Fidelity Ira Beneficiary Form

Fidelity Ira Beneficiary Form - Web inherit an ira as an entity, estate, or trust. Learn about the rules that apply to these accounts here. No advisory fees under $25k. Address & personal information change: Web inherited iras are for beneficiaries of an ira or a 401k plan. To get started, please provide:. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with the appropriate dollar amount specified. Web use this form to add or change beneficiary information, at an account level, for an existing ira(s) including: Web if you would like to add more than 8 primary or contingent beneficiaries, please download and complete a beneficiary designation form. Top what is a transfer on death.

Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. The university of california is enhancing the uc retirement savings program with a new roth contribution option for the uc 403 (b). Learn about the rules that apply to these accounts here. Web use this form to establish a fidelity advisor ira beneficiary distribution account (bda), which allows a beneficiary who inherits a traditional ira, rollover ira, sep/sarsep. In the future, you may revoke the beneficiary designation and designate a different. Web inherit an ira as an entity, estate, or trust. Use this form if you are a beneficiary and wish to have assets transferred to a beneficiary account in your name or request a distribution. Web a losing a loved one if you've recently experienced a loss, we can help you navigate the important financial steps to take in this difficult time. Web inherited iras are for beneficiaries of an ira or a 401k plan. Web fa ira beneficiary designation form this form is to add, delete, or change beneficiaries and/or beneficiary share percentages on a fidelity advisor ira.

Web tuesday, august 1, 2023. Web beneficiaries — ira /hsa use this form to add or change the beneficiaries of your fidelity ira (including traditional, rollover, sep, simple, roth, and inherited ira) or. Address & personal information change: To report a death to fidelity, fill out. Web fidelity does not sell your information to third parties for monetary consideration. General instructions please complete this form and sign it on the back. Web use this form to add or change beneficiary information, at an account level, for an existing ira(s) including: Start investing & planning for your retirement with help from fidelity. Web inherit an ira as an entity, estate, or trust. No advisory fees under $25k.

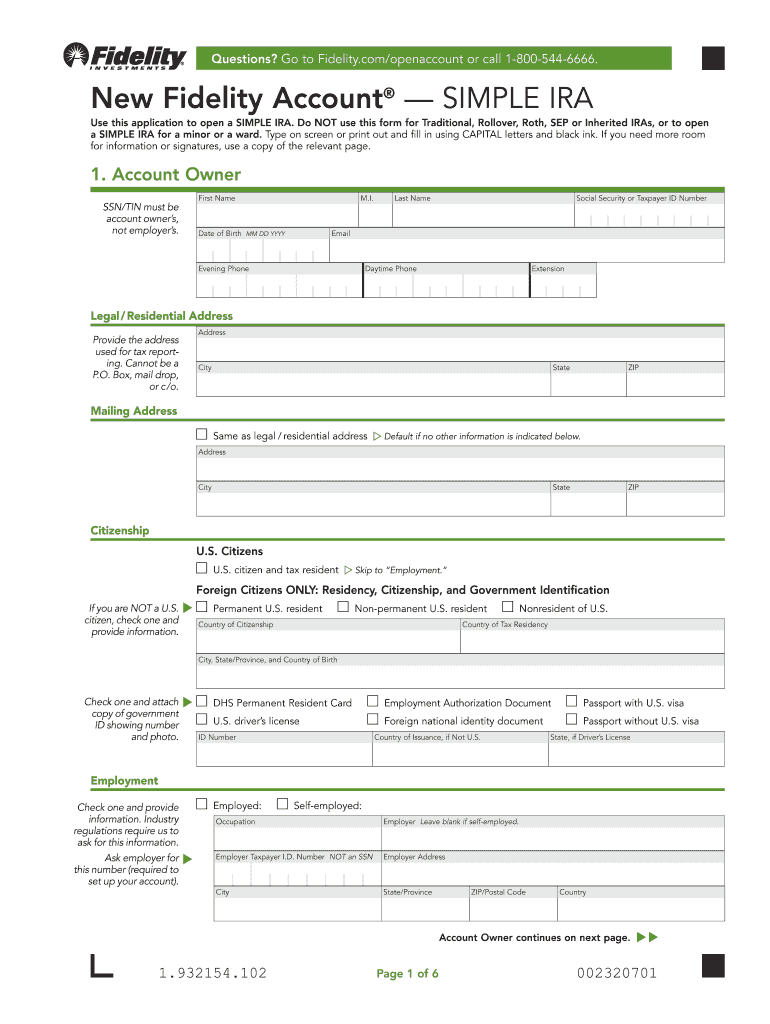

Fidelity Simple Ira Enrollment Form Fill Online, Printable, Fillable

No advisory fees under $25k. Most of the time you can add, change, or delete your beneficiaries online. Web a losing a loved one if you've recently experienced a loss, we can help you navigate the important financial steps to take in this difficult time. General instructions please complete this form and sign it on the back. In the future,.

About Privacy Policy Copyright TOS Contact Sitemap

Use this form if you are a beneficiary and wish to have assets transferred to a beneficiary account in your name or request a distribution. No advisory fees under $25k. Top what is a transfer on death. Web fidelity does not sell your information to third parties for monetary consideration. Ad with fidelity go, we manage your ira so you.

Fidelity Roth Ira Form Universal Network

Address & personal information change: Web fa ira beneficiary designation form this form is to add, delete, or change beneficiaries and/or beneficiary share percentages on a fidelity advisor ira. Web use this form to add or change beneficiary information, at an account level, for an existing ira(s) including: Web fidelity does not sell your information to third parties for monetary.

IRA Inheritance NonSpouse IRA Beneficiary Fidelity Ira

To get started, please provide:. In the future, you may revoke the beneficiary designation and designate a different. Web fidelity does not sell your information to third parties for monetary consideration. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Web use this form to add or change beneficiary information,.

Fidelity Simple Ira Salary Reduction Agreement Form

Use this form if you are a beneficiary and wish to have assets transferred to a beneficiary account in your name or request a distribution. In the future, you may revoke the beneficiary designation and designate a different. To report a death to fidelity, fill out. General instructions please complete this form and sign it on the back. No advisory.

Fidelity Ira Change Of Beneficiary form Unique Doc 1e

General instructions please complete this form and sign it on the back. Address & personal information change: Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with the appropriate.

Ira Rollover Form Fidelity Universal Network

Web beneficiaries — ira /hsa use this form to add or change the beneficiaries of your fidelity ira (including traditional, rollover, sep, simple, roth, and inherited ira) or. Web if you would like to add more than 8 primary or contingent beneficiaries, please download and complete a beneficiary designation form. Web use this form to add or change beneficiary information,.

Fidelity IRA Review ROTH, Fees, Account Performance (2022)

Most of the time you can add, change, or delete your beneficiaries online. Web if you would like to add more than 8 primary or contingent beneficiaries, please download and complete a beneficiary designation form. Learn about the rules that apply to these accounts here. To get started, please provide:. Web fa ira beneficiary designation form this form is to.

Fidelity Ira Change Of Beneficiary form Brilliant References Resume Sample

In the future, you may revoke the beneficiary designation and designate a different. Web inherited iras are for beneficiaries of an ira or a 401k plan. Learn about the rules that apply to these accounts here. Web fidelity does not sell your information to third parties for monetary consideration. Web tuesday, august 1, 2023.

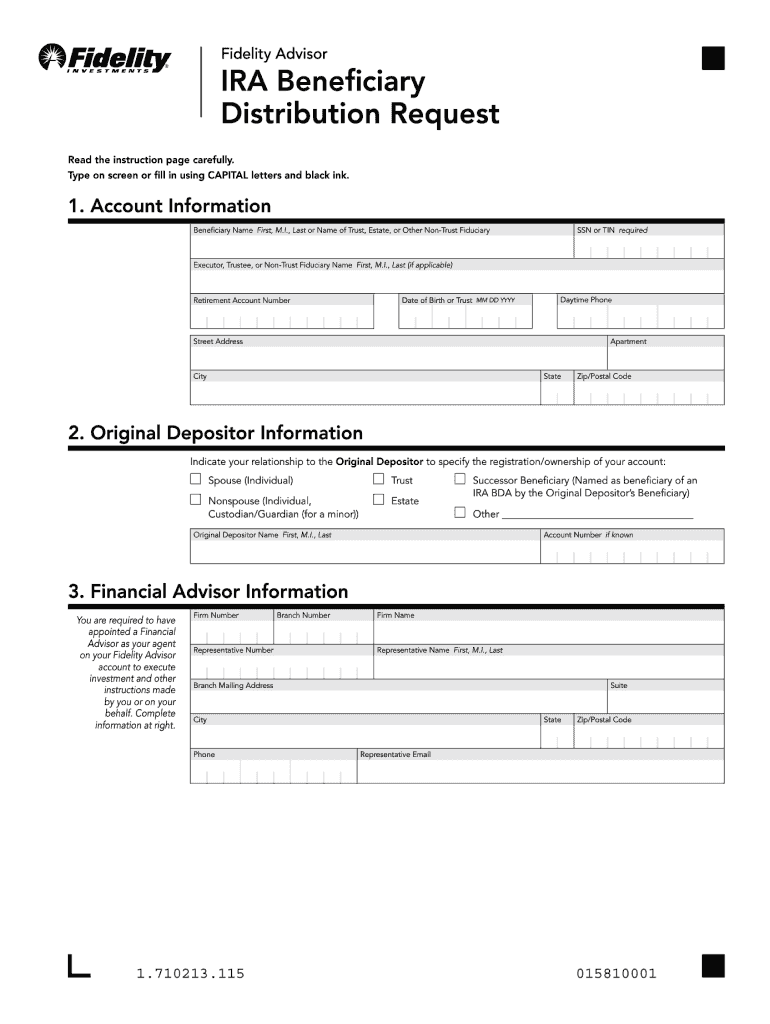

fidelity advisor ira beneficiary distribution request form Fill out

Use this form if you are a beneficiary and wish to have assets transferred to a beneficiary account in your name or request a distribution. Most of the time you can add, change, or delete your beneficiaries online. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with.

Top What Is A Transfer On Death.

Most of the time you can add, change, or delete your beneficiaries online. Web beneficiaries — ira /hsa use this form to add or change the beneficiaries of your fidelity ira (including traditional, rollover, sep, simple, roth, and inherited ira) or. Web inherit an ira as an entity, estate, or trust. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with the appropriate dollar amount specified.

The University Of California Is Enhancing The Uc Retirement Savings Program With A New Roth Contribution Option For The Uc 403 (B).

Web fidelity does not sell your information to third parties for monetary consideration. General instructions please complete this form and sign it on the back. No advisory fees under $25k. Ad with fidelity go, we manage your ira so you don't have to.

However, We And Our Marketing And Advertising Providers (Providers) Collect Certain Information.

Learn about the rules that apply to these accounts here. Web use this form to initiate a distribution from your fidelity advisor ira beneficiary distribution account (bda) or fidelity advisor roth ira bda. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. In the future, you may revoke the beneficiary designation and designate a different.

Web Tuesday, August 1, 2023.

To get started, please provide:. To report a death to fidelity, fill out. Open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary. Web you'll need to assign at least one beneficiary for each account;