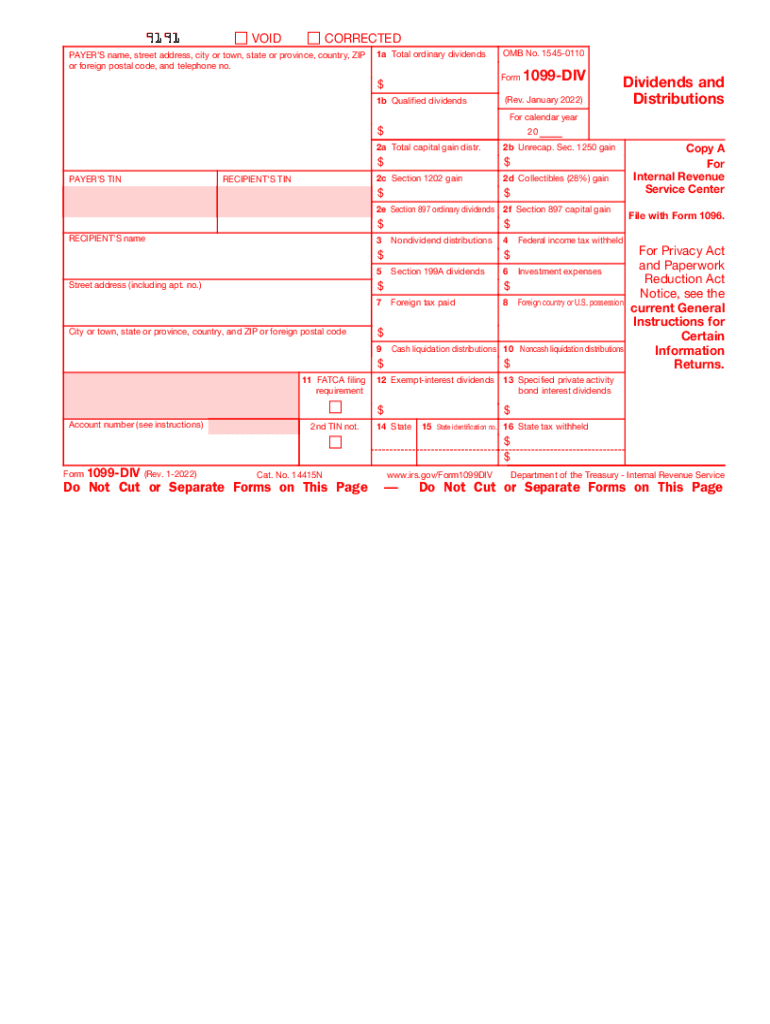

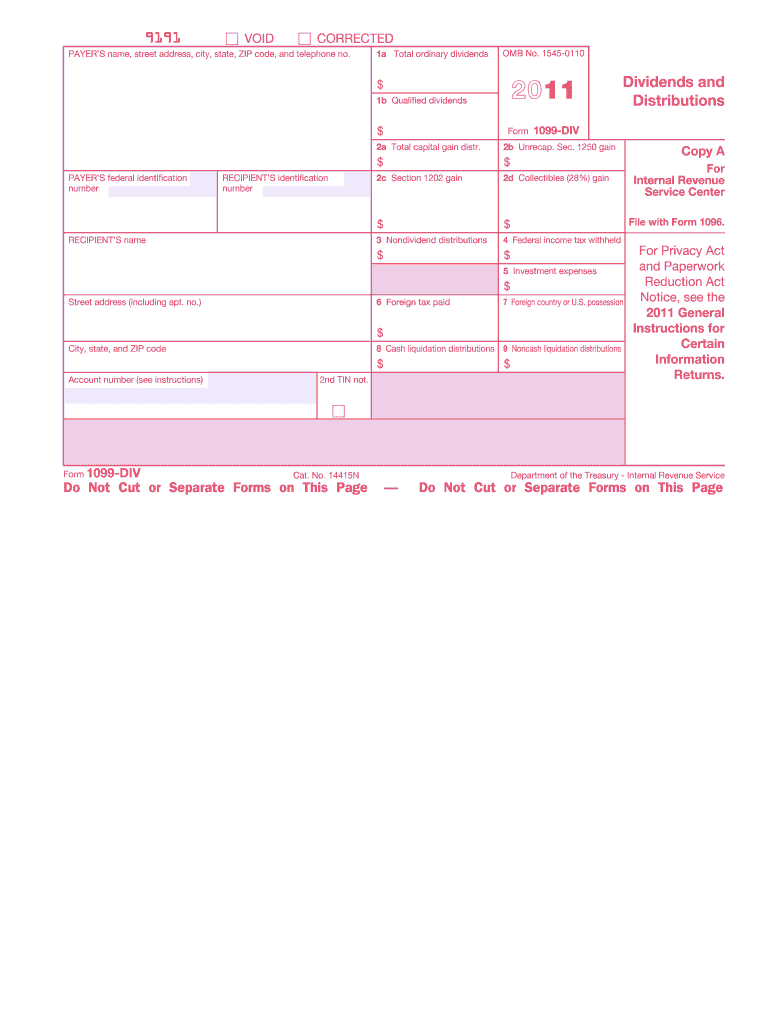

Form 1099 Div 2022

Form 1099 Div 2022 - What’s new new box 11. Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership. For 2022, if you received more than $10 in dividends from one of these. Copy a for internal revenue service center. Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year. For the most recent version, go to irs.gov/form1099div. Current general instructions for certain information. For privacy act and paperwork reduction act notice, see the. Both the form and instructions will be updated as needed. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year.

The “fatca filing requirement” checkbox has been assigned box number 11. For privacy act and paperwork reduction act notice, see the. Current general instructions for certain information. For the most recent version, go to irs.gov/form1099div. Both the form and instructions will be updated as needed. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year. Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership. What’s new new box 11. Copy a for internal revenue service center.

Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year. Current general instructions for certain information. For the most recent version, go to irs.gov/form1099div. Both the form and instructions will be updated as needed. For 2022, if you received more than $10 in dividends from one of these. What’s new new box 11. For privacy act and paperwork reduction act notice, see the. Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. The “fatca filing requirement” checkbox has been assigned box number 11.

Definición del Formulario 1099 Traders Studio

For the most recent version, go to irs.gov/form1099div. Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year. Both the form and instructions will be updated as needed. Current general instructions for certain information. For 2022, if you received more than $10 in dividends.

2022 Form IRS 1099DIV Fill Online, Printable, Fillable, Blank pdfFiller

For 2022, if you received more than $10 in dividends from one of these. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. Current general instructions for certain information. For the most recent version, go to irs.gov/form1099div. Both the form and instructions will be updated as.

1099 Div Fillable Form Fill Out and Sign Printable PDF Template signNow

Both the form and instructions will be updated as needed. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. For the most recent version, go to irs.gov/form1099div. Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends.

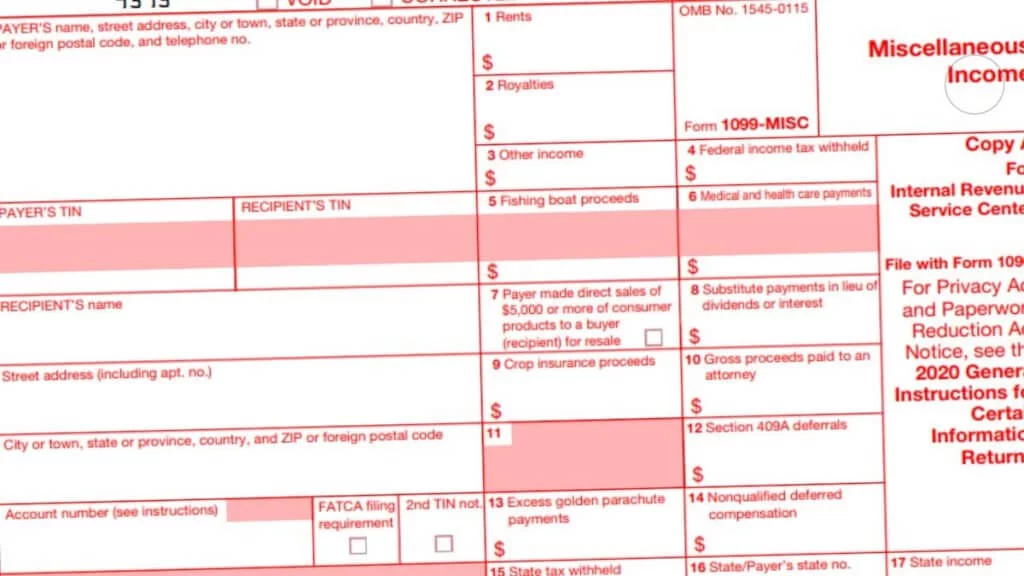

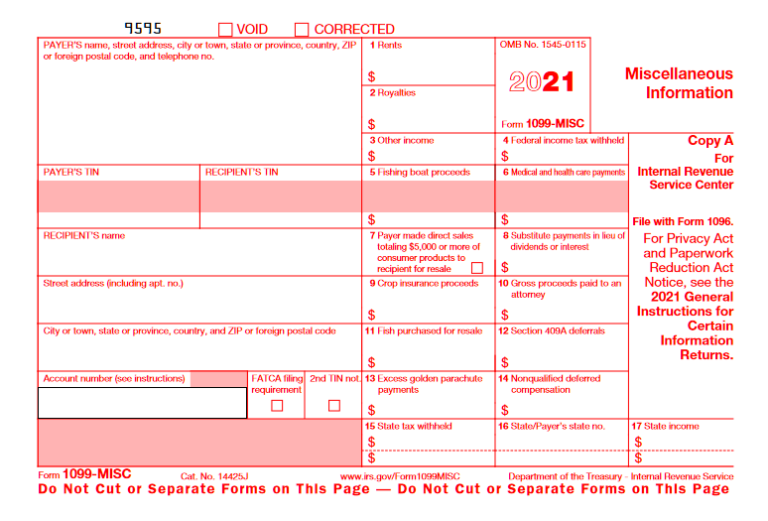

Irs Printable 1099 Form Printable Form 2022

The “fatca filing requirement” checkbox has been assigned box number 11. For privacy act and paperwork reduction act notice, see the. Both the form and instructions will be updated as needed. Copy a for internal revenue service center. Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a.

How To Read A 1099b Form Armando Friend's Template

Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership. The “fatca filing requirement” checkbox has been assigned box number 11. For the most recent version, go to irs.gov/form1099div. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. Both the form and instructions will.

Top10 US Tax Forms in 2022 Explained PDF.co

What’s new new box 11. For privacy act and paperwork reduction act notice, see the. Both the form and instructions will be updated as needed. Copy a for internal revenue service center. The “fatca filing requirement” checkbox has been assigned box number 11.

1099 MISC Form 2022 1099 Forms TaxUni

For 2022, if you received more than $10 in dividends from one of these. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. For privacy act and paperwork reduction act notice, see the. Copy a for internal revenue service center. Web this form is used by.

Form 1099A Acquisition or Abandonment of Secured Property Definition

Current general instructions for certain information. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership. For the most recent version, go to irs.gov/form1099div. Copy a for internal revenue service center.

1099 NEC Form 2022

Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year. Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership. Current general instructions for certain information. This form is a record of all taxable dividend and capital gains earned in your mutual.

1099 Tax Calculator 2021 1099 Forms

Both the form and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099div. Copy a for internal revenue service center. For 2022, if you received more than $10 in dividends from one of these. Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership.

Copy A For Internal Revenue Service Center.

Individual, joint, trust, ugma, utma, estate, transfer on death (tod) and association/partnership. This form is a record of all taxable dividend and capital gains earned in your mutual fund account during the 2022 calendar year. For the most recent version, go to irs.gov/form1099div. Web this form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year.

For Privacy Act And Paperwork Reduction Act Notice, See The.

Current general instructions for certain information. Both the form and instructions will be updated as needed. What’s new new box 11. The “fatca filing requirement” checkbox has been assigned box number 11.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)