File Form 1120 Electronically

File Form 1120 Electronically - Try it for free now! Web amended and superseding corporate returns. Notes you should create a copy of the return before you enter amended. Pay as you go, cancel any time. Start setting up gusto for free and don't pay a cent until you're ready to run payroll. Web form 1120 is a u.s. Get your maximum refund fast Property and casualty insurance company income tax return? Ad easy guidance & tools for c corporation tax returns. Corporation income tax return, including recent updates, related forms and instructions on how to file.

Web amended and superseding corporate returns. Notes you should create a copy of the return before you enter amended. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web form 1120 is a u.s. Complete, edit or print tax forms instantly. Web what is form 1120? Once you’ve completed form 1120,. Adjusted seasonal installment method and annualized income installment method (see instructions) part i adjusted. Ad easy guidance & tools for c corporation tax returns. Form 1120 is the tax form c corporations (and llcs filing as corporations) use to file their income taxes.

Property and casualty insurance company income tax return? Web information about form 1120, u.s. Ad easy guidance & tools for c corporation tax returns. Use this form to report the. It is used to report income, gains, losses, deductions, and credits, and to determine the income tax liability of a. Form 1120 is the tax form c corporations (and llcs filing as corporations) use to file their income taxes. Complete, edit or print tax forms instantly. Pay as you go, cancel any time. Ad access irs tax forms. Web amended and superseding corporate returns.

Federal Form 1120 Schedule E Instructions Bizfluent

Which ultratax cs/1120 forms are. Corporation income tax return form. Start setting up gusto for free and don't pay a cent until you're ready to run payroll. Ad easy guidance & tools for c corporation tax returns. Get your maximum refund fast

Form 1120 Amended Return Overview & Instructions

Upload, modify or create forms. Web amended and superseding corporate returns. Do i need to file an application to file electronic returns? Use this form to report the. Web the following includes answers to common questions about electronic filing.

File Form 1120POL Online Efile Political Organization Return

Try it for free now! Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Ad access irs tax forms. Start setting up gusto for free and don't pay a cent until you're ready to run payroll. Notes you should create a copy of the return before you enter amended.

Are you a Foreign Corporation doing business in the U.S.? Be Safe File

Once you’ve completed form 1120,. Which ultratax cs/1120 forms are. Corporation income tax return form. Complete, edit or print tax forms instantly. Pay as you go, cancel any time.

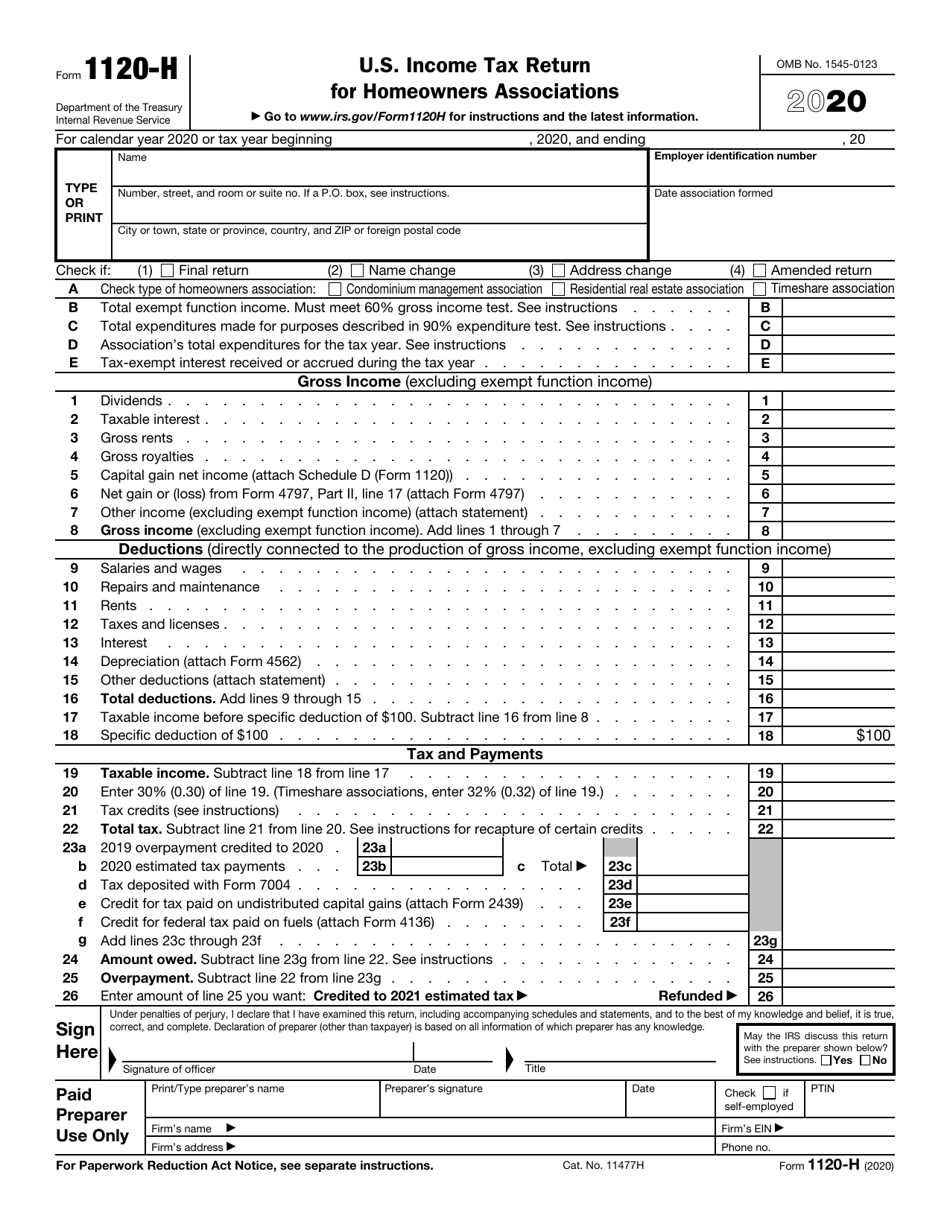

How to File Form 1120H for a Homeowners Association YouTube

Web what is form 1120? It is used to report income, gains, losses, deductions, and credits, and to determine the income tax liability of a. Try it for free now! Corporation income tax return, including recent updates, related forms and instructions on how to file. Notes you should create a copy of the return before you enter amended.

IRS Form 1120H Download Fillable PDF or Fill Online U.S. Tax

Web the following includes answers to common questions about electronic filing. Property and casualty insurance company income tax return? Form 7004 (automatic extension of time to file); B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Web information about form 1120, u.s.

Instructions to Fill Out Form 1120

Try it for free now! Complete, edit or print tax forms instantly. Web amended and superseding corporate returns. Do i need to file an application to file electronic returns? Ad know exactly what you'll pay each month.

Do I Need to File Form 1120S if no Activity? YouTube

Form 7004 (automatic extension of time to file); Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Upload, modify or create forms. Corporation income tax return, including recent updates, related forms and instructions on how to file. Try it for free now!

(x 3)(x 4)(x 6)(x 7)=1120 E START サーチ

Get your maximum refund fast Corporation income tax return form. Use this form to report the. Complete, edit or print tax forms instantly. Web the following includes answers to common questions about electronic filing.

How to Electronically File a Form 990 Tax Return

Web the following includes answers to common questions about electronic filing. Web information about form 1120, u.s. It is used to report income, gains, losses, deductions, and credits, and to determine the income tax liability of a. Start setting up gusto for free and don't pay a cent until you're ready to run payroll. Corporation income tax return form.

Web Amended And Superseding Corporate Returns.

Ad access irs tax forms. Adjusted seasonal installment method and annualized income installment method (see instructions) part i adjusted. Try it for free now! Once you’ve completed form 1120,.

Ad Know Exactly What You'll Pay Each Month.

Web information about form 1120, u.s. Start setting up gusto for free and don't pay a cent until you're ready to run payroll. Notes you should create a copy of the return before you enter amended. Form 1120 is the tax form c corporations (and llcs filing as corporations) use to file their income taxes.

Form 7004 (Automatic Extension Of Time To File);

Get your maximum refund fast B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Corporation income tax return form. Which ultratax cs/1120 forms are.

Corporation Income Tax Return, Including Recent Updates, Related Forms And Instructions On How To File.

Web the following includes answers to common questions about electronic filing. Ad easy guidance & tools for c corporation tax returns. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). It is used to report income, gains, losses, deductions, and credits, and to determine the income tax liability of a.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)