Download Form 1041

Download Form 1041 - Application for automatic extension of time to file certain business income tax,. Web up to $40 cash back easily complete a printable irs 1041 form 2022 online. Best solution for any devices! Please note that proseries basic doesn't. Web department of the treasury internal revenue service see back of form and instructions. The 1041 program must be installed before it can be accessed. Complete, edit or print tax forms instantly. Web we last updated the u.s. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Create a blank & editable 1041 form,.

Complete, edit or print tax forms instantly. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Income tax return for estates and trusts in december 2022, so this is the latest version of form 1041, fully updated for tax year 2022. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. December 2018) department of the treasury internal revenue service. Get the current filing year’s forms, instructions, and publications for free from the irs. Bundle & save $ 124 95 state additional. Application for automatic extension of time to file certain business income tax,. Web department of the treasury internal revenue service see back of form and instructions.

Web department of the treasury internal revenue service see back of form and instructions. Complete, edit or print tax forms instantly. Income tax return for estates and trusts in december 2022, so this is the latest version of form 1041, fully updated for tax year 2022. Web our 1041 tax software calculates your tax return as you work — and because it's based in the cloud, you can work in real time from anywhere, using any device. Web solved•by turbotax•2428•updated january 13, 2023. Get ready for this year's tax season quickly and safely with pdffiller! The 1041 program must be installed before it can be accessed. All forms individual forms information returns fiduciary reporting entity returns transfer. Please note that proseries basic doesn't. You'll get all of the.

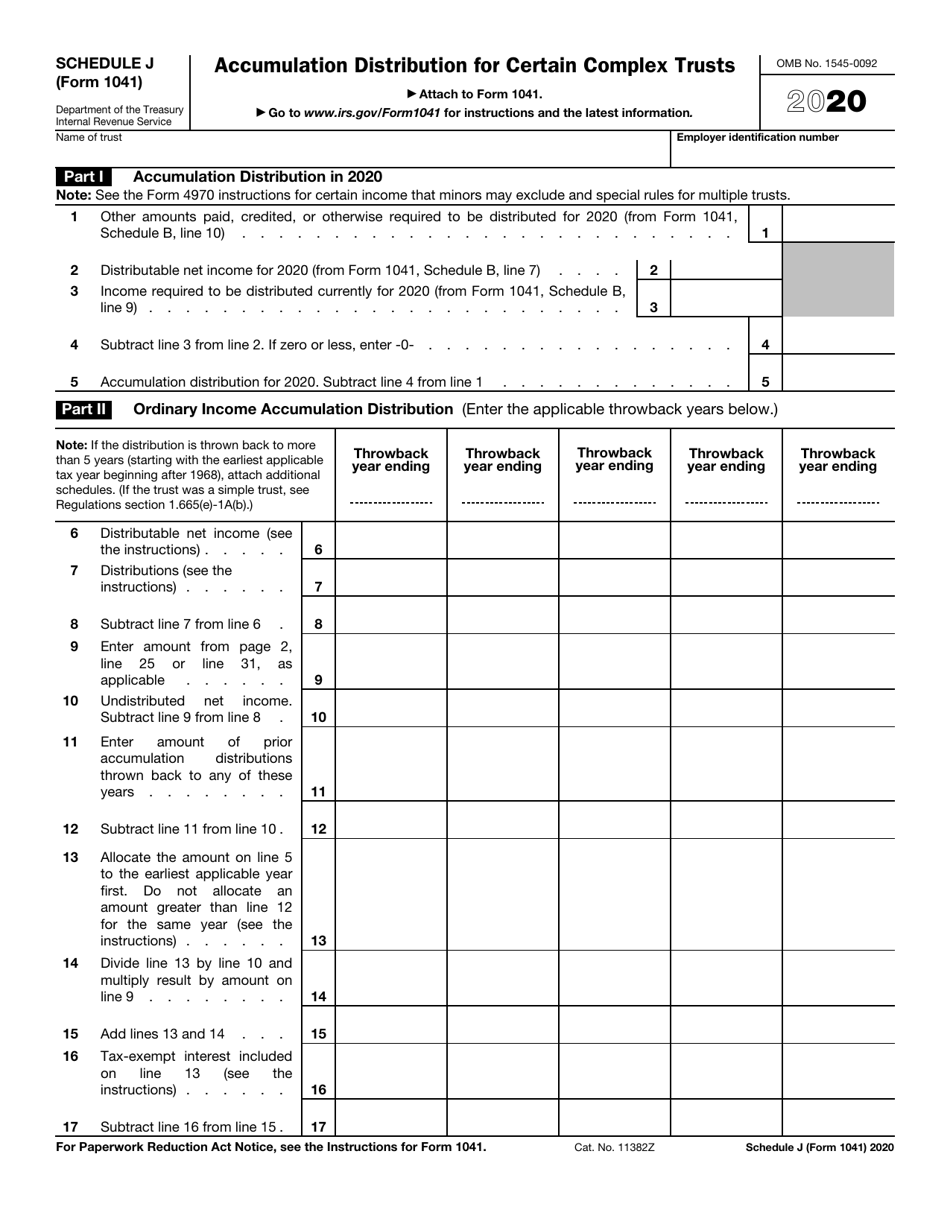

IRS Form 1041 Schedule J Download Fillable PDF or Fill Online

The 1041 program must be installed before it can be accessed. You'll get all of the. Web get federal tax return forms and file by mail. Web solved•by turbotax•2428•updated january 13, 2023. Web department of the treasury internal revenue service see back of form and instructions.

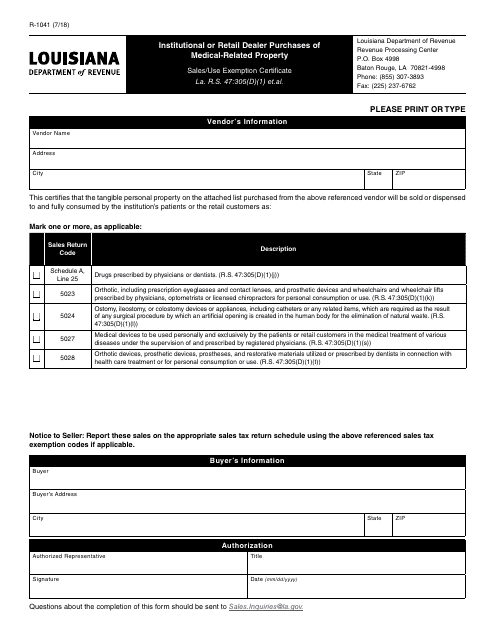

Form R1041 Download Fillable PDF or Fill Online Institutional or

Ad get ready for tax season deadlines by completing any required tax forms today. Please note that proseries basic doesn't. Create a blank & editable 1041 form,. Application for automatic extension of time to file certain business income tax,. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

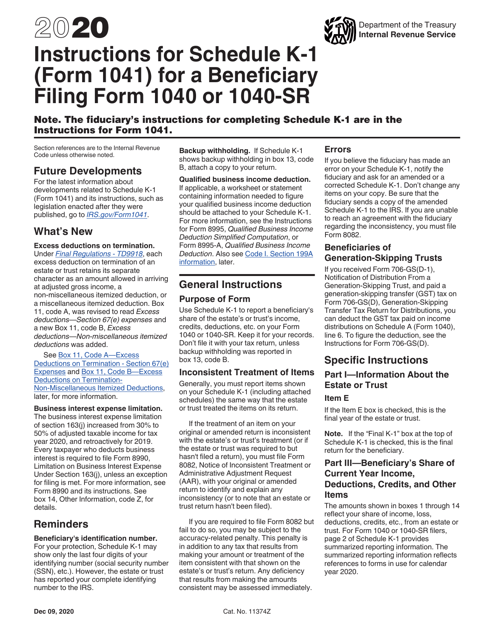

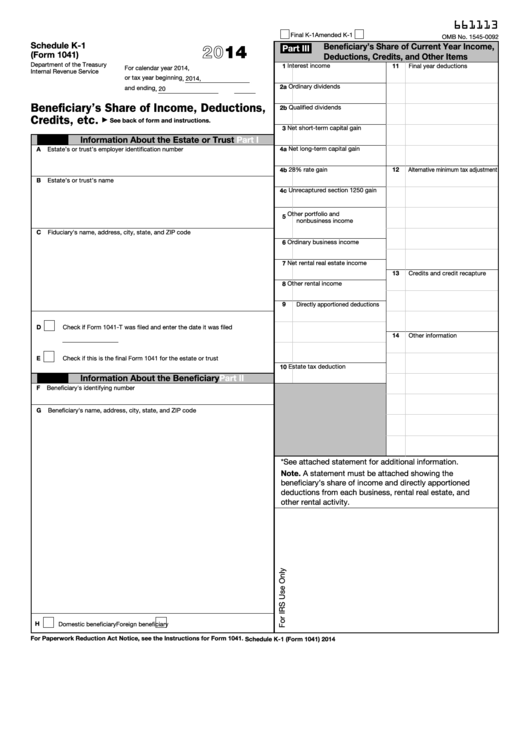

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

Bundle & save $ 124 95 state additional. Complete, edit or print tax forms instantly. All forms individual forms information returns fiduciary reporting entity returns transfer. Order by phone at 1. You'll get all of the.

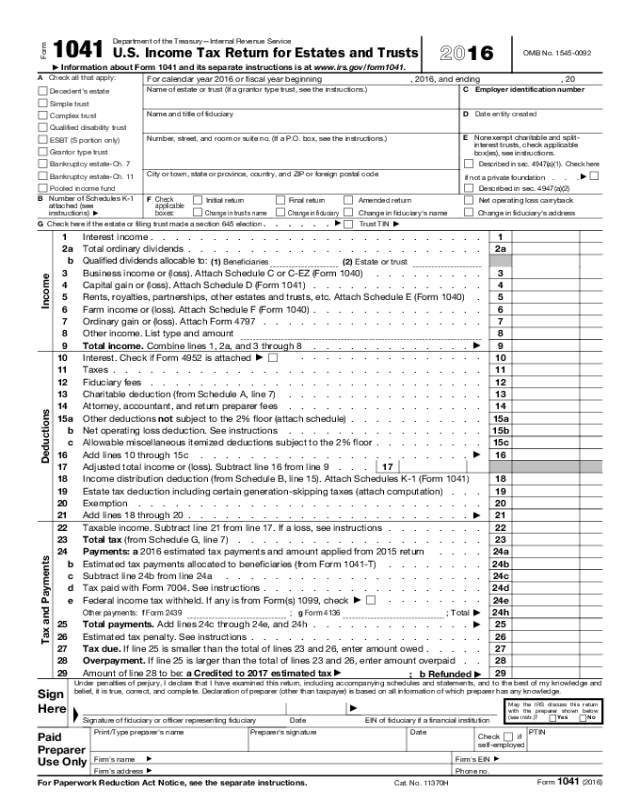

Form 1041 Edit, Fill, Sign Online Handypdf

Income tax return for estates and trusts in december 2022, so this is the latest version of form 1041, fully updated for tax year 2022. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Complete, edit or print tax forms instantly. All forms individual forms information returns fiduciary reporting entity returns transfer..

Form 1041 U.S. Tax Return for Estates and Trusts (2014) Free

Web up to $40 cash back 2019 1041 form. Web up to $40 cash back easily complete a printable irs 1041 form 2022 online. Bundle & save $ 124 95 state additional. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. December 2018) department of the treasury internal revenue service.

Fillable Form 1041 (Schedule K1) Beneficiary'S Share Of

Income tax return for estates and trusts in december 2022, so this is the latest version of form 1041, fully updated for tax year 2022. The 1041 program must be installed before it can be accessed. Bundle & save $ 124 95 state additional. Please note that proseries basic doesn't. Web solved•by turbotax•2428•updated january 13, 2023.

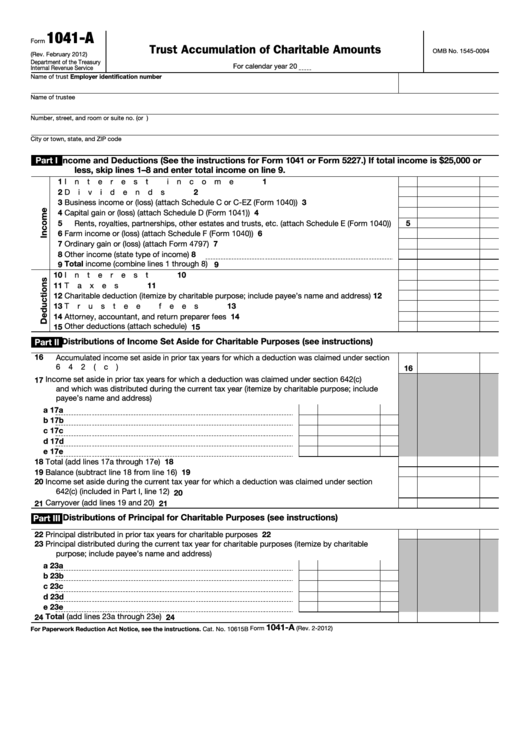

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

Income tax return for estates and trusts in december 2022, so this is the latest version of form 1041, fully updated for tax year 2022. Create a blank & editable 1041 form,. Income tax return for estates and trusts 2020 department of the treasury—internal revenue service. Bundle & save $ 124 95 state additional. Web get federal tax return forms.

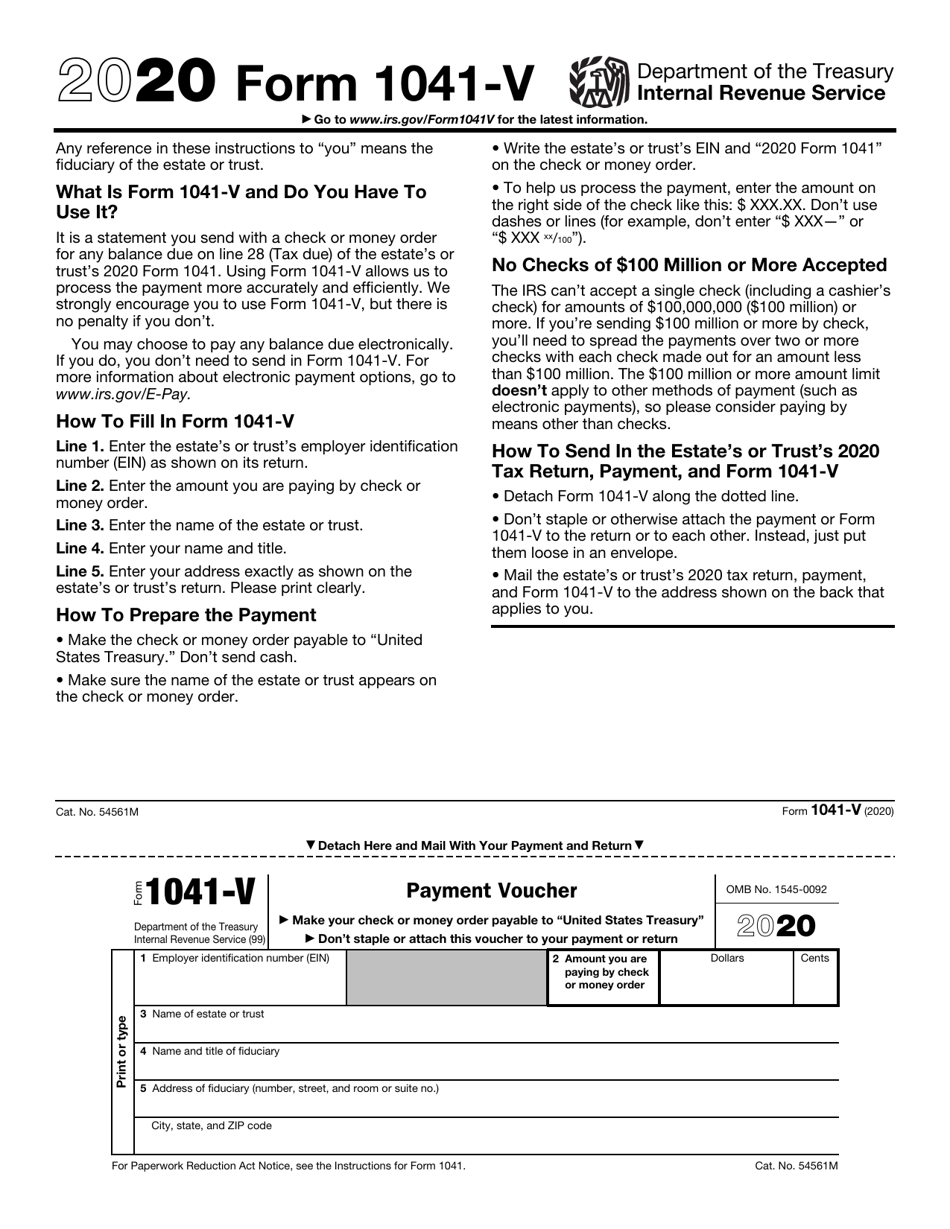

IRS Form 1041V Download Fillable PDF or Fill Online Payment Voucher

Bundle & save $ 124 95 state additional. Income tax return for estates and trusts 2020 department of the treasury—internal revenue service. Web get form 1041 for windows pc & mac. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. December 2018) department of the treasury internal revenue service.

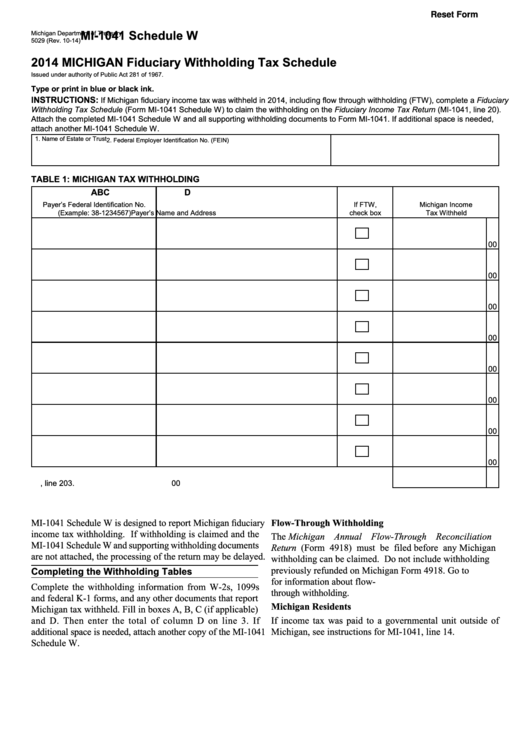

Fillable Form Mi1041 2014 Michigan Fiduciary Withholding Tax

Web up to $40 cash back 2019 1041 form. Complete, edit or print tax forms instantly. Please note that proseries basic doesn't. Web how do i access form 1041 in proseries professional? Web get federal tax return forms and file by mail.

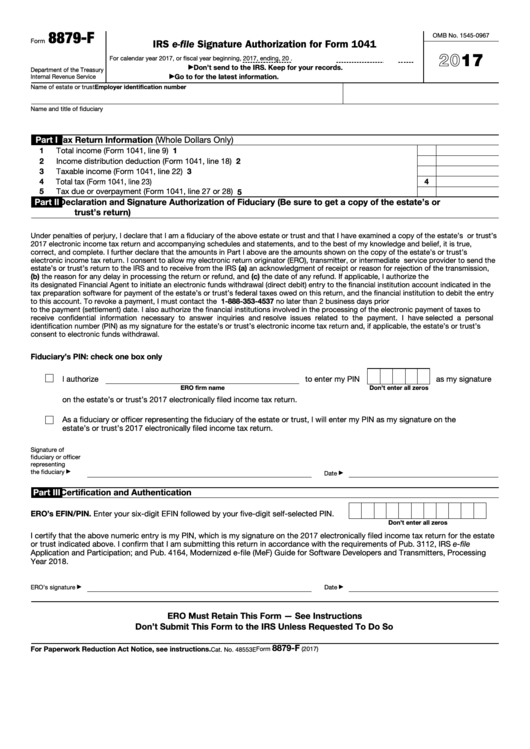

Fillable Form 8879F Irs EFile Signature Authorization For Form 1041

Bundle & save $ 124 95 state additional. Application for automatic extension of time to file certain business income tax,. Complete, edit or print tax forms instantly. Bundle & save $ 124 95 state additional. Complete, edit or print tax forms instantly.

Web Our 1041 Tax Software Calculates Your Tax Return As You Work — And Because It's Based In The Cloud, You Can Work In Real Time From Anywhere, Using Any Device.

Get ready for this year's tax season quickly and safely with pdffiller! You'll get all of the. All forms individual forms information returns fiduciary reporting entity returns transfer. Web get federal tax forms.

Web Department Of The Treasury Internal Revenue Service See Back Of Form And Instructions.

Order by phone at 1. Web up to $40 cash back 2019 1041 form. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Download, print or email irs 1041 tax form on pdffiller for free.

Bundle & Save $ 124 95 State Additional.

You'll need turbotax business to file form 1041, as the personal versions of turbotax don't. December 2018) department of the treasury internal revenue service. Web solved•by turbotax•2428•updated january 13, 2023. Complete, edit or print tax forms instantly.

The 1041 Program Must Be Installed Before It Can Be Accessed.

Best solution for any devices! Web up to $40 cash back easily complete a printable irs 1041 form 2022 online. Complete, edit or print tax forms instantly. Web how do i access form 1041 in proseries professional?