Delaware Form 1100

Delaware Form 1100 - Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate income tax return (form 1100 or form 1100ez) regardless of the amount, if any, of its gross income or its taxable income. When completing a form electronically, please download the form prior to completing it to obtain the best results. Check the box if you are filing a change form. Delaware division of revenue p.o. Corporate request for change form instructions. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax return (form 1100 or form 1100ez) regardless of the amount, if any, of its gross income or its taxable income. If an automatic federal extension has been Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year.arequest for anautomatic extension of six months to the internal revenue service will automatically extend by six months the filing date for the delaware return. Web state of delaware form 1100s s corporation reconciliation and shareholders information return instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code requires that every corporation that is an s corporation for federal income tax. Mail this form with remittance payable to:

We last updated the corporate income tax return in january 2023, so this is the latest version of form 1100, fully updated for tax year 2022. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax return (form 1100 or form 1100ez) regardless of the amount, if any, of its gross income or its taxable income. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. When completing a form electronically, please download the form prior to completing it to obtain the best results. Check the box if you are filing a change form. Corporate request for change form. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. If an automatic federal extension has been Web this is a form for reporting the income of a corporation. A request for an automatic extensionof six months to the internal revenue service will automatically extend by six months the filing date for the delaware return.

Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year.arequest for anautomatic extension of six months to the internal revenue service will automatically extend by six months the filing date for the delaware return. The delaware division of revenue offers multiple options for filing your business taxes and/or. If an automatic federal extension has been Delaware division of revenue p.o. Mail this form with remittance payable to: Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Web state of delaware form 1100s s corporation reconciliation and shareholders information return instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code requires that every corporation that is an s corporation for federal income tax. When completing a form electronically, please download the form prior to completing it to obtain the best results. You can print other delaware tax forms here. Mail this form with remittance payable to:

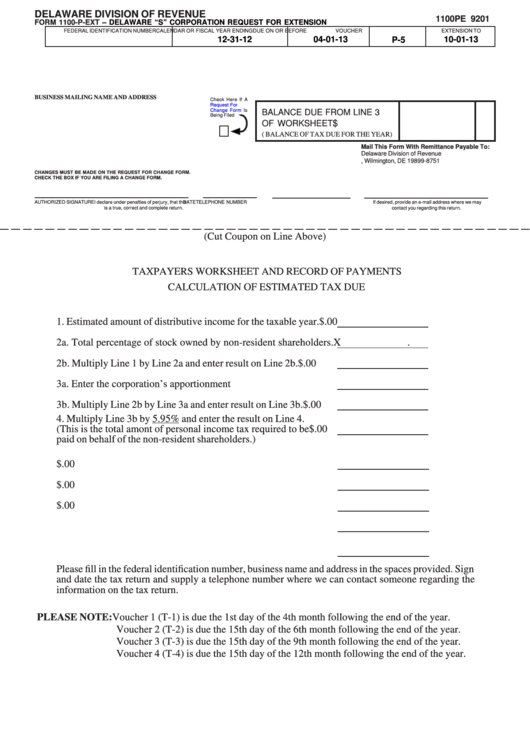

Fillable Form 1100PExt Delaware "S" Corporation Request For

Calendar year 2022 and fiscal year ending 2023. Delaware division of revenue, p.o. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Check the box if you are filing a change form. If an automatic federal extension has been

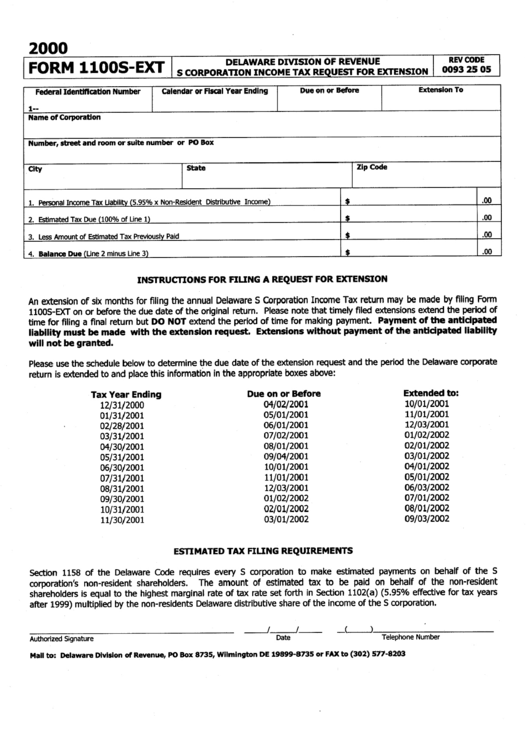

Form 1100sExt S Corporation Tax Request For Extension 2000

You can print other delaware tax forms here. You can print other delaware tax forms here. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Corporate request for change form. A request for an automatic extension of six months to the internal revenue service will automatically extend by.

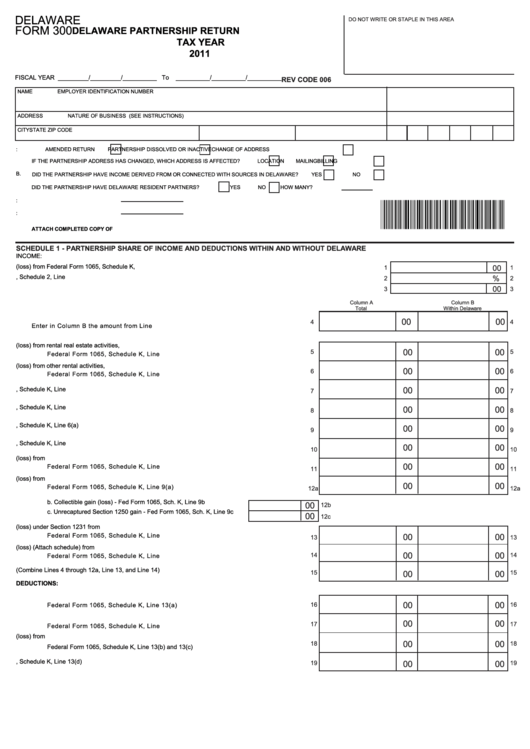

Delaware Form 300 Delaware Partnership Return 2011 printable pdf

The delaware division of revenue offers multiple options for filing your business taxes and/or. If an automatic federal extension has been Corporate request for change form instructions. Check the box if you are filing a change form. Check the box if you are filing a change form.

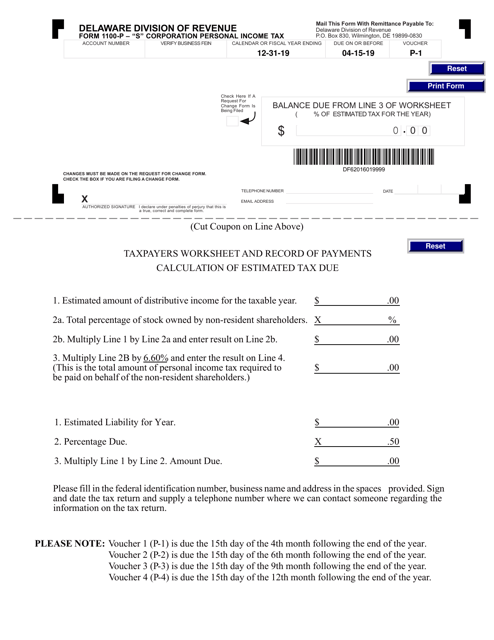

Form 1100P1 Download Fillable PDF or Fill Online '"s'" Corporation

If an automatic federal extension has been Web state of delaware form 1100s s corporation reconciliation and shareholders information return instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code requires that every corporation that is an s corporation for federal income tax. A request for an automatic.

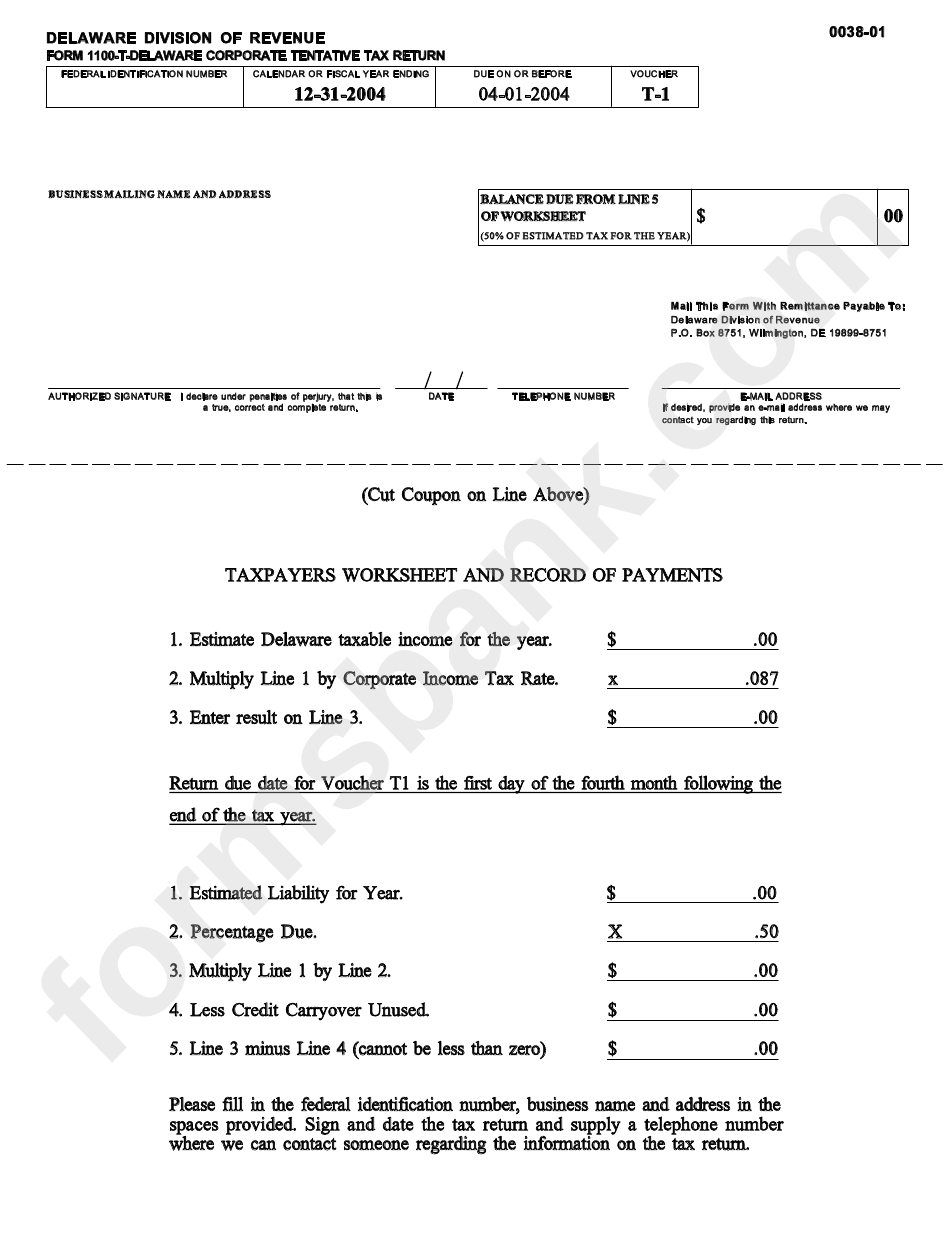

Form 1100T Delaware Corporate Tentative Tax Return 2004 printable

If an automatic federal extension has been Corporate request for change form instructions. Corporate request for change form. Electronic filing is fast, convenient, accurate and easy. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year.

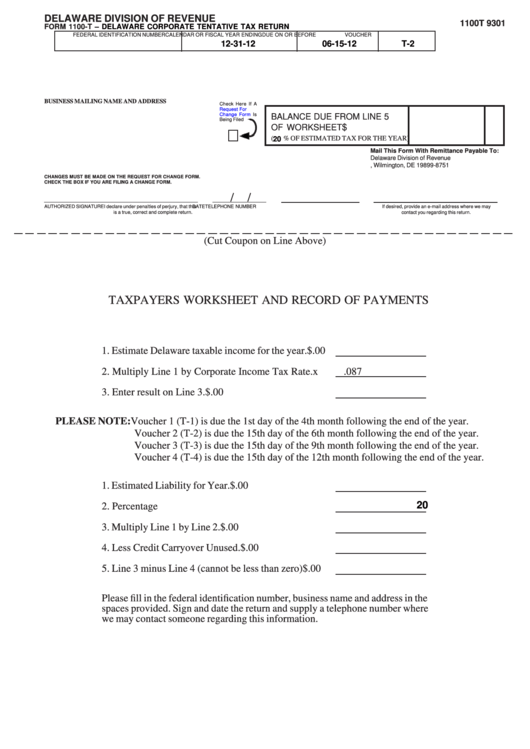

Fillable Form 1100T Delaware Corporate Tentative Tax Return 2012

If an automatic federal extension has been Corporate request for change form instructions. Electronic filing is fast, convenient, accurate and easy. Check the box if you are filing a change form. Calendar year 2022 and fiscal year ending 2023.

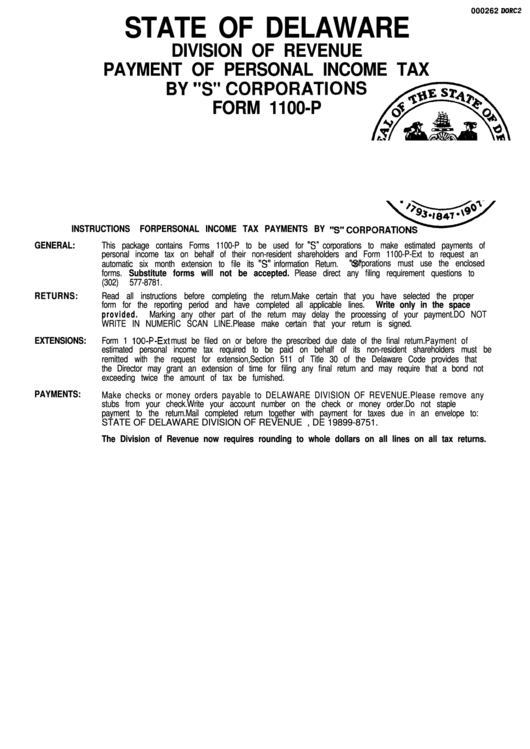

Form 1100P Instructions For Personal Tax Payments By "S

If an automatic federal extension has been Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file.

Delaware Form 5403 2020 Fill and Sign Printable Template Online US

If an automatic federal extension has been Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Web this is a form for reporting the income of a corporation. If an automatic federal extension has been Web 2021 delaware corporation income tax return form 1100 *df11021019999* df11021019999

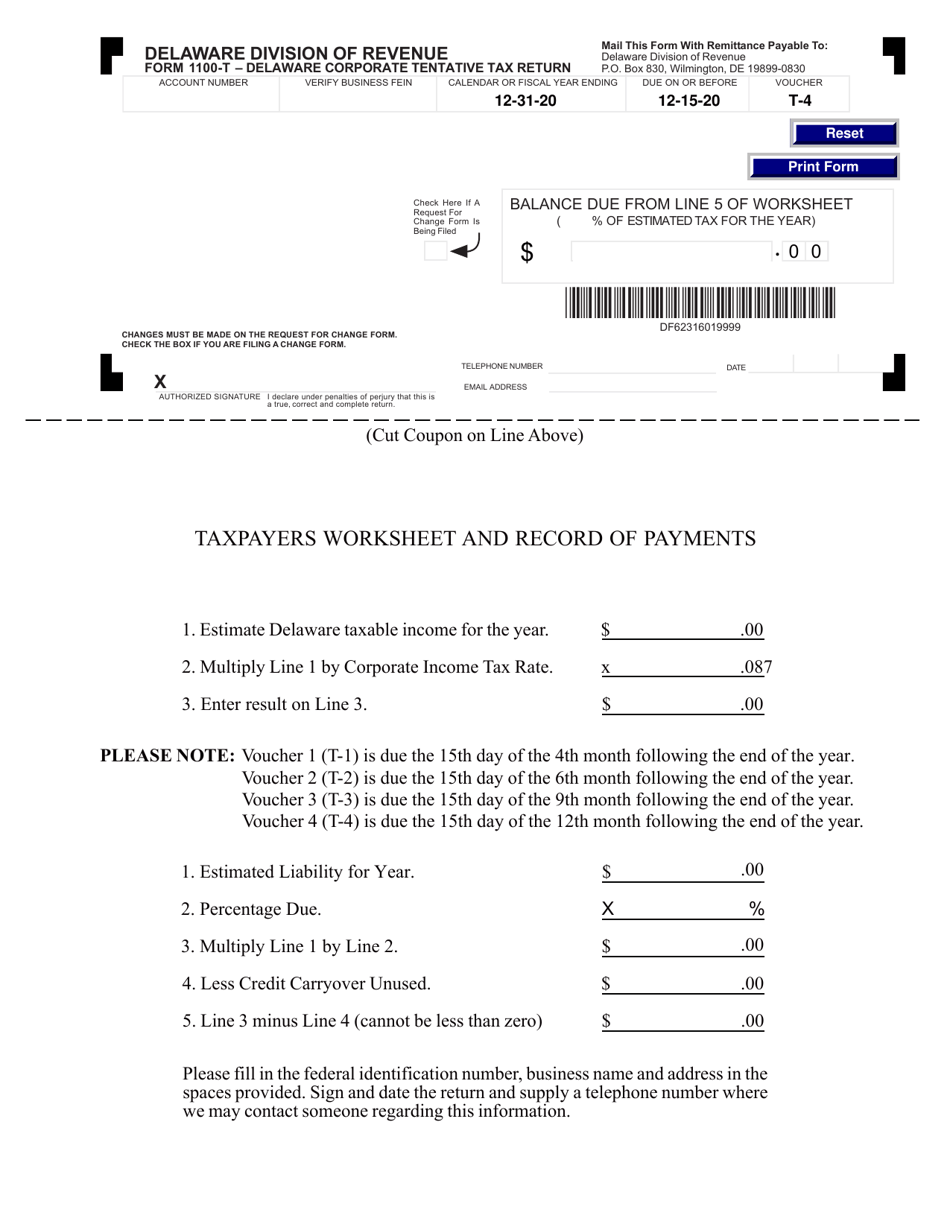

Form 1100T4 Download Fillable PDF or Fill Online Delaware Corporate

Check the box if you are filing a change form. We last updated the corporate income tax return in january 2023, so this is the latest version of form 1100, fully updated for tax year 2022. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. If an automatic.

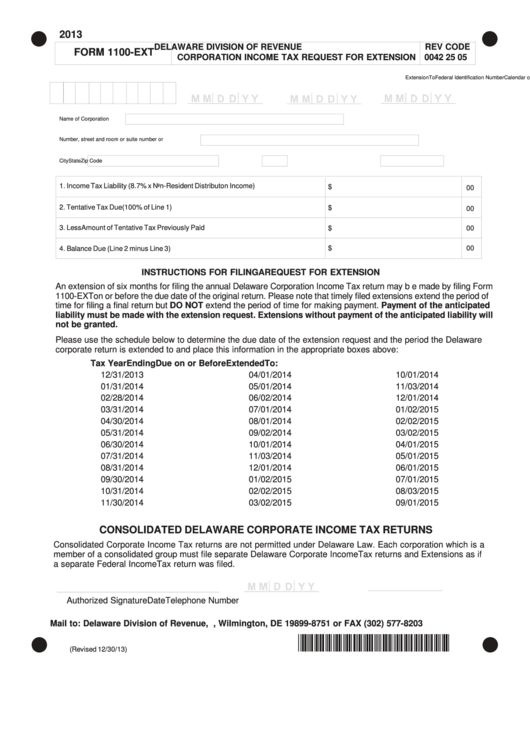

Form 1100Ext Delaware Division Of Revenue Corporation Tax

Delaware division of revenue p.o. Corporate request for change form. A request for an automatic extension of six months to the internal revenue service will automatically extend by six months the filing date for the delaware return. Check the box if you are filing a change form. Web this is a form for reporting the income of a corporation.

When Completing A Form Electronically, Please Download The Form Prior To Completing It To Obtain The Best Results.

The delaware division of revenue offers multiple options for filing your business taxes and/or. If an automatic federal extension has been You can print other delaware tax forms here. Web 2021 delaware corporation income tax return form 1100 *df11021019999* df11021019999

Corporate Request For Change Form Instructions.

Electronic filing is fast, convenient, accurate and easy. Check the box if you are filing a change form. Delaware division of revenue, p.o. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022.

A Request For An Automatic Extensionof Six Months To The Internal Revenue Service Will Automatically Extend By Six Months The Filing Date For The Delaware Return.

Web state of delaware form 1100s s corporation reconciliation and shareholders information return instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code requires that every corporation that is an s corporation for federal income tax. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate income tax return (form 1100 or form 1100ez) regardless of the amount, if any, of its gross income or its taxable income. Calendar year 2022 and fiscal year ending 2023. Delaware division of revenue p.o.

Corporate Request For Change Form.

Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Mail this form with remittance payable to: You can print other delaware tax forms here. Web 2019 form 1100 page 3 date signature of offi cer title email address make check payable and mail to: