File Form 8862 Online

File Form 8862 Online - Ad download or email irs 8862 & more fillable forms, register and subscribe now! From within your taxact return ( online or desktop), click federal. Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Here is how to add form 8862 to your. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. This form is for income. Filing this form allows you to reclaim credits for which you are now. Complete, edit or print tax forms instantly. You may be asked to provide other information before.

Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Use get form or simply click on the template preview to open it in the editor. Web how to fill out and sign form 8862 turbotax online? Ad download or email irs 8862 & more fillable forms, register and subscribe now! Expand the federal and forms and schedules folders. Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. File your 2290 tax now and receive schedule 1 in minutes. Complete, edit or print tax forms instantly. Web taxpayers complete form 8862 and attach it to their tax return if: Web need to file form 8862, information to claim certain credits after disallowance before you can reclaim the credit if the credit was denied or reduced for any reason other than a.

You may be asked to provide other information before. File your 2290 tax now and receive schedule 1 in minutes. From within your taxact return ( online or desktop), click federal. We last updated federal form 8862 in december 2022 from the federal internal revenue service. Web 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Web you must file form 8862 you must attach the applicable schedules and forms to your return for each credit you claim. Web how to fill out and sign form 8862 turbotax online? Web follow these steps to generate form 8862: If you wish to take the credit in a. Ad download or email irs 8862 & more fillable forms, register and subscribe now!

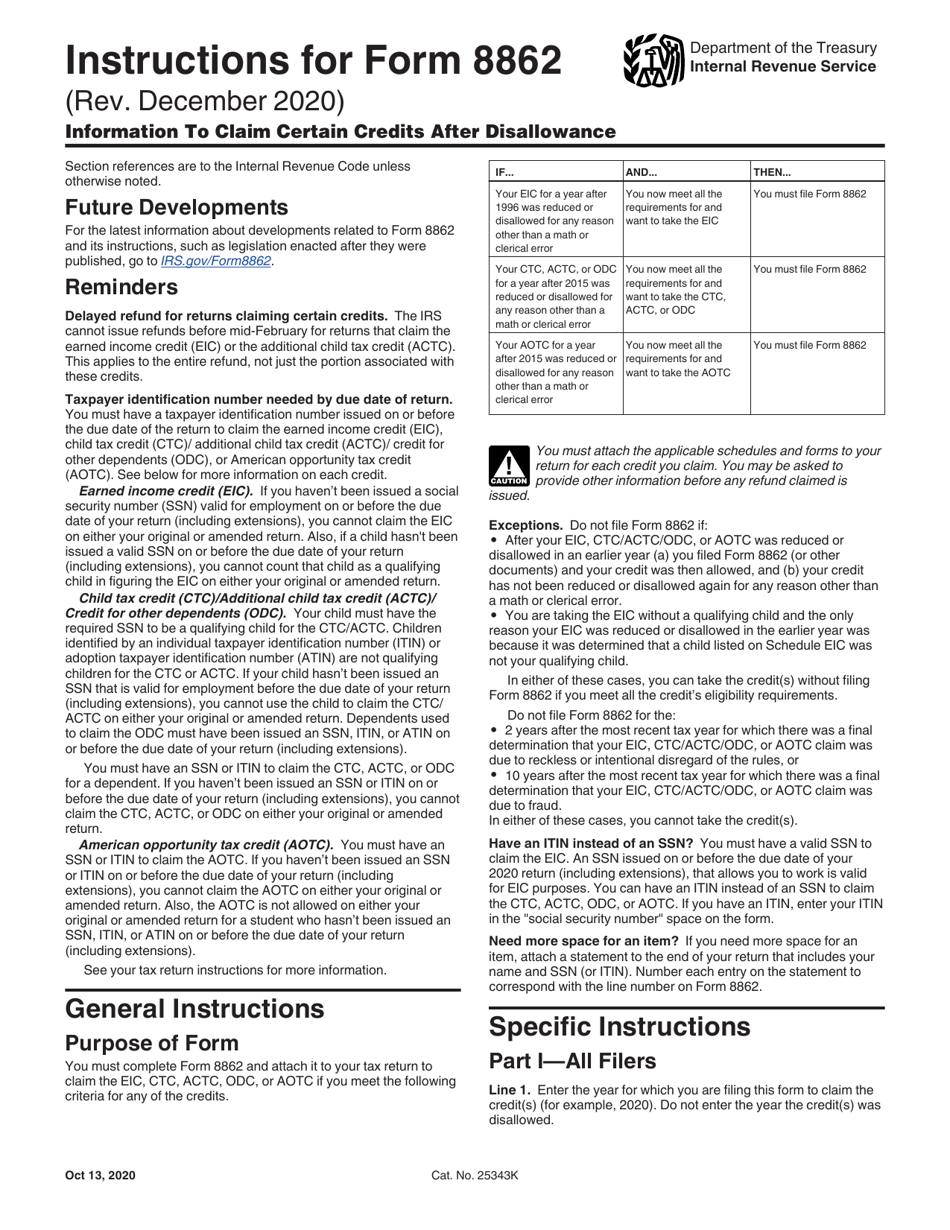

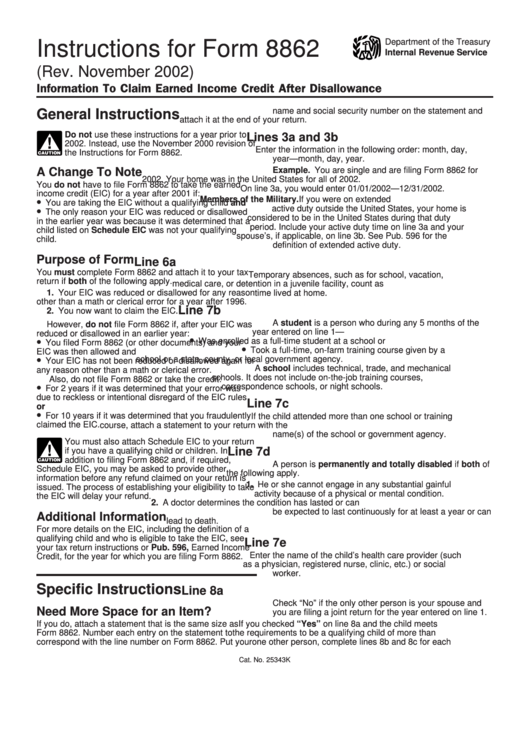

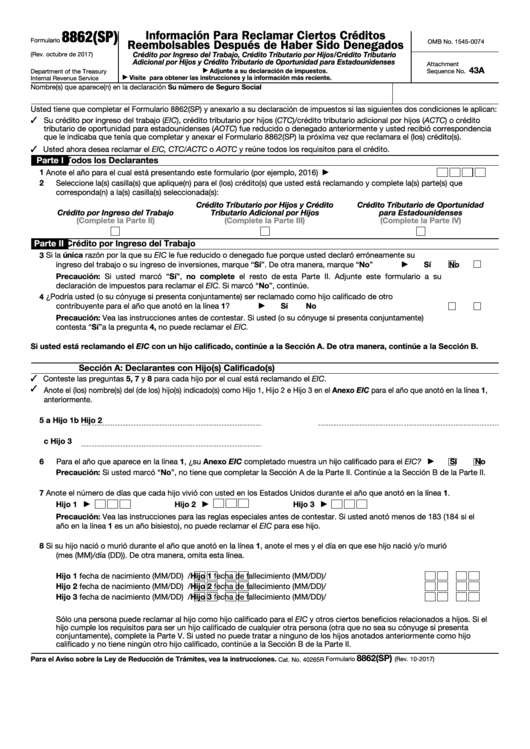

Download Instructions for IRS Form 8862 Information to Claim Certain

Web follow these steps to generate form 8862: Start completing the fillable fields and. Web you must file form 8862 you must attach the applicable schedules and forms to your return for each credit you claim. Enjoy smart fillable fields and interactivity. You can use the steps below to help you get to where to fill out information for form.

Irs Form 8862 Printable Master of Documents

Web taxpayers complete form 8862 and attach it to their tax return if: You can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web how to fill out and sign form 8862 turbotax online? Expand the federal and forms and schedules folders. You may.

Instructions for IRS Form 8862 Information to Claim Certain Credits

From within your taxact return ( online or desktop), click federal. Web need to file form 8862, information to claim certain credits after disallowance before you can reclaim the credit if the credit was denied or reduced for any reason other than a. Ad access irs tax forms. Web form 8862 is required to be filed with a taxpayer’s tax.

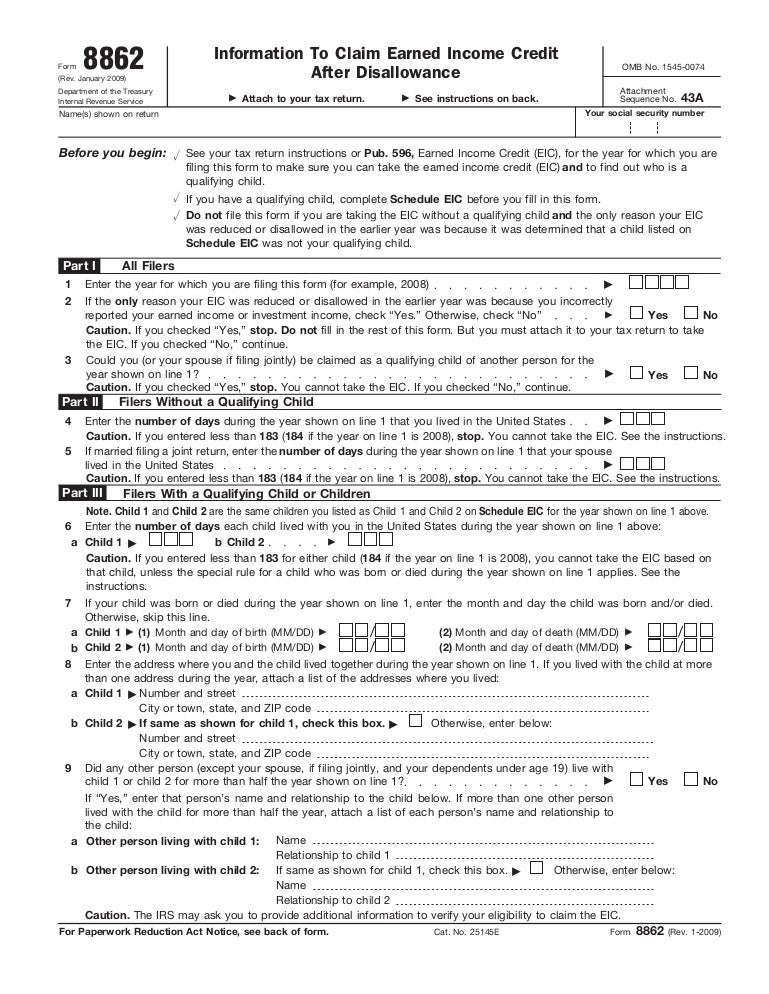

Form 8862Information to Claim Earned Credit for Disallowance

This form is for income. Web do not file this form if you are taking the eic without a qualifying child and the only reason your eicwas reduced or disallowed in the earlier year was because it was determined. Web to add form 8862 to your taxact ® return: Web you must file form 8862 you must attach the applicable.

Form 8862 Edit, Fill, Sign Online Handypdf

Ad access irs tax forms. Web need to file form 8862, information to claim certain credits after disallowance before you can reclaim the credit if the credit was denied or reduced for any reason other than a. From within your taxact return ( online or desktop), click federal. Web be sure to follow the instructions from the irs if you.

How to claim an earned credit by electronically filing IRS Form 8862

Click on eic/ctc/aoc after disallowances. This form is for income. If you wish to take the credit in a. You may be asked to provide other information before. Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862.

20182020 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

Expand the federal and forms and schedules folders. Use get form or simply click on the template preview to open it in the editor. Click on eic/ctc/aoc after disallowances. Get your online template and fill it in using progressive features. Web you must file form 8862 you must attach the applicable schedules and forms to your return for each credit.

Instructions For Form 8862 Information To Claim Earned Credit

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web do not file this form if you are taking the eic without a qualifying child and the only reason your eicwas reduced or disallowed in the earlier year was because it was determined. Don't miss this 50% discount. File your 2290 tax now and receive.

Top 14 Form 8862 Templates free to download in PDF format

Don't miss this 50% discount. Expand the federal and forms and schedules folders. Complete, edit or print tax forms instantly. Web to add form 8862 to your taxact ® return: Complete, edit or print tax forms instantly.

Web 1 Best Answer.

We last updated federal form 8862 in december 2022 from the federal internal revenue service. Don't miss this 50% discount. Web taxpayers complete form 8862 and attach it to their tax return if: This form is for income.

Get Your Online Template And Fill It In Using Progressive Features.

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web do not file this form if you are taking the eic without a qualifying child and the only reason your eicwas reduced or disallowed in the earlier year was because it was determined. Go to the input returntab.

Ad Access Irs Tax Forms.

You can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Click the forms button in the top left corner of the toolbar. Web need to file form 8862, information to claim certain credits after disallowance before you can reclaim the credit if the credit was denied or reduced for any reason other than a.

Web More About The Federal Form 8862 Tax Credit.

Web how to fill out and sign form 8862 turbotax online? Web if the irs rejected one or more of these credits: Complete irs tax forms online or print government tax documents. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math.