Form 1041 Extended Due Date 2022

Form 1041 Extended Due Date 2022 - Web form 1041 april 15 sept. Web for calendar year tax returns reporting 2022 information that are due in 2023, the following due dates will apply: Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Ad discover 2290 form due dates for heavy use vehicles placed into service. Since april 15 falls on a saturday, and emancipation day. Not everyone has to ask for more time, however. Use form 7004 to request an automatic 6. Web 15th march 2022: Get ready for tax season deadlines by completing any required tax forms today. Individual (form 1040) april 18, 2022:

30 c corporation (calendar year) form 1120 march 15 sept.15 before jan. Web a trust or estate with a tax year that ends june 30 must file by october 15 of the same year. Ad access irs tax forms. Reference the aicpa tax section’s state and local tax. Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web what is the due date for irs form 1041? 17, 2022, to file a return. If not, i need to file an extension but this article makes no. Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022.

Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022. Web individuals and families. What it does to you. Use form 7004 to request an automatic 6. Web a trust or estate with a tax year that ends june 30 must file by october 15 of the same year. Web what is the due date for irs form 1041? Ad discover 2290 form due dates for heavy use vehicles placed into service. Web washington — taxpayers requesting an extension will have until monday, oct. Web • 1120s on extension due • 1065 on extension due • 3rd qtr estimated tax payment due: Web 15th march 2022:

U.S. Tax Return for Estates and Trusts, Form 1041

Web individuals and families. The 15th day of the 4th month after the end of the tax year for the return. Not everyone has to ask for more time, however. Form 1040 (for individuals) 18th april 2022: 31, 2025 starting with 2016.

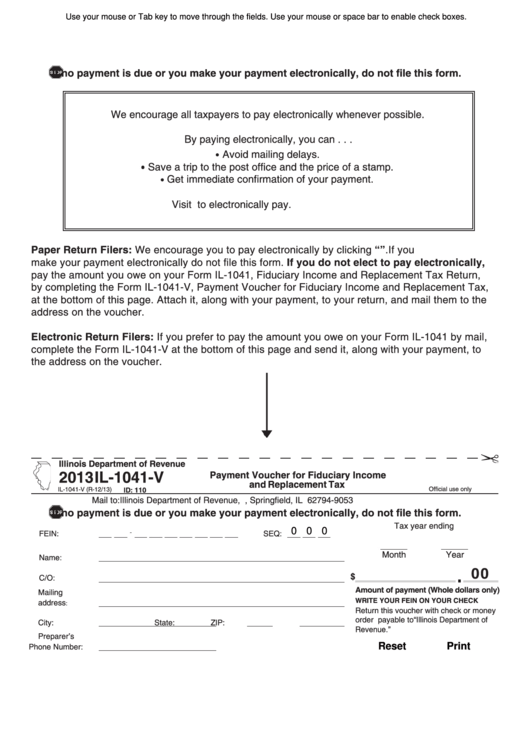

Fillable Form Il1041V Payment Voucher For Fiduciary And

Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Monday, october 2, 2023 • 1041 on extension due: 17, 2022, to file a return. For calendar years, you must file your tax return by april 15. If not, i need to file an extension but this article makes.

Form 1041T Allocation of Estimated Tax Payments to Beneficiaries

30 c corporation (calendar year) form 1120 march 15 sept.15 before jan. Q1 2022 individual and c corporation estimated tax payments: If not, i need to file an extension but this article makes no. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web • 1120s on extension due • 1065 on extension due • 3rd qtr.

1041 Fill Out and Sign Printable PDF Template signNow

Web washington — taxpayers requesting an extension will have until monday, oct. Since april 15 falls on a saturday, and emancipation day. Q1 2022 individual and c corporation estimated tax payments: Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web a trust or estate with a tax year that ends june 30 must file by october.

2018 2019 IRS Form 1041ES Fill Out Digital PDF Sample

Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022. Individual (form 1040) april 18, 2022: Which extension form is used for form 1041? What it does to you. Monday, october 2, 2023 • 1041 on extension due:

When to File Form 1041 H&R Block

Form 1041 due date when is it due for irs form 1041? 17, 2022, to file a return. If not, i need to file an extension but this article makes no. What it does to you. Federal tax filing deadlines for tax year 2021 april 21, 2020 |.

Form 1041 Extension Due Date 2019 justgoing 2020

Web 1041 due date/extenstion i'm trying to find out if the 1041 due date got extended for tax year 2020. 17, 2022, to file a return. 30 c corporation (calendar year) form 1120 march 15 sept.15 before jan. Q1 2022 individual and c corporation estimated tax payments: For fiscal year estates and trusts,.

IRS Form 1041 Schedule I Download Fillable PDF or Fill Online

17, 2022, to file a return. Web washington — taxpayers requesting an extension will have until monday, oct. Web • 1120s on extension due • 1065 on extension due • 3rd qtr estimated tax payment due: Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web a 1041 extension.

Form 1041N U.S. Tax Return for Electing Alaska Native

For calendar years, you must file your tax return by april 15. Web 1041 due date/extenstion i'm trying to find out if the 1041 due date got extended for tax year 2020. Ad discover 2290 form due dates for heavy use vehicles placed into service. Ad access irs tax forms. Monday, october 2, 2023 • 1041 on extension due:

Schedule D 1 Printable & Fillable Blank PDF Online IRS Tax Forms

Web 15th march 2022: Not everyone has to ask for more time, however. Get ready for tax season deadlines by completing any required tax forms today. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web individuals and families.

What It Does To You.

Federal tax filing deadlines for tax year 2021 april 21, 2020 |. Web individuals and families. Web • 1120s on extension due • 1065 on extension due • 3rd qtr estimated tax payment due: Form 1041 due date when is it due for irs form 1041?

Not Everyone Has To Ask For More Time, However.

Q1 2022 individual and c corporation estimated tax payments: Monday, october 2, 2023 • 1041 on extension due: Use form 7004 to request an automatic 6. Web for calendar year tax returns reporting 2022 information that are due in 2023, the following due dates will apply:

Which Extension Form Is Used For Form 1041?

Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. 30 c corporation (calendar year) form 1120 march 15 sept.15 before jan. Web washington — taxpayers requesting an extension will have until monday, oct. 31, 2025 starting with 2016.

The 15Th Day Of The 4Th Month After The End Of The Tax Year For The Return.

Get ready for tax season deadlines by completing any required tax forms today. Reference the aicpa tax section’s state and local tax. Web 15th march 2022: Complete, edit or print tax forms instantly.