Form 1116 Instruction

Form 1116 Instruction - Web for more information on calculating your allowable foreign tax credit, see form 1116 instructions and irs publication 514. Election to claim the foreign tax credit without filing form 1116. Web form 1116 is one tax form every u.s. To be eligible for the foreign tax credit, four stipulations must be met: There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web form 1116 instructions step one: You must prepare form 1116 if your. Foreign taxes not eligible for a credit. Foreign taxes eligible for a credit. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer.

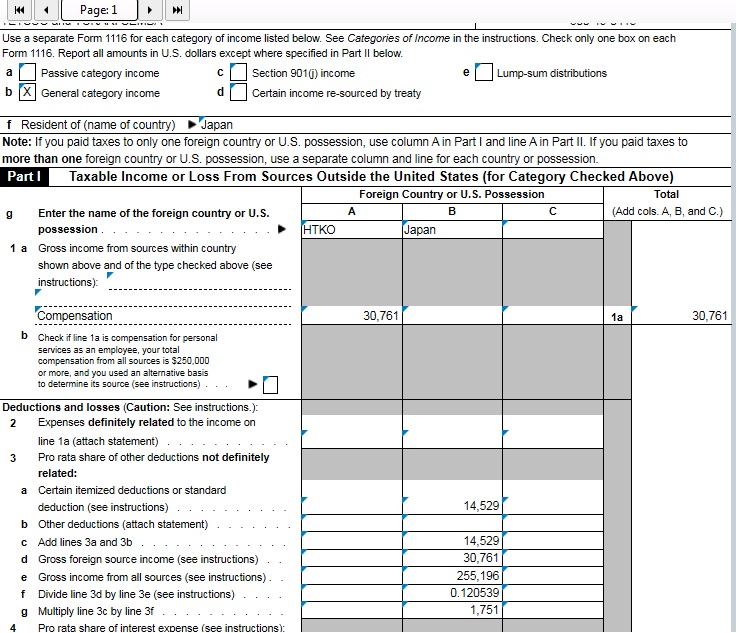

To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i, line. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they. Web how to claim the foreign tax credit. You provide detailed information using each of the form's four sections:. In a nutshell, the high tax passive income on page one, line 1a is backed out of the. Web for instructions and the latest information. Enter the gross income (not the tax) of this category type where indicated. Foreign taxes eligible for a credit. Your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the. See the instructions for line 12, later.

See the instructions for line 12, later. As shown on page 1 of your tax return. Your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the. When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. Foreign taxes eligible for a credit. Web how to claim the foreign tax credit. Since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web form 1116 instructions for foreign tax credits: A credit for foreign taxes can be claimed only for foreign tax.

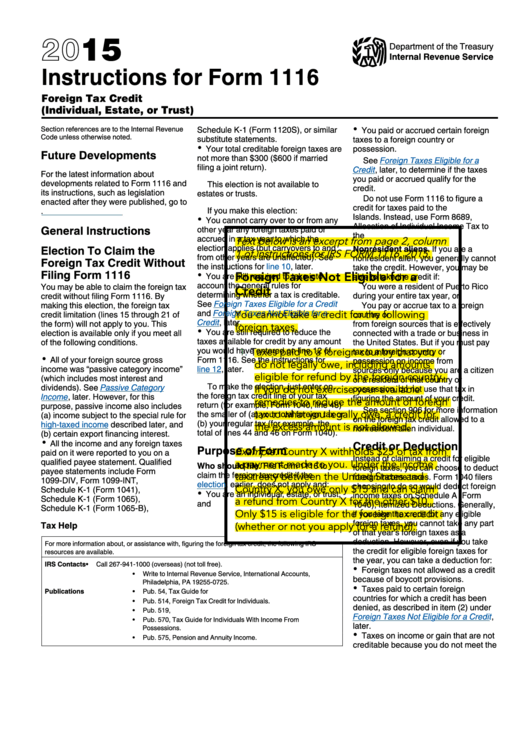

2015 Instructions For Form 1116 printable pdf download

Web form 1116 instructions for foreign tax credits: Foreign taxes eligible for a credit. Web in addition, there is a limit on the amount of the credit that you can claim. Enter the gross income (not the tax) of this category type where indicated. File form 1116, foreign tax credit, to claim the foreign tax credit if you are an.

How To Claim Foreign Tax Credit On Form 1040 Asbakku

Web form 1116 instructions for foreign tax credits: In a nutshell, the high tax passive income on page one, line 1a is backed out of the. Web election to claim the foreign tax credit without filing form 1116. A credit for foreign taxes can be claimed only for foreign tax. Web for tax year 2022, please see the 2022 instructions.

How can I add Form 1116? General Chat ATX Community

You must prepare form 1116 if your. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Web election to claim the foreign tax credit without filing form 1116. Election to claim the foreign tax credit without filing form 1116. Expat should learn to love, because it’s one of two ways.

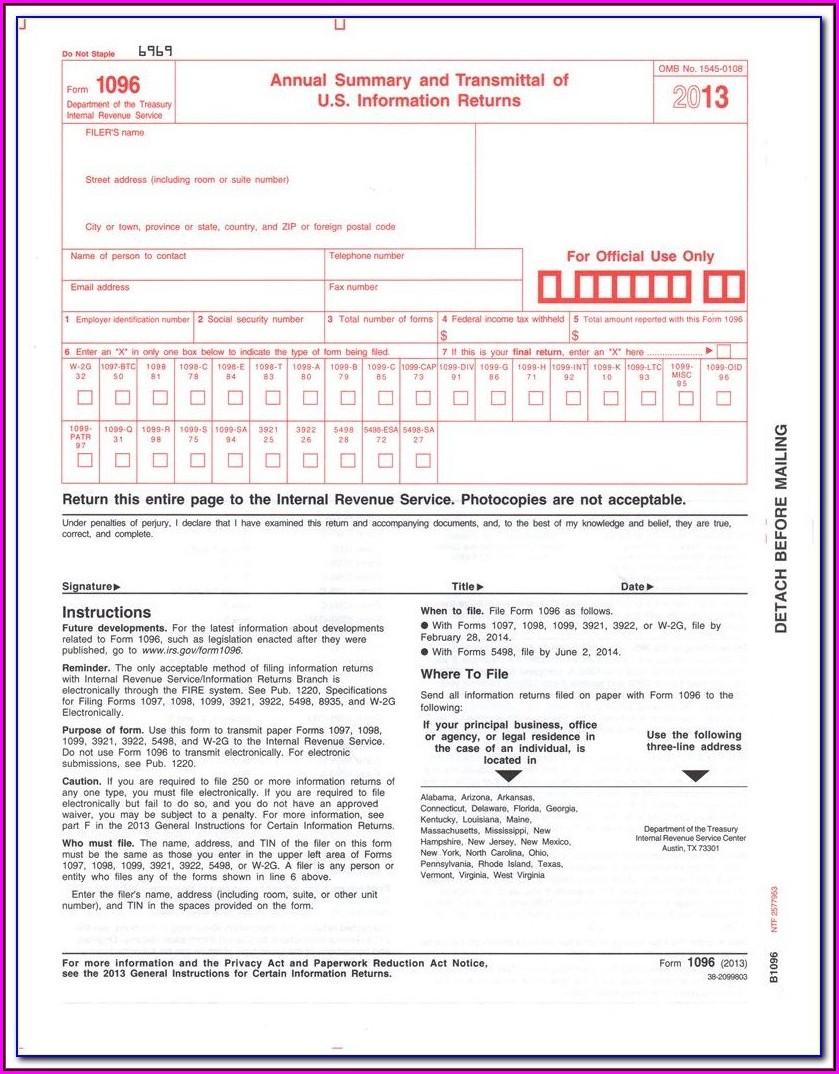

Irs Forms 1096 Instructions Form Resume Examples mx2WjzPV6E

There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. In a nutshell, the high tax passive income on page one, line 1a is backed out of the. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Expat.

Instructions for 1116 2016

Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Generating form 1116 foreign tax credit for. Web in addition, there is.

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

As shown on page 1 of your tax return. Your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the. Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. Enter the gross income (not the tax) of this category type where indicated. To make.

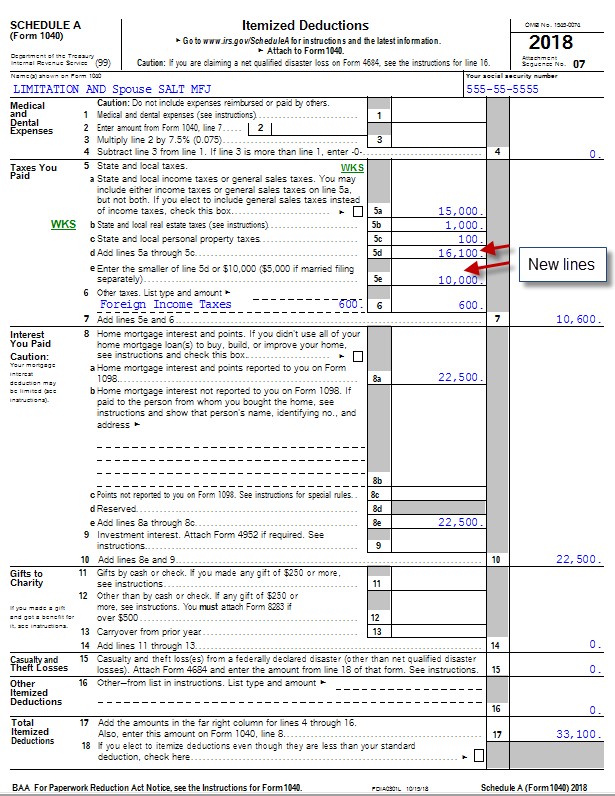

How Tax Reform Affects the State and Local Tax (SALT) Deduction Tax

Web how to claim the foreign tax credit. Web get answers to frequently asked questions about entering an individual form 1116, foreign tax credit, in intuit lacerte. Foreign taxes eligible for a credit. You must prepare form 1116 if your. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in.

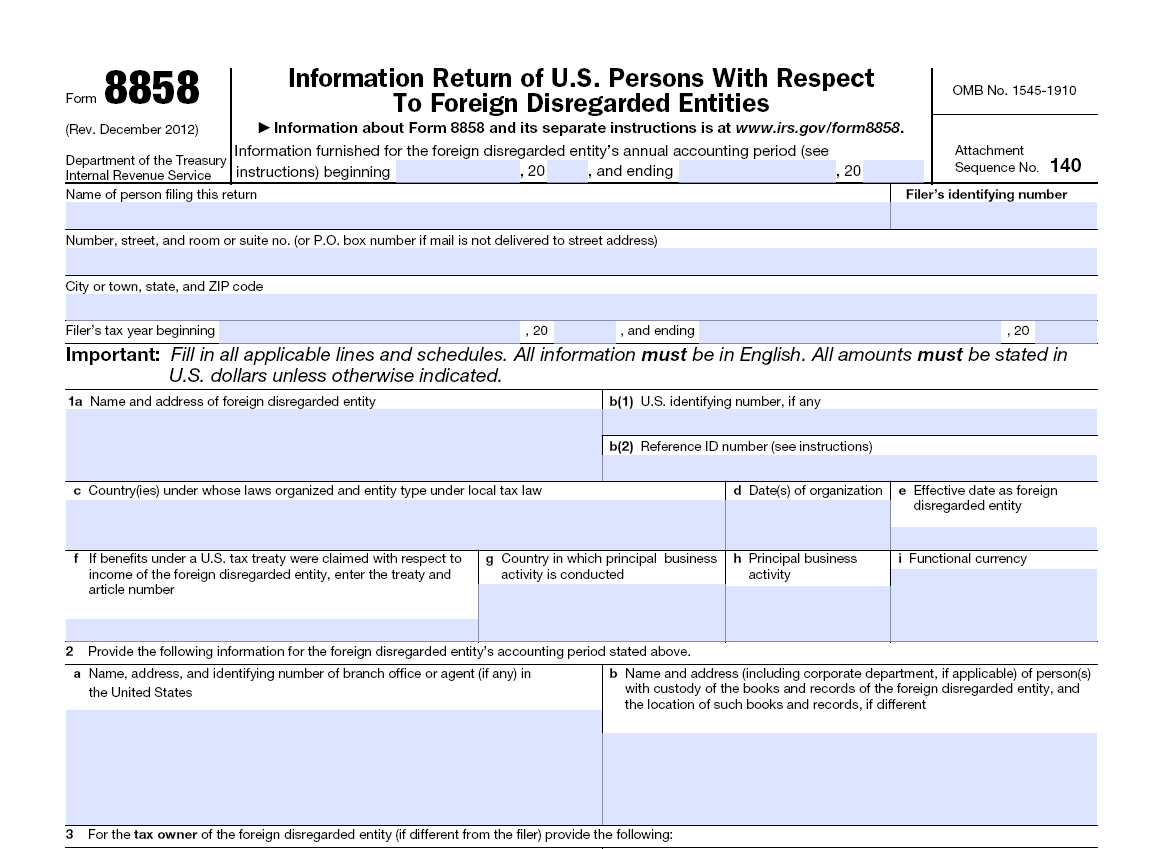

US Expat Tax Compliance Foreign Disregarded EntitiesUS Expat Tax

Web for tax year 2022, please see the 2022 instructions. In a nutshell, the high tax passive income on page one, line 1a is backed out of the. Your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the. Web form 1116 instructions step one: A credit for foreign taxes can be claimed.

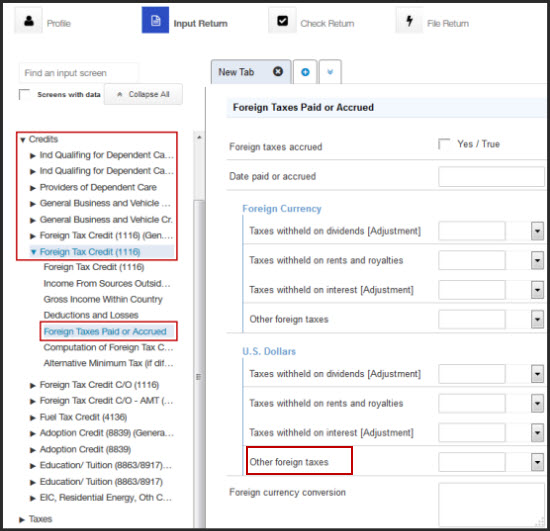

How do I generate Form 1116 Foreign Tax Credit in ProConnect Tax

Foreign taxes eligible for a credit. Web how to claim the foreign tax credit. Foreign taxes eligible for a credit. Generating form 1116 foreign tax credit for. Web for more information on calculating your allowable foreign tax credit, see form 1116 instructions and irs publication 514.

Form 1116 Edit, Fill, Sign Online Handypdf

Find out if you qualify for the foreign tax credit. Web for tax year 2022, please see the 2022 instructions. Web form 1116 instructions step one: Web in addition, there is a limit on the amount of the credit that you can claim. Web the form 1116 instructions provide the mechanics of how the reclassification is done.

Web Schedule C (Form 1116) Is Used To Identify Foreign Tax Redeterminations That Occur In The Current Tax Year In Each Separate Category, The Years To Which They.

To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i, line. Generating form 1116 foreign tax credit for. Web election to claim the foreign tax credit without filing form 1116. Web for tax year 2022, please see the 2022 instructions.

Web How To Claim The Foreign Tax Credit.

As shown on page 1 of your tax return. Election to claim the foreign tax credit without filing form 1116. Since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know. A credit for foreign taxes can be claimed only for foreign tax.

Web Form 1116 Instructions For Foreign Tax Credits:

You must prepare form 1116 if your. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web in addition, there is a limit on the amount of the credit that you can claim. Find out if you qualify for the foreign tax credit.

Web For Instructions And The Latest Information.

File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or. See the instructions for line 12, later. Enter the gross income (not the tax) of this category type where indicated. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer.