First Time Penalty Abatement Form 990

First Time Penalty Abatement Form 990 - It is referred to as first time abate (fta) and is available for. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web a filer may request abatement of a penalty in a written statement setting forth all the extenuating circumstances. Web if you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Web more from h&r block. Web during the call, if you apply for reasonable cause but we determined you qualify for first time abate, we'll apply the latter. If the organization fails to file a timely and accurate return with the irs, the irs is permitted to. If you don't qualify for either or we can't approve your. Web penalty relief for nonprofits. Web prior 3 years are clean no ftf no accuracy penalties no ftp note:

Web penalty relief for nonprofits. Web a filer may request abatement of a penalty in a written statement setting forth all the extenuating circumstances. Web so even if a private foundation were to qualify for relief from irc section 6651 late filing and tax payment penalties (i.e., up to 25% of the tax due) by filing its 2019 or 2020 form. Web can penalties for filing form 990 late be abated? Web prior 3 years are clean no ftf no accuracy penalties no ftp note: You could be eligible for one of three types of irs penalty aid: Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web if you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Web here is how we get compensated. Web this administrative waiver was implemented in 2001 for tax periods with ending dates after december 31, 2000.

Web so even if a private foundation were to qualify for relief from irc section 6651 late filing and tax payment penalties (i.e., up to 25% of the tax due) by filing its 2019 or 2020 form. Web during the call, if you apply for reasonable cause but we determined you qualify for first time abate, we'll apply the latter. Web first, the fta policy only provides relief from income tax penalties against individuals and certain entities for failure to file under sections 6651(a)(1), 6698(a)(1), or. Web more from h&r block. Web if you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. If the organization fails to file a timely and accurate return with the irs, the irs is permitted to. You may make the request in response to a penalty. 2210 penalty for underpayment of estimated tax by individuals does not disqualify a. Web this administrative waiver was implemented in 2001 for tax periods with ending dates after december 31, 2000. You could be eligible for one of three types of irs penalty aid:

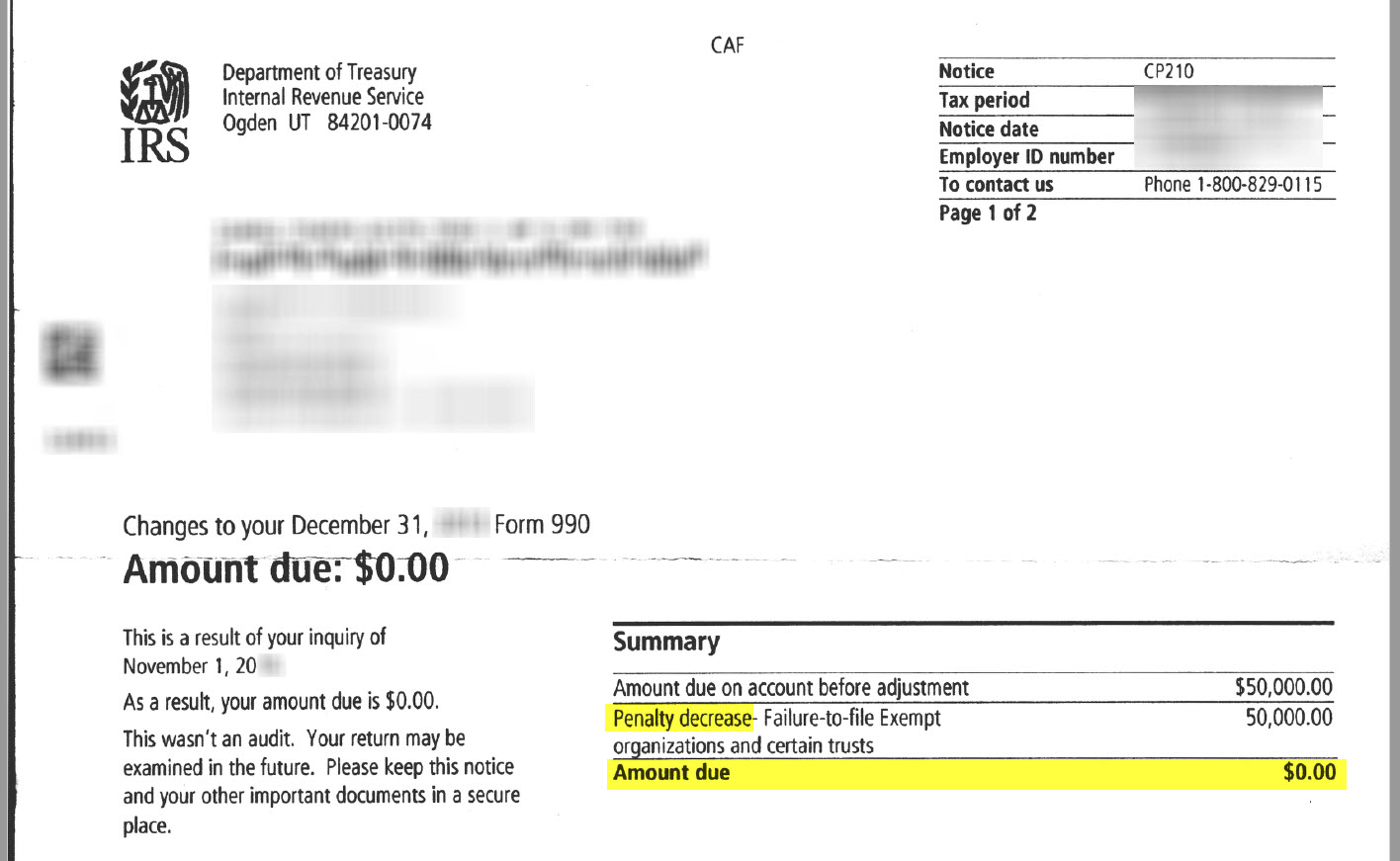

How to Write a Form 990 Late Filing Penalty Abatement Letter 50,000

Web first, the fta policy only provides relief from income tax penalties against individuals and certain entities for failure to file under sections 6651(a)(1), 6698(a)(1), or. Web more from h&r block. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web during the call, if you apply for reasonable cause but.

Do I Qualify for First Time Tax Penalty Abatement? — Tax Problem

Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. You may make the request in response to a penalty. If the organization fails to file a timely and accurate return with the irs, the irs is permitted to. Web penalty relief for nonprofits. If.

First Time Penalty Abatement Irs Get Assistance TaxReliefMe

Web here is how we get compensated. Web first, the fta policy only provides relief from income tax penalties against individuals and certain entities for failure to file under sections 6651(a)(1), 6698(a)(1), or. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web prior 3 years are clean no ftf no.

Tax Forms, Letter Example, Correspondence, First Time, One, Cards

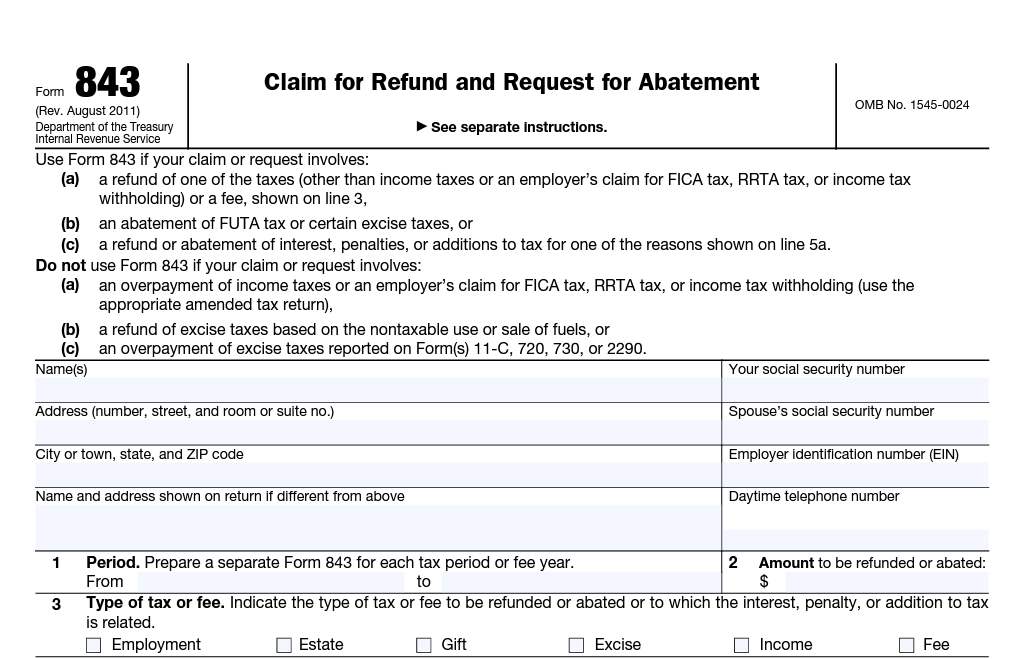

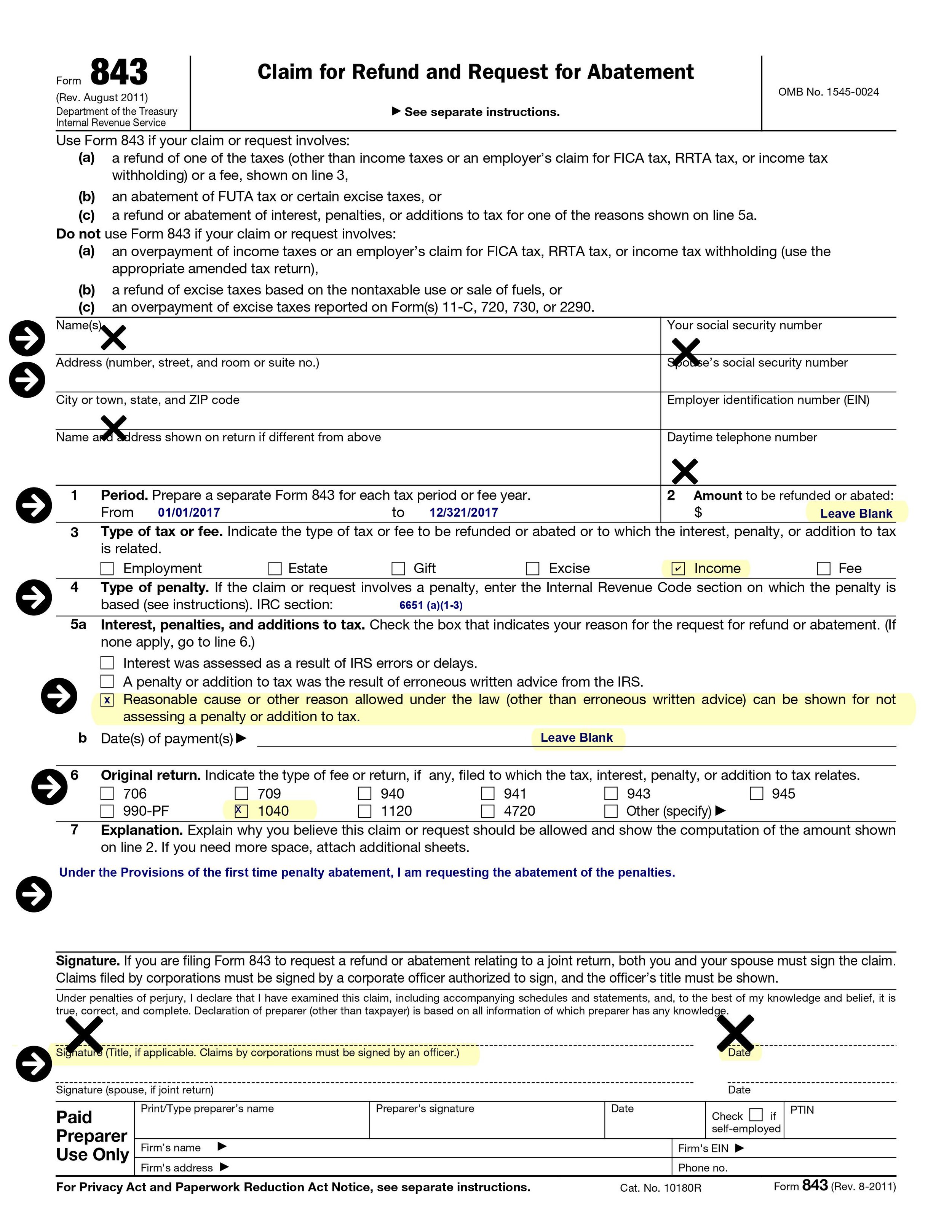

You may make the request in response to a penalty. Web if you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. There, you’ll tell the irs which penalty. Web prior 3 years are clean no ftf no accuracy penalties no ftp note: Web can penalties.

Qualifying and Requesting IRS First Time Penalty Abatement Waiver

You could be eligible for one of three types of irs penalty aid: Web if you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Web penalty relief for nonprofits. Web prior 3 years are clean no ftf no accuracy penalties no ftp note: 2210 penalty.

First Time Penalty Abatement YouTube

Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. Web a filer may request abatement of a penalty in a written statement setting forth all the.

Penalty Abatement Tax Relief ETS Tax Relief

You may make the request in response to a penalty. There, you’ll tell the irs which penalty. Web this administrative waiver was implemented in 2001 for tax periods with ending dates after december 31, 2000. Web a filer may request abatement of a penalty in a written statement setting forth all the extenuating circumstances. Web prior 3 years are clean.

Choosing the right year for firsttime penalty abatement Accounting Today

If the organization fails to file a timely and accurate return with the irs, the irs is permitted to. It is referred to as first time abate (fta) and is available for. Web here is how we get compensated. 2210 penalty for underpayment of estimated tax by individuals does not disqualify a. Web a filer may request abatement of a.

Sales Tax Penalty Waiver Sample Letter Irs Letter 1277 Penalty

Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web more from h&r block. Web during the call, if you apply for reasonable cause but we determined you qualify for first time abate, we'll apply the latter. You could be eligible for one of three types of irs penalty aid: Web.

Form 843 Penalty Abatement Request & Reasonable Cause

Web so even if a private foundation were to qualify for relief from irc section 6651 late filing and tax payment penalties (i.e., up to 25% of the tax due) by filing its 2019 or 2020 form. 2210 penalty for underpayment of estimated tax by individuals does not disqualify a. You could be eligible for one of three types of.

Failure To Timely File The Information Return, Absent Reasonable Cause, Can Give Rise To A Penalty Under Section.

Web first, the fta policy only provides relief from income tax penalties against individuals and certain entities for failure to file under sections 6651(a)(1), 6698(a)(1), or. If you don't qualify for either or we can't approve your. Web here is how we get compensated. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for.

Web During The Call, If You Apply For Reasonable Cause But We Determined You Qualify For First Time Abate, We'll Apply The Latter.

Web if you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Web this administrative waiver was implemented in 2001 for tax periods with ending dates after december 31, 2000. Web penalty relief for nonprofits. Web more from h&r block.

2210 Penalty For Underpayment Of Estimated Tax By Individuals Does Not Disqualify A.

You could be eligible for one of three types of irs penalty aid: Web can penalties for filing form 990 late be abated? Web prior 3 years are clean no ftf no accuracy penalties no ftp note: Web so even if a private foundation were to qualify for relief from irc section 6651 late filing and tax payment penalties (i.e., up to 25% of the tax due) by filing its 2019 or 2020 form.

There, You’ll Tell The Irs Which Penalty.

It is referred to as first time abate (fta) and is available for. Web a filer may request abatement of a penalty in a written statement setting forth all the extenuating circumstances. If the organization fails to file a timely and accurate return with the irs, the irs is permitted to. You may make the request in response to a penalty.