Under

For instructions and the latest information. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Depreciation of qualified improvement property (see instructions) 10. Income tax liability of a foreign corporation. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an

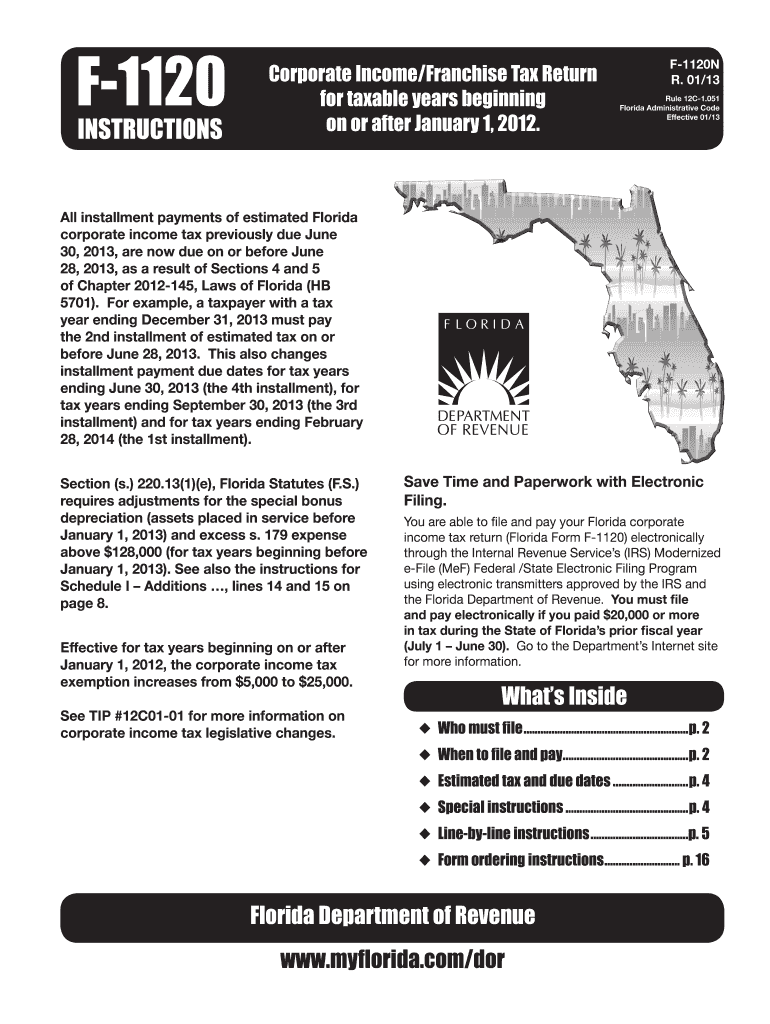

Fl F 1120 Instructions Form Fill Out and Sign Printable PDF Template

Eligible net income of an international banking facility (see instructions) 8. 168(k), irc, special bonus depreciation (see instructions) 9. Prior versions will be available on irs.gov. Income tax liability of a foreign corporation. Depreciation of qualified improvement property (see instructions) 10.

Form 1120 Filing Instructions

Prior versions will be available on irs.gov. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending, 20. For instructions and the latest information. Income tax liability of a foreign.

2019 Form IRS 1120F Fill Online, Printable, Fillable, Blank pdfFiller

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Prior versions will be available on irs.gov. 168(k), irc, special bonus depreciation (see instructions) 9. Eligible net income of an international banking facility (see instructions) 8. Number, street, and room or suite no.

Form 1120 Schedule J Instructions

Depreciation of qualified improvement property (see instructions) 10. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Prior versions will be available on irs.gov. Film, television, and live theatrical production expenses (see instructions) 11. Income tax liability of a foreign corporation.

Income Tax Liability Of A Foreign Corporation.

Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Depreciation of qualified improvement property (see instructions) 10. 168(k), irc, special bonus depreciation (see instructions) 9. Film, television, and live theatrical production expenses (see instructions) 11.

Prior Versions Will Be Available On Irs.gov.

For instructions and the latest information. Number, street, and room or suite no. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending, 20. Eligible net income of an international banking facility (see instructions) 8.

Unless Exempt Under Section 501, All Domestic Corporations (Including Corporations In Bankruptcy) Must File An

A foreign corporation files this form to report their income, gains, losses, deductions, credits, and to. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.