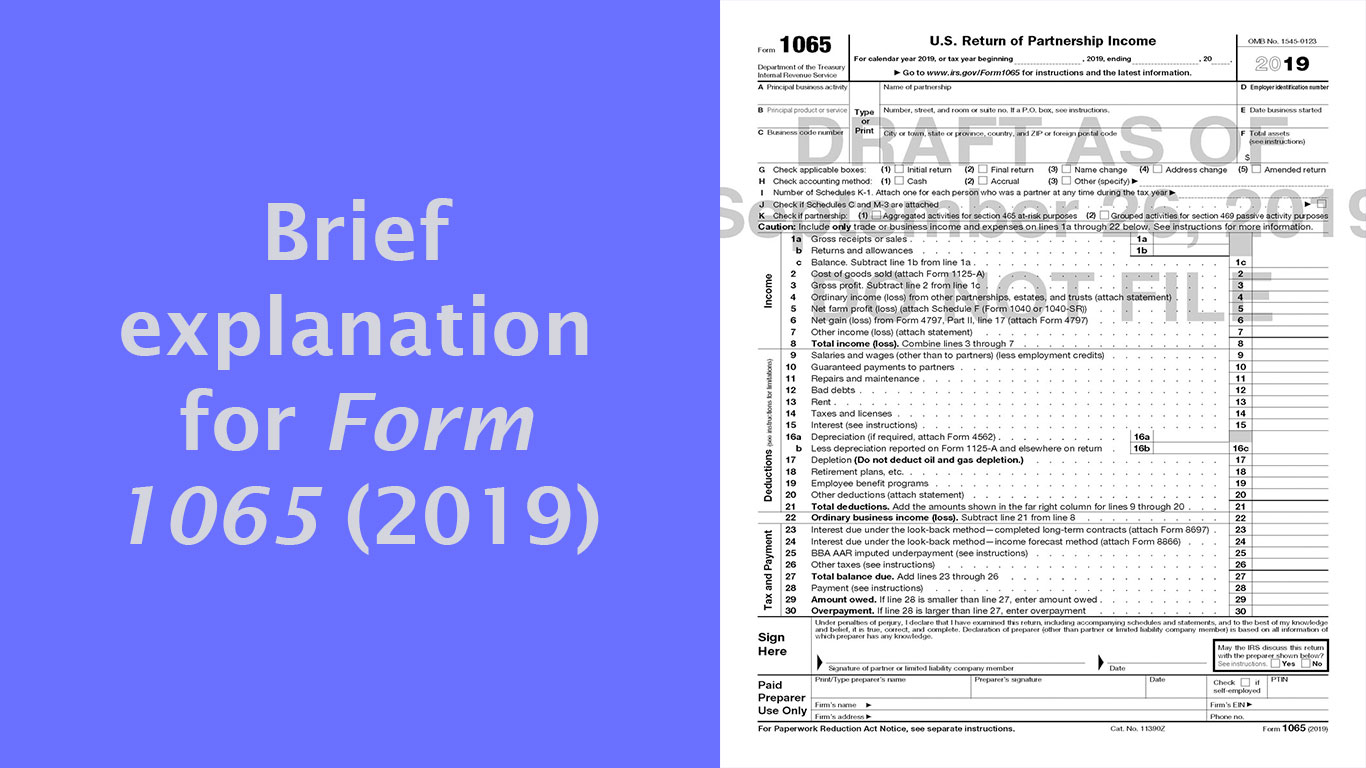

Form 1065 Late Filing Penalty 2021

Form 1065 Late Filing Penalty 2021 - A late filing penalty is assessed against the partnership if the partnership fails to file form 1065, u.s. Web 1973 rulon white blvd. When is the deadline to file form 1065? Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. Web what is the penalty for filing a form 1065 late? Web the penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were. If you file a form 1065 partnership tax return late, you will certainly receive a late filing penalty notice. Can partnerships elected as a business extend the deadline? Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. Web failure to file or show information on a partnership return (irc sec.

Web the tax due date was march 15, 2021. Web failure to file or show information on a partnership return (irc sec. If you file a form 1065 partnership tax return late, you will certainly receive a late filing penalty notice. And international information returns (iirs) assessed a. Web purpose of form.2 definitions.2 who must file.4 termination of the partnership.4 electronic filing.4 when to file.4 where to file.5 who must sign.5. Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. The penalty is calculated as 5% of your. A late filing penalty is assessed against the partnership if the partnership fails to file form 1065, u.s. Web the penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were. 6698)—for partnership taxable years beginning in 2021, a return for purposes of irc.

Web purpose of form.2 definitions.2 who must file.4 termination of the partnership.4 electronic filing.4 when to file.4 where to file.5 who must sign.5. And international information returns (iirs) assessed a. Web what is the penalty for filing a form 1065 late? Return of partnership income, by the. Web income tax returns: Web the penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were. The penalty is calculated as 5% of your. A late filing penalty is assessed against the partnership if the partnership fails to file form 1065, u.s. 6698)—for partnership taxable years beginning in 2021, a return for purposes of irc. Web 1973 rulon white blvd.

Avoiding Late Penalties On 1065 And 1120S Returns Silver Tax Group

Web failure to file or show information on a partnership return (irc sec. Who must file form 1065? If you file a form 1065 partnership tax return late, you will certainly receive a late filing penalty notice. Web purpose of form.2 definitions.2 who must file.4 termination of the partnership.4 electronic filing.4 when to file.4 where to file.5 who must sign.5..

Form 1065 (2019), Partnership Tax Return 1065 Meru Accounting

Web income tax returns: Return of partnership income, by the. If you file a form 1065 partnership tax return late, you will certainly receive a late filing penalty notice. Web the penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were..

Form 10 Filing Instructions 10 10 Various Ways To Do Form 10 Filing

Web what is the penalty for filing a form 1065 late? Web 1973 rulon white blvd. And international information returns (iirs) assessed a. Web the penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were. Who must file form 1065?

IRS Form 1065 or Form 1120S FirstTime Late Filing Penalty Abatement

Web the penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were. Web what is the penalty for filing a form 1065 late? Web income tax returns: If you file a form 1065 partnership tax return late, you will certainly receive.

Irs Form 1065 K 1 Instructions Universal Network

Can partnerships elected as a business extend the deadline? A late filing penalty is assessed against the partnership if the partnership fails to file form 1065, u.s. Web the tax due date was march 15, 2021. Web 1973 rulon white blvd. Web failure to file or show information on a partnership return (irc sec.

Prepare Form 990EZ

If penalties have already been assessed, irs will abate. If you file a form 1065 partnership tax return late, you will certainly receive a late filing penalty notice. Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. Can partnerships elected as a business extend.

Florida f1065 late filing penalty Fill online, Printable, Fillable Blank

A late filing penalty is assessed against the partnership if the partnership fails to file form 1065, u.s. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. Return of partnership income, by the. Web failure to file or show information on a partnership return.

Form 1065 Instructions 2022 2023 IRS Forms Zrivo

Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. Web under penalties of perjury, i declare that i have examined this return, including accompanying schedules and statements, and to the best of my knowledge. If penalties have already been assessed, irs will abate. Web.

1065 Extension 2021 2022 IRS Forms Zrivo

Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. Web under penalties of perjury, i declare that i have examined this return, including accompanying schedules and statements, and to the best of my knowledge. If penalties have already been assessed, irs will abate. Web.

Avoiding Late Penalties On 1065 And 1120S Returns Silver Tax Group

Web what is the penalty for filing a form 1065 late? And international information returns (iirs) assessed a. Web the penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were. Web under penalties of perjury, i declare that i have examined.

Web 1973 Rulon White Blvd.

Web failure to file or show information on a partnership return (irc sec. Return of partnership income, by the. Can partnerships elected as a business extend the deadline? Web income tax returns:

Web The Penalty Is $205 For Each Month Or Part Of A Month (For A Maximum Of 12 Months) The Failure Continues, Multiplied By The Total Number Of Persons Who Were.

6698)—for partnership taxable years beginning in 2021, a return for purposes of irc. If penalties have already been assessed, irs will abate. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. And international information returns (iirs) assessed a.

Who Must File Form 1065?

Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. If you file a form 1065 partnership tax return late, you will certainly receive a late filing penalty notice. Web what is the penalty for filing a form 1065 late? A late filing penalty is assessed against the partnership if the partnership fails to file form 1065, u.s.

Web Under Penalties Of Perjury, I Declare That I Have Examined This Return, Including Accompanying Schedules And Statements, And To The Best Of My Knowledge.

Web the tax due date was march 15, 2021. The penalty is calculated as 5% of your. Web purpose of form.2 definitions.2 who must file.4 termination of the partnership.4 electronic filing.4 when to file.4 where to file.5 who must sign.5. When is the deadline to file form 1065?