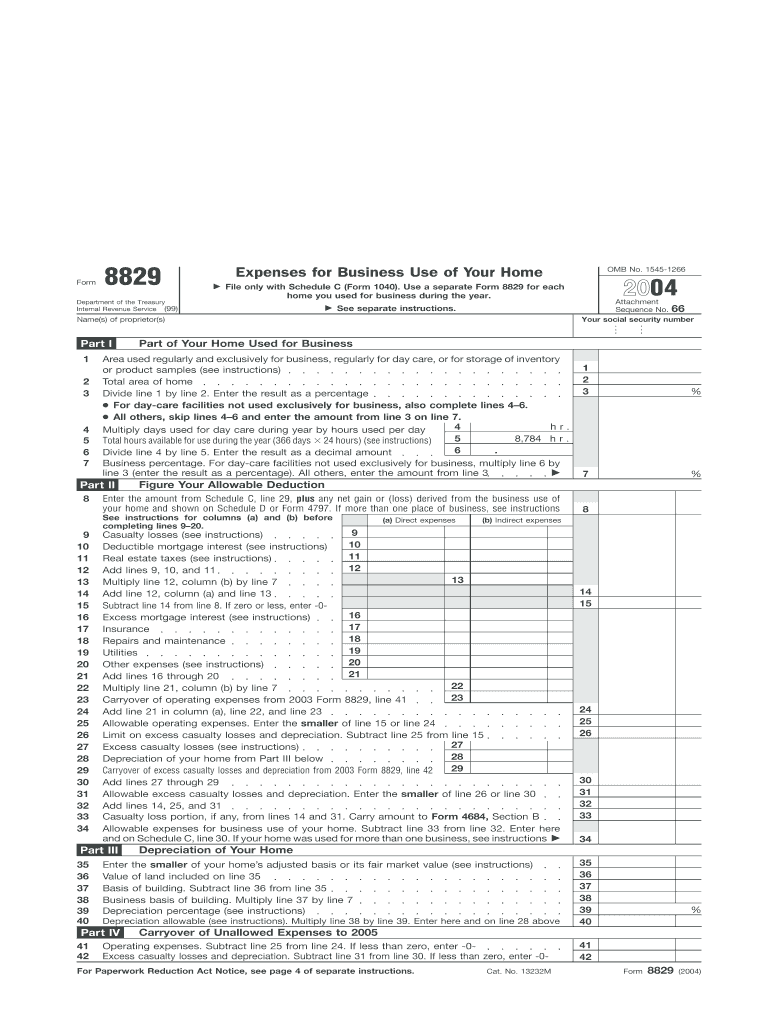

Example Of Form 8829 Filled Out

Example Of Form 8829 Filled Out - Web complete and download form 8829 to claim a tax deduction on home office expenses. Click the jump to home office deduction link in the search results. Business expenses incurred in the home can be. Complete and download irs forms in minutes. 176 name(s) of proprietor(s) your social security. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and losses. With this method of calculating the home office deduction. Claiming expenses for the business use of your home. Business owners use irs form 8829 to claim tax deductions for the.

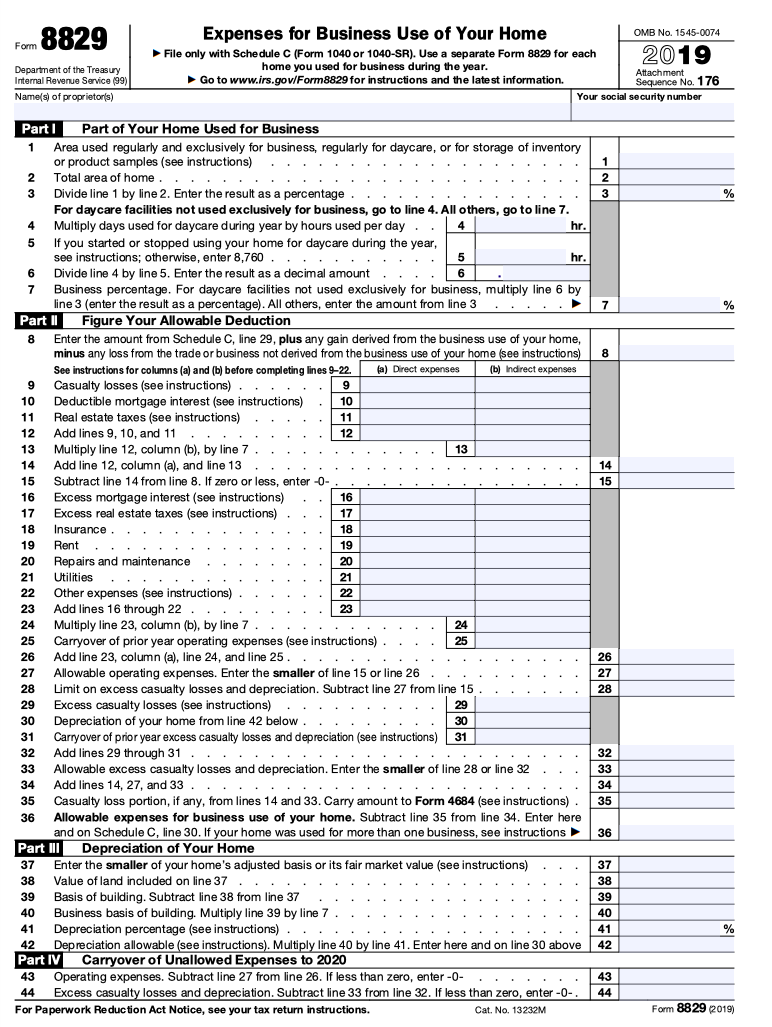

Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. With this method of calculating the home office deduction. Web go to www.irs.gov/form8829 for instructions and the latest information. Business owners use irs form 8829 to claim tax deductions for the. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Web complete and download form 8829 to claim a tax deduction on home office expenses. Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes. Web the simplified option. Web if you are interested in claiming a home office deduction, you will need to fill out home office deduction form 8829. The home office deduction is a key tax deduction you want to be mindful of this tax season.

Complete, edit or print tax forms instantly. Web complete and download form 8829 to claim a tax deduction on home office expenses. Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes. Business expenses incurred in the home can be. Web open your tax return in turbotax and search for this exact phrase: Eligible taxpayers can get a deduction of $5 per square foot of the home. Complete and download irs forms in minutes. Here is how to fill out the form line by line. With this method of calculating the home office deduction. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction.

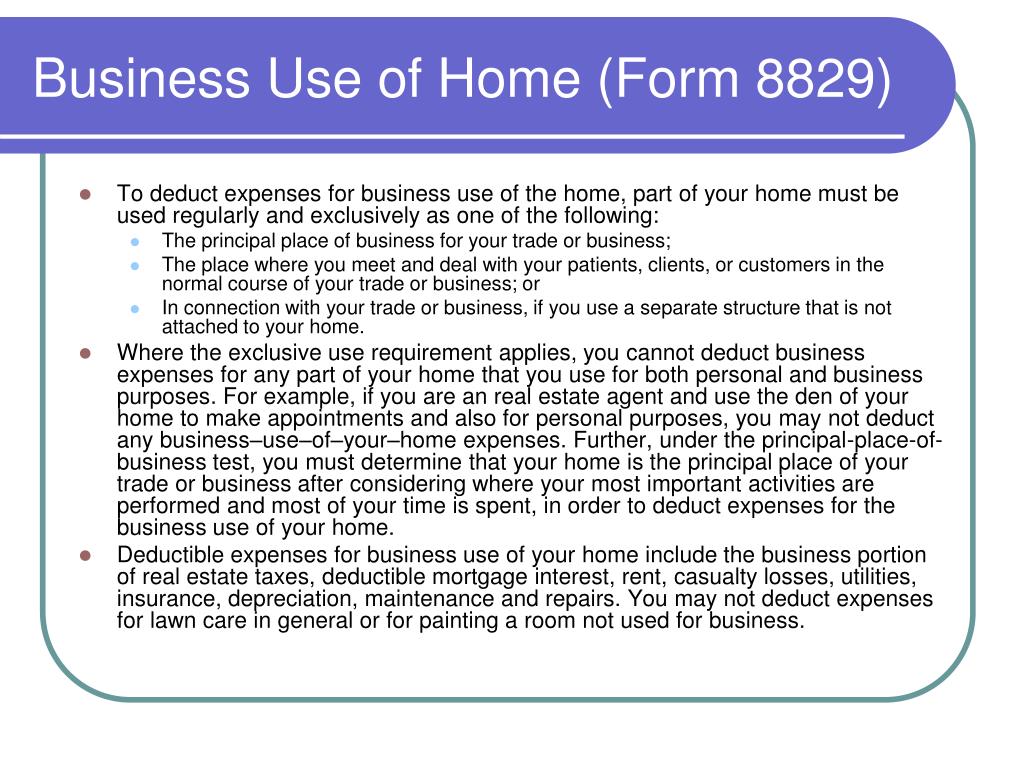

PPT Tax Tips for Real Estate Agents PowerPoint Presentation, free

The home office deduction is a key tax deduction you want to be mindful of this tax season. Complete, edit or print tax forms instantly. Upload, modify or create forms. Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes. The form then is added to the business owner’s.

Home office tax deduction still available, just not for COVIDdisplaced

Web if you are interested in claiming a home office deduction, you will need to fill out home office deduction form 8829. Web open your tax return in turbotax and search for this exact phrase: Click the jump to home office deduction link in the search results. 176 name(s) of proprietor(s) your social security. Business expenses incurred in the home.

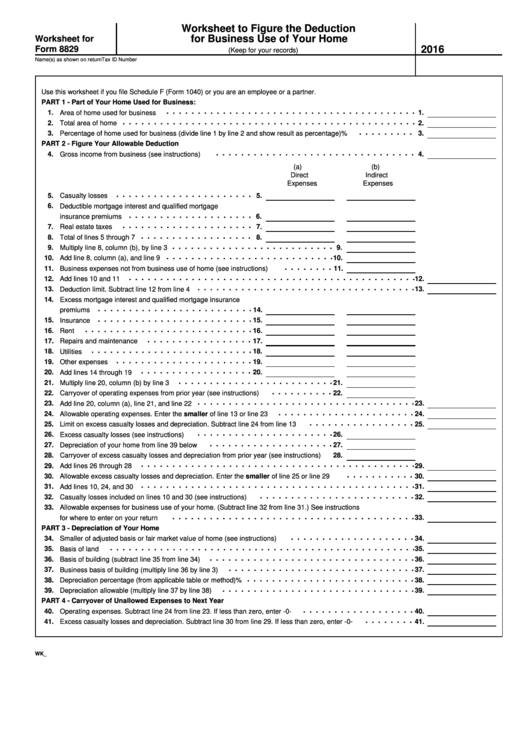

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Try it for free now! Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes. Business expenses incurred in the home can be. Complete and download irs forms in minutes. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form.

Sample Example Of W9 Form Filled Out Fill Online, Printable, Fillable

Web open your tax return in turbotax and search for this exact phrase: Web if you are interested in claiming a home office deduction, you will need to fill out home office deduction form 8829. The form then is added to the business owner’s schedule c as part of their personal tax return. Upload, modify or create forms. Business owners.

How to Fill out Form 8829 Bench Accounting

Complete and download irs forms in minutes. Business expenses incurred in the home can be. Upload, modify or create forms. Web form 8829 is the form used by sole proprietors to calculate and report expenses for business use of home (aka “the home office deduction“). With this method of calculating the home office deduction.

The New York Times > Business > Image > Form 8829

Claiming expenses for the business use of your home. Upload, modify or create forms. Web the simplified option. Complete, edit or print tax forms instantly. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022.

Publication 947 Practice Before the IRS and Power of Attorney

Try it for free now! Eligible taxpayers can get a deduction of $5 per square foot of the home. Web form 8829 is the form used by sole proprietors to calculate and report expenses for business use of home (aka “the home office deduction“). Business expenses incurred in the home can be. Web the simplified option.

How to do Form 1040 Part 2 YouTube

The form then is added to the business owner’s schedule c as part of their personal tax return. Try it for free now! Web for example, if only 10% of the square footage of your house is reserved exclusively for business use, you can only use 10% of your home expenses as a. Complete and download irs forms in minutes..

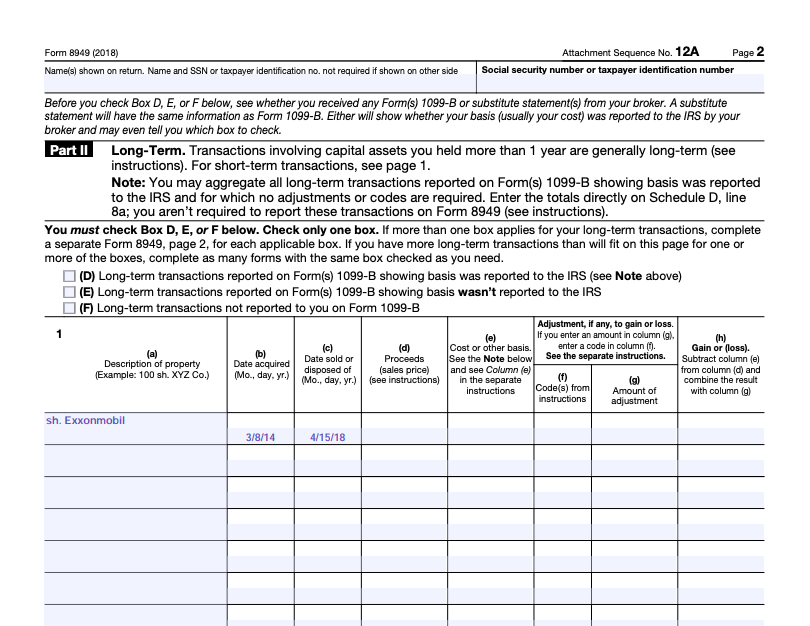

Can You Please Help Me Fill Out Form 8949? So I Kn...

Here is how to fill out the form line by line. Click the jump to home office deduction link in the search results. Business owners use irs form 8829 to claim tax deductions for the. Web the simplified option. Web complete and download form 8829 to claim a tax deduction on home office expenses.

Form 8829 Fill Out and Sign Printable PDF Template signNow

Web open your tax return in turbotax and search for this exact phrase: Web the simplified option. With this method of calculating the home office deduction. Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and losses..

Claiming Expenses For The Business Use Of Your Home.

Web go to www.irs.gov/form8829 for instructions and the latest information. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. The home office deduction is a key tax deduction you want to be mindful of this tax season. Click the jump to home office deduction link in the search results.

Web The Simplified Option.

The form then is added to the business owner’s schedule c as part of their personal tax return. Business expenses incurred in the home can be. Complete and download irs forms in minutes. Web complete and download form 8829 to claim a tax deduction on home office expenses.

Web If You Are Interested In Claiming A Home Office Deduction, You Will Need To Fill Out Home Office Deduction Form 8829.

Try it for free now! Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Upload, modify or create forms. Web form 8829 is the form used by sole proprietors to calculate and report expenses for business use of home (aka “the home office deduction“).

With This Method Of Calculating The Home Office Deduction.

Complete, edit or print tax forms instantly. Web for example, if only 10% of the square footage of your house is reserved exclusively for business use, you can only use 10% of your home expenses as a. Web open your tax return in turbotax and search for this exact phrase: Here is how to fill out the form line by line.