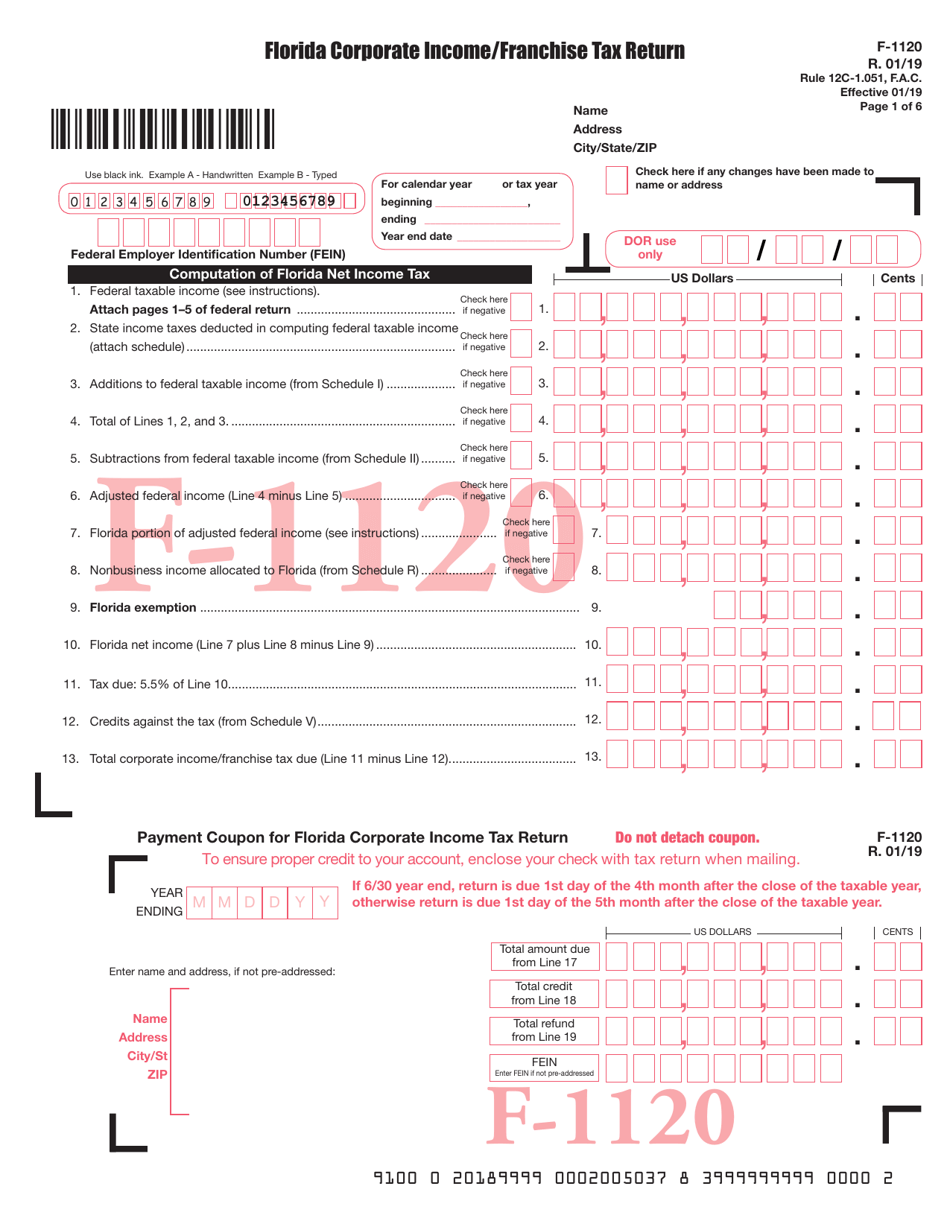

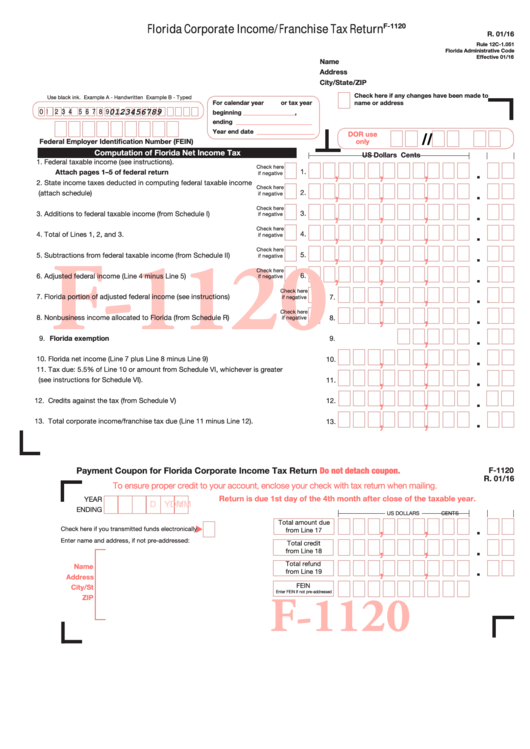

Florida Form 1120

Florida Form 1120 - Florida corporate income/franchise tax return for 2022 tax year. Florida corporate income/franchise tax return for 2014 tax year: You can print other florida tax forms here. Florida law does not allow net operating loss carrybacks It has florida net income of $45,000 or less. Florida corporate income/franchise tax return for 2013 tax year: It conducts 100% of its business in florida. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Florida corporate short form income tax return.

It conducts 100 percent of its business in florida (does not apportion income). Florida corporate short form income tax return. It has florida net income of $45,000 or less. Florida corporate income/franchise tax return for 2013 tax year: It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida law does not allow net operating loss carrybacks Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Links are provided for both options. Florida corporate income/franchise tax return for 2014 tax year: It conducts 100% of its business in florida.

It has florida net income of $45,000 or less. Efective 01/23 name page 1 of 6 address city/state/zip use black ink. It has florida net income of $45,000 or less. Florida corporate income/franchise tax return for 2013 tax year: It conducts 100% of its business in florida. You can print other florida tax forms here. It conducts 100 percent of its business in florida (does not apportion income). Florida corporate income/franchise tax return for 2022 tax year. Florida corporate income/franchise tax return for 2014 tax year: Florida corporate short form income tax return.

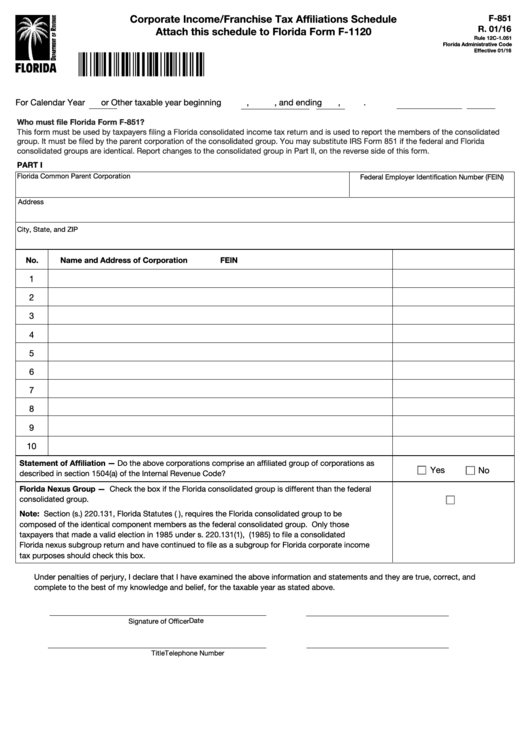

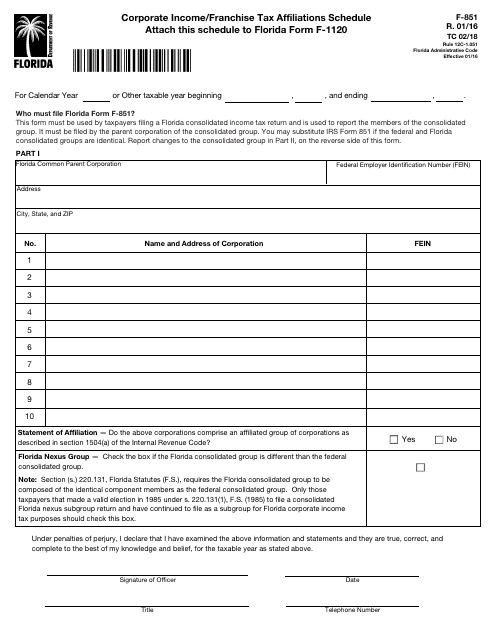

Fillable Form F851 Florida Department Of Revenue Corporate

Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Florida corporate income/franchise tax return for 2013 tax year: It conducts 100 percent of its business in florida (does not apportion income). Links are provided for both options. Florida corporate short form income tax return.

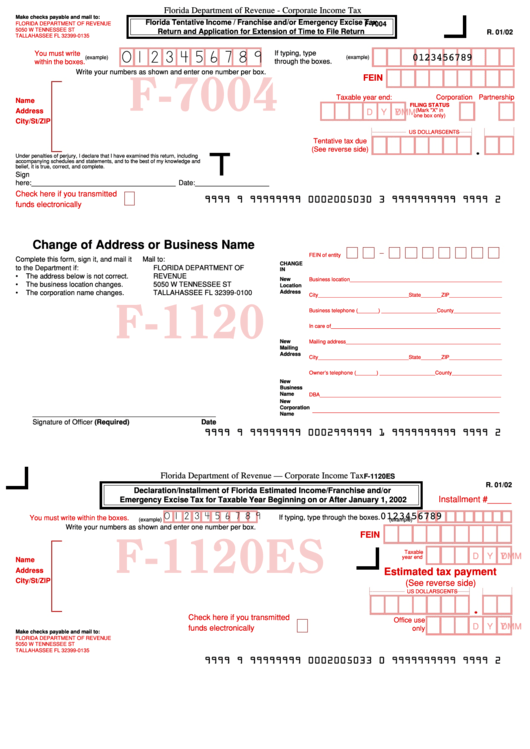

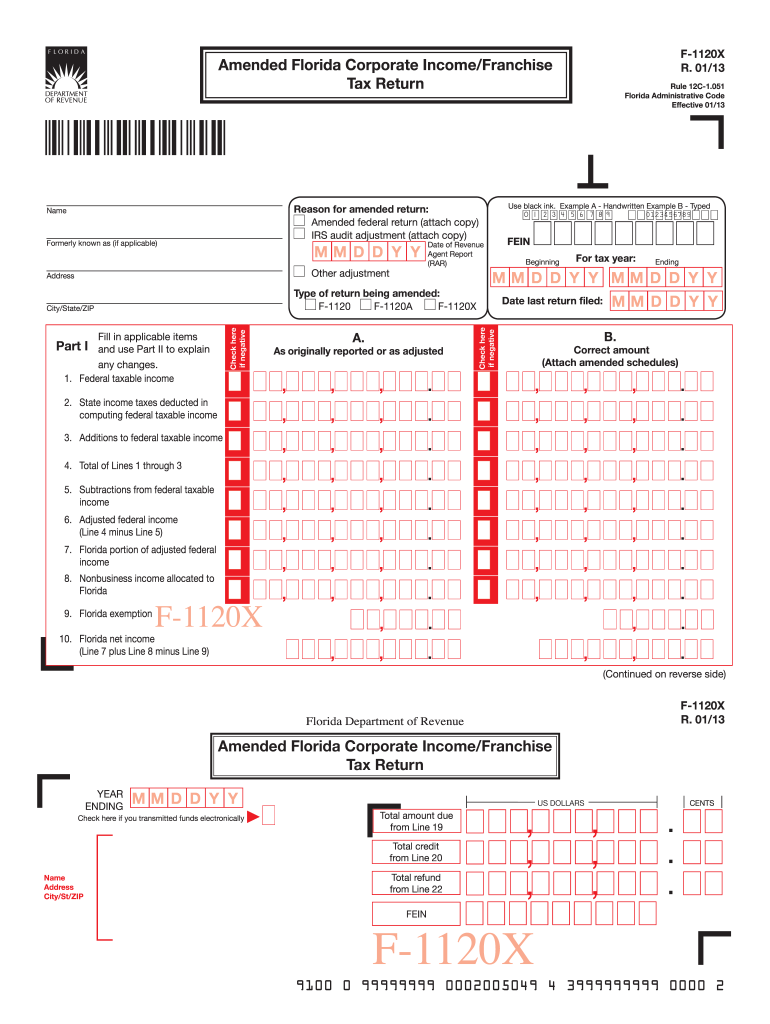

Form F7004 Corporate Tax, Form F1120 Change Of Address Or

It has florida net income of $45,000 or less. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida law does not allow net operating loss carrybacks It conducts 100 percent of its business in florida (does not apportion income). Florida corporate income/franchise tax return.

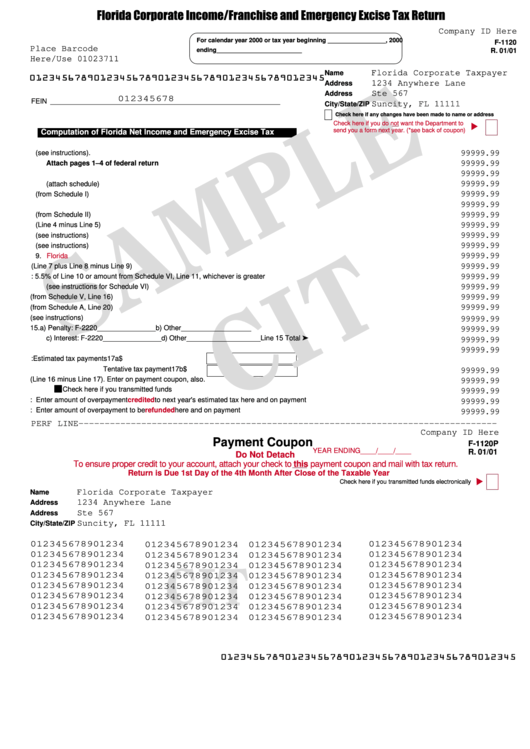

Form F1120 Florida Corporate And Emergency Excise

You can print other florida tax forms here. Florida corporate income/franchise tax return for 2013 tax year: It conducts 100 percent of its business in florida (does not apportion income). Florida corporate income/franchise tax return for 2022 tax year. It has florida net income of $45,000 or less.

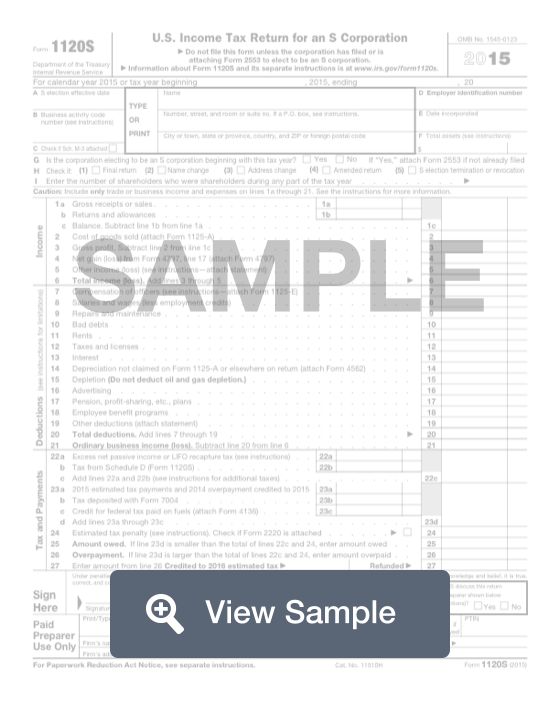

Form 1120S S Corporation Tax Return Fill Out Online PDF FormSwift

You can print other florida tax forms here. Efective 01/23 name page 1 of 6 address city/state/zip use black ink. It conducts 100 percent of its business in florida (does not apportion income). It has florida net income of $45,000 or less. Links are provided for both options.

Form F1120 Schedule F851 Download Fillable PDF or Fill Online

Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Florida corporate income/franchise tax return for 2014 tax year: Links are provided for both options. It has florida net income of $45,000 or less. You can print other florida tax forms here.

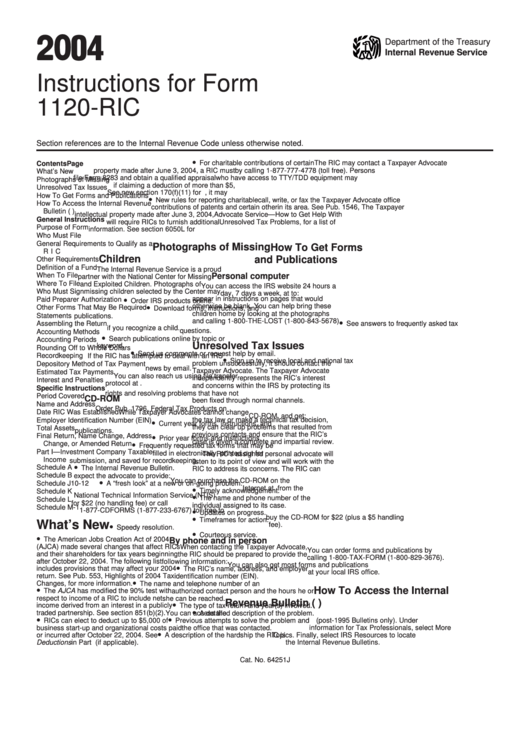

Instructions For Form 1120Ric U.s. Tax Return For Regulated

Links are provided for both options. Florida corporate short form income tax return. Florida law does not allow net operating loss carrybacks It conducts 100 percent of its business in florida (does not apportion income). It has florida net income of $45,000 or less.

Instructions for Preparing Form F1120 for 2008 Tax Year R.01/09

It conducts 100% of its business in florida. Florida corporate income/franchise tax return for 2014 tax year: It conducts 100 percent of its business in florida (does not apportion income). You can print other florida tax forms here. Florida corporate income/franchise tax return for 2013 tax year:

Form F1120 Download Printable PDF or Fill Online Florida Corporate

Florida corporate income/franchise tax return for 2014 tax year: It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, You can print other florida tax forms here. Florida corporate income/franchise tax return for 2013 tax year: It has florida net income of $45,000 or less.

Form F 1120 Fill Out and Sign Printable PDF Template signNow

It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Florida corporate income/franchise tax return for 2013 tax year: You can print other florida tax forms here. It conducts 100 percent of its business.

Fillable Form F1120 Florida Corporate Tax Return

Florida corporate income/franchise tax return for 2013 tax year: Florida corporate income/franchise tax return for 2022 tax year. Florida law does not allow net operating loss carrybacks You can print other florida tax forms here. Florida corporate income/franchise tax return for 2014 tax year:

It Conducts 100 Percent Of Its Business In Florida (Does Not Apportion Income).

It conducts 100% of its business in florida. It has florida net income of $45,000 or less. Florida law does not allow net operating loss carrybacks Florida corporate income/franchise tax return for 2022 tax year.

It Has Florida Net Income Of $45,000 Or Less.

Florida corporate short form income tax return. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida corporate income/franchise tax return for 2013 tax year: You can print other florida tax forms here.

Florida Corporate Income/Franchise Tax Return For 2014 Tax Year:

Links are provided for both options. Efective 01/23 name page 1 of 6 address city/state/zip use black ink.