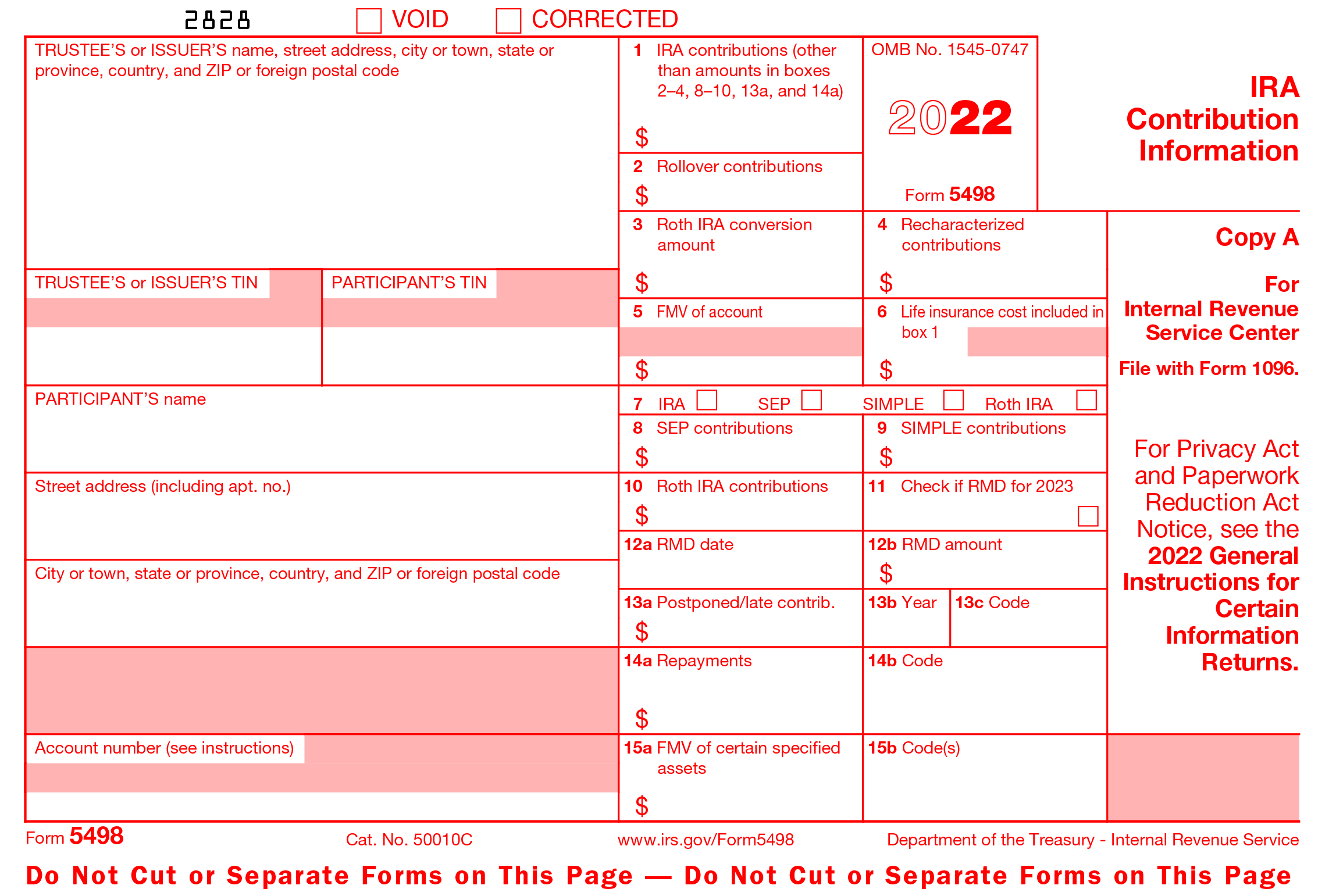

Federal Form 5498

Federal Form 5498 - When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Complete, edit or print tax forms instantly. Web form 5498 is used for various purposes. Web we last updated the ira contribution information (info copy only) in april 2022,so this is the latest version of form 5498, fully updated for tax year 2021. The irs form 5498 exists so that financial institutions can report ira information. Web you received form 5498 because we're required by federal law to send you one. Federal law requires tiaa to report deductible and nondeductible contributions, conversions, re. Register and subscribe now to work on your irs 5498 & more fillable forms. Form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the. What is irs form 5498?

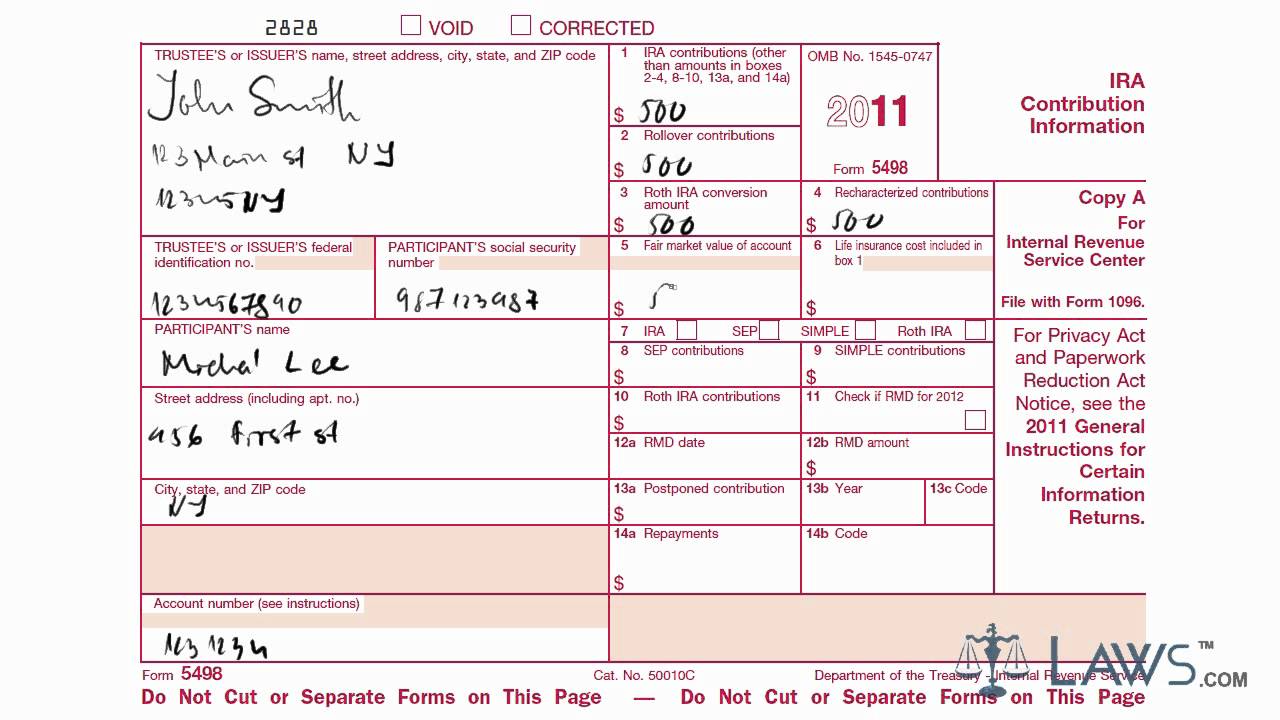

When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Federal law requires tiaa to report deductible and nondeductible contributions, conversions, re. You can download or print. Complete, edit or print tax forms instantly. Web in the year an ira participant dies, you, as an ira trustee or issuer, must generally file a form 5498 and furnish an annual statement for the decedent and a form 5498 and an. The irs form 5498 exists so that financial institutions can report ira information. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web here are some frequently asked questions and answers about form 5498. What information is reported on form 5498? Web federal tax form 5498 is used to report contributions to traditional, roth, and simple iras, as well as employer donations to qualified retirement plans, such as 401 (k), 403 (b), and.

What is irs form 5498? Web you received form 5498 because we're required by federal law to send you one. Web in the year an ira participant dies, you, as an ira trustee or issuer, must generally file a form 5498 and furnish an annual statement for the decedent and a form 5498 and an. Complete, edit or print tax forms instantly. What information is reported on form 5498? Web we last updated the ira contribution information (info copy only) in april 2022,so this is the latest version of form 5498, fully updated for tax year 2021. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web here are some frequently asked questions and answers about form 5498. Complete, edit or print tax forms instantly. In addition to annual contributions made to.

Federal Form 5498 📝 Get IRS 5498 Tax Form IRA Contribution

Web we last updated the ira contribution information (info copy only) in april 2022,so this is the latest version of form 5498, fully updated for tax year 2021. Web you received form 5498 because we're required by federal law to send you one. What is irs form 5498? In addition to annual contributions made to. What information is reported on.

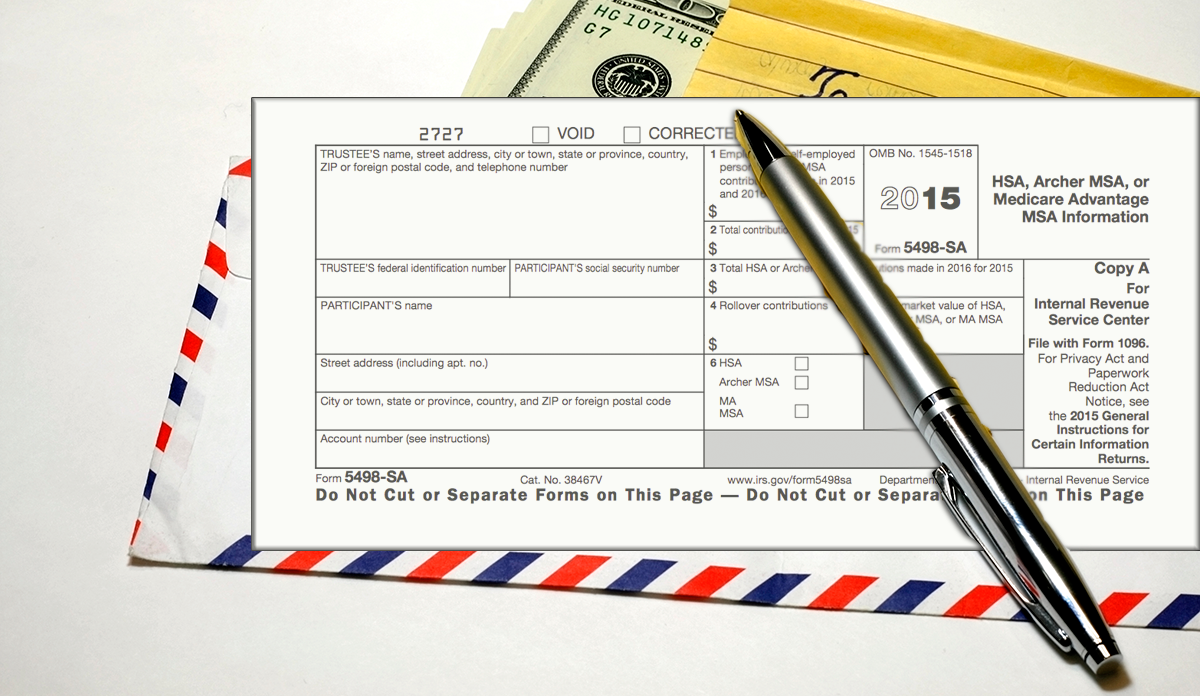

What is IRS Form 5498SA? BRI Benefit Resource

It may appear to be. Web filing form 5498 with the irs. In addition to annual contributions made to. Web here are some frequently asked questions and answers about form 5498. The irs form 5498 exists so that financial institutions can report ira information.

IRS Form 5498 IRA Contribution Information

What information is reported on form 5498? Register and subscribe now to work on your irs 5498 & more fillable forms. Web here are some frequently asked questions and answers about form 5498. Form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the. Complete, edit.

Formulario de objetivo del IRS 5498 Traders Studio

Web we last updated the ira contribution information (info copy only) in april 2022,so this is the latest version of form 5498, fully updated for tax year 2021. Web federal tax form 5498 is used to report contributions to traditional, roth, and simple iras, as well as employer donations to qualified retirement plans, such as 401 (k), 403 (b), and..

What Banks & Financial Institutions should know about Form 5498?

You can download or print. Form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. In addition to annual contributions made to. Web we last updated.

Form 5498 YouTube

It may appear to be. Form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the. Web the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) or coverdell education savings account (esa) to. Web.

Laser 5498 Tax Form Copy B Free Shipping

Web you received form 5498 because we're required by federal law to send you one. It may appear to be. You can download or print. Register and subscribe now to work on your irs 5498 & more fillable forms. Web filing form 5498 with the irs.

Laser 5498 Tax Forms State Copy C Free Shipping

Complete, edit or print tax forms instantly. Web the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) or coverdell education savings account (esa) to. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira).

Fillable Form 5498SA (2022) Edit, Sign & Download in PDF PDFRun

The irs form 5498 exists so that financial institutions can report ira information. Form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the. Complete, edit or print tax forms instantly. Web you received form 5498 because we're required by federal law to send you one..

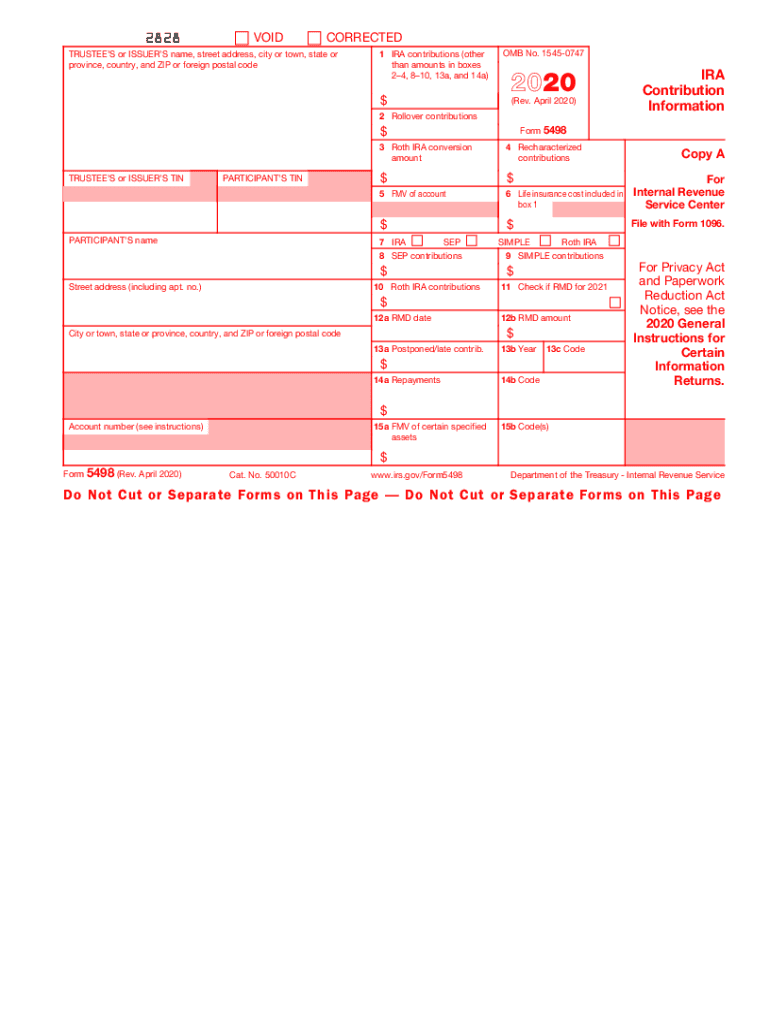

2020 Form IRS 5498 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Complete, edit or print tax forms instantly. Form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the.

It May Appear To Be.

Web we last updated the ira contribution information (info copy only) in april 2022,so this is the latest version of form 5498, fully updated for tax year 2021. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. What information is reported on form 5498? Web here are some frequently asked questions and answers about form 5498.

Web The Information On Form 5498 Is Submitted To The Irs By The Trustee Or Issuer Of Your Individual Retirement Arrangement (Ira) Or Coverdell Education Savings Account (Esa) To.

You can download or print. Complete, edit or print tax forms instantly. Web form 5498 is used for various purposes. Web you received form 5498 because we're required by federal law to send you one.

In Addition To Annual Contributions Made To.

Web federal tax form 5498 is used to report contributions to traditional, roth, and simple iras, as well as employer donations to qualified retirement plans, such as 401 (k), 403 (b), and. Federal law requires tiaa to report deductible and nondeductible contributions, conversions, re. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Complete, edit or print tax forms instantly.

Web When You Make Contributions To An Ira, It’s Likely That You Will Receive A Form 5498 From The Organization That Manages Your Retirement Account.

Register and subscribe now to work on your irs 5498 & more fillable forms. What is irs form 5498? The irs form 5498 exists so that financial institutions can report ira information. Form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the.

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)