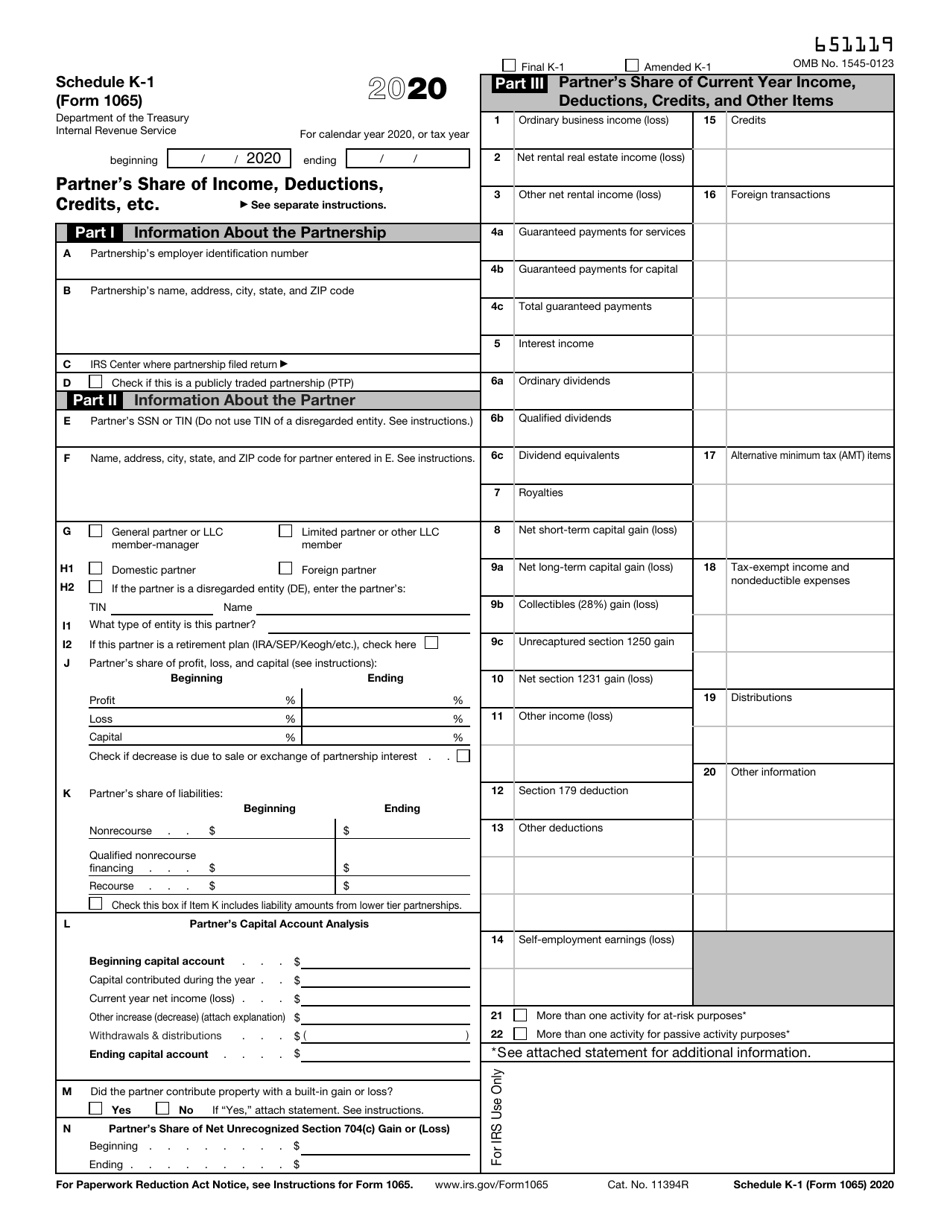

Form 1065 Box 20 Code Z Stmt

Form 1065 Box 20 Code Z Stmt - Under the section general business,. Web box 20, code ag. Gross receipts for section 448(c)(2). I've got partner losses and no special credit. Partnerships and partners must determine whether they are subject to certain accounting methods and to section 163(j). Code z, section 199a income; Web find irs mailing addresses by state to file form 1065. And the total assets at the end of the. Web •box 20, new codes have been added for the qualified business income deduction: When data sharing to a 1040 return from a 1065 return, these fields populate screen.

Generally, you are allowed a deduction up to 20% of your. Where do i find the amount to. Web box 20, code ag. I am filing the 1065 forms in turbotax. The taxact® program has entry fields for the following items that may have. Turbo tax says i need to enter an amount. Under the section general business,. If the partnership's principal business, office, or agency is located in: My wife and i own a rental property under llc. Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends,.

The taxact® program has entry fields for the following items that may have. Generally, you are allowed a deduction up to 20% of your. Web •box 20, new codes have been added for the qualified business income deduction: Web find irs mailing addresses by state to file form 1065. I am filing the 1065 forms in turbotax. When data sharing to a 1040 return from a 1065 return, these fields populate screen. Under the section general business,. Turbo tax says i need to enter an amount. Code z, section 199a income; And the total assets at the end of the.

Free Online Fillable 1065 Form Printable Forms Free Online

When data sharing to a 1040 return from a 1065 return, these fields populate screen. Turbo tax says i need to enter an amount. Web •box 20, new codes have been added for the qualified business income deduction: I noticed that box 20 in schedule k1 has z. Web find irs mailing addresses by state to file form 1065.

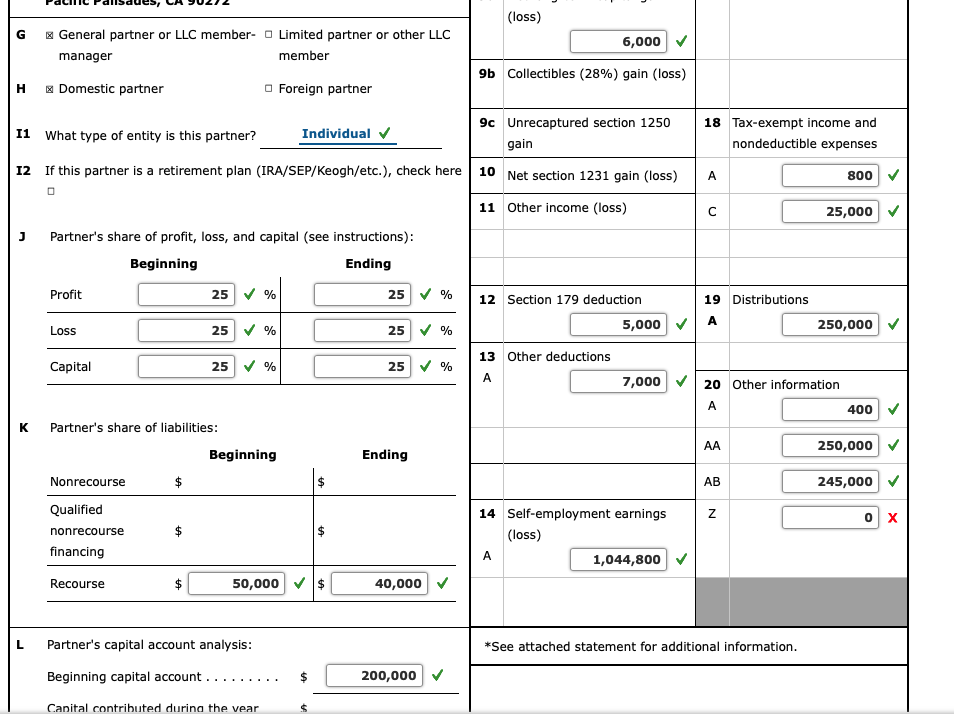

(loss) G General partner or LLC member Limited

Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends,. Other than the regulation section 1.199a (c) (4) aggregation group disclosure statement, all partner. Web box 20, code ag. My wife and i own a rental property under llc. If the partnership's principal business, office,.

FAFSA Tutorial

Next to the z , i see. Web box 20, code ag. Code z, section 199a income; Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends,. And the total assets at the end of the.

Entering K1 add' info form. For Box 20 Code Z (15) the descri

My wife and i own a rental property under llc. Web box 20, code ag. The taxact® program has entry fields for the following items that may have. When data sharing to a 1040 return from a 1065 return, these fields populate screen. Generally, you are allowed a deduction up to 20% of your.

Form 1065 Tax Software Universal Network

Under the section general business,. Next to the z , i see. Web box 20, code ag. Partnerships and partners must determine whether they are subject to certain accounting methods and to section 163(j). Web •box 20, new codes have been added for the qualified business income deduction:

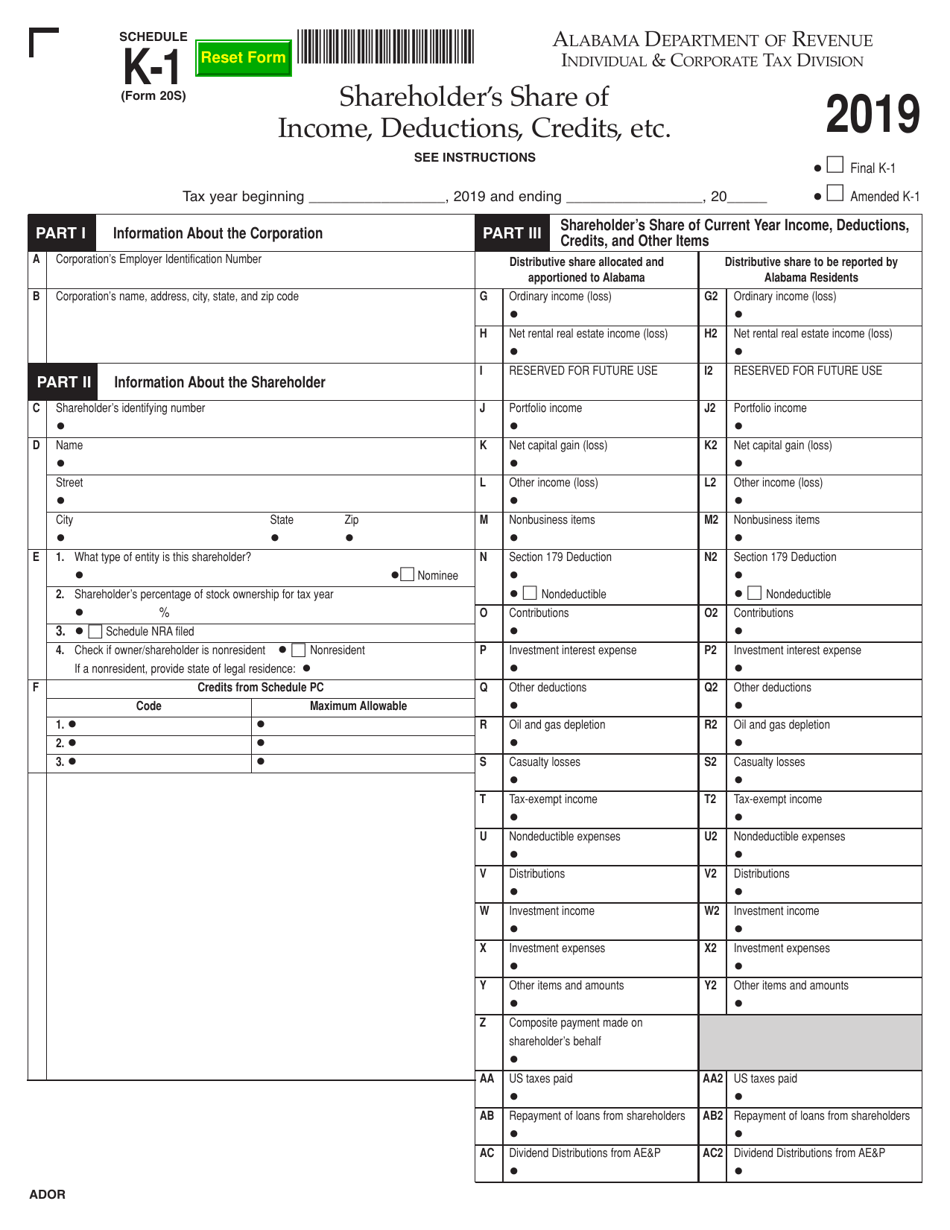

Form 20S Schedule K1 Download Fillable PDF or Fill Online Shareholder

My wife and i own a rental property under llc. Where do i find the amount to. I noticed that box 20 in schedule k1 has z. Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends,. When data sharing to a 1040 return from.

Form K1 1065 Instructions Ethel Hernandez's Templates

Gross receipts for section 448(c)(2). Turbo tax says i need to enter an amount. Code z, section 199a income; Other than the regulation section 1.199a (c) (4) aggregation group disclosure statement, all partner. And the total assets at the end of the.

Form 1065 Edit, Fill, Sign Online Handypdf

My wife and i own a rental property under llc. Partnerships and partners must determine whether they are subject to certain accounting methods and to section 163(j). And the total assets at the end of the. When data sharing to a 1040 return from a 1065 return, these fields populate screen. Under the section general business,.

Form 1065x Editable Fill out and Edit Online PDF Template

Next to the z , i see. Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends,. I am filing the 1065 forms in turbotax. If the partnership's principal business, office, or agency is located in: Under the section general business,.

U.S Tax Return for Partnership , Form 1065 Meru Accounting

Web find irs mailing addresses by state to file form 1065. Other than the regulation section 1.199a (c) (4) aggregation group disclosure statement, all partner. Turbo tax says i need to enter an amount. When data sharing to a 1040 return from a 1065 return, these fields populate screen. Generally, you may be allowed a deduction of up to 20%.

Other Than The Regulation Section 1.199A (C) (4) Aggregation Group Disclosure Statement, All Partner.

Web find irs mailing addresses by state to file form 1065. Under the section general business,. I've got partner losses and no special credit. I am filing the 1065 forms in turbotax.

My Wife And I Own A Rental Property Under Llc.

I noticed that box 20 in schedule k1 has z. Where do i find the amount to. The taxact® program has entry fields for the following items that may have. When data sharing to a 1040 return from a 1065 return, these fields populate screen.

And The Total Assets At The End Of The.

Web box 20, code ag. Partnerships and partners must determine whether they are subject to certain accounting methods and to section 163(j). Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends,. Turbo tax says i need to enter an amount.

Generally, You Are Allowed A Deduction Up To 20% Of Your.

If the partnership's principal business, office, or agency is located in: Code z, section 199a income; Web •box 20, new codes have been added for the qualified business income deduction: Next to the z , i see.