Does My Business Need To File Form 720

Does My Business Need To File Form 720 - If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. Web efile irs form 720, form 2290 & form 8849 through an irs authorized official efile provider, most experienced and 1st in the list. Web businesses that are subject to excise tax generally must file a form 720, quarterly federal excise tax return to report the tax to the irs. 9.5 draft ok to print ah xsl/xmlfileid:. Web only check the final return if the company is 1) going out of business or 2) will not be required to file a form 720 in future quarters. Web instructions for form 720 (rev. Web a business that only purchases the excise goods does not need to file a form 720. To report loss or profit of the. Web the irs form 720 is used by businesses to file a quarterly federal excise tax return. Web businesses providing goods and services that are subject to excise tax must file a form 720 quarterly to report the tax to the irs.

Web those that can be filed electronically, according to the irs, are: Is electronic filing of form 720 required? Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file. This includes forms 720, 2290, 8849, and faxed requests for expedite copies of form 2290. Web if your expat business deals in those particular products, the irs requires that you file form 720 every quarter. Web you don't import gas guzzling automobiles in the course of your trade or business. Form 720 is used by taxpayers to report. If you need to report excise taxes on tanning bed, fuel, or sport fishing equipment, we’ll show you. If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year.

Here’s what you need to know. Web forms 1120, 1120a and 1120s. This is a different form than what is used to file business income tax returns. This includes forms 720, 2290, 8849, and faxed requests for expedite copies of form 2290. Web you don't import gas guzzling automobiles in the course of your trade or business. Irs still accepts paper forms 720. Web the irs form 720 is used by businesses to file a quarterly federal excise tax return. Web efile irs form 720, form 2290 & form 8849 through an irs authorized official efile provider, most experienced and 1st in the list. However, certain companies — such as those in farming, manufacturing,. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file.

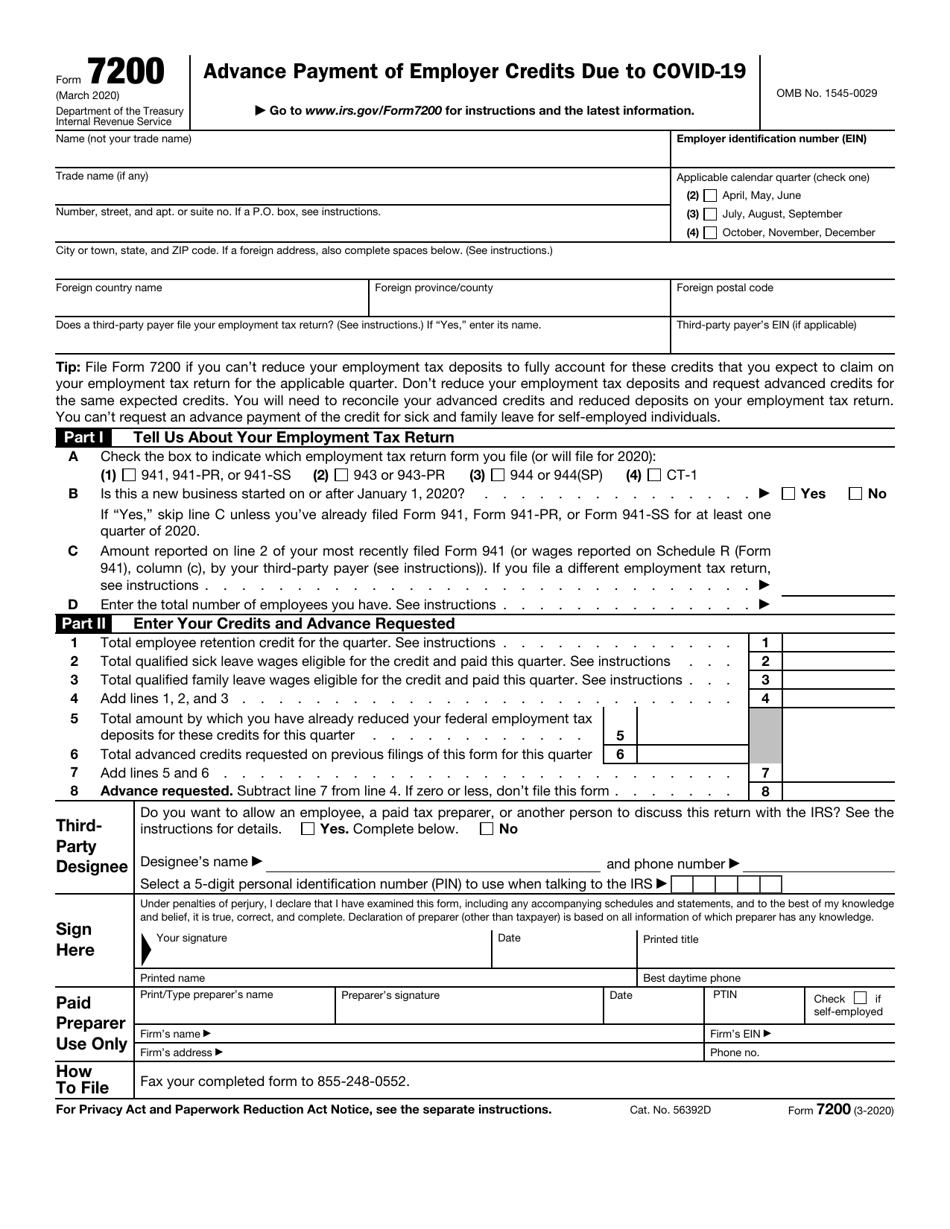

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

However, certain companies — such as those in farming, manufacturing,. Due april 15th (for 2015 taxes, the filing deadline is april 18, 2016): Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Here’s what you need to know. Web the irs form 720 is used by businesses to.

Model 720 in Spain Guide) How to Do Your Asset Declaration

Form 720 is used by taxpayers to report. Due april 15th (for 2015 taxes, the filing deadline is april 18, 2016): Web don't file duplicate excise tax forms paper excise forms are taking longer to process. This is a different form than what is used to file business income tax returns. Web the irs form 720 is used by businesses.

PCORI Fee Reporting in Excise Tax Form 720 IRS

Web don't file duplicate excise tax forms paper excise forms are taking longer to process. Web does my business need to submit irs form 720? Irs still accepts paper forms 720. This includes forms 720, 2290, 8849, and faxed requests for expedite copies of form 2290. If you owe a pcori fee, it must be paid using irs form 720.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Web don't file duplicate excise tax forms paper excise forms are taking longer to process. This includes forms 720, 2290, 8849, and faxed requests for expedite copies of form 2290. Web if your expat business deals in those particular products, the irs requires that you file form 720 every quarter. Irs still accepts paper forms 720. If you owe a.

Why Does My Business Need A Website? Evans Alliance Evans Alliance

However, certain companies — such as those in farming, manufacturing,. Web only check the final return if the company is 1) going out of business or 2) will not be required to file a form 720 in future quarters. Due april 15th (for 2015 taxes, the filing deadline is april 18, 2016): Web efile irs form 720, form 2290 &.

FORM 720 DEADLINE MARCH 2014 FATCA DEADLINE JUNE 2014 THE FINAL N…

This is a different form than what is used to file business income tax returns. Web only check the final return if the company is 1) going out of business or 2) will not be required to file a form 720 in future quarters. Web businesses providing goods and services that are subject to excise tax must file a form.

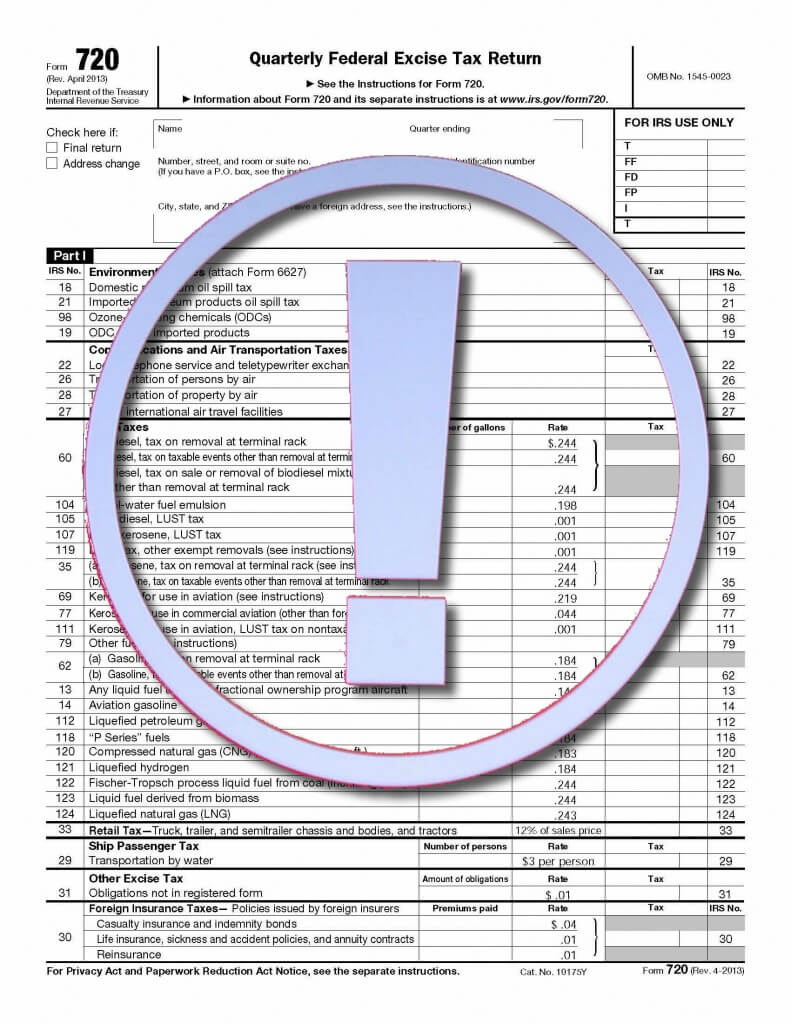

Form 720 Quarterly Federal Excise Tax Return

Web don't file duplicate excise tax forms paper excise forms are taking longer to process. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Here’s what you need to know. Is electronic filing.

IRS Updates Form 720 for Reporting ACA PCOR Fees myCafeteriaPlan

Irs still accepts paper forms 720. Web you don't import gas guzzling automobiles in the course of your trade or business. Form 720 is used by taxpayers to report. Web businesses that are subject to excise tax generally must file a form 720, quarterly federal excise tax return to report the tax to the irs. Complete part ii, line 133.

Does my business need file storage? Key things to consider before you

Taxact makes preparing and filing your. Web instructions for form 720 (rev. Web efile irs form 720, form 2290 & form 8849 through an irs authorized official efile provider, most experienced and 1st in the list. Irs still accepts paper forms 720. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

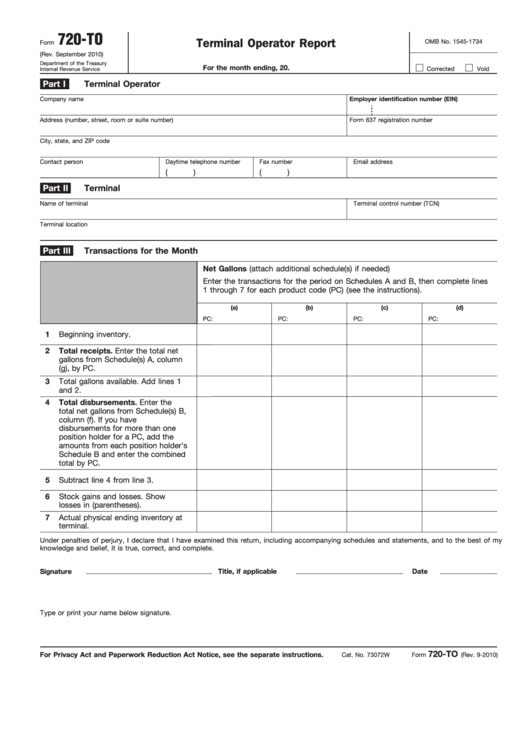

Fillable Form 720To Terminal Operator Report printable pdf download

If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. Form 720, quarterly federal excise tax; Web don't file duplicate excise tax forms paper excise forms are taking longer to process. Web businesses that are subject to excise tax generally must file a form 720,.

Web The Irs Form 720 Is Used By Businesses To File A Quarterly Federal Excise Tax Return.

Web does my business need to submit irs form 720? 9.5 draft ok to print ah xsl/xmlfileid:. Irs still accepts paper forms 720. Web those that can be filed electronically, according to the irs, are:

Web Only Check The Final Return If The Company Is 1) Going Out Of Business Or 2) Will Not Be Required To File A Form 720 In Future Quarters.

You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. Web businesses that are subject to excise tax generally must file a form 720, quarterly federal excise tax return to report the tax to the irs. If you need to report excise taxes on tanning bed, fuel, or sport fishing equipment, we’ll show you. This is a different form than what is used to file business income tax returns.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web a business that only purchases the excise goods does not need to file a form 720. Complete part ii, line 133 (c) or (d). Web whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file. To report loss or profit of the.

Form 720 Is Used By Taxpayers To Report.

However, certain companies — such as those in farming, manufacturing,. Web businesses that owe excise taxes might need to file form 720. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. This includes forms 720, 2290, 8849, and faxed requests for expedite copies of form 2290.